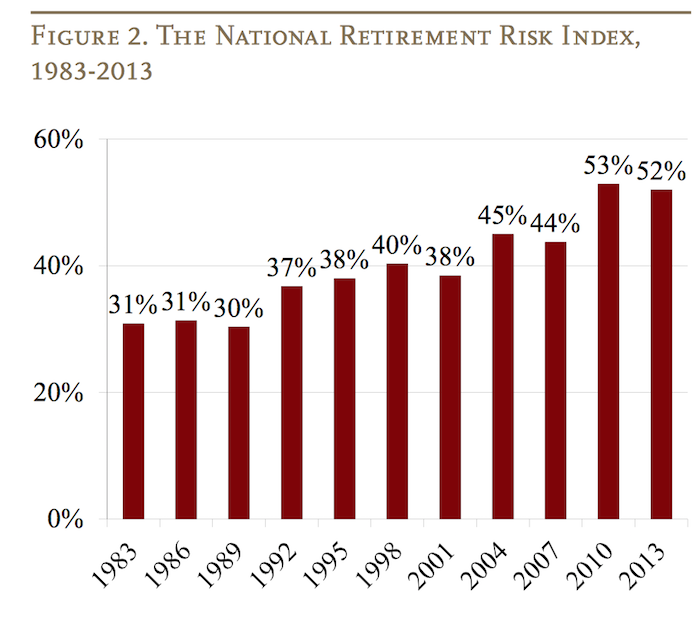

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Personal debt levels in the USA continue to be alarmingly high. Thankfully in the last couple of years things have been moving slightly in the right direction. But the debt levels are still far too high.

The chart shows USA household debt in the 60% range of disposable income in the 1980s. It isn’t as if the 1980s in the USA were some low debt era. Personal debt was high then. It rose into the 120% range in the last 10 years and in the last few years dipped to the 110% range.

Given the large amount of debt falling into collection managing that debt has becoming increasingly important to local banks and credit unions. Companies like, Intelligent Banking Solutions, are helping those institutions deal with collections while building a strong business themselves.

As consumers we need to use debt sparingly and without our means or be trapped in a personal financial crisis. It is hard enough to get ahead today without creating problems such as paying high interest rate debt or penalties and fees for failing to pay back your obligations as required.

A reasonable amount of government debt is not a problem in a strong economy. If countries take on debt wisely and grow their economy paying the interest on that debt isn’t a problem. But as that debt grows as a portion of GDP risks grow.

Debt borrowed in other currencies is extremely risky, for substantial amounts. When things go bad they snowball. So if your economy suffers, your currency often suffers and then the repayment terms drastically become more difficult (you have to pay back the debt with your lower valued currency). And the economy was already suffering which is why the currency decreased and this makes it worse and they feed on each other and defaults have resulted in small economies over and over from this pattern.

If a government borrows in their currency they can always pay it back as the government can just print money. They may pay back money not worth very much but they can pay it back. Of course investors see this risk and depending on your economy and history demand high interest to compensate for this risk (of being paid back worthless currency). And so countries are tempted to borrow in another currency where rates are often much lower.

If you owe debts to other countries you have to pay that money outside the system. So it takes a certain percentage of production (GDP) and pays the benefit of that production to people in other countries. This is what has been going on in the USA for a long time (paying benefits to those holding our debt). Ironically the economic mess created by central banks and too-big-to-fail banks has resulted in a super low interest rate environment which is lousy for lenders and great for debtors (of which the USA and Japanese government are likely the 2 largest in the world).

The benefits to the USA and Japan government of super low interest rates is huge. It makes tolerating huge debt loads much easier. When interest rates rise it is going to create great problems for their economies if they haven’t grown their economies enough to reduce the debt to GDP levels (the USA is doing much better in this regard than Japan).

Japan has a much bigger debt problem than the USA in percentage terms. Nearly all their debt is owed to those in Japan so when it is paid it merely redistributes wealth (rather than losing it to those overseas). It is much better to redistribute wealth within your country than lose it to others (you can always change the laws to redistribute it again, if needed, as long as it is within your economy).

Insurance can be annoying as you pay for something you hope not to use. I don’t recall ever getting a payment on life insurance, homeowners insurance, disability insurance or auto insurance. And that I haven’t had a claim is good. On health insurance I have had minor things covered like a physical or dentist and that is it.

Health insurance is critical in the USA. One insurance that people often don’t think of however is disability insurance. Disability insurance is a very important insurance that too many people don’t consider (many jobs offer it, though not all, and some may take a year before you are covered). Studies show that a 20 year old has a 30% chance of becoming disabled before reaching retirement age. In the USA, the Social Security Administration provides disability benefits for total disabilities.

In the USA you may be eligible for social security disability payments but it is a small amount (so not sufficient by itself). But if you are living overseas and not paying social security I am not sure if you are covered, even for the limited coverage it provides.

I am not sure what the situation is for citizens of other countries, maybe they have better safety nets for people (I would imagine Europe does, but many places probably don’t).

I had been living in Malaysia for several years and am now going nomadic (an increasingly popular choice for a small but determined group of people) and insurance is important for people living overseas and traveling. For nomads or frequent travelers global health insurance is good (though usually it will exclude the USA if you are not a “USA 1%er”(or world .2%)/very-rich as the extremely broken USA health care system is crazy – you can be covered globally excluding the USA for about 1/6 of that same coverage excluding the USA, depending, of course on your coverage). Special care for travelers and nomads should be paid to coverage to return you home if you are very sick or injured.

Disability insurance is something thing digital nomads should pay attention to. But it is normally ignored. And it is a bit tricky as insurance companies are generally extremely slow to catch up to what the world is doing and disability insurance seems to be stuck in the old notions about how tied people were to one country (as are other things – demanding physical addresses even if they know you are nomadic…, basing rules on silly ideas about where you happen to be at some point in time with customer hostile breaking of internet services that have been paid for etc.).

Related: Personal Finance Basics: Long Term Disability Insurance – The Growing Market for International Travel for Medical Care – Long Term Care Insurance: Financially Wise but Current Options are Less Than Ideal