I have decided to wind down my investment test with LendingClub. I should end up with a investment return of about 5% annually. So it beat just leaving the money in the bank. But returns are eroding more recently and the risk does not seem worth the returns.

Early on I was a bit worried by how often the loan defaulted with only 0, 1 or 2 payments made. Sure, there are going to be some defaults and sometimes in extremely unlucky situation it might happen right away. But the amount of them seems to me to indicate LendingClub fails to do an adequate job of screening loan candidates.

Over time the rates LendingClub quoted for returns declined. The charges to investors for collecting on late loans were very high. It was common to see charges 9 to 10 times higher as the investor than were charged to the person that took out the loan and made the late payment.

For the last 6 months my account balance has essentially stayed the same (bouncing within the same range of value). I stopped reinvesting the payments received from LendingClub loans several months ago and have begun withdrawing the funds back to my account. I will likely just leave the funds in cash to increase my reserves given the lack of appealing investment options (and also a desire to increase my cash position in given my personal finances now and looking forward for the next year). I may invest the funds in dividend stocks depending on what happens.

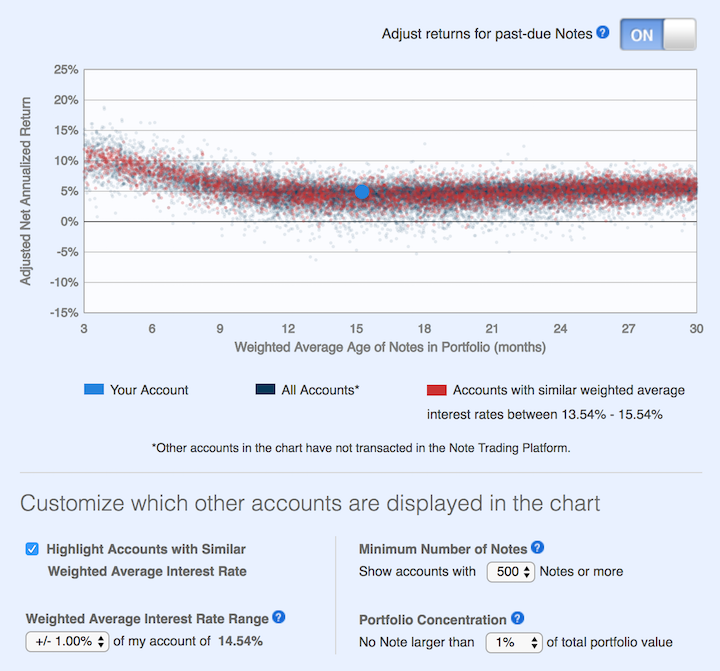

This chart shows lending club returns for portfolios similar to mine. As you can see a return of about 5% is common (which is about where I am). Quite a few more than before actually have negative returns. When I started, my recollection is that their results showed no losses for well diversified portfolios.

The two problems I see are poor underwriting quality and high costs that eat into returns. I do believe the peer to peer lending model has potential as a way to diversify investments. I think it can offer decent rates and provide some balance that would normally be in the bond portion of a portfolio allocation. I am just not sold on LendingClub’s execution for delivering on that potential good investment option. At this time I don’t see another peer to peer lending options worth exploring. I will be willing to reconsider these types of investments at a later time.

I plan to just withdraw money as payments on made on the loans I participated in through LendingClub.

Related: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age (2015) – Investing in Peer to Peer Loans – Looking for Yields in Stocks and Real Estate (2012) – Where to Invest for Yield Today (2010)

Comments

1 Comment so far

Hi John,

Had similar experience with Lending Club and Prosper returns. I had invested on both platforms since 2010. Noticed that my returns are still around 8.5% on Prosper but dropped to 5.6% in LC when projecting default rate of late notes. I share your belief that they are not yet tapping the full potential of the P2P idea and fall a bit short of it in execution and underwriting. There was a shift a few years back where they removed a lot of the peer-to-peer interaction between borrowers and lenders, such as the Groups function. Some of that may have been out of fear of identity theft and of vigilante collections activity by spurned lenders taking default matters in their own hands. The problem is that it is almost TOO EASY to get a loan so there is little vetting and screening. In order to compete to make loans, they lower the bar. For now, am following a similar wind-down path to what you describe, though I have bought the LC stock @$5.28. At this point and consider that the bad news of Founder/CEO Laplanche’s ethics violations and ouster are in the past. The platform has regained investor confidence and the stock looks poised for solid recovery.

Cheers,

Frank