The USA supreme court has ruled, 5-4, that manufacturer price fixing is ok (technically setting a minimum price would be ok). An interesting question is who will benefit from this. The right answer might also provide valuable investment ideas. My first thought is this will help those that provide customers added value. Without price to be a factor in the decision that leaves convenience and service. I would think Amazon.com could benefit (though they would likely rather provide discount prices to gain more market share I think they will retain and even grow market share due to convenience). Also retailers like Crutchfield that provide excellent after market support should benefit. Places that people go to only due to cheap prices will probably suffer. And of course the consumer that have to pay the higher prices will suffer. Basically retailers will win due to higher prices then there is just the matter of whether they lose enough business to offset that gain (customers moving from poor service but cheap retailers to good service retailers since there is no price difference).

I also think the idea of using fixed prices as a business strategy will not be as easy as it may seem. Competitors don’t have to institute such a policy and therefore discounters could offer lower prices on their products which might then mean they don’t sell many of yours (and the retailer may just choose not to carry yours). The biggest winners might even turn out to be manufacturers that take advantage of competitors that set minimum prices (by not setting minimum prices themselves) and gaining market share.

Related: High court eases ban on minimum prices – Supreme Court OKs retail price fixing by manufacturers

The merger condition required they offer the price point for 2.5 years. Unfortunately it appears it didn’t require that AT&T actually tell anyone about it.

So you can get discount DSL, if you live in the service area, and can figure out how to get the company to allow you to get the price they proposed to the court to bolster their case for merger approval. It sure would be nice if you could deal with companies that didn’t seem to have teams of lawyers kept busy trying to figure out how to say one thing while tricking customers out of as much money as possible. It seems to me we are getting less and less ethical. We just accept that companies are going to try and trick customers into paying as much as possible. My belief that you should just provide an honest service or product at a fair price seems to be some quaint old idea 🙁 But since that seems to be the case you have to treat companies as though they are going to trick you in any way they can. Be careful out there.

Related: Incredibly Bad Customer Service from Discover Card – Fake Checks That Make You Pay – Companies Claim to Value Customers

The federal debt is not officially calculated the way that other accounting is done. Future obligations are not included, thus promising ever larger payments for health and retirement programs are not accurately reflected in government official debt totals. There are some legitimate arguments for why using exactly the same standards as others does not make sense for the federal government accounting. However the current methods make it too easy for politicians to claim they are not spending our grandchildren’s money for promises they make today. Rules ‘hiding’ trillions in debt:

Bottom line: Taxpayers are now on the hook for a record $59.1 trillion in liabilities, a 2.3% increase from 2006. That amount is equal to $516,348 for every U.S. household. By comparison, U.S. households owe an average of $112,043 for mortgages, car loans, credit cards and all other debt combined.

Foisting debts on our grandchildren because we elect politicians that refuse to either cut spending (and promised spending) or raise taxes is a sad legacy of the last 30 years for the USA.

Related: Washington Paying Out Money it Doesn’t Have – Is the USA Broke – The Fallacy of Estate Tax Repeal – Social Security Trust Fund

I originally setup the 10 stocks for 10 years portfolio in April of 2005. In order to track performance I setup a marketocracy portfolio but had to make some adjustment to comply with the diversification rules. In December of 2006 I announced a new 11 stocks for the next 10 years (9 are the same, I dropped First Data Corporation, which had split into 2 companies and added Tesco and Yahoo). Now I will add Templeton Emerging Market Fund (EMF) making it 12 stocks for the next 10 years. I like the emerging market area and liked the concentration in China and southeast Asia the Dragon fund offered. I still do, but given the rapid rise in the Chinese market especially other markets look more attractive than previously. EMF will allow for a wider geographic representation.

At this time the stocks in the marketocracy portfolio in order of returns –

Google (134% return, 15% of the marketocracy portfolio, 12% of portfolio if I were buying today)

PetroChina (127%, 7.5%, 8%)

Amazon (92%, 6%, 6%)

Templeton Dragon Fund (73%, 11.5%, 10%)

Toyota (69%, 10%, 10%)

Cisco (54%, 6%, 8%)

Tesco (14% [22.55 purchase price on Dec 11th 2006]*, 0, 10%)

Templeton Emerging Market Fund (EMF) (15%, 2%, 4%)

Intel (6%, 4%, 8%)

Pfizer (-6%, 4%, 8%)

Yahoo (-12%, 4%, 6%)

Dell (-23%, 6%, 10%)

Read more

So I had a Discover Card. They charged me for charges I didn’t authorize. They then force me through their maze of policies telling me that it was not possible to be more customer friendly – their policies couldn’t be any different they were the policy (as if that made any sense). So Discover Card had to shut down my account. I told them if they couldn’t provide better service then I didn’t want a new account after they closed my account which was the only way they wouldn’t charge me for charges I didn’t authorize. They owed me $240 from their cashback bonus program. Now they refuse to pay me the money I earned because they say that it is their policy not to pay the cashback bonus if an account is closed.

After going around on that for awhile and them assuring me it was their policy and it was not possible for it to be done any other way by them or anyone else I asked what happened if someone died. Oh then the account is closed and we pay the money we owe on the cashback bonus. So obviously it isn’t that the account being closed makes it impossible for Discover to pay what was owed. It seems pretty obvious it is just a good way to take money Discover owes and just count on people not wanting to waste their time fighting to get what Discover owed them. Maybe one of their marketing people told them doing this to people that just had a parent/spouse… die might be bad publicity so they decided to actual pay what was owed in those instances. Jeez why can’t credit card companies just provide good service and treat customers well instead of only doing the absolute least they can that won’t spark outrage from the public and legislative action to prohibit such practices (I image not paying what was owed to people that died would spark legislative action if it wasn’t already illegal).

Is it really legal to charge someone for charges they didn’t authorize and when they tell you they didn’t authorize them refuse to do anything about it if they don’t close their account and then say we are not going to pay your cashback bonus because your account is closed? it seems to be yet another instance of credit card companies doing everything they can to take money from customers. Of course they claimed it was impossible to do anything else it was their policy to do it this way and no other credit card company is any different.

Read more

Jim Jubak makes a good case for why investing is safer overseas now.

…

And as I look ahead, I see few signs that the United States will put its financial ship into better trim and lower the country risk that comes with owning U.S. equities and bonds.

…

I think you need to compare markets one by one to look for those where investors, who tend to stick with the conventional wisdom until something whacks them over the head, have mispriced risk. The countries that I find particularly interesting as investment targets are those that have made the biggest strides in getting their houses in order.

He makes a good point. I have long advocated the benefits of international investing. And looking forward the potential for economic development (and investment gains) outside the USA are strong. As he says this does not mean abandoning the USA stock market but does mean thinking about increasing ownership of foreign stocks (probably using mutual funds though in our 10 stocks for 10 year portfolio we have 3 individual stocks: Toyota, Tesco (added in the December 2006 update), PetroChina and Templeton Dragon Fund [closed end mutual fund]).

Related: State of the nation? Broke – Our Only Hope: Retiring Later

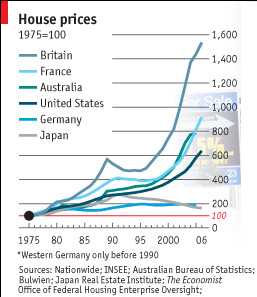

From 1975 to 2006 house prices in the UK increased 14 times. At 14 times that works out to about a 9% annual rate of return which is doesn’t sound nearly as impressive as a 14 fold increase to most people (I believe). The article does not mention if the chart is adjusted for inflation (a 9% return after inflation is incredibly good, a 9% return before factoring in inflation – which would reduce the rate of return – is good but reasonable) – my guess is that the chart is adjusted for inflation (meaning Britain’s owning real estate have been fortunate). Online calculator for annual rates of return over time.

Real estate rate of returns (when calculated on the total price) also underestimate the “real return” most investors experience because investors often only put down a portion of the investment. So the real rate of return is increased dramatically to the investor as a result of the the multiplier effect of buying on margin. Of course, real estate also has expense related to upkeep and the advantage of providing a place to live…

The graph (from the economist – see: Through the roof) shows other countries, USA: about 6 times, France 9 times… Remember these rates are averages for entire countries some areas in each country will have far exceeded these rates.

The graph could be a bit better if they didn’t make several of the colors almost the same.

Related: More Non Bubble Bursting in Housing – Europe and USA Housing Price Boom – How Not to Convert Equity – 30 year fixed Mortgage Rates

Realtors take a large percentage of a home’s sale price for their services. It has never made much sense to me. It does not seem like the services are proportional to the sales price. I don’t see how it costs 5 times more to sell a $1,000,000 house than a $200,000 house. The Freakonomics authors have commented on the problems caused by the way realtors charge for services.

Study Offers Provocative Comparison of Selling a Home:

“Our results are good news for buyers,” he said. “The price buyers pay appears to be driven entirely by the characteristics of the property and of the seller. Whether the property is sold through FSBOMadison.com or a realtor appears to make little difference in terms of purchase price.” “Realtors undoubtedly can provide value to sellers,” Nevo concluded. “But our research shows that for-sale-by-owner Web sites increasingly are making selling your own home more appealing and offering a viable alternative to realtors.”

Study: The Relative Performance of Real Estate Marketing Platforms: MLS versus FSBOMadison.com (pdf)

Very nice illustration in Personal Finance Success Comes More From Smart Budgeting Than Smart Investing:

Now, Kevin’s a smart investing cookie and is able to crank out a 16% return each year. I just take my money, dump it in a Vanguard 500, and move on with life, which means over the long haul I earn a 12% return. Who earns more in the long run?

After five years of this same investing, Kevin has $34,385.68 in his investment account, while I have $63,528.47 in mine, a difference of $29,142.79 in the frugal guy’s favor. Even at the twenty five year mark, if the investments have continued for that long, Kevin has $1,246,070.12 in his account, while I have $1,333,338.70 in mine, a difference of $87,268.58.

I would use lower returns (to better match what I think is reasonable to use in projections about the future) but by using higher returns it actually makes a stronger point (the compounding at 16% is extraordinary – I was actually surprised that at the 25 year mark that the results were the way they were). The lesson is powerful. Your personal finance situation is a factor of several things, but very close to the most important is just actually saving money, as the post illustrates.

Related: Trying to Keep up with the Jones – Earn more, spend more, want more – Living on Less – Saving for Retirement – How much have people saved?