Early last year when studying my portfolio I decided my two biggest positions (Apple and Google – those ready the blog won’t be surprised due to my 10 stocks for 10 years posts) continued to warrant the large portion of the portfolio they held. I also decided that I would systemically sell say 1% of Apple and 2% of Alphabet a year (the Apple dividend was also paying about 1% – actually it was more then but is much less now).

That was just a long term plan that helped me think about the long term portfolio management. But that, like all investment decision, was subject to revision. As both continued to soar I decided it made sense to sell more but maintain a similar plan, just maybe selling 2% and 4% a year (or something).

Basically I still like them as investments. I still feel both companies long term prospects are excellent. I do also feel both are pretty richly valued. They certainly do not seem to be the huge bargains they were 15 years ago. At first my main reasons for slowly selling some was mainly that the portions of the portfolio were growing a bit too high. At this time, that has become even more true. But also the prices are also getting very rich. Selling at these prices seems pretty attractive.

At these prices if I sold more now and then prices decline I can have already cashed in my planned yearly sales (based on my original plan) and therefore could hold off for several years (instead of selling at those reduced prices). And if the prices continue to go up, well I still own a lot of them and so I will profit handsomely in that case.

I have a new 2nd largest holding – Sea Limited ($SE). It is a Singapore based company that I am very high on for the long term. I bought a fair amount, all in that last year. But nowhere near enough to be my second largest holding. However my originally purchases were in the $50s and $60 and today, less than a year since my first purchase, it is at $217. It is a richly valued stock but I believe the potential is still very promising I have no plans on selling any of this anytime soon. It is volatile, it is down 5% today.

It is useful to think about the long term and even to make tentative plans. But, as an investor, adjust those plans as conditions change. I see such plans as helpful thoughts and reminders, not plans to follow automatically.

I do continue to find that the existing prices in the market make finding great investments difficult. I am normally very “over-invested” in the stock market. I have been trying to reduce how over-invested I am. I am doing that a bit less successfully than I would like. But I am raising some cash. I do remain over-invested, which is fine for me, but I also am a bit more over-invested than I think is warranted. I will continue to try to raise some cash. It is a bit difficult for me as I am naturally drawn to make investments when I see available cash to invest.

Related: Retirement Portfolio Allocation for 2020 – Long Term Changes in Underlying Stock Market Valuation

The markets continue to provide difficult options to investors. In the typical market conditions of the last 50 years I think a sensible portfolio allocation was not that challenging to pick. I would choose a bit more in stocks than bonds than the commonly accepted strategy. And I would choose to put a bit more overseas and in real estate.

But if that wasn’t done and even something like 60% stocks and 40% bonds were chosen it would seem reasonable (or 60% stocks 25% bonds and 15% money market – I really prefer a substantial cushion in cash in retirement). Retirement planning is fairly complex and many adjustments are wise for an individual’s particular situation (so keep in mind this post is meant to discuss general conditions today and not suggest what is right for any specific person).

I wrote about Retirement Savings Allocation for 2010: 5% real estate, 35% global stocks, 5% money market, 55% USA stocks. This was when I was young and accumulating my retirement portfolio.

Today, investment conditions make investing in retirement more difficult than normal. With interest rates so low bonds provide little yield and have increased risk (due to how much long term bond prices would fall if interest rates rise, given how low interest rates are today). And with stocks so highly valued the likelihood of poor long term returns at these levels seems higher than normal.

So the 2 options for the simplest version of portfolio allocation are less attractive than usual, provide lower income than usual and have great risk of decline than usual. That isn’t a good situation.

View of Glacier National Park (a nice place to go in retirement, or before retirement) by John Hunter

I do think looking for dividend stocks to provide some current yield in this situation makes sense. And in so doing substitute them for a portion of the bond portfolio. This strategy isn’t without risk, but given the current markets I think it makes sense.

I have always thought including real estate as part of a portfolio was wise. It makes even more sense today. In the past Real Estate Investment Trusts (REITs) were very underrepresented in the S&P 500 index, in 2016 and 2017 quite a few REITs were added. This is useful to provide some investing in REITs for those who rely on the S&P 500 index funds for their stock investments. Still I would include REIT investments above and beyond their portion of the S&P 500 index. REITs also provide higher yields than most stocks and bonds today so they help provide current income.

While I am worried about the high valuations of stocks today I don’t see much option but to stay heavily invested in stocks. I generally am very overweight stocks in my portfolio allocation. I do think it makes sense to reduce how overweight in stocks my portfolio is (and how overweight I think is sensible in general).

I created a 10 stocks for 10 years portfolio in April of 2005 which I shared on this blog. It did very well.

Over the years I adjusted the portfolio occasionally. Unfortunately the website I used to track results stopped doing that (and it is much more difficult to track results – with dividends, stock splits, spinoff… than you might suppose). I estimate I beat the S&P 500 by maybe 300 basis points annually (for the portfolio with slight adjustment over time, which is the one I tracked).

With this post I have created a new 10 stocks for 10 years portfolio.

The 10 stocks I came up with are (closing price on 22 April 2005 – % of portofilo invested):

- Tencent (TCEHY) – $43 and 15% (using the USA ADR). A phenomenal company with incredible global prospects for the long term. As the stock price has been hampered by concerns about China it has great potential for appreciation from the current price.

- Alibaba (BABA) – $175 and 15% (using USA ADR). Another phenomenal company with incredible global prospects that has performed poorly this year due to China concerns.

- Alphabet (GOOGL) – $1,254 and 11% (in the original 2005 portfolio the price was $216 and it started at 12% of the portfolio. The prospects are great long term, the stock price reflects that so it isn’t cheap but over the long term I expect it to do very well).

- Apple (AAPL) – $225 and 11% (I added Apple to the original 10 for 10 portfolio in 2010. The biggest mistake in the original portfolio was leaving off Apple, I considered it but chose not to include it. It has been my largest stock holding for years. It has been very cheap even just a few years ago, though today I think the price is much more reasonable so it isn’t the great bargin it has been. Still the long term prospects are great.)

- Abbvie (ABBV) – $97 and 10% (I added Abbive to the original portfolio in 2014. I would select a couple other healthcare stocks in a real invested portfolio for balance but Abbvie is the company I am most comfortable with so I include it here.)

- Toyota (TM) $125 and 9% (in the 2005 portfolio the price was $72 and it made up 12% of the portfolio). I believe the company is very well managed and the long term prospects are good though I am a bit worried about autonomous cars and the future of transportation. A potential new market for Toyota is robotics but they have not been as aggressive with software development innovation as I would hope on that front. The companies I am most interested in are very internet focused and I don’t like how concentrated that makes this portfolio so adding Toyota and Abbive adds a bit of diversity, though obviously not much)

- Amazon (AMZN) – $2,002 and 8% (in the 2005 portfolio the price was $33 a share, it was by far the best performer. It started as 8% of the original 2005 portfolio. I am very high on the prospects for the company, the stock price is what leads me to limit it to 8% of the new portfolio.)

- Naspers (NPSNY) – $33 and 8% (bought 30 October 2018, the company is largely a proxy for Tencent but also has many other significant investments in internet companies, the decline in Tencent, along with the Chinese market decline, and therefore the decline in Naspers just makes it too good an opportunity to pass up)

- Vanguard Health Care Index Fund (VHT) – $177 and 8% (I can’t decide on what other health care stock to hold for 10 years but I believe strongly in global growth of health care investments over the next 10 years so I settled on this low expense ETF.)

- Danaher (DHR) – $103 and 5% (I like this company but honestly the biggest reason for including it is to get some more diversity in the portfolio. I added it to the 2005 portfolio in 2008.)

I strongly believe that 10 years from now the Chinese stock market will have performed extremely well. There are of course numerous substantial worries about Chinese investments (the real estate bubble, high debt levels, “Great Firewall”, difficult government regulatory environment, restrictions on the press, restrictions on open debate…) but there are many reasons to be very optimistic about the long term prospects for China’s economic growth and the very promising leading companies prospects: such as Tencent, Alibaba, Baidu, Ctrip….

At this time it seems to me that the stock prices of leading Chinese companies are being held down compared to other leading companies (Apple, Google, Amazon…). Either the USA companies are overvalued or the Chinese ones are very under-valued or the global economy outside the USA is going to do very poorly in the next 10 years. Google, Apple etc. make a huge amount overseas but they have more earnings in the USA than Tencent and Alibaba (which still have almost none in the USA though their global business, outside China, is growing extremely rapidly).

One very big factor that I believe will support Chinese stock prices over the next 10 to 20 years is an large increase in the holdings of stocks by those in China. The current distribution of savings in China has extremely limited stock investments (and much larger bank savings accounts and real estate investments than in other countries). I expect that to change with a large increase in stock investing in China over the next 10 to 20 years.

Two other companies that are interesting are Naspers (which owns a huge amount of Tencent) and Softbank (which owns a large amount of Alibaba). Softbank has a large portfolio of investments in leading technology companies globally though much of it is held in a somewhat complicated manner. Naspers is more focused but also has a strong global portfolio. One of the very important aspects of Alibaba and Tencent is their huge portfolio of technology company investments made at the venture capital stage mostly (Google also has quite a few more investments than most people realize). I also believe Vanguard Emerging Market ETF (VWO) is a very good long term investment.

I wouldn’t be surprised if Chinese stocks had difficulty in the next year or two but long term stocks such as Alibaba and Tencent offer the best prospects considering realistic expectations for possible rewards compared to the risk investing in them poses today.

This portfolio is not meant to be a complete personal financial portfolio (at most it would be a portion of the portfolio allocated to equity holdings). Previous posts on portfolio allocation: Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation, Investment Options Are Much Less Comforting Than Normal These Days (2013) and Investing Return Guesses While Planning for Retirement.

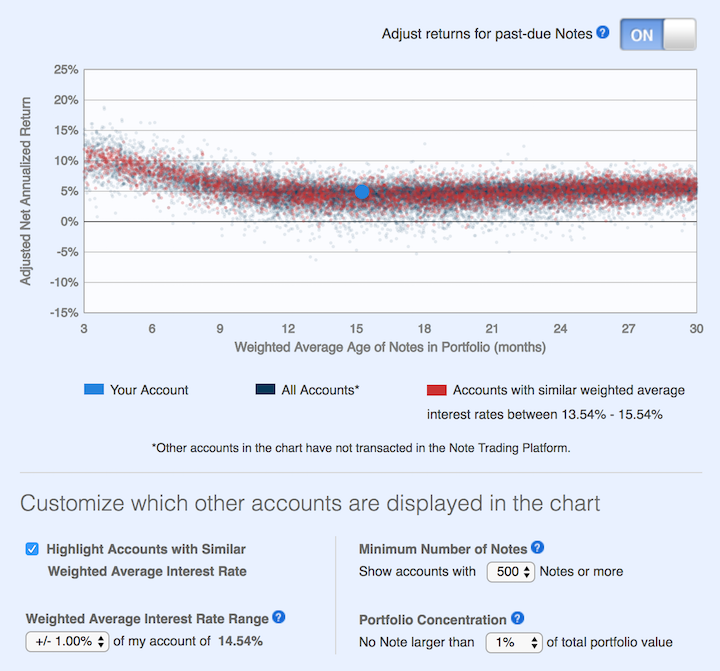

I have decided to wind down my investment test with LendingClub. I should end up with a investment return of about 5% annually. So it beat just leaving the money in the bank. But returns are eroding more recently and the risk does not seem worth the returns.

Early on I was a bit worried by how often the loan defaulted with only 0, 1 or 2 payments made. Sure, there are going to be some defaults and sometimes in extremely unlucky situation it might happen right away. But the amount of them seems to me to indicate LendingClub fails to do an adequate job of screening loan candidates.

Over time the rates LendingClub quoted for returns declined. The charges to investors for collecting on late loans were very high. It was common to see charges 9 to 10 times higher as the investor than were charged to the person that took out the loan and made the late payment.

For the last 6 months my account balance has essentially stayed the same (bouncing within the same range of value). I stopped reinvesting the payments received from LendingClub loans several months ago and have begun withdrawing the funds back to my account. I will likely just leave the funds in cash to increase my reserves given the lack of appealing investment options (and also a desire to increase my cash position in given my personal finances now and looking forward for the next year). I may invest the funds in dividend stocks depending on what happens.

This chart shows lending club returns for portfolios similar to mine. As you can see a return of about 5% is common (which is about where I am). Quite a few more than before actually have negative returns. When I started, my recollection is that their results showed no losses for well diversified portfolios.

The two problems I see are poor underwriting quality and high costs that eat into returns. I do believe the peer to peer lending model has potential as a way to diversify investments. I think it can offer decent rates and provide some balance that would normally be in the bond portion of a portfolio allocation. I am just not sold on LendingClub’s execution for delivering on that potential good investment option. At this time I don’t see another peer to peer lending options worth exploring. I will be willing to reconsider these types of investments at a later time.

I plan to just withdraw money as payments on made on the loans I participated in through LendingClub.

Related: Peer to Peer Portfolio Returns and The Decline in Returns as Loans Age (2015) – Investing in Peer to Peer Loans – Looking for Yields in Stocks and Real Estate (2012) – Where to Invest for Yield Today (2010)

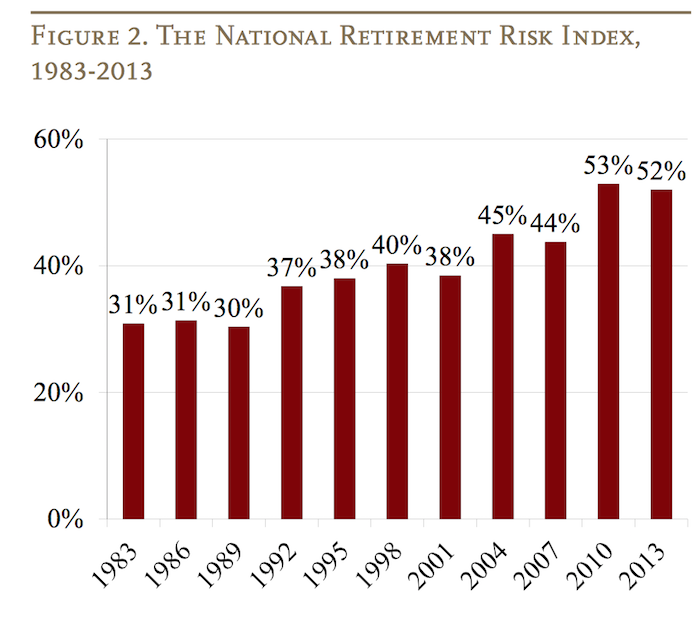

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

Brett Arends writes about the investment portfolio he uses?

It’s 10% each in the following 10 asset classes:

- U.S. “Minimum Volatility” stocks

- International Developed “Minimum Volatility” stocks

- Emerging Markets “Minimum Volatility” stocks

- Global natural-resource stocks

- US Real Estate Investment Trusts

- International Real Estate Investment Trusts

- 30-Year Zero Coupon Treasury bonds

- 30-Year TIPS

- Global bonds

- 2-Year Treasury bonds (cash equivalent)

This is another interesting portfolio choice. I have discussed my thoughts on portfolio choices several times. This one is again a bit bond heavy for my tastes. I like the global nature of this one. I like real estate focus – though as mentioned in previous articles how people factor in their personal real estate (home and investments) needs to be considered.

Related: Cockroach Portfolio – Lazy Golfer Portfolio – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment

Dylan Grice suggests the Cockroach Portfolio: 25% cash; 25% government bonds; 25% equities; and 25% gold. What we can learn from the cockroach

Government bonds protect against deflation (provided your money’s invested in solid government bonds and not trash). Equities offer capital growth and income. And gold, as we know, protects against currency depreciation, inflation, and financial collapse. It’s vitally important to maintain holdings in each, in my opinion.

The beauty of a ‘static’ allocation across these four asset classes is that it removes emotion from the investment process.

I don’t really agree with this but I think it is an interesting read. And I do agree the standard stock/bond/cash portfolio model is not good enough.

I would rather own real estate than gold. I doubt I would ever have more than 5% gold and only would suggest that if someone was really rich (so had money to put everywhere). Even then I imagine I would balance it with investments in other commodities.

One of the many problems with “stock” allocations is that doesn’t tell you enough. I think global exposure is wise (to some extent S&P 500 does this as many of those companies have huge international exposure – still I would go beyond that). Also I would be willing to take some stock in commodities type companies (oil and gas, mining, real estate, forests…) as a different bucket than “stocks” even though they are stocks.

And given the super low interest rates I see dividend paying stocks as an alternative to bonds.

The Cockroach Portfolio does suggest only government bonds (and is meant for the USA where those bonds are fairly sensible I think) but in the age of the internet many of my readers are global. It may well not make sense to have a huge portion of your portfolio in many countries bonds. And outside the USA I wouldn’t have such a large portion in USA bonds. And they don’t address the average maturity (at least in this article) – I would avoid longer maturities given the super low rates now. If rates were higher I would get some long term bonds.

View of Glacier National Park, from Bears Hump Trail in Waterton International Peace Park in Canada, by John Hunter

These adjustments mean I don’t have as simple a suggestion as the cockroach portfolio. But I think that is sensible. There is no one portfolio that makes sense. What portfolio is wise depends on many things.

The 12 stock for 10 years portfolio consists of stocks I would be comfortable putting away for 10 years. I look for companies with a history of large positive cash flow, that seemed likely to continue that trend.

Since April of 2005 the portfolio Marketocracy calculated annualized rate or return is 8.2% (the S&P 500 annualized return for the period is 7.8%). Marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund. Without that fee the return beats the S&P 500 annual return by about 240 basis points annually (10.2% to 7.8%). And I think the 240 basis point “beat” of the S&P rate is really less than a fair calculation, as the 200 basis point “deduction” removes what would be assets that would be increasing.

In reviewing the data it seemed to me the returns for TDF and EMF were too low. In examining the Marketocracy site they seem to have failed to credit dividends paid since 2010 (which are substantial – over 15% of the current value has been paid in dividends that haven’t been credited). I have written Marketocracy about the apparent problem. If I am right, the total return for the portfolio likely will go up several tens of basis points, maybe – perhaps to a 10.5% return? And the returns for those 2 positions should increase substantially.

Since the last update I have added Abbvie (part of the former Abbot which was split into two companies in 2013). I will sell TDF from the fund (I include it in the table below, since I haven’t sold it all yet).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 622% | 10% | 10% | |

| Google – GOOG | 388% | 18% | 16% | |

| Danaher – DHR | 111% | 10% | 10% | |

| Templeton Dragon Fund – TDF | 100%*** | 3% | 0% | |

| PetroChina – PTR | 82% | 4% | 4% | |

| Toyota – TM | 65% | 9% | 10% | |

| Apple – AAPL | 57% | 15% | 15% | |

| Intel – INTC | 32% | 7% | 7% | |

| Templeton Emerging Market Fund – EMF | 29%*** | 5% | 7% | |

| Pfizer – PFE | 27% | 6% | 5% | |

| Abbvie – ABBV | 18% | 3% | 5% | |

| Cisco – CSCO | 12% | 3% | 4% | |

| Cash | – | 7%* | 4% | |

| Tesco – TSCDY | -5%** | 0%* | 3% |

The current marketocracy results can be seen on the Sleep Well marketocracy portfolio page.

Related: 12 Stocks for 10 Years: January 2012 Update – May 2013 portfolio update – 12 Stocks for 10 Years, July 2009 Update

I make some adjustments to the stock holdings over time (selling of buying a bit of the stocks depending on large price movements – this rebalances and also lets me sell a bit if I think things are getting highly priced. So I have sold some Amazon and Google as they have increased greatly. These purchases and sales are fairly small (resulting in a annual turnover rate under 5%).

There are many asset allocation strategies; which often are pretty similar. In general they oversimplify the situation (so an investor needs to study and adjust them to their situation – though most don’t do this, which is a problem). In general, I think asset allocation suggestions are too heavily weighted on bonds, and that is even more true today in the current environment – of could that is just my opinion.

I ran across this suggested allocation in Eyewitness to a Wall Street mugging which I think has several good values.

- It focuses on low fee, market index funds. Fees are incredibly important in determining long term investment success

- It has lower bond allocation than normal

- It has more international exposure than many – which I think is wise (this suggested portfolio is for those in the USA, USA portion should be lowered for others)

- It includes real estate (some suggested allocations miss this entirely)

In my opinion this allocation should be adjusted as you get closer to retirement (put a bit more into more stable, income producing investments).

My personal preference is to use high quality dividend stocks in the current interest rate environment. I would buy them myself which does require a bit more work than once a year rebalancing that the lazy golfer portfolio allows.

I would also include 10% for Vanguard emerging markets fund (VWO) (for sake of a rule of thumb reduce Inflation Protected Securities Fund to 10% if you are more than 10 years from retirement, when between 10 and 1 year from retirement put Inflation Protected Securities Fund at 15% and Total Stock Market Index Fund at 35%, when 1 year from retirement or retired lower emerging market to 5% and put 5% in money market.

Depending on your other assets this portfolio should be adjusted (large real estate holdings [large net value on personal home, investment real estate…] can mean less real estate in this portfolio, 401k holdings may mean you want to tweak this [TIAA CREF has a very good real estate fund, if you have access to it you might make real estate a high value in your 401k and then adjust your lazy portfolio], large pension means you can lower income producing assets, how close you are to retirement, etc.).

The Lazy Golfer Portfolio (Annually rebalance the fund on your birthday and ignore Wall Street for the remaining 364 days of the year) contains 5 Vanguard index funds

- 40% Total Stock Market Index Fund (VTSMX)

- 20% Total International Stock Index Fund (VGTSX)

- 20% Inflation Protected Securities Fund (VIPSX)

- 10% Total Bond Market Index Fund (VBMFX)

- 10% REIT Index Fund (VGSIX)

Related: Retirement Planning, Looking at Asset Allocation – Lazy Portfolio Results – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Starting Retirement Account Allocations for Someone Under 40 – Taking a Look at Some Dividend Aristocrats