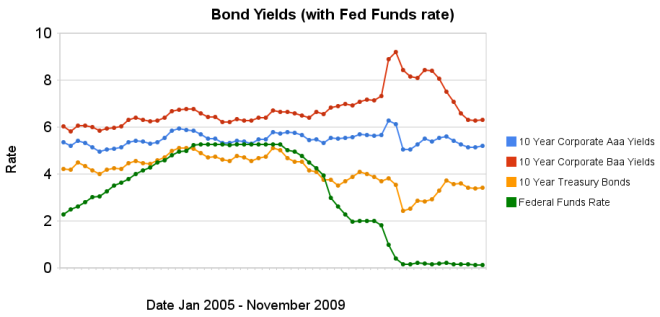

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

Comments

1 Comment so far

The United States economy appears to be gaining strength and if job growth can continue the Fed will likely reduce the amount giveaways to the banks by increasing the fed funds rate…