There are many problems with the extremely low interest rates available in decade since the too-big-to-fail financial crisis. The interest rates seem to me to be artificially sustained by massive central bank actions for 12 years now.

Extraordinarily low rates encourage businesses to borrow money, after all how hard is it to invest in something that will return the business more than a few percent a year (that they can borrow at). Along with the continued efforts by the central banks to flood the economy with money any time there is even a slowdown in growth teaches companies to not worry about building a business that can survive bad times. Just borrow and if necessary borrow more if you are having trouble then just borrow more.

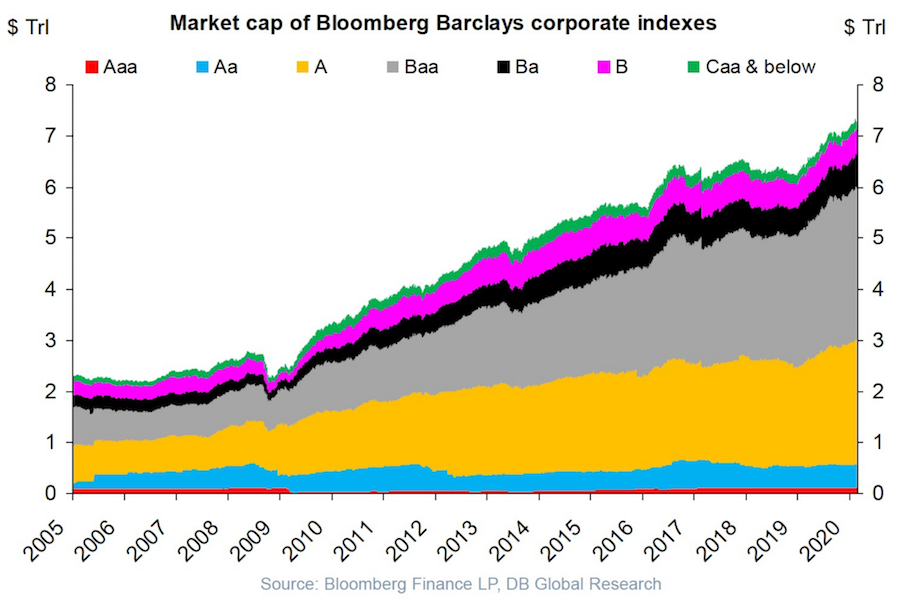

USA corporate debt has increased from a bit over $2 trillion in 2005 to over $7 trillion in 2020.

This isn’t a healthy way to build an economy. Businesses should be robust and able to sustain themselves if the economy experiences a recession and interest rates rise and the ability to borrow decreases.

Extremely low interest rates hide a huge potential cost if interest rates rise. Sure the huge debt is covered by cash flow in good times with the interest rate on your debt is 4%. What happens if interest rates rise to 6% and the economy declines? At some point investors (and banks) are going to realize that huge debt burdens on companies that are overly leveraged are not safe and deserve a premium interest rate.

I don’t think there is any risk to companies with very strong balance sheets and a business model that won’t have any trouble maintaining positive cash flow in a significant recession (Apple, Abbvie, Google, Costco, etc.). But many businesses are over-leveraged and at a significant risk of default in a bad economy.

The stock market is down quite a bit today partially due to the worry that the leveraged oil shale companies in the USA will go under if OPEC does not manage to restrict the supply of oil in order to keep oil prices high (or at least keep oil prices from collapsing).

Plenty of leveraged buyouts (where private equity firms take out cash and leave behind barely functional businesses) are barely able to survive even with extremely low interest rates. Those companies are in danger of failing when they experience even a small problems.

Artificially low rates (due to massive central bank intervention) also deprive savers of a reasonable return on their bonds. This either transfers money from savers to debtors. It also encourages savers to move more money in the stock market in order to get a reasonable return. It is healthy for savers to invest in the stock market. But it is better if they can balance some of their portfolio in bonds and money market funds that pay a reasonable rate.

The debt load in the economy makes the economy less able to absorb economic shocks. Companies like Apple and Google with huge net cash positions have no problem absorbing large economic shocks.

Many other companies have not only not built up cash reserves during the long economic expansion of the last 10 years but have actually added on huge amounts of debt. Some of those did so wisely and sustainably and will be able to survive economic downturns. Given the huge amount of debt many companies have taken on some companies will not be able to survive. And depending on how many fail that will have a cascade effect that puts more companies at peril.

So long as economic times are relatively good and huge amounts or credit are available to nearly any company it is easy to have poorly managed companies seem to prosper. When that tide turns the huge debt level can create a much larger downturn than would otherwise have happened.

Related: Too Much Leverage Killed Mervyns – Leverage, Complex Deals and Mania – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment (2011)