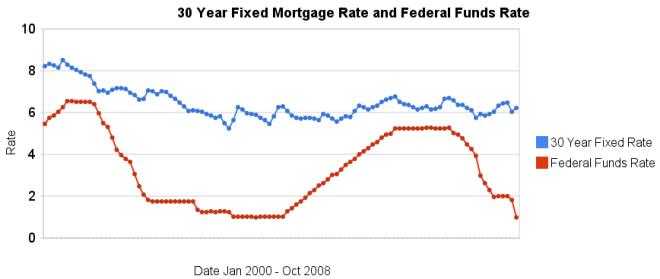

More dramatic evidence that changing in the federal funds rate do not lead to similar changes in 30 year fixed mortgage rates. It is true the last few months are very unusual times for the credit market. However, the current lack of correlation is not the exception, the graph clearly shows there is very little correlation between changes in the two interest rates.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Affect of Fed Funds Rates Changes on Mortgage Rates – posts on financial literacy – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Comments

1 Comment so far

All these problems about the economy is deeply rooted on mortgages. Homeowners cannot afford the amortization of their loans anymore. The best solution to this is to reduce mortgage interest rates for a 30-yr. fixed to a 4.5%. This way homeowners will be able to refinance and/or purchase new homes. Once this is done, people will not buy principal residence and/or refinance their existing home.