The health care system in the USA is broken, as I have written about previously: USA Paying More for Health Care, International Health Care System Performance… One of the many problems created by the current system is ruined person finances for millions of people in the USA due to health care costs. The Rising Costs of Care And a Failing Economy Drive More Americans Into Medical Debt

…

Medical debt can quickly snowball. Consumers with unpaid bills can wind up in court defending themselves against lawsuits filed by doctors and hospitals, which typically charge the uninsured full price for care, without the hefty discounts negotiated by health plans. Debtors’ wages can be garnished, liens can be placed on their homes, and their future job and housing prospects torpedoed by bad credit ratings.

…

Unwilling to wait for federal action, a handful of states, most notably Massachusetts, have passed laws designed to expand health coverage or to protect medical debtors. An Illinois law passed last year caps rates that hospitals can charge the uninsured, while a New York statute bars foreclosures intended to pay off medical bills.

Purchasing health insurance against the risk of medical costs is critical to any financial plan. The concept (buying health insurance) is simple but securing that coverage is not as easy as knowing it is required for a sensible financial plan.

Related: Broken Health Care System: Self-Employed Insurance – Resources Focused on Improving the Health Care System – Excessive Health Care Costs

Consumer Credit Falls By Record Amount in November

This is good news. People need to stop spending money they don’t have. I understand perfectly well this means that spending will go down (which will likely lead to reduced economic output – though technically it doesn’t have to, a reduction in imported goods could more than offset the reduced spending and GDP would not decline). Living beyond your means is not a good thing. We should hope that consumer debt continues to decrease. If that means we have some suffering today to pay for living beyond our means for years the “fix” is not to continue to live beyond our means. The “fix” is to accept the consequences of past behavior and build a more sustainable economy now for the future.

Ideally this decrease can be someone gradual, abrupt changes in the economy often cause problems, but far too many economists and policy makers only care about today and the next 6 months. They have been living this way for decades. And it is not sustainable. Consumer debt levels in the USA are far too high. The UK has an even worse personal debt problem. They should come down. Reducing those levels is good for the individuals involved (they gain most of the benefit) and also for the health of the economy (though it does decrease the current economy a bit while making the foundation for future economy much stronger).

Read more

Madoff ‘victims’ do math, realize they profited

The issue came to the forefront this week as about 8,000 former Madoff clients began to receive letters inviting them to apply for up to $500,000 in aid from the Securities Investor Protection Corp. Lawyers for investors have been warning clients to do some tough math before they apply for any funds set aside for the victims, and figure out whether they were a winner or loser in the scheme.

Hundreds and maybe thousands of investors in Madoff’s funds have been withdrawing money from their accounts for many years. In many cases, those investors have withdrawn far more than their principal investment.

…

Jonathan Levitt, a New Jersey attorney who represents several former Madoff clients, said more than half of the victims who called his office looking for help have turned out to be people whose long-term profits exceeded their principal investment.

I discussed this aspect last month, the SPIC covers actual losses, not losses based upon false gains you didn’t have, I don’t think. So if you invested $100,000 and were told (falsely) it was worth $300,000 after years of gains you are not covered for $300,000. And I certainly hope the SPIC fund doesn’t payoff people who already had gains based on false accounting from Madoff.

This whole situation also points out the value of diversification. Diversification is important not just in asset classes (stocks, bonds, cash, real estate…) but in the accounts and companies with which you are dealing (I have always been a bit paranoid in this feeling, compared to others that think this level of diversification is not really needed but this is an example of the risks investments face that diversification can help manage). This is a very difficult situation for investors that had counted on assess they believed they had earned but in fact they had not.

Related: Bail us Out, say Madoff Victims – How to Protect Your Financial Health – Real Free Credit Report – identity theft links

According to the FDIC study of bank overdraft programs during 2007, 75% of banks automatically enrolled customers in automated overdraft programs (which charge high fees). By contrast, 95% of banks treated linked-account programs as opt-in programs, requiring that customers affirmatively request to have accounts link (which are normally do not charge customers high fees).

Fees assessed for linked-account and overdraft LOC programs were typically lower than for automated overdraft programs. Almost half of the banks with linked-account programs (48.9 percent) reported charging no explicit fees for the service. The most common fee associated with linked-account programs was a transfer fee; where charged, the median transfer fee was $5.

There really is no excuse (other than trying to gouge your “customers”) for these fee levels. Charging any money to just move money from a customers saving account to checking account is just making it obvious the bank doesn’t want to serve the bank wants to take money from you. The banks in the sample used by FDIC earned an estimated $1.97 billion in NSF-related fees in 2006, representing 74 percent of the $2.66 billion in service charges on deposit accounts reported by these banks.

A small fee when lending the customer money may be justified but the banks seem to just operate in order to have a big pool of people to catch them with big fees. The model seems to be if we get more “customers” we can catch more of them with one fee or another. It is not an honorable business model to try and catch your customers with huge fees for minor items.

Make sure you have a free linked-account overdraft protection that will tap your saving account if your checking account falls below 0. If they don’t have such a free program, choose a bank or credit union that does. Also an overdraft line of credit might be wise. If the fee is more than $10, go somewhere where they are not so greedy. You also will owe interest on your borrowings (probably a ludicrously high interest rate).

Related: Don’t Let the Credit Card Companies Play You for a Fool – 10 Things Your Bank Won’t Tell You – Hidden Credit Card Fees – FDIC Limit Raised to $250,000

$30.1 trillion in stock market valuation was wiped out last year – Journal of a Plague Year: Faith in Markets Cracks Under Losses:

…

Lehman Brothers Holdings Inc., with assets of $639 billion, filed the largest bankruptcy in U.S. history on Sept. 15. Its creditors may have lost as much $75 billion, the firm’s chief restructuring officer said.

Bear Stearns Cos. was taken over by JPMorgan Chase & Co. in March after a funding crisis triggered by losses from subprime- mortgage investments. Merrill Lynch & Co., facing a crisis of its own, sold itself to Charlotte, North Carolina-based Bank of America Corp. And the last two major investment banks, Goldman Sachs Group Inc. and Morgan Stanley, converted to bank holding companies and got capital injections from the U.S. government.

2008 was quite a memorable year in the markets. What the markets will do this year is hard to know. But the economy is likely to be very weak. Job losses will increase. If we are lucky the economy will be picking up by the end of the year. A huge problem is we have been living well beyond our means for decades. And now we are selling out even more of our children and grandchildren’s future to pay for the extravagance of those last few decades. How costly our credit-card-like financing of government bailouts is going to be is the most important issue I believe.

There is nothing wrong with spending money you saved for a raining day when that day comes. There is a big problem (for your future) taking our more credit cards to spend money you didn’t bother to save. You might have to do so, but the costs you are heaping on your future is very high (and for the economy overall many of those costs will be borne by children not yet born).

Related: The Economy is in Serious Trouble – Crisis May Push USA Federal Deficit to Above $1 Trillion for 2009 – What Should You Do With Your Government “Stimulus” Check? – Over 500,000 Jobs Disappeared in November

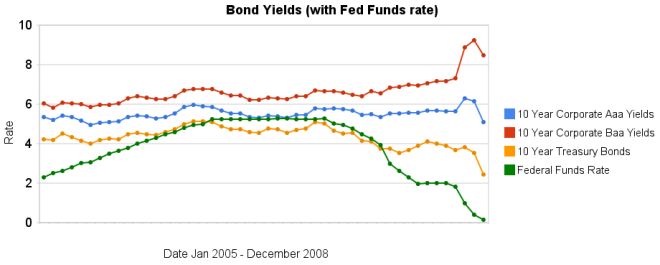

The recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In the last 3 months the yields on Baa corporate bonds have increased significantly while treasury bond yields have decreased significantly. Aaa bond yields have decreased but not dramatically (57 basis points), well at least not compared to the other swings.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 266 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 604 basis points, the spread was 280 basis point in January, and 362 basis points in September.

When looking for why mortgage rates have fallen so far recently look at the 10 year treasury bond rate (which has fallen 127 basis points in the last 3 months). The rate is far more closely correlated to mortgage rates than the federal funds rate is.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Corporate and Government Bond Rates Graph (Oct 2008) – Corporate and Government Bond Yields 2005-2008 (April 2008) – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – posts on interest rates – investing and economic charts

As I suspected those (who are not earning minimum wage you can be sure) that have lost money on the Madoff case would expect others to bail them out: well paid lawyers (I am sure) are making their case for just such a bailout of their wealthy clients.

…

The SIPC has little more than $1.6bn of funds and has promised $500,000 to each Madoff victim who had an account with his firm in the past 12 months.

The debate needs to be about what is the proper role for government. Not about this instance. What type of losses do we want secured? How large of payments do we want to insure? That amount has been $500,000 if we are changing the rules after the fact for a few is that really the best course of action)? How should these payments be funded? Do we really want to raise taxes on our grand children (many of which who will earn less than the equivalent of $50,000 today)? I don’t think so. This SIPC fund should be paid for by fees on investments just like the FDIC is paid for based on fees on covered deposits (as the SIPC is now – but no taxpayer funding should occur).

If we decide we want to pay back people several million each then the fees just need to be raised to fund such a system. Just as with the FDIC if we want the government to backstop the fund by guaranteeing they will loan the fund money if it runs short of cash is fine with me. Then the SIPC fund just pays back the taxpayers with interest.

Read more

Compounding is the Most Powerful Force in the Universe

A talking head with some valuable info. I remember my father (a statistics professor) getting me to understand this as a small child (about 6 years old). The concept of growth and mathematical compounding is an important idea to understand as you think and learn about the world. It also is helpful so you understand that statistics don’t lie but ignorant people can draw false conclusions from data.

It is unclear if Einstein really said this but he is often quoted as saying “compounding is the most powerful force in the universe.” Whether he did or not, understanding this simple concept is a critical component of numeracy (literacy with numbers). My guess is that people just find the concept of compounding amazing and then attribute quotes about it to Einstein.

I strongly encourage you to watch at least the first 2 segments (a total of 15 minutes). And then take some time and think about compounding in ways to help you internalize the concepts. You can also read his book: The Essential Exponential For the Future of Our Planet by Albert Bartlett.

Understanding the benefits of compound interest can help you become a much more successful investor. And understanding the principles of compounding can help you see the excess of bubbles cannot continue. You still have to overcome psychology that can be a powerful force leading you to believe never ending growth is possible. But at least you will have the mathematical understanding to help.

Related: Curious Cat Investing and Economics Search – Playing Dice and Children’s Numeracy – Saving for Retirement (compound interest) – Bigger Impact: 15 to 18 mpg or 50 to 100 mpg?

I don’t believe you should carry credit card debt at all. See my tips on using credit cards effectively. And you should have an emergency fund to pay at least 6 months of expenses to tap before using credit card debt. But if you do have debt and you are in such a bad personal financial situation where you will not be able to pay back what you have borrowed this might be useful information: Credit Card Companies Willing to Deal Over Debt

So lenders and their collectors are rushing to round up what money they can before things get worse, even if that means forgiving part of some borrowers’ debts. Increasingly, they are stretching out payments and accepting dimes, if not pennies, on the dollar as payment in full.

…

Lenders are not being charitable. They are simply trying to protect themselves. Banks and card companies are bracing for a wave of defaults on credit card debt in early 2009, and they are vying with each other to get paid first.

…

Card companies will offer loan modifications only to people who meet certain criteria. Most customers must be delinquent for 90 days or longer. Other considerations include the borrower’s income, existing bank relationships and a credit record that suggests missing a payment is an exception rather than the rule.

While a deal may help avoid credit card cancellation or bankruptcy, it will also lead to a sharp drop in the borrower’s credit score for as long as seven years, making it far more difficult and expensive to obtain new loans. The average consumer’s score will fall 70 to 130 points, on a scale where the strongest borrowers register 700 or more.

This is only an option to minimize a big mistake that results in you finding your self in a very bad situation. The credit card companies are not charities or known for giving away money. They are only going to do this when they figure they won’t get the full amount they are owed and figure getting some is the best they can hope for.

Related: Americans are Drowning in Debt – Families Shouldn’t Finance Everyday Purchases on Credit – Don’t Let the Credit Card Companies Play You for a Fool – Hidden Credit Card Fees

Retirement Myths and Realities provides some ideas from former Boeing President, Henry Hebeler:

…

My father used to tell me to save 10 percent of my wages all the time for retirement. And so I did. I never looked at any retirement plan; we didn’t have retirement planning tools in those days.

…

I think the number is closer to 15 (percent) to 20 percent — that’s from the time when you’re a relatively young person, say, 30 years old or something like that.

…

A retiree’s inflation rate is about 0.2 percent higher than the normal Consumer Price Index. When you retire, you have medical expenses that continually increase. You have more need for this service and the unit cost is increasing much faster than inflation.

…

Now, if you’re going to retire at 80 years old, you could actually have a bigger number than 4 percent. If you’re going to retire around 65 or so, 4 percent is not a bad number. Some people are now saying 3.5 percent instead of 4 percent. If you’re going to retire at 55, you’d better spend a lot less than 4 percent because you’ve got another 10 years of life that you’re going to have to support.

He makes some interesting points. I agree it is very important for people to become financially literate and take the time to understand their retirement plans. Just hoping it will work out or trusting that just doing what someone told you are very bad ideas. You need to educate yourself and learn about financing your retirement.

I am not really convinced by his idea that you need to start saving 15-20% for retirement at age 30. But that is a decision each person has to make for themselves. Of course there are many factors including how much risk you are willing to accept, when you plan on retiring, what standard of living you want in retirement…

Related: How Much Retirement Income? – posts on retirement – Saving for Retirement – Our Only Hope: Retiring Later