Pitfalls in Retirement (pdf) is quite a good white paper from Meril Lynch, I strongly recommend it.

could safely spend 10% or more of their savings each year.

But, as explained below, the respondents most on target were the one in 10 who estimated sustainable spending rates to be 5% or less. This is significantly impacted by life expectancy; if you have a much lower life expectancy due to retiring later or significant health issues perhaps you can spend more. But counting on this is very risky.

This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.

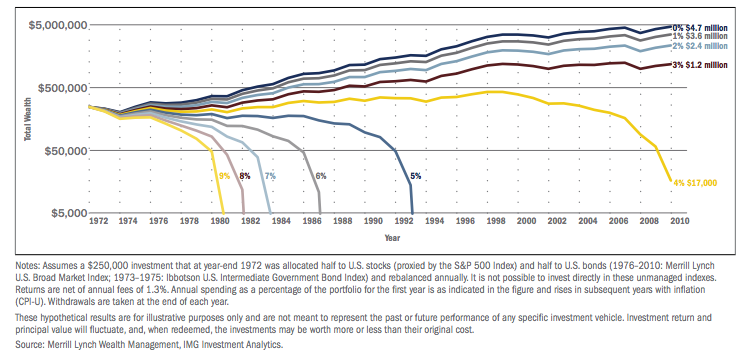

Chart showing retirement assets over time based on various spending levels, from the Merill Lynch paper.

The chart is actually quite good, the paper also includes another good example (which is helpful in showing how much things can be affected by somewhat small changes*). One piece of good news is they assume much larger expense rates than you need to experience if you choose well. They assume 1.3% in fees. You can reduce that by 100 basis points using Vanguard. They also have the portfolio split 50% in stocks (S&P 500) and 50% in bonds.

Several interesting points can be drawn from this data. One the real investment returns matter a great deal. A 4% withdrawal rate worked until the global credit crisis killed investment returns at which time the sustainability of that rate disappeared. A 5% withdrawal rate lasted nearly 30 years (but you can’t count on that at all, it depends on what happens with you investment returns).

Related: What Investing Return Projections to Use In Planning for Retirement – How Much Will I Need to Save for Retirement? – Saving for Retirement

An interesting tidbit from the paper: A 65-year-old woman has a 62% chance of living past 85; for a 65-year-old couple, the chance of at least one spouse living past 95 is 31%.

When planning for retirement there are many unknowns. One thing to remember is you can’t count on working until your planned retirement date. Health complications can force you to retire early. Also economic or business conditions may force you to do so. Perhaps you can find another job, maybe not. Even if you do, it may be at a much lower salary.

Another paper: New World, New Rules (pdf) also has some interesting material. They do push some high revenue items (hedge funds, private equity…) for them, but as long as you can sensibly separate advice from sales pitches it is worth reading.

Another interesting tidbit from the paper: in 2011, 40% of the profits for the companies in the S&P 500 came from outside the USA. The idea of allocating portions of your portfolio to USA stock and foreign stocks is fairly largely confused by this. Much of your USA stock portfolio is very global already.

Another thing to consider is it is very wise to adjust your withdrawal rate based on investment conditions. So while you can’t expect to withdrawal over 4% every year if you have several good investing years that would allow you to take some extra money as long as you willing to take under 4% if you have a couple bad years.

* I do have a quibble with the way they discuss retiring 2 years later having such an impact. And they are not the only ones that do this, it happens all the time. They assume both people retire with the same investment value. But that is an unreasonable assumption. The whole reason why retiring just before a huge market slump is so bad is your assets take a huge hit. Well if you are just 2 years from retirement when that huge decline takes place you are not going to be able to make up for it and retire with that same amount.

You would basically have the same big loss the person that retired 2 years earlier did, you just experience it before you retire. You may be able to pick up an extra $10,000 or something by saving more since you see the decline just before you retire but basically the comparison is not accurate (in the way they claim). The biggest thing that having the huge decline just before you retire would allow is delaying retirement a few years (that way you can save up more money but just as important you can reduce the expected years in retirement because you work a few more years).

Comments

1 Comment so far

[…] Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually […]