In some ways investing recently has been pretty easy, anything you have bought (almost) goes up – and usually goes up a lot. But when looking for bargains to invest in, it just keeps getting more and more difficult in my opinion.

Apple’s most recent earnings report was spectacular. However, unlike when similar things happened 8 years ago, when such great news allowed you to buy a great company cheaply even after great news now Apple went from an already pricy level and added 10% to that the next day. And it has continued to go up. Apple is by far my largest holding (given how expensive it is, a fairly crazy 25%). So I do still like the company long term, but I have been selling a bit the last year (though not nearly enough to keep it from dominating my portfolio more and more).

Years ago it was easy for me to buy Apple and be very confident I would do very well over the next 5 to 10 years. Now I am more hopeful than confident. And one reason why I continue to hold so much is I don’t see other great buys.

In the last 6 months I did make a big buy of Sea Limited ($SE) a company based in Singapore with large gaming, internet commerce and emoney interests. They are especially focused on South East Asia. I bought a lot of this quickly and that has proved wise (at least so far). I made it my 3rd largest holding (Alphabet is 2nd) very quickly and I am up over 100% already. It is speculative. But given my options it seemed like a great opportunity. I would have been much slower to increase the size of this position if I had other options I really liked.

Overall I am going much more into cash as a safe haven than I have before. Normally I am extremely overweight stocks. Even today I am still overweight stocks compared to the conventional wisdom (and the only bonds I hold are Series I USA Savings Bonds (which are actually a good investment option, though you are limited to buying $10,000 per year).

While the markets are giving investors great returns finding good buys is becoming more and more difficult (at least for me). For example, my 10 Stocks for 10 Years (2018 version) has done very well. But several of those stocks are much less a bargain today that they were. Apple is up from $225 to $450. Danaher from $103 to $206. Amazon from $2,000 to $3,150. Tencent from $43 to $68. Alibaba from $175 to $256. The only stock down is Abbvie, from $97 to $95 (though with dividends, it yields 5% now, it is up a small bit). Abbive seems like the rare bargain to me today. While there are short term risks Tencent and Alibaba also seem to be priced reasonably and offer good long term potential.

I think, my post, Long Term Changes in Underlying Stock Market Valuation, provides insight into the challenges of consistently finding the type of values today than was possible in previous decades.

Related: Investment Options Are Much Less Comforting Than Normal These Days (2013) – Retirement Portfolio Allocation for 2020 – Tucows: Building 3 Businesses With Strong Positive Cash Flow

The markets continue to provide difficult options to investors. In the typical market conditions of the last 50 years I think a sensible portfolio allocation was not that challenging to pick. I would choose a bit more in stocks than bonds than the commonly accepted strategy. And I would choose to put a bit more overseas and in real estate.

But if that wasn’t done and even something like 60% stocks and 40% bonds were chosen it would seem reasonable (or 60% stocks 25% bonds and 15% money market – I really prefer a substantial cushion in cash in retirement). Retirement planning is fairly complex and many adjustments are wise for an individual’s particular situation (so keep in mind this post is meant to discuss general conditions today and not suggest what is right for any specific person).

I wrote about Retirement Savings Allocation for 2010: 5% real estate, 35% global stocks, 5% money market, 55% USA stocks. This was when I was young and accumulating my retirement portfolio.

Today, investment conditions make investing in retirement more difficult than normal. With interest rates so low bonds provide little yield and have increased risk (due to how much long term bond prices would fall if interest rates rise, given how low interest rates are today). And with stocks so highly valued the likelihood of poor long term returns at these levels seems higher than normal.

So the 2 options for the simplest version of portfolio allocation are less attractive than usual, provide lower income than usual and have great risk of decline than usual. That isn’t a good situation.

View of Glacier National Park (a nice place to go in retirement, or before retirement) by John Hunter

I do think looking for dividend stocks to provide some current yield in this situation makes sense. And in so doing substitute them for a portion of the bond portfolio. This strategy isn’t without risk, but given the current markets I think it makes sense.

I have always thought including real estate as part of a portfolio was wise. It makes even more sense today. In the past Real Estate Investment Trusts (REITs) were very underrepresented in the S&P 500 index, in 2016 and 2017 quite a few REITs were added. This is useful to provide some investing in REITs for those who rely on the S&P 500 index funds for their stock investments. Still I would include REIT investments above and beyond their portion of the S&P 500 index. REITs also provide higher yields than most stocks and bonds today so they help provide current income.

While I am worried about the high valuations of stocks today I don’t see much option but to stay heavily invested in stocks. I generally am very overweight stocks in my portfolio allocation. I do think it makes sense to reduce how overweight in stocks my portfolio is (and how overweight I think is sensible in general).

Apple analysts are of no value to investors

If the stock moved more than 2% on any uptick in volume, I had to write a story explaining why. After dealing with that every day for about three years, I realized the overwhelming majority of analysts had no better clue than I did about what was moving Cisco’s stock.

Most investors know this, but if you don’t remember this lesson. The “explanations” you hear from media often are just as useless as horoscopes. A bunch of meaningless words presented in the hopes you don’t realize they are empty words.

The talking heads (and writers) need to say something. It would be much more useful if they took the time to do some research and put in some thought but they seem to be driven by the need to fill space instead of the need to inform.

It is also a huge waste of time, explaining random variation.

Related: Fooled by Randomness – Seeing Patterns Where None Exists – Illusions, Optical and Other – Understanding Data

Dual momentum investing boiled down to the simplest view involves only seeing if the S&P 500 outperformed USA t-bills for the last year. If so, invest in an low cost S&P 500 fund. If not, invest in a high quality short duration bond fund.

There are many different tweaks to this idea. Dual Momentum Investing by Gary Antonacci does a good job of exploring this idea and providing evidence on historical returns using this method. 3 big advantages of this strategy are

- Simplicity – easy to implement and it takes nearly no time each year

- Low cost – uses low cost index fund and has very limited transaction costs (direct or tax costs from sales) as it averages fewer than 1 trade a year)

- Good performance historically – the book details performance and the low risk nature of the strategy in backtesting.

There are ways to adjust the strategy that increase the complexity a bit for those looking to increase returns or reduce risks.

It is something worth reading in my opinion. The book isn’t the easiest to read but it is decent and worth reading.

Gary Antonacci also has a blog worth reading.

Related: Curious Cat Investment Books – Famous Stock Traders: Nicolas Darvas – Market Inefficiencies and Efficient Market Theory

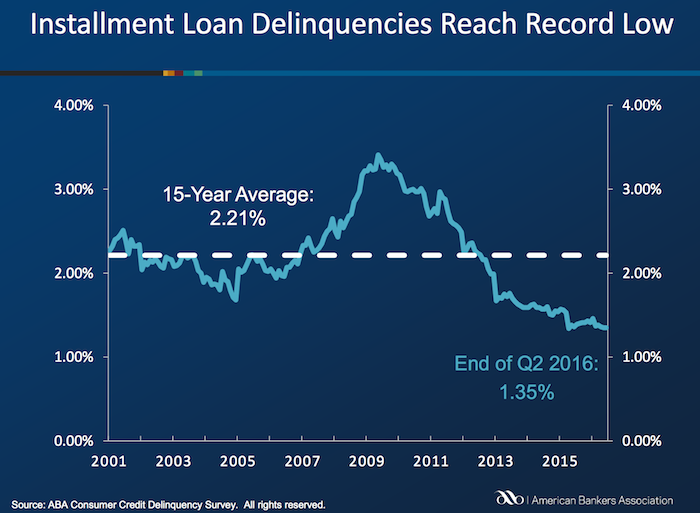

Delinquencies in closed-end loans fell slightly in the second quarter, driven by a drop in home equity loan delinquencies, according to results from the American Bankers Association’s Consumer Credit Delinquency Bulletin.

The composite ratio, which tracks delinquencies in eight closed-end installment loan categories, fell 3 basis points to 1.35% of all accounts – a record low. This also marked the third year that delinquency rates were below the 15-year average of 2.21%. The ABA report defines a delinquency as a late payment that is 30 days or more overdue. This is good news but the personal financial health of consumers in the USA is still in need of significantly improvements to their balance sheets. Debt levels are still too high. Savings levels are still far to low.

Home equity loan delinquencies fell 4 basis points to 2.70% of all accounts, which helped drive the composite ratio down. Other home related delinquencies increased slightly, with home equity line delinquencies rising 6 basis points to 1.21% of all accounts and property improvement loan delinquencies rising 2 basis points to 0.91% of all accounts. Home equity loan delinquencies dipped further below their 15-year average of 2.85%, while home equity line delinquencies remained just above their 15-year average of 1.15 percent.

Bank card delinquencies edged up 1 basis point to 2.48% of all accounts in the second quarter. They remain significantly below their 15-year average of 3.70 percent.

The second quarter 2016 composite ratio is made up of the following eight closed-end loans. All figures are seasonally adjusted based upon the number of accounts.

Closed-end loans

Home equity loan delinquencies fell from 2.74% to 2.70%.

Mobile home delinquencies fell from 3.41% to 3.17%.

Personal loan delinquencies fell from 1.44% to 1.43%.

Direct auto loan delinquencies rose from 0.81% to 0.82%.

Indirect auto loan delinquencies rose from 1.45% to 1.56%.

Marine loan delinquencies rose from 1.03% to 1.23%.

Property improvement loan delinquencies rose from 0.89% to 0.91%.

RV loan delinquencies rose from 0.92% to 0.96%.

Open-end loans

Bank card delinquencies rose from 2.47% to 2.48%.

Home equity lines of credit delinquencies rose from 1.15% to 1.21%.

Non-card revolving loan delinquencies rose from 1.57% to 1.65%.

Related: Debt Collection Increasing Given Large Personal Debt Levels (2014) – Consumer and Real Estate Loan Delinquency Rates from 2001 to 2011 in the USA – Good News: Credit Card Delinquencies at 17 Year Low (2011) – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – The USA Economy Needs to Reduce Personal and Government Debt (2009)

When I lived in Malaysia I learned that the residential electricity rates were very low for the low levels of use and climbed fairly rapidly as you used a lot of electricity (say running your air conditioner a lot). I think this is a very good idea (especially for the not yet rich countries). In rich countries even most of the “poor” have high use of electricity and it isn’t a huge economic hardship to pay the costs.

Effectively the rich end up subsidizing the low rates for the poor, which is a very sensible setup it seems to me. The market functions fairly well even though it is distorted a bit to let the poor (or anyone that uses very little electricity) to pay low rates.

In a country like Malaysia as people become rich they may well decide to use a great deal of electricity for air conditioning (it is in the tropics). But their ancestors didn’t have that luxury and having that be costly seems sensible to me. Allowing the poor to have access to cheap electricity is a very good thing with many positive externalities. And subsidizing the rate seems to be a good idea to me.

Often you get bad distortions in how markets work when you try to use things like subsidies (this post is expanded from a comment I made on Reddit discussing massive bad investments created by free electricity from the power company to city governments – including free electricity to their profit making enterprises, such as ice rinks in Puerto Rico).

View of downtown Johor Bahru from my condo (a small view of Singapore visible is in the background)

With the model of low residential rates for low usage you encourage people to use less electricity but you allow everyone to have access at a low cost (which is important in poor or medium income countries). And as people use more they have to pay higher rates (per kwh) and those rates allow the power company to make a profit and fund expansion. Often in developing countries the power company will be semi-private so the government is involved in providing capital and sharing in profits (as well as stockholders).

The USA mainly uses central air conditioning everywhere. In Malaysia, and most of the world actually, normally they just have AC units in some of the rooms. In poor houses they may well have none. In middle class houses they may have a one or a couple rooms with AC units.

Even in luxury condos (and houses) they will have some rooms without AC at all. I never saw a condo or house with AC for the kitchen or bathrooms. The design was definitely setup to use AC in fairly minimal ways. The hallways, stairways etc. for the “interior” of the high rise condos were also not air conditioned (they were open to the outside to get good air flow). Of course as more people become rich there is more and more use of AC.

Related: Traveling for Health Care – Expectations – Looking at the Malaysian Economy (2013) – Pursuing a Growing Economy While Avoiding the Pitfalls That Befall to Many Middle Income Countries – Singapore and Iskandar Malaysia – Looking at GDP Growth Per Capita for Selected Countries from 1970 to 2010 – Malaysian Economy Continues to Expand, Budget Deficits Remain High (2012) – Iskandar Malaysia Housing Real Estate Investment Considerations (2011)

One thing for investors consulting historical data to remember is we may have had fundamental changes in stock valuations over the decades (and I suspect they have). Just to over simplify the idea if lets say the market valued the average stock at a PE of 11 and everyone found stocks a wonderful investment. And so more and more people buy stocks and with everyone finding stocks wonderful they keep buying and after awhile the market is valuing the average stock at a PE of 14.

Within the market there is tons of variation those things of course are not nearly that simple, but the idea I think holds. Well if you look back at historical data the returns will include the adjustment of going from a PE of 11 to a PE of 14. Now maybe the new few decades would adjust from PE of 14 to PE of 17 but maybe not. At some point that fundamental re-adjustment will stop.

And therefore future returns would be expected to be lower than historically due to this one factor. Now maybe other factors will increase returns to compensate but if not the historical returns may well provide an overly optimistic view.

And if there is a short term bubble that lets say pushes the PR to 16 while the “fair” long term value is 14, then there will be a negative impact on the returns going forward bringing the PE from 16 to 14. That isn’t necessarily a drop (though it could be) in stock prices, it could just be very slow increases as earning growth slowly pushes PE back to 14.

Monument to the People’s Heroes with the Shanghai skyline in the background. See more photos by John Hunter

Another thing to consider is another long term macro-economic factor may also be giving long term historical returns an extra boost. The type of economic growth from the end of World War I to 1973 (just to pick a specific time, there was a big economic slowdown after OPEC drastically increased the price of oil). While that period includes the great depression and World War II, which massively distorts figures, from the end of WW I through the 1960s Europe and the USA went through an amazing amount of economic growth.

I am largely a fundamental investor with the long term time horizon that fits such investing. I however am also a believer in using some more speculative investing for a portion of a portfolio if it fits the risk profile of an investor.

If you are not comfortable with the risk of an investment most of the time you shouldn’t make that investment. There is a bit of a conflict, for example, where an investor is scared of any loss from say an investment in a stock market index and trying to save for retirement on a median level income. It is nearly impossible to save for retirement without investing in stocks if you are not already rich, so as with most investment advice there is a bit of difficulty at the extremes but in general investors shouldn’t take on risk they are not comfortable with.

For experienced investors with a high level of financial literacy more speculative options can have a useful role in a portfolio. Though you should realize most people fail with speculation, so you have to be realistic about your prospects. I have used speculative investments including naked short selling, leverage (margin) and options.

Spread betting is another speculative strategy that can play a part in an investment portfolio. Spread betting is not allowed in the USA (with our highly regulated personal investing environment but is available in most other countries). They are somewhat similar to binary options (which are allowed in the USA) and to futures contracts (they are not the same, just those are comparable to get some idea of how you would use them in a portfolio).

Spread betting really is a bet on what will happen. You don’t buy a financial instrument. You place a bet with a company and if the prices move for you and you close the position with a gain they pay out a gain to you and if you close out the position with a loss your capital held with them is reduced by your loss amount.

Since the price to control a position is much less than the notional position size there is a large degree of leverage which increases the affect of gains and loses. Since positions can move against you and must be settled if the loss exceed your deposit with the company you are trading with having a substantial cash cushion is the way I would use such a speculative account. If I decided I could afford to risk losing $5,000 I would deposit that amount.

My purchases would about 10% of the capital in the account (so $500 at first). If that is leveraged at 20 to 1 (just requiring 5% down on margin), that would make my effective leverage just 2 to 1. But if I added other positions that would increase my leverage, say 2 more purchases and my leverage would be 6 to 1.

The way I have managed the speculative portion of my portfolio is to fund it and then pull off part of the gains to my long term portfolio and retain part of the gains to build my speculative account. It isn’t really quite that clear as I have different level of speculation in my portfolio. Options are speculative but have a limit of 100% loss. Selling stocks short (naked shorting) is speculative but has theoretically unlimited losses. Using margin on regular stocks has the potential to lose more than you have invested though most of the time you should be stopped out before the losses are too much beyond your entire account value.

So I don’t really have a clear cut speculative portfolio but I roughly follow that procedure. I have added to the speculative portion when I have had very large gains in a particular portion of my main portfolio.

Another factor with spread betting, shorting and options is that they can actually be used to reduce the risk of your overall portfolio using certain strategies. If you believe there is a risk for a market downturn but don’t want to sell any of your stock holdings you can use spread betting to create a position that will gain if the market declines. That gain then will offset the likely loss on your stock positions thus reducing you risk in a market decline.

Of course, if you do that and the market moves up you will create a loss on you spread betting position that offsets your gains on your stock positions. You could also bet against specific stocks that you think will decline more in a market decline and seek to increase your return of course that has risks (including the market declining along with your stocks but that stocks you bet against could move against you anyway). I have used this strategy with selling stocks short occasionally.

An additional risk to consider with spread betting is you need to find a company you trust to be around to pay off your gains. You would want to examine the safety of your funds and that (in the UK) the account is covered by the Financial Conduct Authority (FCA) and complies with the FCA’s Client Assets provisions (and in other countries they have similar coverage). To be safe you should consider whether holding more than the covered amount is wise in your account. The last 10 years have provided examples of the riskiness of financial companies going out of business; that your funds wouldn’t be accessible is a risk that must be considered.

Related: Shorting Using Inverse Funds – Books on Trading and Speculating in Financial Markets – Selling Covered Call Options

The 10 publicly traded companies with the largest market capitalizations.

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 1 | Apple | USA | $626 billion |

| 2 | Exxon Mobil | USA | $405 billion |

| 3 | Microsoft | USA | $383 billion |

| 4 | USA | $379 billion | |

| 5 | Berkshire Hathaway | USA | $337 billion |

| 6 | Johnson & Johnson | USA | $295 billion |

| 7 | Wells Fargo | USA | $270 billion |

| 8 | GE | USA | $260 billion |

| 9 | Wal-Mart | USA | $246 billion |

| 10 | Alibaba | China | $246 billion |

Alibaba makes the top ten, just weeks after becoming a publicly traded company. The next ten most valuable companies:

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 11 | China Mobile | China | $240 billion* |

| 12 | Hoffmann-La Roche | Switzerland | $236 billion |

| 13 | Procter & Gamble | USA | $234 billion |

| 14 | Petro China | China | $228 billion |

| 15 | ICBC (bank) | China | $228 billion** |

| 16 | Royal Dutch Shell | Netherlands | $227 billion |

| 17 | Novartis | Switzerland | $224 billion |

| 18 | Nestle | Switzerland | $224 billion*** |

| 19 | JPMorgan Chase | USA | $224 billion |

| 20 | Chevron | USA | $210 billion |

Petro China reached to top spot in 2010. I think NTT (Japan) also made the top spot (in 1999); NTT’s current market cap is $66 billion.

Market capitalization shown are of the close of business today, as shown on Yahoo Finance.

According to this March 2014 report the USA is home to 47 of the top 100 companies by market capitalization. From 2009 to 2014 that total has ranged from 37 to 47.

The range (during 2009 to 2014) of top 100 companies by country: China and Hong Kong (8 to 11), UK (8 to 11), Germany (2 to 6), France (4 to 7), Japan (2 to 6), Switzerland (3 to 5).

Related: Stock Market Capitalization by Country from 1990 to 2010 – Global Stock Market Capitalization from 2000 to 2012 – Investing in Stocks That Have Raised Dividends Consistently – The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects (2011)

A few other companies of interest:

Facebook, USA, current market cap is $210 billion.

Pfizer, USA, $184 billion.

Toyota, Japan, $182 billion.

Read more

Hedge funds seek to pay the managers extremely well and claim to justify enormous paydays with claims of superior returns. Markets provide lots of volatility from which lots of different performances will result. Claiming the random variation that resulted in the superior performance of there portfolio as evidence the deserve to take huge payments for themselves from the current returns is not sensible. But plenty of rich people fall for it.

As I have written before: Avoiding Hedge Fund Investments is One of the Benefits of Being in the 99%.

This is pretty well understood by most knowledgeable investors, financial planners and investing experts. But funds that charge huge fees continue to get away with it. If you are smart you will avoid them. A few simple investing rules get you well into the top 10% of investors

- seek low fees

- diversify – pay attention to risk of portfolio overall

- limit trading (low turnover)

- use tax advantage accounts wisely (in the USA 401(k)s and IRAs)

From a personal finance perspective, saving money is a key. Most people fail at being decent investors before they even get a chance to invest by spending more than they can afford and failing to save, and even worse going into debt (other than to some extent for college education and house). Consistently putting aside 10-20% of your income and investing wisely will put you in good shape over the long term.