Credit problems create a vicious cycle. Credit card interest rates are increased, fees are onerous and even applying for jobs is negatively affected (many employers look at credit reports as one factor in the hiring process), insurance companies look at them too and can offer higher rates. Employers and insurers have the belief that bad credit is an indication of other risks they don’t want to take on. Once into the cycle there are challenges to deal with. I must admit I think it is silly to look at credit for most jobs. But a significant number of organizations do so that is an issue someone that gets themselves in this trouble has to deal with.

I think the best way to deal with this problem is to build a virtuous cycle of savings instead. We tend to focus on how to cope with a bad situation instead of how to take sensible actions to avoid getting in the bad situation. In general we spend far too much money and take on too much debt – we live beyond our means and fail to save. Then we have a perfectly predictable temporary hit to our financial situation and a vicious cycle begins.

If we just acted more responsibly when times were good we would have plenty of room to absorb a temporary financial hit without the negative cycle starting. The time to best manage this cycle is before you find yourself in it. Avoiding it is far better than trying to get out of it.

Build up an emergency fund. Don’t borrow using credit cards – or any form of consumer debt (borrowing for education, a car or a house, I think, are ok). Save up your money until you can afford what you want to purchase. Don’t buy stuff just to buy stuff.

Re: The Vicious Circle of Poor Credit

Related: Real Free Credit Report – In the USA 43% Have Less Than $10,000 in Retirement Savings – Financial Planning Made Easy

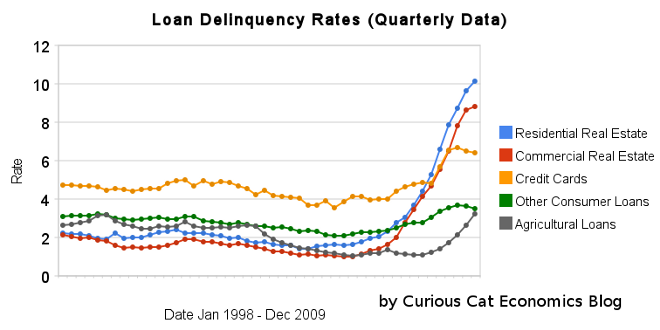

The chart shows the total percent of delinquent loans by commercial banks in the USA.

That last half of 2009 saw real estate delinquencies continue to increase. Residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies in 98 basis points to 8.81%. Agricultural loan delinquencies also increased (112 basis points) though to just 3.24%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.

Related: Loan Delinquency Rates Increased Dramatically in the 2nd Quarter – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… – posts with charts showing economic data

Read more

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7%, based on U.S. Bureau of Labor Statistics surveys. Hiring for the census added 48,000 jobs in March, a large temporary increase, but less than expected amount, for the month. The change in total nonfarm payroll employment for January was revised from -26,000 to +14,000, and the change for February was revised from -36,000 to -14,000 together this results in an addition of 90,000 jobs.

The 162,000 added jobs is the largest increase since March of 2007. It is a good start but the economy will have to continue to increase the number of job added each month to reduce unemployment. Population growth requires an addition of approximately 125,000 jobs a month. The current labor pool has been temporarily reduced by those who have dropped out of the labor market. As jobs return they will come back into the market.

The economy has lost 8.2 million jobs since the recession started in December 2007. Now that was the bubble induced peak still, by the time the economy adds 8 million jobs many more jobs will be needed (since 125,000 additional jobs are needed each month). Still if we added 200,000 a month it would take 40 months to get back to the previous peak total. And by that time the economy would have accumulated another 9 million jobs needed (it would be about Dec 2013 = 6 * 12 months *125,000/month). While the bubble induced peak may well be a unrealistic target, the job market needs to add over 200,000 jobs a month to regain ground lost over the last several years.

In March, the number of unemployed persons was little changed at 15.0 million, and the unemployment rate remained at 9.7%. The number of long-term unemployed (those jobless for 27 weeks and over) increased by 414,000 over the month to 6.5 million. In March, 44.1% of unemployed persons were jobless for 27 weeks or more. Both are all time highs.

The civilian labor force participation rate (64.9%) and the employment-population ratio (58.6%) continued to edge up in March. The average length of unemployment rose to 31 weeks – the highest average ever (since 1948).

Related: USA Unemployment Rate Remains at 9.7% – 663,000 Jobs Lost in March, 2009 in the USA – Another 450,000 Jobs Lost in June, 2009 – Manufacturing Employment Data – 1979 to 2007

Read more

From Greg Mankiw’s Blog

Taxes/GDP x GDP/Person = Taxes/Person

France .461 x 33,744 = $15,556

Germany .406 x 34,219 = $13,893

UK .390 x 35,165 = $13,714

US .282 x 46,443 = $13,097

Canada .334 x 38,290 = $12,789

Italy .426 x 29,290 = $12,478

Spain .373 x 29,527 = $11,014

Japan .274 x 32,817 = $8,992

The USA is the 2nd lowest for percent of GDP taxes 28.2% v 27.4% for Japan. But in taxes per person toward the middle of the pack. France which has 46% taxes/GDP totals $15,556 in tax per person compared to $13,097 for the USA.

Related: Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… – Oil Consumption by Country in 2007 – USA, China and Japan Lead Manufacturing Output in 2008 – Bigger Impact: 15 to 18 mpg or 50 to 100 mpg?

10 Ways the New Healthcare Bill May Affect You by Katie Adams

…

Starting this fall, your health insurance company will no longer be allowed to “drop” you (cancel your policy) if you get sick.

…

Starting this year your child (or children) cannot be denied coverage simply because they have a pre-existing health condition. Health insurance companies will also be barred from denying adults applying for coverage if they have a pre-existing condition, but not until 2014.

…

If you currently have pre-existing conditions that have prevented you from being able to qualify for health insurance for at least six months you will have coverage options before 2014. Starting this fall, you will be able to purchase insurance through a state-run “high-risk pool”, which will cap your personal out-of-pocket expenses for healthcare. You will not be required to pay more than $5,950 of your own money for medical expenses; families will not have to pay any more than $11,900.

…

Under the new law starting in 2014, you will have to purchase health insurance or risk being fined.

…

Starting in 2018, if your combined family income exceeds $250,000 you are going to be taking less money home each pay period. That’s because you will have more money deducted from your paycheck to go toward increased Medicare payroll taxes. In addition to higher payroll taxes you will also have to pay 3.8% tax on any unearned income, which is currently tax-exempt.

Related: How the health care bill could affect you – Answers About Health Care Bill – Why the Health Care Bill May Eventually Curb Medical Costs – post on health care – USA Consumers Paying Down Debt – Personal Finance Basics: Long-term Care Insurance

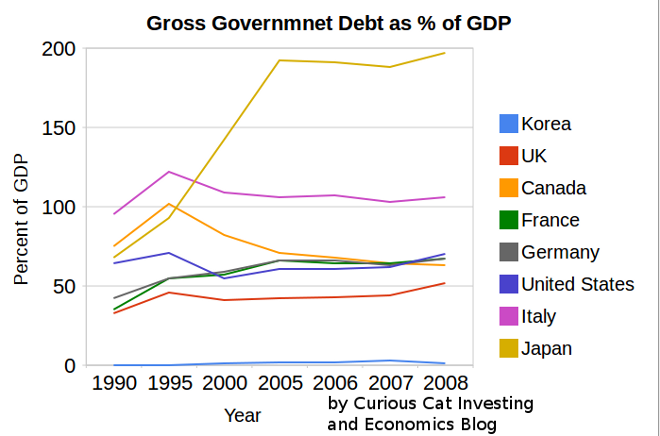

Recently Greece and the huge USA federal deficits have highlighted the problem of excessive government debt. The above chart shows gross government debt by country from the IMF.

Korea has essentially no gross government debt (under 2% of GDP for the entire period). At the other end of the spectrum Japan has seen gross government debt rise to 197% (Japan’s 2008 figure is an IMF estimate). The IMF did not have data for Greece (which would likely look very bad) or China (which I would think would be very low – maybe even negative – the government having more assets than debt).

The USA debt stood at 64% in 1990, 71% in 1995, 55% in 2000, 61% in 2005 and 70% in 2008. Most countries are expected to see significant increases in 2009. The IMF sees the USA going to 85% in 2009 and 100% in 2012. They see Germany at 79% in 2009 and 90% in 2012. They See the UK at 69% in 2009 and 94% in 2012. They see Japan at 237% in 2012.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.___________________________

The data here is very similar to the OECD data I provided earlier, Government Debt Compared to GDP 1990 to 2007, though with some notable differences. In the OECD data was still in the best shape, but is seen as having 29% debt to GDP in 2007. The IMF data attempts to avoid issues where some countries have debt of non-federal governments that are hidden when looking just at federal government debt.

Data source: IMF data (for some countries the data is also from that site but at different urls).

Related: The Long-Term USA Federal Budget Outlook – USA, China and Japan Lead Manufacturing Output in 2008 – Oil Consumption by Country in 2007 – Saving Spurts as Spending Slashed

There are several personal finance basics that everyone must account for. Retirement requires the most planning and accumulating the largest amount of money. Luckily if you plan ahead you have a long time for compounding to work in your favor. Unfortunately most people continue to fail to make even the most minimal efforts to save for retirement: 43% have less than $10k for retirement

The percentage of workers who said they have less than $10,000 in savings grew to 43% in 2010, from 39% in 2009, according to the Employee Benefit Research Institute’s annual Retirement Confidence Survey. That excludes the value of primary homes and defined-benefit pension plans.

Fewer workers report that they and/or their spouse have saved for retirement (69%, down from 75% in 2009 and 72% in 2008. Moreover, fewer workers say that they and/or their spouse are currently saving for retirement (60%, down from 65 percent in 2009).

27% say they have less than $1,000 in savings (up from 20% in 2009).

46% report they and/or their spouse have tried to calculate how much money they will need to have saved for a comfortable retirement by the time they retire.

What is a very rough estimate of what you need? Well obviously factors like a pension, social security payments, age at retirement, home ownership, health insurance, marital status… make a huge difference in the total amount needed. But something in the neighborhood of 15-25 times your desired retirement income is in the ballpark of what most experts recommend. So if you want $50,000 in income you need $750,000 – $1,250,000. Obviously that is difficult to save over a short period of time. The key to saving for retirement is a consistent, long term saving program.

Related: Retirement Savings Survey Results (2007) – How Much Will I Need to Save for Retirement? – Personal Finance Basics: Long-term Care Insurance

The government has stopped some of the worst abuses by credit card issuers however, those financial institutions are not without ways of continuing to take advantage of customers, Credit-Card Fees: the New Traps

…

Banks already are reaping more fees on overseas transactions. Not only are they raising foreign-exchange transaction fees—the cost customers pay for purchases made in foreign currencies—but they are expanding the definition of what qualifies as a foreign transaction.

In the past, people who made online purchases from foreign merchants, or who traveled to a country where the purchases are often in U.S. dollars such as the Bahamas, were generally immune from paying such fees. But Citi and Bank of America recently imposed their 3% foreign-transaction fees on all foreign transactions—even if that purchase is charged in U.S. dollars. Discover Financial Services also began charging a new 2% for foreign purchases last year.

…

And there are ways to avoid annual fees. Citigroup is alerting some customers that it is assessing a $60 annual fee on their cards. The cure for that is simple. If you spend $2,400 on the card in a 12-month period, the bank will refund the fee.

I’ll tell you a better way to avoid the abusive fees. Don’t deal with the large banks that the government bailed out. My credit union offers a credit card with no annual fee without any minimum spending requirements, and many others do as well.

Related: How to avoid getting ripped off by credit card companies – More Outrageous Credit Card Fees – Sneaky Credit Card Fees – USA Consumers Paying Down Debt –

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 9.5% of all loans outstanding as of the end of the fourth quarter of 2009, down 17 basis points from the third quarter of 2009, and up 159 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 50 basis points from 9.9% in the third quarter of 2009 to 10.4% this quarter.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.6%, an increase of 11 basis points from the third quarter of 2009 and 128 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 15% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 1.2 percent, down 22 basis points from last quarter and up 12 basis points from one year ago.

The percentages of loans 90 days or more past due and loans in foreclosure set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

The data is far from good but it could well signal the situation is improving. The next few quarters seem poised to start showing better results. Granted given how bad these results are we have a long way to go before the data is actually good. “We are likely seeing the beginning of the end of the unprecedented wave of mortgage delinquencies and foreclosures that started with the subprime defaults in early 2007, continued with the meltdown of the California and Florida housing markets due to overbuilding and the weak loan underwriting that supported that overbuilding, and culminated with a recession that saw 8.5 million people lose their jobs,” said Jay Brinkmann, MBA’s chief economist.

“The continued and sizable drop in the 30-day delinquency rate is a concrete sign that the end may be in sight. We normally see a large spike in short-term mortgage delinquencies at the end of the year due to heating bills, Christmas expenditures and other seasonal factors. Not only did we not see that spike but the 30-day delinquencies actually fell by 16 basis points from 3.79% to 3.63%. Only three times before in the history of the MBA survey has the non-seasonally adjusted 30-day delinquency rate dropped between the third and fourth quarter and never by this magnitude.

“This drop is important because 30-day delinquencies have historically been a leading indicator of serious delinquencies and foreclosures. With fewer new loans going bad, the pool of seriously delinquent loans and foreclosures will eventually begin to shrink once the rate at which these problems are resolved exceeds the rate at which new problems come in. It also gives us growing confidence that the size of the problem now is about as bad as it will get.

“Despite the drop in short-term delinquencies, foreclosure rates could continue to climb, however, based on the ability of borrowers 90 days or more delinquent to solve their problems. A sizable number of the loans in the 90+ day delinquent bucket are in loan modification programs. They are carried as delinquent until borrowers demonstrate they will make the payments agreed to in the plans.

Related posts: Mortgage Delinquencies Continue to Climb (Nov 2009) – USA Housing Foreclosures Slowly Declining (Dec 2009) – Nearly 10% of Mortgages Delinquent or in Foreclosure – How Not to Convert Equity (Jan 2006)

Read more

There was a $1 trillion gap at the end of fiscal year 2008 between the $2.35 trillion states had set aside to pay for employees’ retirement benefits and the $3.35 trillion price tag of those promises, according to a new report released by the Pew Center on the States. The shortfall, which will have to be paid over the next 30 years by state and local governments, amounts to more than $8,800 for every household in the United States.

The figures detailed in Pew’s report, The Trillion Dollar Gap, include pension, health care and other non-pension benefits promised to both current and future retirees in states’ and participating localities’ public sector retirement systems.

Pew’s numbers likely underestimate the bill coming due because the most recent available data do not account for the second half of 2008, when states’ pension fund investments were particularly affected by the financial crisis. Additionally, most states’ accounting methods spread the investment declines over a period of time–meaning states will be dealing with their losses for several years.

“While the economic crisis and drop in investments helped create it, the trillion dollar gap is primarily the result of states’ inability to save for the future and manage the costs of their public sector retirement benefits,” said Susan Urahn, managing director, Pew Center on the States. “The growing bill coming due to states could have significant consequences for taxpayers—higher taxes, less money for public services and lower state bond ratings. States need to start exploring reforms.”

In fiscal year 2008, states’ pension plans had $2.8 trillion in long-term liabilities, with more than $2.3 trillion reserved to cover those costs. Overall, states’ pension systems were 84 percent funded—above the 80 percent funding level recommended by experts. Still, the unfunded portion–$452 billion–is substantial, and states’ performance is down slightly from an 85 percent combined funding level in fiscal year 2006. Pension liabilities have grown by $323 billion since 2006, outpacing asset growth by almost $87 billion.

Retiree health care and other non-pension benefits, such as life insurance, create another huge bill coming due: a $587 billion total liability to pay for current and future benefits, with only $32 billion–or just over 5 percent of the cost–funded as of fiscal year 2008. Half of the states account for 95 percent of the liability. Because of a 2004 Governmental Accounting Standards Board rule, the full range of non-pension liabilities was officially reported in fiscal year 2008 for the first time across all 50 states.

Many state and local governments continue to provide very large pay to state and local government employees and often use very generous retirement packages as a way of disguising the true cost of the pay packages they provide.

Related: NY State Raises Pension Age to Save $48 Billion – True Level of USA Federal Deficit – Charge It to My Kids – USA Federal Debt Now $516,348 Per Household – Politicians Again Raising Taxes On Your Children – Consumer Debt Reduced below $2.5 Trillion

Read more