More Insurers Raise Fees on Variable Annuities

As SmartMoney has reported, this is one way that annuities are failing to live up to their big promises. The guarantees attached to the products – minimum returns of 6% per year or better, market upside, no chance of loss and a lifetime income stream – were designed to attract people in retirement or close to it.

And it worked, attracting $650 billion in assets in the last five years. But the guarantees are only as good as the insurance company’s ability to hedge them, and even when the markets were rising, some insurance company executives admitted their strategies hadn’t been tested by real-life crisis conditions. Now some estimates suggest that hedging costs have doubled in the last year, and insurers are passing those costs along to their customers.

…

For example, an investor might purchase a $100,000 annuity that pays a guaranteed 6% annual return for 10 years, or market returns — whichever is better. The fees for a product like that might look something like this:

- 1.3% annually on the current balance to cover the underlying investment

- 1% annually on the current balance for the insurance wrapper (called the mortality and expense charge)

- 1% of the original purchase price to cover the guarantee

The fees now rising are all in that last category — charges that cover guarantees. At the Hartford, the fees of three different kinds of guarantees are rising, from the current charge of 0.35% to 0.75%.

In general I am not inclined to insurance investment products. They are frequently overloaded with fees. Annuities can provide some balance in retirement, so annuitizing a portion of assets at retirement may be reasonable. But I would not use insurance investment products for a significant portion of my retirement assets.

Related: Personal Finance: Long-term Care Insurance – Many Retirees Face Prospect of Outliving Savings – Investor Protection Needed – Retirement Tips from TIAA CREF

I have posted photos from the first day of my Utah trip: Antelope Island, Great Salt Lake and Salt Lake City.

Related: Medieval Peasants had More Vacation Time – Dream More, Work Less – Parfrey’s Glen, Wisconsin Photos

Here is an interesting article at Bloomberg looks at the Chicago school of economics: Friedman Would Be Roiled as Chicago Disciples Rue Repudiation by John Lippert

By the end of November, the government had committed $8.5 trillion, or more than half the value of everything produced in the country in 2007, to save the financial system.

…

Robert Lucas, a Chicago economist who won a Nobel in 1995 for a theory that argued against governments trying to fine-tune consumer demand, says deregulation may have gone too far. Depression-era laws that separated commercial and investment banks helped depositors decide if they wanted secure accounts or riskier investments. Today, without these distinctions, people can’t be sure if their investments, or those of their customers, are safe.

“I’m changing my views on bank regulation every week,” Lucas, 71, says. “It was an area I saw as under control. Now I don’t believe that.” Lucas says he voted for Obama, the only Democrat besides Bill Clinton he’d supported in 44 years. He concluded the candidate was comfortable talking with professional economists.

…

“The big event of the last 20 years is the success of free markets in India and China,” says McCloskey via telephone from South Africa, where she’s a visiting professor at the University of the Free State in Bloemfontein. “This is more important than any financial crisis and makes it really hard to argue for a return to central planning.”

I believe capitalism is the best system for economic development. Unfortunately, as I have written before, too many decision makers don’t have the slightest clue about economics. They accept simplistic views just like scientifically illiterate people accept simplistic claims that have no merit.

The basics are pretty easy. You want to use the market to guide the economy. You need to regulate in those areas the market alone is know to be weak (negative externalities – including pollution, risks to the public…) anti-market behavior (large players controlling markets for their own benefit, large players paying off politicians for benefits…) and systemic risks (“too big to fail“…). And practical consideration is more important that ideological purity.

One of the most important consistent failures is the continued favoring of large entities that pay politicians large amounts of money. The continued creation of huge organizations that are anti-competitive by their nature and create systemic economic risk have not economic justification. The role of the government should be to enforce competitive markets not allow huge competitors to buyout other huge competitors so that they can further distort the market.

Related: Ignorance of Capitalism – Misuse of Statistics, Mania in Financial Markets – Greenspan Says He Was Wrong On Regulation – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Treasury Now (1987) Favors Creation of Huge Banks

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

The economy (in the USA and worldwide) continues to struggle and the prospects for 2009 do not look good. My guess is that the economy in 2009 will be poor. If we are lucky, we will be improving in the fall of 2009, but that may not happen. But what does that mean for how to invest now?

I would guess that the stock market (in the USA) will be lower 12 months from now. But I am far from certain, of that guess. I have been buying some stocks over the last few months. I just increased my contributions to my 401(k) by about 50% (funded by a portion of my raise). I changed the distribution of my future contributions in my 401(k) (I left the existing investments as they were).

My contributions are now going to 100% stock investments (if I were close to retirement I would not do this). I had been investing 25% in real estate. I also moved into a bit more international stocks from just USA stocks. I would be perfectly fine continuing to the 25% in real estate, my reason for switching was more that I wanted to buy more stocks (not that I want to avoid the real estate). The real estate funds have declined less than 3% this year. I wouldn’t be surprised for it to fall more next year but my real reason for shifting contributions to stocks is I really like the long term prospects at the current level of the stock market (both globally and in the USA). The short term I am much less optimistic about – obviously.

I will also fully fund my Roth IRA for 2009, in January. I plan to buy a bit more Amazon (AMZN) and Templeton Emerging Market Fund (EMF). And will likely buy a bit of Danaher (DHR) or PetroChina (PTR) with the remaining cash.

Related: 401(k)s are a Great Way to Save for Retirement – Lazy Portfolio Results – Starting Retirement Account Allocations for Someone Under 40

Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use “high yield” bank savings account now, FDIC insured – John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

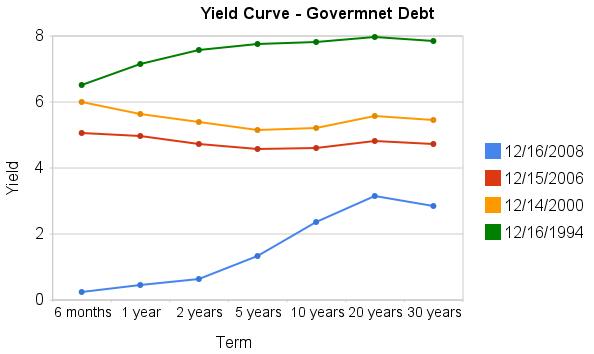

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

The Securities Investor Protection Corporation restores funds to investors with assets in the hands of bankrupt and otherwise financially troubled brokerage firms. The Securities Investor Protection Corporation was not chartered by Congress to combat fraud, but to return funds (with a $500,000 limit for securities and under that a $100,000 cap on cash) that you held in a covered account.

With the recent Madoff fraud case some may wonder about SIPC coverage. What SIPC would cover is cash fraudulently withdrawn from covered account (if I owned 100 shares of Google and they took my shares that is covered – as I understand it). What SIPC does not cover is investment losses. From my understanding Madoff funds suffered both these types of losses.

And I am not sure how the Ponzi scheme aspects would be seen. For example, I can’t imagine false claims from Mandoff about returns that never existed are covered. Therefore if you put in $100,000 10 years ago and were told it was now worth $400,000, I can’t image you would be covered for the $400,000 they told you it was worth – if that had just been a lie. And if your $100,000 from strictly a investing perspective (not counting money they fraudulently took to pay off other investors) was only worth $50,000 (it had actually lost value) then I think that would be the limit of your coverage. So if they had paid your $50,000 to someone else fraudulently you would be owed that. Figuring out what is covered seems like it could be very messy.

Read more

Fed Could Remake Credit Card Regulations

…

The proposal would also dictate how credit card companies should apply customers’ payments that exceed the minimum required each month. When different annual percentage rates apply to different balances on the same card, banks would be prohibited from applying the entire amount to the balance with the lowest rate. Many card issuers do that so that debts with the highest interest rates linger the longest, thereby costing the consumer more.

Industry officials have lobbied against the provisions, particularly the one restricting their ability to raise interest rates. They have warned that the changes would force them to withhold credit or raise interest rates because they won’t be able to manage their risk.

“If the industry cannot change the pricing for people whose credit deteriorates then they have to treat most credit-worthy customers the same as someone whose credit has deteriorated,” Yingling said. “What that means for most people is they’ll pay a higher interest rate.”

The government has been far to slow in prohibiting the abusive practices of credit card companies.

Related: How to Use Your Credit Card Responsibly – Avoid Getting Squeezed by Credit Card Companies – Legislation to Address the Worst Credit Card Fee Abuse – Maybe (Dec 2007) – Sneaky Credit Card Fees – Poor Customer Service: Discover Card

I don’t actually agree with the contention in this post, but the post is worth reading. I will admit I am more certain of I like the prospect of investing in certain stocks (Google, Toyota, Danaher, Petro China, Templeton Dragon Fund, Amazon [I don’t think Amazon looks as cheap as the others, so their is a bit more risk I think but I still like it]) for the next 5 years than I am in the overall market. But I am also happy to buy into the S&P 500 now in my 401(k).

Stocks Still Overpriced even after $6 Trillion in Market Cap gone from the Index

…

Even if we assumed a healthy economy, the price is no bargain. Throw in the fact that we are in recession and you can understand why the S & P 500 is still overvalued. We haven’t even come close to the historical P/E of 15.79 which includes good times as well.

Just to be clear current PE ratios have nothing to do with next year. It would be accurate to say someone making the argument that the S&P 500 is cheap now because of the current PE ratio, is leaving out an important factor which is what will earning be like next year. It does seem likely earnings will fall. But I also am not very concerned about earning next year, but rather earning over the long term. I see no reason to be fearful the long term earning potential of say Google is harmed today.

Related: S&P 500 Dividend Yield Tops Bond Yield for the First Time Since 1958 – 10 Stocks for 10 Years – Starting Retirement Account Allocations for Someone Under 40 – Books on Investing