Since the S&P/Case-Shiller 20 city home price index peaked in June 2006 it has fallen 19.5%. In the year ending July 2008 the decline was 16.3%. That is a record drop. In that year Las Vegas declined 29.9%, Phoenix 29.3% and Miami 28.2%. For the largest cities: New York City declined 7.4%, Los Angeles 26.2%, Chicago 10% and Dallas 2.5% (the second lowest decline – Charlotte declined 1.8%); Houston and Philadelphia, the 4th and 5th largest cities are not included in the 20 city index.

Only one city shows a decline in housing values since January, 2000: Detroit is down nearly 7%. Washington is up 95% since January, 2000 (even with a 15.8% decline in the last year), Los Angels and New York are tied for second at 93% increases. The 20 city index is up 66% from January 2000 to July 2008.

The S&P/Case-Shiller Composite of 20 Home Price Index is a value-weighted average of the 20 metro area indices for single family homes.

Source: Record Home Price Declines (pdf)

Related: Housing Prices Post Record Declines – Home Price Declines Exceeding 10% Seen for 20% of Housing Markets – Fourteen Fold Increase in 31 Years – The Ever Expanding House – Coming Collapse in Housing?

I have had difficulty finding good economic data on manufacturing jobs. I have posted about this previously but have trouble finding much worth posting about: Worldwide Manufacturing Job Data – Manufacturing Jobs. The Unites States Department of Labor, Bureau of Labor Statistics has published some interesting data and so here is a look at some of that data.

The table shows average annual productivity gains (output per hour, in USA dollars – I think it is not clear) – the 2007 output totals are from the United Nations data I posted about last week (Data on Top Manufacturing Countries).

| Average Annual Manufacturing Productivity Gains by Country | ||||||

|---|---|---|---|---|---|---|

| Country | 1979-1990 | 1990-1995 | 1995-2000 | 2000-2007 | 1979-2007 | 2007 Output $USA billion |

| Taiwan | 6.1 | 4.7 | 5.6 | 6.4 | 5.9 | |

| Korea | NA | 9.4 | 10.8 | 7.6 | NA | 241 |

| USA | 2.8 | 3.7 | 5.6 | 4.6 | 3.9 | 1,831 |

| France | 3.8 | 3.4 | 4.6 | 3.5 | 3.8 | 296 |

| Japan | 3.8 | 3.3 | 3.4 | 3.8 | 3.6 | 926 |

| United Kingdom | 4.1 | 2.8 | 2.7 | 3.9 | 3.6 | 342 |

| Germany | 2.1 | 2.9 | 3.7 | 3.8 | 3.0 | 670 |

| Spain | 3.3 | 3.1 | 0.8 | 2.1 | 2.5 | 208 |

| Canada | 2.1 | 3.4 | 3.8 | 1.1 | 2.4 | 218 |

| Italy | 3.4 | 3.8 | 1.4 | -.2 | 2.2 | 345 |

The countries that were part of the study but are not included in the table above: Australia, Belgium, Denmark, Netherlands, Norway, Sweden.

Manufacturing productivity increased in 14 of 16 countries in 2007, according to the study. The United States of America increase of 4.1 was the fourth largest among the 16 economies and was slightly above the 3.9 percent U.S. average annual increase since 1979. 15 of the 16 countries increased manufacturing output in 2007.

9 countries increased manufacturing hours worked in 2007, the USA increased 2.3% (below their average increase since 1979). Hours worked decreased for all countries in the period of 2000-2007 (UK has had the largest decrease 3.9% annual average decrease, the USA in next at 3.1%).

Manufacturing employment increased in 10 countries in 2007. From 2000-2007 the USA has experienced average annual declines of 3% in manufacturing employment (the second sharpest drop to the UK which has fallen 4%). From 1979-2007 the USA annual declines averaged 1.2% (only Taiwan.9% and Spain .1% showed increases). From 2000-2007 four countries show slight average annual increases: Spain .5%, Korea .4%, Taiwan .2% and Italy .2%. From 2000-2007 only 3 countries showed annual average decreases in output: Canada -.3%, Italy -.2% and UK – .1%.

Hourly manufacturing compensation has increased in all countries for the period 1979-2007 (data shown for this item is in each national currency: USA 4.6% average annual increases, Spain up 7.2% annually, Taiwan up 7%, UK 6.8%, Germany 4.4%, Japan 4.2%.

via: Canada’s Manufacturing Crisis in International Perspective

Related: posts on employment – Top 10 Manufacturing Countries 2006

re: New Rule: If your company is to big to fail, your company is too big to exist. The next Prez. needs to split up huge companies like we did with AT&T.

Exactly right. Companies too big to fail have massive negative externalities that should be managed through regulation. And the discussion (see link) of this claiming that the huge, anti-capitalist, companies that exist now are not monopolies and therefore anti-trust laws should not be used makes no sense. Anti-trust laws are not for monopolies. Trusts were huge anti-competitive organizations that sought to eliminate the free market and extract benefits by distorting the market. Those laws were adopted not to regulate monopolies but to regulate anti-competitive behavior.

The free market theory formulated by Adam Smith et.al. was based on perfect competition where no one entity could influence the market. In reality that is not possible but approximations of it can exist (we are far from such a state today, however). Fine, the anti-capitalist large corporations are not monopolies – they are oligopolistic that can still extract profits through their ability to distort the free market. Is the fact they are not a monopoly really that relevant?

Enforcing rules that prevent businesses from using their size and power to extract outsized profits is the right thing to do. Anti-trust laws are the proper tool. when politicians are paid lots of money by people with the gold to allow them to cripple the free market and create large corporations that profit, not by competing in a free market, but by manipulating the market that is a bad practice. It won’t change until people stop electing politicians that reward those that pay them for favors. And that is unlikely to happen anytime soon.

What we can hope is that there is some limit on how egregious the favors politicians grant those paying them money are. Maybe this latest escapade (and the costs of those favors to bankers) will cause a reduction in the favors granted. I don’t have high expectations for the changes though.

Read more

The updated data from the United Nations on manufacturing output by country clearly shows the USA remains by far the largest manufacturer in the world. UN Data, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 |

|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,663 | 1,700 | 1,831 |

| China | 143 | 299 | 484 | 734 | 891 | 1,106 |

| Japan | 804 | 1,209 | 1.034 | 954 | 934 | 926 |

| Germany | 438 | 517 | 392 | 566 | 595 | 670 |

| Russian Federation | 211 | 104 | 73 | 222 | 281 | 362 |

| Italy | 240 | 226 | 206 | 289 | 299 | 345 |

| United Kingdom | 207 | 219 | 228 | 269 | 303 | 342 |

| France | 224 | 259 | 190 | 249 | 248 | 296 |

| Korea | 65 | 129 | 134 | 200 | 220 | 241 |

| Canada | 92 | 100 | 129 | 177 | 195 | 218 |

| Spain | 101 | 103 | 98 | 164 | 176 | 208 |

| Brazil | 120 | 125 | 96 | 137 | 170 | 206 |

| Additional countries of interest – not the next largest | ||||||

| India | 50 | 59 | 67 | 118 | 135 | 167 |

| Mexico | 50 | 55 | 107 | 122 | 136 | 144 |

| Indonesia | 29 | 60 | 46 | 80 | 102 | 121 |

| Turkey | 33 | 38 | 38 | 75 | 85 | 101 |

The USA’s share of the manufacturing output of the countries that manufactured over $200 billion in 2007 (the 12 countries on the top of the chart above) in 1990 was 28%, 1995 28%, 2000 33%, 2005 30%, 2006 28%, 2007 27%. China’s share has grown from 4% in 1990, 1995 7%, 2000 11%, 2005 13%, 2006 15%, 2007 16%.

Total manufacturing output in the USA was up 76% in 2007 from the 1990 level. Japan, the second largest manufacturer in 1990, and third today, has increased output 15% (the lowest of the top 12, France is next lowest at 32%) while China is up an amazing 673% (Korea is next at an increase of 271%).

Read more

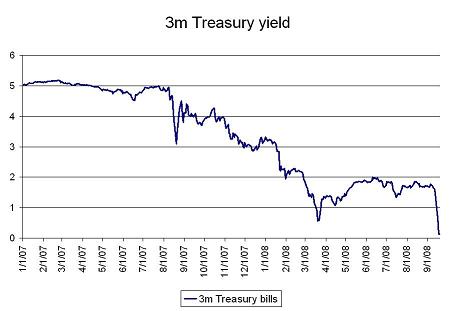

On Wednesday of last week the United States 3 month treasury bill yield reached .03%, yet another remarkable chart from the current crisis.

via: No one wants to hold risk … – “I guess this is what a close to systemic financial crisis in the US looks like”

Daily Treasury Yield Rates show that the rate for Friday the 12th of September 1.49%, Monday the 15th 1.02%, Tuesday .84%, Wednesday .03%, Thursday .23% and Friday .99%.

Related: Corporate and Government Bond Yields – Curious Cat Investing and Economics Search – Credit Crisis Continues (April 2008)

SEC to temporarily ban short-selling: report

Wow, that would be very surprising to me (especially if you asked more than a month ago the chances of this happening). But given these crazy times I can believe it. I wish they just properly regulated short selling the last 10 years (the failure to do so has been very disappointing). And I would be against banning short selling unless there were a very extreme situation. I don’t see that are necessary now, but I have far from all the details so maybe it is warranted now (though I am skeptical).

Update: SEC Halts Short Selling of Financial Stocks

Given the importance of confidence in financial markets, the SEC’s action halts short selling in 799 financial institutions.

Related: Naked Short Selling – Shorting Using Inverse Funds – Investor Protection Needed

Watching your new worth decline isn’t fun. But when investing over the long term you will have some good periods and some bad periods. Diversification can help smooth out the extremes but the markets are often driven by emotion. And those emotions (greed, fear…) cause extreme price swings. I am getting ready to invest more in the market. I don’t know how much further we will go down, or if we are at the bottom now (unlikely). But there are investments I am happy to own at these prices. The main reason I don’t buy more is the limitation of my capital. And I would rather buy in slowly so if prices decline I can get more for my money.

Not surprisingly the stocks I am looking at are those in the 12 stocks for 10 years portfolio. I am looking at buying more Templeton Dragon Fund, Toyota and Google for myself now. I am happy to be able to buy more of these stocks for the long term. It is not fun to see my net asset value decrease but that does provide some opportunities for buying stocks at lower prices. They may turn out to be bargains, or maybe they will drop much further. That only time will tell, but I am happy to add to those positions at these prices.

On the overall market I am waiting and watching. But I am leaning now toward moving more of my long term investing into stocks – I am already over-weighted there compared to the conventional wisdom but that is my style. I am willing to take more risk with a long long term investment portfolio. As the time frame shrinks (and the assets grow) I believe in reducing the risk profile for the overall portfolio (though I still believe conventional wisdom over-emphasizes price volatility risk (compared to inflation risk, for example). This market does have real potential for creating serious long term problems, which is why I need to think more (and get more information) about the long term implications.

Related: Investment Risks – books on investing – Does a Declining Stock Market Worry You? – Uncertain Economic Times

Fed to Loan A.I.G. $85 Billion in Rescue

The decision, only two weeks after the Treasury took over the federally chartered mortgage finance companies Fannie Mae and Freddie Mac, is the most radical intervention in private business in the central bank’s history.

This whole meltdown of the companies that exemplified the mantra that government regulation is bad (when they would like to make money by avoiding regulation) that now come begging for government bailouts because of the risk to the economy of failing to provide bailouts sure is disheartening. You might even think real changes will be made. I am sure changes will be made for awhile and then people will forget and special interests will pay politicians to get special favors and we will find ourselves in a different but similar mess a few decades from now.

Related: Fed Continues Wall Street Welfare – 2nd Largest Bank Failure in USA History – Estate Tax Repeal

Why Allocations Make A Big Difference

Good advice, but I believe people need to be much more careful with bonds than many people believe. Long term bonds can be volatile (both due to interest rate and other risks). And with interest rates low this risk is higher. The duration of your bonds (as well as credit/business risk) is a very important factor (the longer the duration the higher the interest rate risk).

I also think the importance of asset allocation increases as your assets increase and the goal gets closer (normally retirement but also could be a child’s education fund…). And I think you need to look at more than just stocks versus bonds (different types of stocks, real estate… are important considerations). I discussed some possible retirement account allocations possibilities for early in life in a previous post.

Related: Lazy Portfolio Results – Investing books – Roth IRA – Dollar Cost Averaging

Federal Deficit To Double This Year

…

The budget picture is likely to grow even bleaker once government analysts factor in the anticipated costs of the Treasury Department’s decision last weekend to take over struggling mortgage-finance giants Fannie Mae and Freddie Mac.

It is no surprise those that spend what they don’t have personally elect those that do the same thing for the nation. But as those that spend money they don’t have eventually realize you have to become responsible at some point.

Related: More Government Waste – True Level of USA Federal Deficit – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren