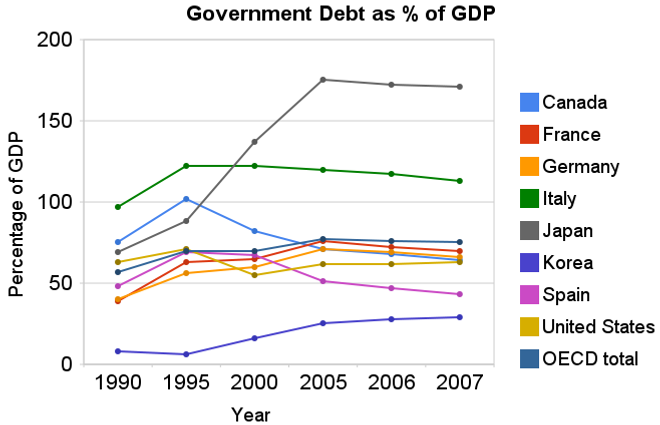

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.For 2007 most countries slightly decreased their government debt to GDP ratio – as economic growth exceeded debt growth. The OECD is made up of countries in Europe and the USA, Japan, Korea, Australia, New Zealand and Canada. The overall OECD debt to GDP ratio decreased from 77% in 2005 to 75% in 2007. The USA moved in the opposite direction increasing from 62% to 63%: still remaining far below the OECD total. Most likely 2008, 2009 and 2010 will see both the USA and other OECD national dramatically increase the debt burden.

Compared to the OECD countries the USA is actually better than average. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2007 at 63% while the overall OECD total is 75%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2007 total of 171% (that is a big problem for them). Korea is in the best shape at just a 29% total in 2007 but that is an increase from just 8% in 1990.

Related: Government Debt as a Percentage of GDP Through 2006 – Oil Consumption by Country in 2007 – Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Top 12 Manufacturing Countries in 2007

The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Notes on the Data from the OECD web site.

For most countries, gross financial liabilities refer to the liabilities (short and long-term) of all the institutions in the general government sector, as defined in the 1993 System of National Accounts (SNA) or in the 1995 European System of Accounts (ESA). This definition differs from the definition of debt applied under the Maastricht Treaty essentially in two respects. First, gross debt according to the Maastricht definition excludes trade credits and advances, as well as shares and insurance technical reserves. Second, government bonds are valued at nominal values instead of at market value or issue price plus accrued interest as required by the SNA rules. The United States and Canada also value government bonds at nominal value.

In principle, debts within and between different levels of government are consolidated; a loan from one level of government to another represents both an asset and an equal liability for the government as a whole and so it cancels out (is “consolidated”) for the general government sector.

The comparability of data can be affected in two ways. First, national differences in implementing SNA/ESA definitions can affect the comparability of government debt across countries. Second, changes in implementing SNA/ESA definitions can affect the comparability of data within a country over time.

There are two standard ways to measure the extent of government debt – by reference to gross financial liabilities or by reference to net financial liabilities – the latter being measured as gross financial liabilities minus financial assets. Gross financial liabilities as a percentage of GDP is the most commonly used government debt ratio and is shown here.

Comments

2 Comments so far

[…] reason, to me. The federal debt is large and growing quickly, which is a problem. But still the USA federal debt to GDP is lower than the OECD average. Even with a few more years of crazy federal debt growth the USA will still be below that […]

[…] data here is very similar to the OECD data I provided earlier, Government Debt Compared to GDP 1990 to 2007, though with some notable differences. In the OECD data was still in the best shape, but is seen as […]