The stock market capitalization by country gives some insight into how countries, and stocks, are doing. Looking at the total market capitalization by country doesn’t equate to the stock holdings by individuals in a country or the value of companies doing work in a specific country.

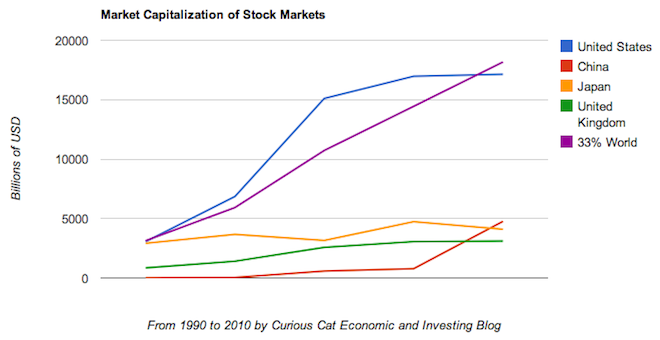

Chart of largest stock market capitalizations by country from 1990 to 2010

In the chart, I divided the world total by 3: just to make the chart look better. The USA was 32.5% of the total in 1990. The USA grew to 46.9% as the tech, finance and housing bubbles were all underway (also Japan was stagnating and the Chinese stock market hadn’t started booming to a significant extent). In 2010 the USA was back down to 31.4%. This will likely continue to decrease (at a much slower pace – I wouldn’t be surprised to see the USA at 25% in 2020) as the rest of the world’s markets continue to grow more quickly.

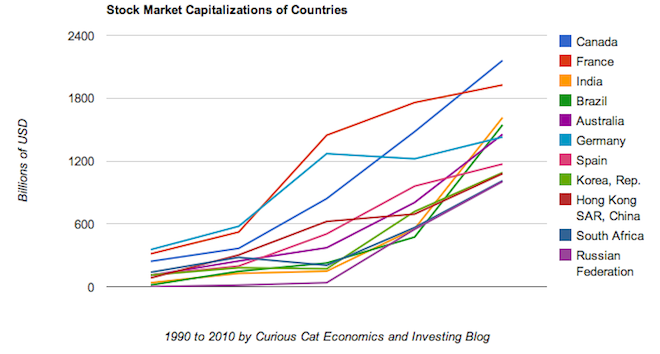

As with so much recent economic data China’s performance here is remarkable and Japan’s is distressing. China grew from nothing in 1990 to the 2nd largest country in 2010. Hong Kong add another $1 trillion to China’s $4.5 trillion. Canada is the only country above $2 trillion not included on this chart. China grew by $4 trillion from 2005 to 2010.

Related: Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Top 10 Countries for Manufacturing Production from 1980 to 2010 –

Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Government Debt as Percent of GDP 1998-2010

One interesting point is how poorly Europe is represented (compared to the economies). The UK has the largest European capitalization. Canada is largest than France which is then followed by India, Brazil and Korea which are ahead of Germany and Spain.

The data is from the world bank and based on the listed domestic companies are the domestically incorporated companies listed on the country’s stock exchanges at the end of the year. I think that means that for example, Toyota stock (TM) is all counted in Japan (even though you can buy ADRs in the USA on the NYSE). And also Intel (INTC) is all counted in the USA, even though both of those companies make a large portion of their money in other countries and with factories in other countries.

The USA’s large market capitalization is a result of several things. First USA based companies (Google, Apple, Intel, Disney…) are very profitable and therefore very valuable. Also many USA companies have expanded globally. I think it also is a result of many investors trusting USA based companies (accounting standards, SEC…) and therefore being willing to invest (and companies basing there to gain that trust).

It will be interesting to see if other countries can start gaining some of the listings the USA has been getting. Tax consequences can play a role (though often companies can just create subsidiaries to deal with tax advantages). Right now the USA actually a fairly high tax location for companies. Companies can often avoid the taxes with accounting maneuvers but if the desire for tax revenue results in that being more difficult for USA based companies, companies may switch to being based elsewhere.

Developing markets are really starting to grow substantially in the last 10 years. I expect that to continue going forward. Some will grow very rapidly. Others will likely decrease a great deal. Foolish government policies can really cripple efforts of developing markets. The USA, Japan (even Germany, UK…) have a large deal of leeway to cope with lousy policies. They suffer but all the other strengths in their economies greatly reduce the suffering.

One of the most important advantages is just huge amounts of wealth: that cushions the impact of bad policy. Developing countries have little cushion. A few bad mistakes and capital will flee elsewhere (as will brainpower) and it can be very difficult to lure them back. The USA and Europe have been eating away at their built up wealth and have less slack today than they did 30 years ago. And developing markets are beginning to create significant stores to absorb some bad mistakes.

Some countries have already made a huge leap over the last 20 years to being able to absorb large shocks: Singapore, Korea… Others are edging closer: Malaysia, Brazil… China has made great economic progress but still has huge issues to deal with. India is making progress but much more slowly than China. Quite a few countries have been doing well, but really need at least another 10 years to feel any safety net at all: Indonesia, South Africa, Thailand, Mexico…

It is nice to see the continued rise of the global market capitalization over time. I think that will continue.

Comments

2 Comments so far

The dominance of the USA in stock market capitalization is quite impressive – the next 7 countries added together don’t quite reach the USA’s stock market capitalization…

1 Apple USA $626 billion

2 Exxon Mobil USA $405 billion

3 Microsoft USA $383 billion

4 Google USA $379 billion