Peer to peer lending has grown dramatically the last few years in the USA. The largest platforms are Lending Club (you get a $25 bonus if you sign up with this link – I don’t think I get anything?) and Prosper. I finally tried out Lending Club starting about 6 months ago. The idea is very simple, you buy fractional portions of personal loans. The loans are largely to consolidate debts and also for things such as a home improvement, major purchase, health care, etc.).

With each loan you may lend as little as $25. Lending Club (and Prosper) deal with all the underwriting, collecting payments etc.. Lending Club takes 1% of payments as a fee charged to the lenders (they also take fees from the borrowers).

Borrowers can make prepayments without penalty. Lending Club waives the 1% fee on prepayments made in the first year. This may seem a minor point, and it is really, but a bit less minor than I would have guessed. I have had 2% of loans prepaid with only an average of 3 months holding time so far – much higher than I would have guessed.

On each loan you receive the payments (less a 1% fee to Lending Club) as they are made each month. Those payments include principle and interest.

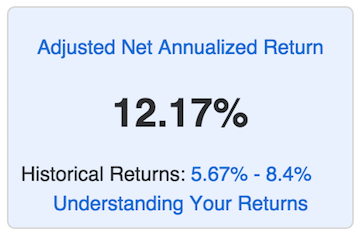

This chart shows the historical performance by grade for all issued loans that were issued 18 months or more before the last day of the most recently completed quarter. Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses. From LendingClub web site Nov 2015, see their site for updated data.

Lending Club provides you a calculated interest rate based on your actual portfolio. This is nice but it is a bit overstated in that they calculate the rate based only on invested funds. So funds that are not allocated to a loan (while they earn no interest) are not factored in to your return (though they actually reduce your return). And even once funds are allocated the actual loan can take quite some time to be issued. Some are issued within a day but also I have had many take weeks to issue (and some will fail to issue after weeks of sitting idle). I wouldn’t be surprised if Lending Club doesn’t start considering funds invested until the loan is issued (which again would inflate your reported return compared to a real return), but I am not sure how Lending Club factors it in.

Return shown for my portfolio. My portfolio is currently 3% A, 25% B, 44% C, 19% D and 9% E loans. The terms of my loans are 81% 36 months and 19% 60 months.

They also don’t credit the money to you until what seems like about 5 days after the payment has been received. This also reduces your achieved rate of return, from the nominal rate charged to the borrower. I would like to assume they factor this into their calculated returns, but given the other decisions they make when calculating the return I am not certain they do.

In any case the real return is still very good compared to my other options and so if they inflate the results by 40 basis points (I don’t know what the actual discrepancy is and the uncertainty looking forward is much larger than that anyway). The expected rate is likely around 5-8% compared to about 0-.25% for me, so the slight exaggeration doesn’t matter to me.

For my portfolio (shown in the graphic above) Lending Club shows a current return of 12% with an expected return through the completion of the outstanding loans of 5.7% to 8.5%. The current return is very inflated when your portfolio is very new as you have experienced no, or very few, defaults. I will explore historical returns, returns as the portfolio ages and the expected returns in a future posts. My portfolio is currently 3% A, 25% B, 44% C, 19% D and 9% E loans. The terms of my loans are 81% 36 months and 19% 60 months.

You can read details on the loans (and filter loans on those details) for things such as: loan type, state of borrower, debt to income ratio, months since a delinquency, months since a default, monthly income, credit score, own/mortgage/rent. Lending club scores the loan quality and determines the loan interest rate depending on that (and 36 month versus 60 month term).

The more risk taken by borrowers the higher the expected returns. So if you take riskier loans you get a higher interest rate on the loan and historically even after losses from defaults the returns are greater. This brings up my biggest concern with these loans: underwriting risk. As long as Lending Club does a good job evaluating underwriting risk and properly assigning interest rates commensurate with that risk this should work very well as an investment.

As long as you have a well diversified portfolio of personal loans there is a long track record of the risk. And while plenty of risky personal loans will default, and more will default if the economy has a downturn the interest rates on the loans provides good income even after such losses. And even if things go poorly the actually losses of capital should be small (over the whole portfolio).

The discussion of investing in peer to peer loans using LendingClub will be continued in next post (next week, updated to add link to the post: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age).

Related: Looking for Yields in Stocks and Real Estate (2012) – Taking a Look at Some Dividend Aristocrat Stocks – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment (2011) – Where to Invest for Yield Today (2010)

Comments

3 Comments so far

[…] shows the returns over the life of portfolios as the portfolio ages […]

You write this “As long as you have a well diversified portfolio of personal loans there is a long track record of the risk,” which doesn’t make sense but may refer to diversification.

My LC experience has NOT lined up with their “promised” returns.

How about yours?

There is a long track record showing the risk of “well diversified portfolios of personal loans” over many different economic climates (recessions, expansions, high inflation…).

My LendingClub experience has fallen short of their “projections.” Of course those “projections” can’t be expected to be what will result in the unknown future in a precise way. It does seem many people are disappointed in LendingClubs returns in the last year+.

As with any investment predicting what this means about future returns is the tricky part. I do think it makes sense to hold back adding to LendingClub loan investments for many people. I have not added money that I may well have if returns had been better. I haven’t pulled any money out – I am reinvesting the money generated by my portfolio in new loans and plan to continue doing so.

My plan has always been to start taking income from my portfolio in 2018. That is still my plan. I would aim to withdraw about 1/2 of net interest I earn. It is still a very small amount of my portfolio (maybe 1%). Even though the returns are not great and are volatile compared to a savings account the interest is still much higher than I can get in other interest bearing options.

I do believe dividend paying stocks are a good alternative (including REITs). I have much more in those than in LendingClub or other interest investments. My Lending Club return is about 6% so far (it has declined a bit in the last year).