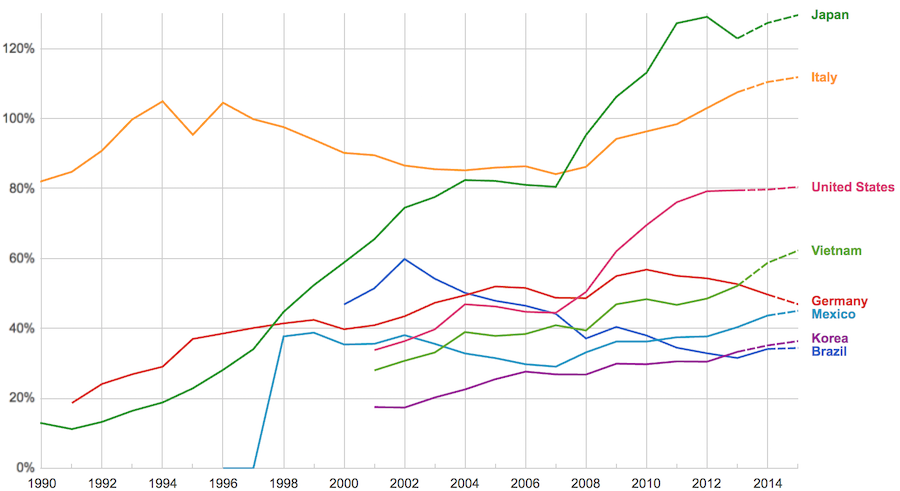

The data, from IMF, does not include China or India.

The chart shows data for net debt (gross debt reduced by certain assets: gold, currency deposits, debt securities etc.).

Viewing our post on the data in 2014 we can see that the USA improved on the expectations, managing to hold net debt to 80% instead of increasing to 88% as expected. Nearly every country managed to take on less debt than predicted (Vietnam took on more, but is very low so this is not a problem).

Taking on debt to invest in valuable resources (building roads, mass transit, internet infrastructure, education, environmental regulation and enforcement, health care, renewable energy…) that will boost long term economic performance can be very useful. The tricky part is knowing the debt levels doesn’t tell you whether the debt was taken on for investment or just to let current taxpayers send the bills for their consumption to their grandchildren.

Also government debt can become a huge burden on the economy (especially if the debt is owed outside the country). The general consensus today seems to be that 100% net debt level is the maximum safe amount and increasing beyond that gets riskier and riskier.

And it isn’t at all that this is a universal truth. Economically weaker countries have greater risks. And to me, if they go above 75% that starts to get very risky. The USA and Japan have extra latitude that others would be wise to realize. Taking on the same level of debt would be very troublesome for most countries. Japan has a huge percentage of their debt held internally which makes a huge difference (it is much safer).

Taking on government debt (at acceptable interest rates) and investing in economically productive projects is wise. There is a huge risk of taking on the debt given that reasonable business case but then spending in foolishly which creates big economic problems in the long run. If the investment don’t pay off the grandchildren of those taking out the debt will be stuck paying it back. But if the investments are wise the grandchildren will inherit a strong economy and benefit from the wise use of debt that was invested well.

I don’t think it takes much imagination to worry about all the ways taking on debt could result in bad long term results. I do believe in the value of wise government spending. I also do worry about politicians just rewarding those that pay give cash to them (their “campaign funds,” show a history of paying former politicians as lobbyists etc. when they leave…) instead of fulfilling their obligation to the country.

Related: Government Debt as Percent of GDP 1998-2010 for OECD – Gross Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China

Comments

1 Comment so far

That’s actually quite interesting. I would like to see where Australia’s is at, it is not a very well known fact to the public about how much debt Australia actually has. All the best.