No, it is not time to sell Apple, if your portfolio is not already too heavily overweighted in Apple it would make sense to buy. There is about as much wrong with Apple today as Toyota 3 years ago, which means essentially nothing is wrong. Yes, neither company is perfect. Maybe people were carried away with how awesome Apple was, but I don’t think the stock price every was.

Apple was a great buy at $700. Of course in the same situation buying it at $500 would be even better. I think it is a great buy at $500 today. I think Apple is going to move ahead just as Toyota has the last few years. The people jumping around at every single rumor of a data point are going beyond reacting to each data point they are reacting to rumors of data points.

I could be wrong. If Apple’s earnings cave over the next 5 years people can claim they say early signals. After a long time watching investors react to data and rumors and speculation I think they are just being foolish. Even if Apple is deteriorating, there needs to be a much better explanation for why investors should believe that than I have seen.

The best reason to question Apple is how long of a run they are on. Figuring the “law” of convergence in mean should make investors wary. That isn’t really true but that idea – that you just don’t stay on such a run (especially when you are huge and the have the largest market capitalization in the world).

But that is more just saying Toyota can’t keep being awesome. There is some sense that most likely they will stumble. But the problem is it is more likely about every other company will stumble first. The winners keep winning more than they start failing. But they also do often start failing. 100 years from now there is a decent chance Apple doesn’t exist. But there is a greater change most of the other companies you can invest in won’t. And there is a greater chance most other investments will do worse than Apple. That is my guess. Other investors get to place their money where there mouth is and we will see in 5 and 10 years how things stand.

I’ll stick with Apple and Toyota and Google and Danaher and Intel and….

Related: Apple’s Earning are Again Great, Significantly Exceeding High Expectations (April 2012) – Apple Tops Google (Aug 2008) – 12 Stocks for 10 Years: Oct 2010 Update

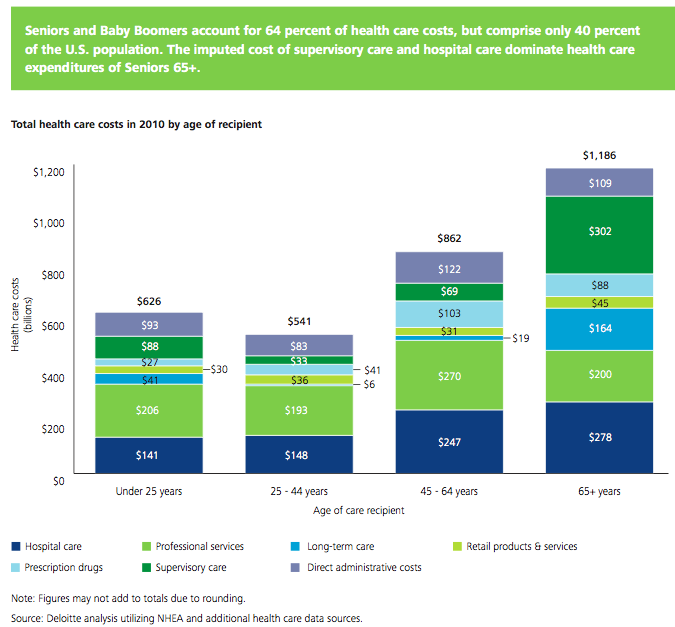

A recent report by Deloitte, The Hidden Costs of U.S. Health Care: Consumer Discretionary Health Care Spending provides some interesting data.

Between 2006 and 2010 USA health care expenditures increased by 19%. Government spending accounted for 40% of costs (remember that figure is lowered due to Deloitte’s including inputed value for care of relatives). Those 65 and older account for 61% of the inputed cost care that is provided.

Seniors and baby boomers account for 64% of health care costs, but comprise only 40% of the USA population. The imputed cost of supervisory care and hospital care are far higher proportions of health care expenditures of seniors (65 and older).

I find this imputed value largely not worth considering. There are problems with the way we count GDP and economic activity (that affect health care and lots of other things). It is fine to be aware that they think $492 billion of extra care is given by family members but using that figure in any sensible way (other than saying hey there is a huge cost in people’s time to dealing with our health care system and sick people that isn’t counted in economic data) is questionable.

It is useful in looking at the increasingly old population we will see in the future and judging their is a large need for supervisory care that is not captured in just looking at the costs included in economic data currently. Not only will our grandkids have to pay for our living beyond our means today they will have to do so while providing unpaid care to their parents and grandparents.

The burden of long term supervisor care (that which can be provided by a non-health care professional) is one reason a resurgence in multi-generation housing options make sense to me. There are other good reasons also (child care, socialization, financial support to the young…). There are some real advantages and real disadvantages to such options. But I think economic advantages are going to encourage more of this going forward.

Related: Personal Finance Basics: Long-term Care Insurance – Health Care in the USA Cost 17.9% of GDP, $2.6 Trillion, $8,402 per person in 2010 – Resources for Improving Health Care System Performance

Those that want to continue the policies of the last few decades of policies that tax our grandkids to pay for us living beyond our means seem to have won the day again. Not a surprise; very sad though.

In my reading stories on the wonderful success of “avoiding the fiscal cliff” seems to amount to passing the George Bush tax cuts again (except this time when in a much much worse budgetary position) and modifying the extent to which the absolute richest benefit from those cuts (so the richest don’t get quite as step cuts as they had been getting but still are getting big cuts from before the Bush tax cuts were made. And the recent trend of treating trust fund babies as the absolute most favored taxpayers was continued (though a few of the absolute richest trust fund babies will have to have some taxes withheld from their windfalls).

I haven’t read anything about them getting rid of the “hedge fund manager” tax favors. Did they? Did they even bother to change the law so retired managers don’t get the super huge tax favors too?

On the spending beyond our means issue they seem to have just decided that having the grandkids continue to fund our spending is wonderful.

If it were up to me I would have continued some of the Bush tax cuts (certainly not for those making more than $200,000 – unless we can cut spending way more than I would guess in which case I would be fine having taxes even for the richest few lowered). I would have continued treatment that reduced taxes owed on dividends and capital gains, though perhaps a bit less than they did. I would cap mortgage deductions (at say $50,000 a year or something).

I certainly would not have supported such massive Bush tax cuts without large spending cuts. If this level of spending is what we intent to do, we need to pay for it and not just bury our kids and grandkids with huge bills. Without spending cuts I would not have voted again for the Bush tax cuts, which seems to be the main extent of their “solution” (taking a bit of the tax cuts for the wealthiest off the plate but pretty much just passing Bush’s tax cut again).