I have decided to wind down my investment test with LendingClub. I should end up with a investment return of about 5% annually. So it beat just leaving the money in the bank. But returns are eroding more recently and the risk does not seem worth the returns.

Early on I was a bit worried by how often the loan defaulted with only 0, 1 or 2 payments made. Sure, there are going to be some defaults and sometimes in extremely unlucky situation it might happen right away. But the amount of them seems to me to indicate LendingClub fails to do an adequate job of screening loan candidates.

Over time the rates LendingClub quoted for returns declined. The charges to investors for collecting on late loans were very high. It was common to see charges 9 to 10 times higher as the investor than were charged to the person that took out the loan and made the late payment.

For the last 6 months my account balance has essentially stayed the same (bouncing within the same range of value). I stopped reinvesting the payments received from LendingClub loans several months ago and have begun withdrawing the funds back to my account. I will likely just leave the funds in cash to increase my reserves given the lack of appealing investment options (and also a desire to increase my cash position in given my personal finances now and looking forward for the next year). I may invest the funds in dividend stocks depending on what happens.

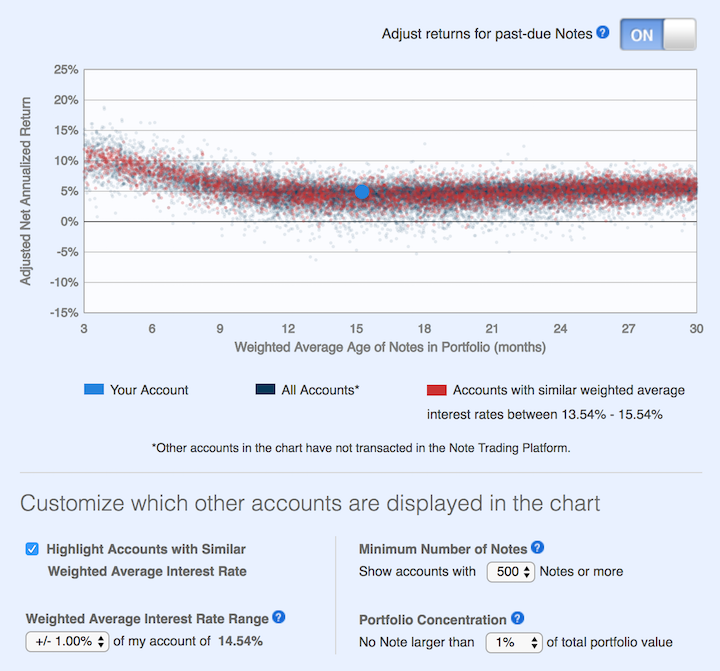

This chart shows lending club returns for portfolios similar to mine. As you can see a return of about 5% is common (which is about where I am). Quite a few more than before actually have negative returns. When I started, my recollection is that their results showed no losses for well diversified portfolios.

The two problems I see are poor underwriting quality and high costs that eat into returns. I do believe the peer to peer lending model has potential as a way to diversify investments. I think it can offer decent rates and provide some balance that would normally be in the bond portion of a portfolio allocation. I am just not sold on LendingClub’s execution for delivering on that potential good investment option. At this time I don’t see another peer to peer lending options worth exploring. I will be willing to reconsider these types of investments at a later time.

I plan to just withdraw money as payments on made on the loans I participated in through LendingClub.

Related: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age (2015) – Investing in Peer to Peer Loans – Looking for Yields in Stocks and Real Estate (2012) – Where to Invest for Yield Today (2010)

We have written about the massive changes in manufacturing globally over the last few decades. As we have shown, the data shows that the USA remained the largest manufacturer until 2010 when China finally took over as the largest.

The massive declines in manufacturing employment were global. It led many to believe jobs were moving from the USA to China but much more accurately jobs were being eliminated everywhere. China lost more manufacturing jobs than the USA during the 1990s and early 2000s.

The manufacturing job losses have been caused by productivity improvements. And those productivity improvements have provided us much cheaper access to manufacturing goods. That continued downward pressure on prices has been a big factor in the drastic decline in inflation. The threat of excessive inflation, which was so feared in the 1980s, has been replaced by the opposite problem – the threat of deflation.

One aspect of the productivity improvement has been the global supply chains that have allowed companies to increase efficiency. The requirements of managing global supply chains are extremely complex and likely would not be possible without software to aid in the complex task.

In his book, The Great Convergence, Richard Baldwin discussed how important the decline in shipping costs had in the economics of the last 50 years (we wrote about this book in: Historical Global Economic Data and Current Issues for Globalization). Those declines in prices, aided by other factors, increased the importance of supply chains.

The last few decades have also seen dramatic changes in supply chains due to the internet. The time from manufacture to consumer has been shaved by direct shipment to consumers and nearly direct shipment to consumers via companies such as Amazon. Again software plays a central role in tying the manufacturing floor to a nearly instantaneous status of incoming orders from end users. Or in the case of software and entertainment, companies like Apple and Netflix have replaced the entire supply chain of manufacturing physical goods (DVDs, CDs…) with software.

These changes in addition to increasing efficiency are again decreasing jobs by increasing the efficiency of the economy. These changes cause harm to those that are being squeezed (both employees and companies) while the economy overall gets more goods at lower prices to consumers.