NYC hotels at a price that’s right

Chelsea Lodge from $119, Pod Hotel from $89, Abingdon Guest House from $179.

New York City Hotels and Hostels – Curious Cat lodging connections – Curious Cat NYC photos

Carnival of Personal Finance #137 includes our post: Your Home as an Investment. Some great links in the carnival:

how much should you save for retirement? – “Assuming 8% growth annually, I’ll need to contribute about 20% of my current salary every year.” (a bit high I think…)

How to “only” yourself to death – “Some quick Excel work tells me that by cutting out and cutting back we dropped our ‘only-ies’ from $316 per month to $191 per month (and a lot of that is cell phone). That’s a 39% monthly savings or $1,500 a year back in our pocket.”

10 Tips for First time Apartment Renters – “you should be paying 1/3 of your gross income, so if you make $5,000 per month before taxes, your rent should not be more than $1,666”

Related: saving for retirement

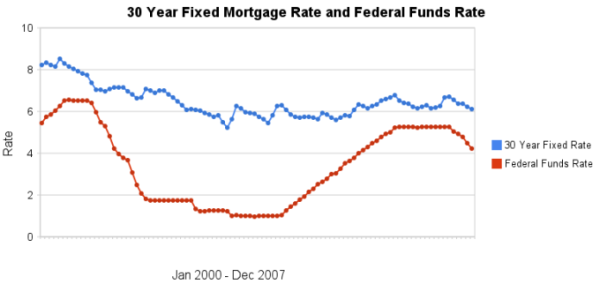

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Read more

In the USA Municipal bonds are issued by state and local governments and are exempt from federal tax. Therefor if you earn a 5% yield your after tax return is equal to that of a 7.5% yield if you are in the 33% federal tax bracket (7% * .67 = 5%). One way to invest in bonds is using a mutual fund (open or closed end funds). Right now the tax equivalent yields (compared to other bonds) of muni bonds are higher than normal.

Muni Bond Funds Offer High Yields, Tax Perks Dec, 2007:

…

With so many defaults going on in the mortgage arena, investors are worried that the insurers won’t be there to back up any munis that might get into trouble. A fair point, but the bond insurers are bolstering their own capital structures to deal with these concerns, and historically, as I said before, defaults in munis are few and far between.

Why are closed-end muni funds trading at a discount? Typical discounts today are about 10%, which is about as deep as such discounts have ever gotten on a historical basis. The typical discount is half that, or less. Closed-end muni funds sometimes even trade at a premium.

One explanation for the big discount might be the fact that many closed-end muni funds use leverage, in order to increase the tax-exempt returns they can offer investors. In the current credit crisis, leverage is seen as an inherently dangerous thing.

In general I find bonds to be a less desirable investment. Especially in the low yield environment recently (and really going back quite a few years). But for diversification some bonds can make sense for certain portfolios. Given the current tradeoffs (risk v. after tax yield) muni bonds certainly deserve consideration. I would shy away from long term bonds or funds (intermediate or short term) but of course every investor makes their own decisions.

Related: Roth IRA (another good tax smart investing tool) – what are bonds? – Alternative Minimum Tax

Shorting is selling first and buying later. The idea is to sell high and then buy low. It can be a bit risky. Since there is no cap on how high a stock can go you can loose more than you invest. Still, as part of a portfolio, using short positions can possibly be a useful strategy at times. You can use shorting to do things like hedge against existing gains (without selling those positions and incurring taxes).

Business Week had an article on Shorting for the 21st Century using inverse funds. These are mutual funds that are structured to behave as short positions – that is to go up if the target portfolio goes down in value. One advantage of using these funds (at this time they are all ETFs – exchange traded funds, I believe) is that you losses are limited to your investment. You do incur additional expenses charged by the fund however.

Experienced investors may find value in exploring the use of inverse funds. Some funds are engineered to move 1 for 1 with the market (that is the fund increases 1% for every 1% decline in the index) and some are engineered to move up 2% for every 1% decline – which also means they go down 2% for every 1% gain in the actual index. Index funds can also be used in retirement accounts (where shorting is not allowed).

Most investors need much more experience and to do a great deal of reading before they would be ready to try these funds. Since markets general go up over time and timing the market is extremely difficult it is unlikely novice investors will succeed in trying to guess right. The usefulness is mainly as a hedging strategy when the investors has determined the portfolio could benefit from a partial hedge.

Related: Risk and reward of exposure – investment speculation books – Ignorance of Many Mortgage Holders – The Greatest Wall Street Danger of All? You – How Not to Convert Equity

Here is updated data from the UN on manufacturing output by country. China continues to grow amazingly moving into second place for 2006. UN Data, in billions of current US dollars:

| Country | 1990 | 2000 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|

| USA | 1,040 | 1,543 | 1,545 | 1,629 | 1,725 | |

| China | 143 | 484 | 788 | 939 | 1096 | |

| Japan | 808 | 1,033 | 962 | 954 | 929 | |

| Germany | 437 | 392 | 559 | 584 | 620 | |

| Italy | 240 | 206 | 295 | 291 | 313 | |

| United Kingdom | 207 | 230 | 283 | 283 | 308 | |

| France | 223 | 190 | 256 | 253 | 275 | |

| Brazil | 117 | 120 | 130 | 172 | 231 | |

| Korea | 65 | 134 | 173 | 199 | 216 | |

| Canada | 92 | 129 | 165 | 188 | 213 | |

| Additional countries of interest – not the next largest | ||||||

| Mexico | 50 | 107 | 111 | 122 | 136 | |

| India | 50 | 67 | 100 | 118 | 130 | |

| Indonesia | 29 | 46 | 72 | 79 | 103 | |

| Turkey | 33 | 38 | 75 | 92 | 100 | |

So yet again everyone in Washington DC wants to raise taxes on your children and grandchildren to spend money today. We might be going into a recession because the bubble of financing real estate led to people spending money they couldn’t pay back. So now home construction is decreasing, banks are having trouble meeting within capitalization requirement without huge inflows of capital from abroad, excess housing supply…

The government has been spending huge amounts of money it doesn’t have for a long time. So what great ideas do our leaders have: put more burden on the children and grandchildren to pay for our spending today. What a sad state of affairs. And almost no-one seems to question this behavior.

Is the idea that we would go into a recession so remote these leaders never imagined it could happen? No, of course they new it would happen. So what should a country, company, individual do if they know they have some expected event in the future they might want to spend money on? This isn’t really tricky. I would guess many 8 years olds understand the concept. You put the money in the piggy bank for when you will want to spend it.

If you decide to spend not only all the money you have but borrow huge amounts that will tax your future earnings to pay back your current spending that is your choice (as long as you can find someone to lend you money). But as many parents have told their kids you have to live with the decisions you make. You don’t get to spend your money today. Spend tomorrows money today. Spend your kids money today. And then when, tomorrow comes, just spend all that money all over again. How can a country allow leaders to so transparently tax the future of the country?

It is a sad state of affairs. The country chooses not to sent aside funds for obvious future needs. Then instead of accepting the hole they have dug for themselves decides to tax their children even more to continue the spendthrift ways. I think we not only need to have politicians actually read the bills before they vote (they refuse to pass such a law) they need to read about the ant and the grasshopper.

I have no problem with the country choosing to set aside funds to use when they want to try and stave off a recessions (to pay for tax cuts or more spending). I do have a problem with: running enormous deficits every year, raising taxes on our children and grandchildren year after year, and then deciding to raise taxes even more on the future when the obvious happens and perfectly predictable desired expenditures present themselves. The get another credit card school of financial management (that everyone in Washington DC seems to practice) is not workable for a country over the long term. As anyone that has used that strategy personally will tell you – it works for awhile but eventually there are serious consequences.

Read more

A house is where you live–not an investment

Very good point – as long as you fall into that category of living there until you die. True for some people but far from all. Also, even for those people, it is not a complete view of the financial situation.

A reverse mortgage will allow you to sell the house and get paid for the rest of the time you live there. So you can build up equity over 20,30,40 years and then take a reverse mortgage and get payments every month (based on your investing in your house). Reverse mortgages, like many financial tools, can be applied poorly and is I would guess unethical behavior related to them is fairly high (so be very careful!). If you think of such an option you need to do your research and actually understand what you are doing – you can’t afford to be like the many ignorant mortgagors. The AARP offers information on Reverse Mortgages.

Additionally, you lock in a large part of your housing cost (you still have maintenance and taxes but you do not have every increasing rent. Now ever increasing rent is not a certainty but for many it is very likely rent will go up on average over the long term. Ownership of your home removes the risk of being priced out of the area you want to live by increasing rental prices over time. You also lose the potential of benefiting if rent prices fall over time, but I would say the more valuable of those options is avoiding the risk of rising rental prices.

Related: How Not to Convert Equity – Housing Inventory Glut – articles on home ownership and real estate

Warren Buffett and Bill Gates are two of the richest people on the planet (though many are gaining on them recently). Both have pledged to give away nearly all (over 99%) of the money they have earned to charity. Both have spoken out against the harm to children and society (and the capitalist system) when huge wealth is provided by lottery of birth to a few instead of provided to those who earn the money.

…

Melinda and Bill will very likely give away more than $100 billion in their lifetimes. Already the foundation has disbursed $14.4 billion – more than the Rockefeller Foundation has distributed since its creation in 1913 (even adjusted for inflation).

…

Bill, who is nine years older than Melinda, plans to spend more than 40 hours a week on philanthropy, leaving 15 or so for his duties as chairman of Microsoft.

…

Early on she and Bill agreed to focus on a few areas of giving, choosing where to place their money by asking two questions: Which problems affect the most people? And which have been neglected in the past? While many philanthropists take the same tack, the Gateses, who love puzzles, apply particular rigor. “We literally go down the chart of the greatest inequities and give where we can effect the greatest change,” Melinda says. So while they don’t give to the American Cancer Society, they have pumped billions into the world’s deadliest diseases – most importantly AIDS, malaria, and tuberculosis – and failing public high schools in the U.S.

Charity is important. As is understanding that capitalism is about people earning their wealth not getting it from Mom and Dad. Unfortunately many politicians don’t know what capitalism is and think that providing huge inheritances to some kids of rich people is capitalism. Providing resources to those that didn’t earn them is the opposite of capitalism. They need to learn. If they oppose capitalism and would rather assure the kids of the rich get huge inheritances that is fine, they just shouldn’t get away with claiming they support capitalism.

Related: Estate Tax Repeal (a very bad idea) – Helping Capitalism Make the World Better – charity links – Multi-millionaires giving to charity not creating later day idle nobility

Behind the Ever-Expanding American Dream House

Consider: Back in the 1950s and ’60s, people thought it was normal for a family to have one bathroom, or for two or three growing boys to share a bedroom. Well-off people summered in tiny beach cottages on Cape Cod or off the coast of California. Now, many of those cottages have been replaced with bigger houses. Six-room apartments in cities like New York or Chicago have been combined, because upper-middle-class people now think a six-room apartment is too small. Is it wealth? Is it greed? Or are there more subtle things going on?

This is extreme wealth. It is also part of the reason housing prices take an ever increasing multiple of median income. Basically people are buying two houses (not just one). Average square footage of single-family homes in the USA: 1950 – 983; 1970 – 1,500; 1990 – 2,080; 2004 – 2,349.

Related: mortgage terms defined – Trying to Keep up with the Jones – Too Much Stuff – Investing Search Engine