Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

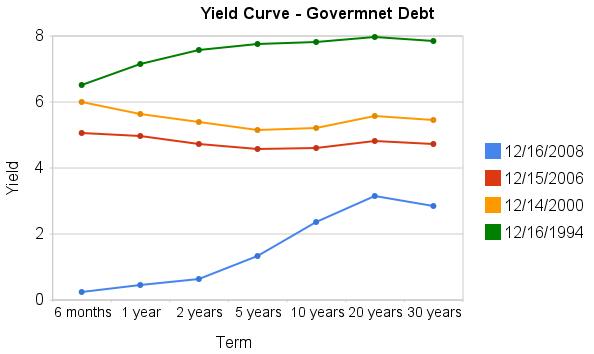

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

Comments

4 Comments so far

I really wish they would stop tinkering with rates, it played a part in some of this mess to begin with.

Businesses like stability IMO, not constantly shifting interest and tax targets.

[…] recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In […]

[…] federal funds rate remains under .25%. The large spread between government bonds and corporate bonds remains very large. In the last 3 […]

[…] From April to July 10 year corporate Aaa yields have stayed essentially unchanged (5.39% to 5.41% in July). Baa yields plunged from 8.39% to 7.09%. And 10 year government bond yields increased from 2.93% to 3.56%. federal funds rate remains under .25%. […]