I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

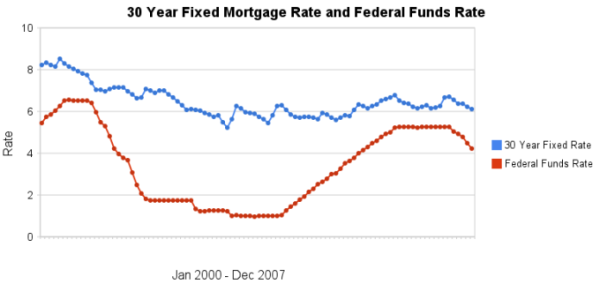

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

30 year rates are largely effected by supply and demand of funds available for long term loans and the anticipated inflation rate. Often the federal reserve lowers the fund rate when the economy is struggling which will also normally mean that the demand for long term loans is reduced – that is the primary reason for some correlation between the rates (not that a drop or increase in federal funds rate causes the 30 year rate to move but that the same economic factor – a slow economy, for example, that prompts the federal reserve to lower rates reduces the demand of long term borrowing which can lower the rate of 30 year mortgages).

For more see: 30 year fixed mortgage rates not affected much by federal funds rate changes.

Related: real estate articles – Fed Plans To Curb Mortgage Excesses – How Not to Convert Equity – mortgage terms – Mortgage Payments by Credit Score

Comments

5 Comments so far

“But now that person might have to pay a half percentage point more. With today’s rates, that translates into 6.75% for a 30-year fixed-rate mortgage instead of 6.25%…”

[…] going back at least 30 years, lowering of rates by the Fed does not co-relate with a decline in 30 year fixed mortgage […]

In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points…

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop)…

Is there any way the goverment could mandate or force the 30 year fixed mortgage rate to stay FIXED at a let’s say 5 to 5.5% giving people a fair amount of time to refinance inot long term rates?

Has the government ever done anything like that in the past.

Why is the 10 year bond been going up?

It seems to me that the bailout should be for fixed long term mortgage rate reductions not LIBOR. LIBOR effects corporations lending and Long term Mortgage rates effect individuals. If the long term mortgage rates were sub 5.5% it would ignite refinancing for individuals that QUALIFY(proof of income, assets, equity). Also, those middle class individuals who qualify to refinance their mortgages would begin SPENDING a portion of the their monthly mortgage savings on other items; therefore, helping reignite the economy.