The number of USA households spending more than 50% of their income on rent is expected to rise at least 11% to 13.1 million by 2025, according to new research by Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners.

The findings suggest that even if trends in incomes and rents turn more favorable, a variety of demographic forces—including the rapid growth of minority and senior populations—will exert continued upward pressure on the number of severely cost-burdened renters.

Under the report’s base case scenario for 2015-2025, the number of severely burdened households aged 65-74 and those aged 75 and older rise by 42% (830,000 to 1.2 million) and 39% (890,000 to 1.2 million); the number of Hispanic households with severe renter burdens increases 27% (2.6 million to 3.4 million); and the number of severely burdened single-person households jumps by 12% (5.1 million to 5.7 million).

Graph from the report. The blip of an improvement from 2010 to 2013 is due to the decline in home ownership which changed the makeup of the “rental population.” Moderate (severe)

burdens are defined as housing costs of 30–50% (more than 50%) of household income. Households with zero or negative income are assumed 30 to be severely burdened, while renters not paying cash rent are assumed to be unburdened.

Enterprise Community Partners argues for more government action on affordable housing. I am worried about such efforts being done in a sensible way but I do agree with the concept of supporting affordable housing. I would use zoning to require affordable housing construction along with market rate housing.

Doing such things well requires a government that is not corrupt and fairly competent which isn’t so easy looking across the USA (unfortunately). An example of somewhere that does this fairly well is Arlington Country, Virginia (which also has a good non-profit focused on affordable housing). Good non-profits can play a vital part in affordable housing over the long term.

My comments on a post by Kiva about their decision to end the Kiva Zip (direct to people loans – no intermediary financial institution) program in Kenya.

I do think it is very important to retain an infrastructure for those people you got to try the new effort with, as I believe Kiva will. This has to be part of any innovation efforts – a budget to include unwinding the effort in a way that is in keeping with Kiva’s mission to help people. I strongly believe in efforts to avoid abandoning those who worked with you in general, but for those taking loans from Kiva it is much more important than normal.

Keep up the good work. And keep challenging Kiva to get better and not get complacent when things are not going as well as they should. I am happy to continue to lend to Kiva but I also am concerned that the focus on making a difference and making people’s lives better can be lost in the desire to grow.

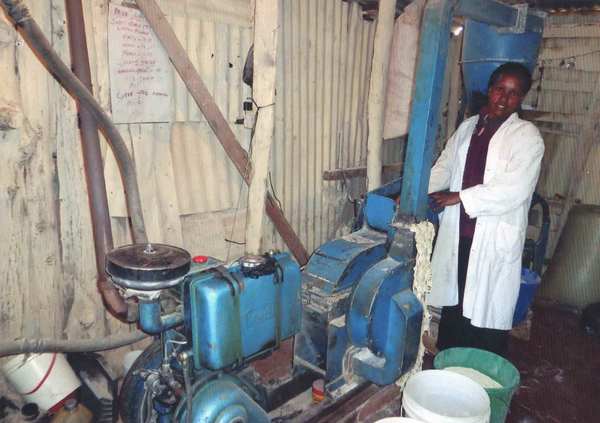

I made a loan via Kiva zip for Hilda to buy a posho mill machine. The loan was repaid in full.

The Curious Cats group on Kiva has made over $27,000 in loans to entrepreneurs around the world (the way Kiva works the groups, they don’t include Kiva Zip loans). You can join us. I believe in the model of micro-finance (Investing in the Poorest of the Poor [this one is grants instead of loans]), though I also believe we need more data on real experience of borrowers. Kiva Zip gives loans directly to people with a 0% interest rate. Normal Kiva loans have financial institutions (some of which are charities but they still have expenses) make the loans and Kiva lenders provide capital (at 0%) but the borrowers have to pay interest (the idea is they pay lower interest since the financial institution has a 0% cost of capital).

Related: Kiva Loans to Entrepreneurs in Columbia, India and Kenya – Kiva Loans Give Entrepreneurs a Chance to Succeed (2011) – Using Capitalism to Create Better Lives in Mali (2009)

The USA economy is far from strong. The global economy seems even weaker. Inflation is not an imminent risk. Under such conditions the USA Federal Reserve adding gasoline to the economy via low interest rates makes sense.

The issue I see is that a .25% Fed Funds rate is adding gasoline to the economy via low interest rates. Many people are saying an increase is like taking away the gasoline and taking out a fire extinguisher. But it really isn’t. Raising the rate to .25% is slightly decrease the amount of gas you are adding to the fire. A .25% Federal Funds rate is pouring nearly as much gas on as you are able to but not quite the absolute most you are able to.

It is also true that the Fed bailing out the too-big-to-fail bankers and banks resulted in them not only opening up the gasoline as much as possible (taking rates to 0) they even went far beyond that with new methods of pouring on gasoline that hadn’t even been considered until the bankers’ risk-taking doomed the economy (and bankrupted their institutions – without government bailouts propping them up).

The Federal Reserve has finally turned off the massive extraordinary dumping of gasoline onto the economic fire (via quantitative easing). But they have kept not only dumping lots of gasoline on the economy but doing so to the absolute maximum possible via a 0% Fed Funds rate.

Arguing for slowing the amount of fuel you are dumping into the economy is not the same as saying you are constricting the economy. We have been put into a crazy global economic condition by the too-big-to-fail bankers and the massive amounts of government and personal debt taken out. So simple analogies are not effective in making policy.

The analogies can help explain what the intent and expectation of the policy is. It is true we have created a very tenuous economic foundation (and we haven’t in any way substantial way addressed the risk too-big-to-fail bankers can throw the global economy into and we still have massive debt problems). The main beneficiaries of the central banker’s policies the last nearly 10 years are too-big-to-fail bankers and those borrowing huge amounts of money.

Those suffering from the policy are savers and I fear those that have to cope with the aftermath of this massive intervention with likely bubbles (government debt, personal debt [including education debt in the USA, etc.]). The main reason I believe rates should be raised are to begin the path to stop transferring wealth from savers to too-big-to-fail bankers and those with massive debt problems.