The markets continue to provide difficult options to investors. In the typical market conditions of the last 50 years I think a sensible portfolio allocation was not that challenging to pick. I would choose a bit more in stocks than bonds than the commonly accepted strategy. And I would choose to put a bit more overseas and in real estate.

But if that wasn’t done and even something like 60% stocks and 40% bonds were chosen it would seem reasonable (or 60% stocks 25% bonds and 15% money market – I really prefer a substantial cushion in cash in retirement). Retirement planning is fairly complex and many adjustments are wise for an individual’s particular situation (so keep in mind this post is meant to discuss general conditions today and not suggest what is right for any specific person).

I wrote about Retirement Savings Allocation for 2010: 5% real estate, 35% global stocks, 5% money market, 55% USA stocks. This was when I was young and accumulating my retirement portfolio.

Today, investment conditions make investing in retirement more difficult than normal. With interest rates so low bonds provide little yield and have increased risk (due to how much long term bond prices would fall if interest rates rise, given how low interest rates are today). And with stocks so highly valued the likelihood of poor long term returns at these levels seems higher than normal.

So the 2 options for the simplest version of portfolio allocation are less attractive than usual, provide lower income than usual and have great risk of decline than usual. That isn’t a good situation.

View of Glacier National Park (a nice place to go in retirement, or before retirement) by John Hunter

I do think looking for dividend stocks to provide some current yield in this situation makes sense. And in so doing substitute them for a portion of the bond portfolio. This strategy isn’t without risk, but given the current markets I think it makes sense.

I have always thought including real estate as part of a portfolio was wise. It makes even more sense today. In the past Real Estate Investment Trusts (REITs) were very underrepresented in the S&P 500 index, in 2016 and 2017 quite a few REITs were added. This is useful to provide some investing in REITs for those who rely on the S&P 500 index funds for their stock investments. Still I would include REIT investments above and beyond their portion of the S&P 500 index. REITs also provide higher yields than most stocks and bonds today so they help provide current income.

While I am worried about the high valuations of stocks today I don’t see much option but to stay heavily invested in stocks. I generally am very overweight stocks in my portfolio allocation. I do think it makes sense to reduce how overweight in stocks my portfolio is (and how overweight I think is sensible in general).

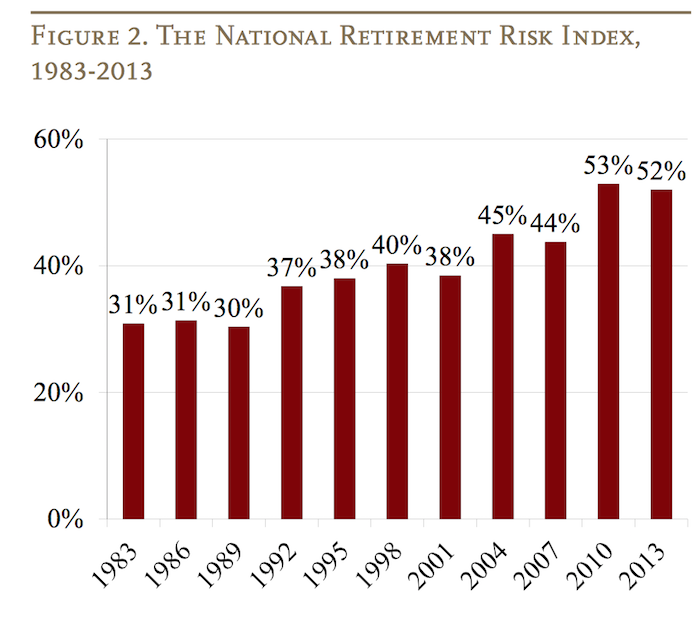

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Delaying when you start collecting Social Security benefits in the USA can enhance your personal financial situation. You may start collecting benefits at 62, but each year you delay collecting increases your payment by 5% to 8% (see below). If you retire before your “normal social security retirement age” (see below) your payments are reduced from the calculated monthly payment (which is based on your earnings and the number of years you paid into the social security fund). If you delay past that age you get a 8% bonus added to your monthly payment for each year you delay.

The correct decision depends on your personal financial situation and your life expectancy. The social security payment increases are based on life expectancy for the entire population but if your life expectancy is significantly different that can change what option makes sense for you. If you live a short time you won’t make up for missing payments (the time while you delayed taking payments) with the increased monthly payment amount.

The “normal social security retirement age” is set in law and depends on when you were born. If you were born prior to 1938 it is 65 and if you are born after 1959 it is 67 (in between those dates it slowly increases. Those born in 1959 will reach the normal social security retirement age of 67 in 2026.

The social security retirement age has fallen far behind demographic trends – which is why social security deductions are so large today (it used to be social security payments for the vast majority of people did not last long at all – they died fairly quickly, that is no longer the case). The way to cope with this is either delay the retirement ago or increase the deductions. The USA has primarily increased the deductions, with a tiny adjustment of the retirement age (increasing it only 2 years over several decades). We would be better off if they moved back the normal retirement age at least another 3 to 5 years (for the payment portion – given the broken health care system in the USA retaining medicare ages as they are is wise).

In the case of early retirement, a benefit is reduced 5/9 of one percent for each month (6.7% annually) before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month (5% annually).

For delaying your payments after you have reached normal social security retirement age increases payments by 8% annually (there were lower amounts earlier but for people deciding today that is the figure to use).

Lets take a quick look at a simple example:

Read more

I have long thought the binary retirement system we have primarily used is less than ideal. It would be better to transition from full time work to part time work to retirement as people move into retirement. According to this study, from the University of Michigan Retirement Research Center, the phased retirement option is becoming more common.

Macroeconomic Determinants of Retirement Timing

The paper doesn’t really focus much on what I would find interesting about the details of how we are (or mainly, how we are not) adjusting to make partial retirement fit better in our organization (the paper is focused on a different topic). The paper does provide some interesting details about the changes with retirement currently.

Related: Career Flexibility – 67 Is The New 55 – Retirement Delayed, Working Longer

I think we could use some innovation in our model of a career. I have thought retirement being largely binary was lame since I figured out that is mainly how it worked. You work 40 hours a week (1,800 – 2,000 hours a year) and then dropped to 0 hours, all year long, from them on.

It seems to me more gradual retirement makes a huge amount of sense (for society, individuals and our economy). That model is available to people, for example those that can work as consultants (and some others) but we would benefit from more options.

Why do we have to start work at 22 (or 18 or 26 or whenever) and then work 40 or so straight years and then retire? Why not gap years (or sabbaticals)? Also why can’t we just go part time if we want.

The broken health care system in the USA really causes problems with options (being so tightly tied to full time work). But I have convinced employers to let me go part-time (while working in orgs that essentially have 0 part time workers). And I am now basically on gap year(s)/sabbatical now. It can be done, but it certainly isn’t encouraged. You have to go against the flow and if you worry about being a conventional hire you may be nervous.

Related: Working Less: Better Lives and Less Unemployment – Why don’t we take five years out of retirement and spread them throughout your working life? – Retiring Overseas is an Appealing Option for Some Retirees – Living in Malaysia as an Expat – 67 Is The New 55

Across the globe, saving for retirement is a challenge. Longer lives and expensive health care create challenge to our natures (saving for far away needs is not easy for most of us to do – we are like the grasshopper not the ants, we play in the summer instead of saving). This varies across the globe, in Japan and China they save far more than in the USA for example.

The United States of America ranks 19th worldwide in the retirement security of its citizens, according to a new Natixis Global Retirement Index. The findings suggest that Americans will need to pick up a bigger share of their retirement costs – especially as the number of retirees grows and the government’s ability to

support them fades. The gauges how well retired citizens live in 150 nations, based on measures of health, material well-being, finances and other factors.

Top Countries for Retirees

- 1 – Norway

- 2 – Switzerland

- 3 – Luxembourg

- 6 – Finland

- 9 – Germany

- 10 – France

- 11 – Australia

- 13 – Canada

- 15 – Japan

- 19 – USA

- 20 – United Kingdom

Western European nations – backed by robust health care and retiree social programs – dominate the top of the rankings, taking the first 10 spots, including Sweden, Austria, Netherlands and Denmark. The USA finished ahead of the United Kingdom, but trailed the Czech Republic and Slovakia.

Globally, the number of people aged 65 or older is on track to triple by 2050. By that time, the ratio of the working-age population to those over 65 in the USA is expected to drop from 5-to-1 to 2.8-to-1. The USA actually does much better demographically (not aging as quickly) as other rich countries mainly due to immigration. Slowing immigration going forward would make this problem worse (and does now for countries like Japan that have very restrictive immigration policies).

The economic downturn has taken a major toll on retirement savings. According to a recent report by the U.S. Senate Committee on Health, Education, Labor and Pensions, the country is facing a retirement savings deficit of $6.6 trillion, or nearly $57,000 per household. As a result, 53% of American workers 30 and older are on a path that will leave them unprepared for retirement, up significantly from 38% in 2011.

On another blog I recently wrote about another study looking at the Best Countries to Retirement Too: Ecuador, Panama, Malaysia. The study in the case was looking not at the overall state of retirees that worked in the country (as the study discussed in this post did) but instead where expat retirees find good options (which stretch limited retirement savings along with other benefits to retirees).

See the full press release.

Related: Top Stock Market Capitalization by Country from 1990 to 2010 – Easiest Countries in Which to Operate a Businesses: Singapore, Hong Kong, New Zealand, USA – Largest Nuclear Power Generation Countries from 1985-2010 – Leading countries for Economic Freedom: Hong Kong, Singapore, New Zealand, Switzerland – Countries with the Top Manufacturing Production

Determining exactly what needs to be saved for retirement is tricky. Basically it is something that needs to be adjusted based on how things go (savings accumulated, saving rate, planned retirement date, investing returns, predicted investing returns, government policy, tax rates, etc.). The simple idea is start by saving 15% of salary by the time you are 30. Then adjust over time. If you start earlier maybe you can get by with 12%…

How Much to Save for Retirement is a very good report by the Boston College center for retirement research. They look at the percent of income replacement social security (for those in the USA) provides. This amount varies greatly depending on your income and retirement (date you start drawing social security payments).

Low earners ($20,000) that retire at 65 have 49% of income replaced by social security. Waiting only 2 years, to 67, the replacement amount increases to 55%. For medium earners ($50,000) 36% and 41% of income is replaced. And for high earners ($90,000) 30% an 34%.

Starting savings early make a huge difference. Starting retirement savings at age 25 requires about 1/3 the percentage of income be saved as starting at 45. So you can save for example 7% from age 25 to 70 or 18% from age 45 to 70. Retiring at 62 versus 70 also carries a cost of about 3 times as great savings required each year. So retiring at 62 would require an impossible 65% if you didn’t start saving until 45. But these numbers are affected by many things (the higher your income the less social security helps so the higher percentages you need to save and many other factors play a role).

Starting to save early is a huge key. Delaying retirement makes a big difference but it is not nearly as much in your control. You can plan on doing that but need to understand that you cannot assume you will get to set the date (either because finding a job you can do and pays what you wish is not easy or you are not healthy enough to work full time).

If you don’t have social security (those outside the USA – some countries have their versions but some don’t offer anything) you need to save more. A good strategy is to start saving for retirement in your twenties. As you get raises increase your percentage. So if you started at 6% (maybe 4% from you and a 2% match, but in any event 6% total) each time you get a raise increase your percentage 100 basis points (1 percentage point).

If you started at 27 at 6% and got a raise each year for 9 years you would then be at 15% by age 36. Then you could start looking at how you were going and make some guesstimates about the future. Maybe you could stabilize at 15% or maybe you could keep increasing the amount. If you can save more early (start at 8% or increase by 150 or 200% basis points a year) that is even better. Building up savings early provides a cushion for coping with negative shocks (being unemployed for a year, losing your job and having to take a new job earning 25% less, very bad decade of investing returns, etc.).

Investing wisely makes a big difference also. The key for retirement savings is safety first, especially as you move closer to retirement. But you need to think of investment safety as an overall portfolio. The safest portfolio is well balanced not a portfolio consisting of just an investment people think of as safe by itself.

Related: Retirement Planning, Investing Asset Considerations – Saving for Retirement Must Be a Personal Finance Priority – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation

Building your saving is largely about not very sexy actions. The point where most people fail is just not saving. It isn’t really about learning some tricky secret.

You can find yourself with pile of money without saving; if you win the lottery or inherit a few million from your rich relative via some tax dodge scheme like generation skipping trusts or charitable remainder trusts.

But the rest of us just have to do a pretty simple thing: save money. Then, keep saving money and invest that money sensibly. The key is saving money. The next key is not taking foolish risks. Getting fantastic returns is exciting but is not likely and the focus should be on lowering risk until you have enough savings to take risks with a portion of the portfolio.

My favorite tips along these lines are:

- spend less than you make

- save some of every raise you get

- save 10-15% of income for retirement

- add to any retirement account with employer matching (where say they add $500 for every $1,000 you put into your 401(k)

Spending less than you make and building up your long term savings puts you in the strongest personal finance position. These things matter much more than making a huge salary or getting fantastic investing returns some year. Avoiding risky investments is wise, and sure making great returns helps a great deal, but really just saving and investing in a boring manner puts you in great shape in the long run. Many of those making huge salaries are in atrocious personal financial shape.

Another way you can boost savings is to do so when you pay off a monthly bill. So when I paid off my car loan I just kept saving the old payment. Then I was able to buy my new car with the cash I saved in advance when I was ready for a new car.

The basics of retirement planning are not tricky. Save 10-15% of your income for about 40 years working career (likely over 15%, if you don’t have some pension or social security – with some pension around 10+% may be enough depending on lots of factors). That should get you in the ballpark of what you need to retire.

Of course the details are much much more complicated. But without understanding any of the details you can do what is the minimum you need to do – save 10% for retirement of all your income. See my retirement investing related posts for more details. Only if you actually understand all the details and have a good explanation for exactly why your financial situation allows less than 10% of income to be saved for retirement every year after age 25 should feel comfortable doing so.

There is value in the simple rules, when you know they are vast oversimplifications. I am amazed how many professionals don’t understand how oversimplified the rules of thumb are.

Here is one thing I see ignored nearly universally. I am sure some professions don’t but most do. If you have retirement assest such as a pension or social security (something that functions as an annuity, or an actually annuity) that is often a hugely important part of your retirement portfolio. Yet many don’t consider this when setting asset allocations in retirement. That is a mistake, in my opinion.

A reliable annuity is most like a bond (for asset allocation purposes). Lets look at an example for if you have $1,500 a month from a pension or social security and $500,000 in other financial assets. $1,500 * 12 gives $18,000 in annual income.

To get $18,000 in income from an bond/CD… yielding 3% you need $600,000. That means, at 3%, $600,000 yields $18,000 a year.

Ignoring this financial asset worth the equivalent of $600,000 when considering how to invest you $500,000 is a big mistake. Granted, I believe the advice is often too biased toward bonds in the first place (so reducing that allocation sounds good to me). To me it doesn’t make sense to invest that $500,000 the same way as someone else that didn’t have that $18,000 annuity is a mistake.

I also don’t think it makes sense to just say well I have $1,100,000 and I want to be %50 in bonds and 50% in stocks so I have “$600,000 in bonds now” (not really after all…) so the $500,000 should all be in stocks. Ignoring the annuity value is a mistake but I don’t think it is as simple as just treating it as though it were the equivalent amount actually invested.

Related: Immediate Annuities – Managing Retirement Investment Risks – How to Protect Your Financial Health – Many Retirees Face Prospect of Outliving Savings

Pitfalls in Retirement (pdf) is quite a good white paper from Meril Lynch, I strongly recommend it.

could safely spend 10% or more of their savings each year.

But, as explained below, the respondents most on target were the one in 10 who estimated sustainable spending rates to be 5% or less. This is significantly impacted by life expectancy; if you have a much lower life expectancy due to retiring later or significant health issues perhaps you can spend more. But counting on this is very risky.

This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.

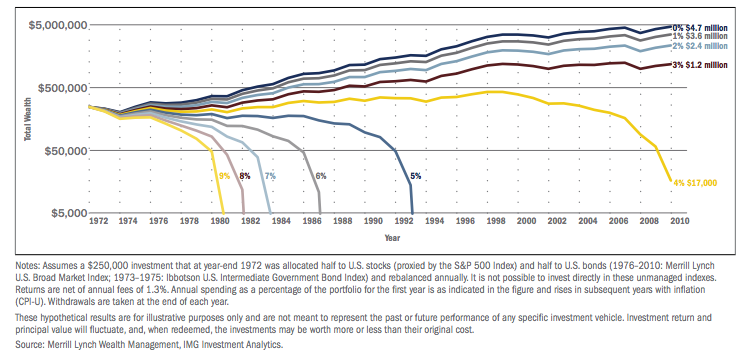

Chart showing retirement assets over time based on various spending levels, from the Merill Lynch paper.

The chart is actually quite good, the paper also includes another good example (which is helpful in showing how much things can be affected by somewhat small changes*). One piece of good news is they assume much larger expense rates than you need to experience if you choose well. They assume 1.3% in fees. You can reduce that by 100 basis points using Vanguard. They also have the portfolio split 50% in stocks (S&P 500) and 50% in bonds.

Several interesting points can be drawn from this data. One the real investment returns matter a great deal. A 4% withdrawal rate worked until the global credit crisis killed investment returns at which time the sustainability of that rate disappeared. A 5% withdrawal rate lasted nearly 30 years (but you can’t count on that at all, it depends on what happens with you investment returns).

Related: What Investing Return Projections to Use In Planning for Retirement – How Much Will I Need to Save for Retirement? – Saving for Retirement