This post lists the 20 publicly traded companies with the largest market capitalization as of today. Since my November 2017 list of the 20 most valuable stocks the value of 2 companies increased by more than $150 billion and 4 companies value decreased by over $100 billion.

In the 20 most valuable companies list there are 13 USA companies, 4 Chinese companies and 1 each for Korea, Netherlands and Switzerland. The remaining 15 companies with market caps above $200 billion are based in: USA 10, China 2, Switzerland 2 and Japan 1.

|

Company |

Country |

Market Capitalization |

| 1 |

Amazon |

USA |

$802 billion |

| 2 |

Microsoft |

USA |

$789 billion |

| 3 |

Alphabet (GOOGL) |

USA |

$737 billion |

| 4 |

Apple |

USA |

$720 billion |

| 5 |

Berkshire Hathaway |

USA |

$482 billion |

| 6 |

Facebook |

USA |

$413 billion |

| 7 |

Tencent |

China |

$404 billion* |

| 8 |

Alibaba |

China |

$392 billion |

| 9 |

Johnson & Johnson |

USA |

$348 billion |

| 10 |

China Unicom |

China |

$333 billion |

Amazon soared $220 billion since my November 2017 post and became the most valuable company in the world. Microsoft soared $147 billion and became the most valuable company in the world briefly before Amazon took the crown.

Apple lost $178 billion since my November 2017 post (after passing $1 trillion in market capitalization during 2018, up $100 billion from the November 2017 total, before declining). Facebook lost $118 billion off their market cap. Tencent lost $104 billion and Alibaba lost $100 billion in value during the same period.

Google increased 8 billion (since my November 2017 post).

The next ten most valuable companies:

|

Company |

Country |

Market Capitalization |

| 11 |

JPMorgan Chase |

USA |

$332 billion |

| 12 |

Visa |

USA |

$304 billion |

| 13 |

Exxon Mobil |

USA |

$304 billion |

| 14 |

Walmart |

USA |

$276 billion |

| 15 |

Industrial & Commercial Bank of China (ICBC) |

China |

$270 billion* |

| 16 |

Bank of America |

USA |

$255 billion |

| 17 |

Nestle |

Switzerland |

$255 billion |

| 18 |

Royal Dutch Shell |

Netherlands |

$250 billion |

| 19 |

Pfizer |

USA |

$249 billion |

| 20 |

Samsung |

Korea |

$240 billion |

Market capitalization shown are of the close of business November 26th, as shown on Google Finance.

Pfizer is the only new company in the top 20, growing by $37 billion to reach $249 billion and take the 19th spot (Wells Fargo dropped out of the top 20 and into 25th place).

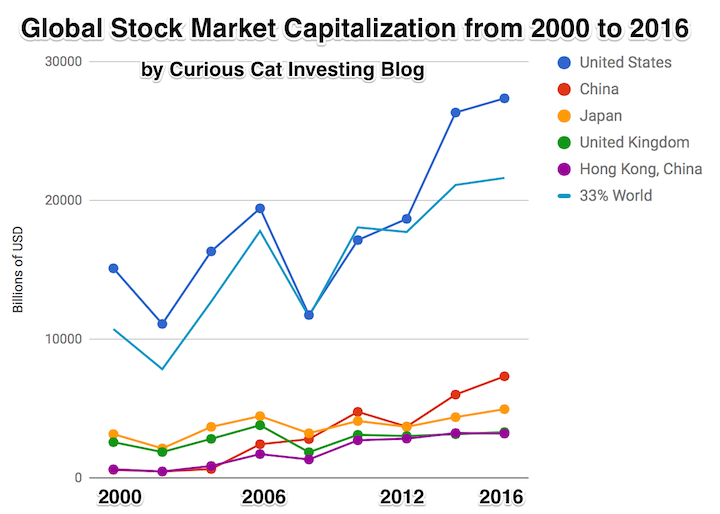

Related: Global Stock Market Capitalization from 2000 to 2012 – Stock Market Capitalization by Country from 1990 to 2010 – Historical Stock Returns

Between $255 billion (which earns 15th place) and $223 billion there are 13 companies with market caps very close to each other.

A few other companies of interest (based on their market capitalization):

Verizon, USA, $240 billion

UnitedHealth, USA, $238 billion

Procter & Gamble, USA, $229 billion

China Construction Bank, China, $226 billion*

Wells Fargo, USA, $225 billion

Novartis, Switzerland, $224 billion

Roche, Switzerland, $224 billion

Intel, USA, $223 billion

Chevron, USA, $215 billion

China Mobile, China, $209 billion

Toyota, Japan, $203 billion

Home Depot, USA, $203 billion

Mastercard, USA, $202 billion

Coca-Cola, USA, $202 billion

Boeing, USA, $200 billion

Others of interest, below $200 billion market capitalization:

Cisco, USA, $196 billion

Merck, USA, $195 billion

Petro China, China, $185 billion

Taiwan Semiconductor (TSMC), Taiwan, $183 billion

Agricultural Bank of China, China, $179 billion*

Oracle, USA, $173 billion

Walt Disney, USA, $168 billion

HSBC, UK, $167 billion

Comcast, USA, $162 billion

Ping An Insurance, China, $158 billion

Unilever, UK, $153 billion

PepsiCo, USA, $153 billion

Bank of China, China, $152 billion*

Netflix, USA, $147 billion

Total, France, $142 billion

McDonald’s, USA, $141 billion

Citigroup, USA, $138 billion

BP, UK, $135 billion

Abbvie, USA, $133 billion

Amgen, USA, $128 billion

DowDuPont, USA, $127 billion

Anheuser Busch, Belgium, $125 billion

SAP, Germany, $125 billion

BHP, Australia, $113 billion

L’Oreal, France, $111 billion

IBM, USA, $110 billion

Sanofi, France, $106 billion

Royal Bank of Canada, $105 billion

Broadcom, USA, $102 billion

Naspers, South Africa, $95 billion (Naspers owns 31% of Tencent – that stake is worth more than Naspers’ market cap by itself)

China Petroleum & Chemical, China, $95 billion

Novo Nordisk, Denmark, $93 billion

Commonwealth Bank of Australia, $92 billion**

NVIDIA, USA, $91 billion

NTT, Japan, $90 billion**

Gilead Sciences, USA, $88 billion

Banco Santander, Spain, $81 billion

Softbank, Japan $78

China Life Insurance Company, China, $78 billion

GE, USA, $78 billion (losing over 50%, 80 billion, since November 2017)

Market capitalization figures were taken from Google finance. ADRs were chosen, if available (so I get the cap reported in USD).

* market cap taken from Google finance based on the Hong Kong exchange (no ADRs option was available) and converted to USD.

** converted from Australian dollars or Japanese Yen to USD

]]>