The Curious Cat Investing and Economics Carnival highlight recent interesting personal finance, investing and economics blog posts.

- The money made by Microsoft, Apple and Google, 1985 until today – “In terms of profit Apple was ahead of Microsoft in the 1980s, but was then passed and left behind. This chart actually reveals that Apple’s upswing the last few years is the first time the company’s profits have really taken off in a big way. Another interesting observation is how closely the profits of Apple and Google match, even though Apple’s revenues are significantly higher.”

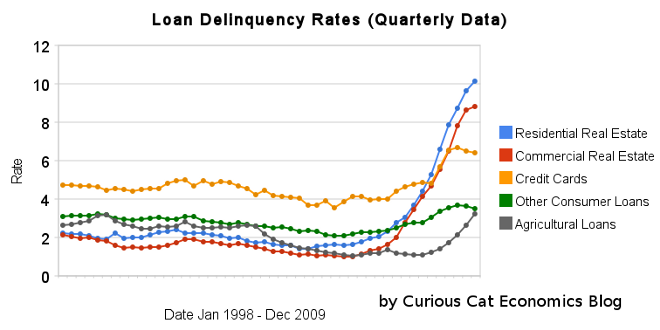

- Real Estate and Consumer Loan Delinquency Rates 1998-2009 by John Hunter – “That last half of 2009 saw residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies increase 98 basis points to 8.81%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.”

- The Principle That Can Make You Rich or Keep You Broke by David Weliver – “Unfortunately, inertia can also keep us at rest; the same principle that helps us achieve positive goals can make it increasingly difficult to escape bad habits.” (John: Very true, see my post on habits).

- Why do we work so much? – “The countries that consistently rank as having the world’s “happiest people” also tend to work fewer hours than people in the U.S… Most corporate ladders are designed to reward employees with money instead of time. Assuming we only want money to use as a tool for happiness, this makes no sense.”

- How Does Apple Become a $300 Billion Company? by Eric Bleeker – “The more Apple can look like the Microsoft of the mobile world, the more it will be worth. Commanding a market with even half the dominance Microsoft did with operating systems is a once-in-a-generation opportunity, but I’m not so sure the mobile world is built in a way that’ll allow that.”

- Top Fed Official Wants To Break Up Megabanks, Stop The Fed From Guaranteeing Wall Street’s Profits by Shahien Nasiripour – “I don’t think we have any business guaranteeing Wall Street spreads,” Hoenig said. “We need to recognize that and address it by removing these guaranteed extremely low rates. I think it’s extremely important that we do that, and not create the conditions for speculative activity and a new crisis down the road.”

- Evaluating Microfinance by Michael Frank – “I decided to use a variation on the “waiting list-control group” method regularly used in medical studies. My evaluation design requires a call for loan applicants in the most similar nearby community that does not have a similar microfinance program already present.”

Credit problems create a vicious cycle. Credit card interest rates are increased, fees are onerous and even applying for jobs is negatively affected (many employers look at credit reports as one factor in the hiring process), insurance companies look at them too and can offer higher rates. Employers and insurers have the belief that bad credit is an indication of other risks they don’t want to take on. Once into the cycle there are challenges to deal with. I must admit I think it is silly to look at credit for most jobs. But a significant number of organizations do so that is an issue someone that gets themselves in this trouble has to deal with.

I think the best way to deal with this problem is to build a virtuous cycle of savings instead. We tend to focus on how to cope with a bad situation instead of how to take sensible actions to avoid getting in the bad situation. In general we spend far too much money and take on too much debt – we live beyond our means and fail to save. Then we have a perfectly predictable temporary hit to our financial situation and a vicious cycle begins.

If we just acted more responsibly when times were good we would have plenty of room to absorb a temporary financial hit without the negative cycle starting. The time to best manage this cycle is before you find yourself in it. Avoiding it is far better than trying to get out of it.

Build up an emergency fund. Don’t borrow using credit cards – or any form of consumer debt (borrowing for education, a car or a house, I think, are ok). Save up your money until you can afford what you want to purchase. Don’t buy stuff just to buy stuff.

Re: The Vicious Circle of Poor Credit

Related: Real Free Credit Report – In the USA 43% Have Less Than $10,000 in Retirement Savings – Financial Planning Made Easy

Welcome to the False Recovery by Eric Janszen

Companies planning for sudden and relatively near-term growth should reshape their strategies to make the best of economic flatness.

He makes a decent point for companies, but the he flips back and forth between the need to save more (because we are buried in debt) and the need to spend more (because we need to grow the economy right now). And while I wouldn’t stake my life on it I wouldn’t be surprised that we have a strong economic rebound (it is also perfectly conceivable we have a next to no growth or even fall into a recession). But it seems to me the return to bubble thinking and spending beyond our means is making a strong comeback.

Another ok, point but we have hardly paying off anything of the previous living beyond our means. It would take decades at this rate.

So the problem is the saving are not actually resulting in increased ability to spend (first point above) – which is bad he says, because it means their won’t be more spending (because people won’t have the ability to spend). Then he says when banks lend the consumers money they will spend and the saving rate will go down (which is bad – though he doesn’t seem to really want more savings (because that means business won’t get increased sales).

The conventional wisdom likes to point out the long term problem of low savings rate but then quickly point out we need more spending or the economy will slow. Yes, when you have an economy that is living beyond its means if you want to address the long term consequences of that it means you have to live within your means. It isn’t tricky. We need to save more. If that means the economy is slower compared to when we lived beyond our means that is what it takes. The alternative is just to live beyond your means for longer and dig yourself deeper into debt.

Read more

The credit crisis has shown the lack of political (or regulatory) skill, ethics and character that the USA has now. The solutions are not simple. Some are obvious, like limiting leverage, not providing huge favors to those that pay politicians huge amounts of cash… While Canadian banking regulators actually did their jobs well it is hard to believe most any American regulators will do well given the last 20 years of failures. Raghuram Rajan provides some interesting thoughts on potential improvement in: Making Debt Holders into Watchdogs

Some banks – such as Citibank, Lehman Brothers, and Royal Bank of Scotland – loaded up on both risks, holding enormous quantities of mortgage-backed securities on the asset side and paying for them with short maturity debt on the liability side. Why did they do it? The simple answer: It was very profitable, provided the tail events did not materialize. Think of insurers that write a lot of earthquake policies (another tail risk). If you didn’t know they were writing earthquake insurance and not setting aside reserves, you would think they were enormously profitable until there’s a quake. For banks, there was always the threat of a day of reckoning when liquidity dried up and defaults skyrocketed. But they set aside few reserves against that happening.

…

Particularly worrisome, as my colleague Douglas Diamond and I have argued, is that once banks are leveraged enough that they will be severely distressed if economywide liquidity dries up, they double down on risky bets.

…

Here’s the drill: To make it harder for tail-risk-taking banks to grow, all banks should be required to issue a minimum level of debt (say, 10% of assets) that is automatically impaired – either converted to equity or written down – if the bank suffers sufficient losses. This will quickly change debt holders’ views on risky expansion. Moreover, no financial institution should be allowed to hold this debt.

Related: Why Congress Won’t Investigate Wall Street – Scientists Say Biotechnology Seed Companies Prevent Research – Drug Prices in the USA

Apartment Rents Rise as Sector Stabilizes

…

enters are also staying put longer: the average renter now stays for 19 months, up from an average of 14 months, said Mr. Friedman, and despite low mortgage rates and greater home affordability, fewer renters are leaving to buy homes. “This is the first time in many, many years that it feels like even people who could afford to buy are making the investment decision not to,” Mr. Friedman said.

…

Portland, Ore., posted the largest rent decline, at 0.7%, followed by Las Vegas, San Diego, and Southern California’s Inland Empire. Those three markets have all seen an uptick in home-buying activity, particularly among the low end from first-time buyers and investors.

Colorado Springs had the largest rent increases, 2.5%, followed by Washington DC, 2% and San Antonio 1.5%. There is a very nice new online tool, Padmapper, for renters or landlords. It is a mashup on Google Maps of rental listings by location from Craigslist and other sources. Very good search options. Easy to use. Find more real estate links on the Curious Cat Cool Connections Directory.

Related: It’s Now a Renter’s Market (April 2009) – Housing Rents Falling in the USA (February 2009) – Apartment-vacancy Rate is 7.8%, a 23-year High

The chart shows the total percent of delinquent loans by commercial banks in the USA.

That last half of 2009 saw real estate delinquencies continue to increase. Residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies in 98 basis points to 8.81%. Agricultural loan delinquencies also increased (112 basis points) though to just 3.24%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.

Related: Loan Delinquency Rates Increased Dramatically in the 2nd Quarter – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… – posts with charts showing economic data

Read more

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7%, based on U.S. Bureau of Labor Statistics surveys. Hiring for the census added 48,000 jobs in March, a large temporary increase, but less than expected amount, for the month. The change in total nonfarm payroll employment for January was revised from -26,000 to +14,000, and the change for February was revised from -36,000 to -14,000 together this results in an addition of 90,000 jobs.

The 162,000 added jobs is the largest increase since March of 2007. It is a good start but the economy will have to continue to increase the number of job added each month to reduce unemployment. Population growth requires an addition of approximately 125,000 jobs a month. The current labor pool has been temporarily reduced by those who have dropped out of the labor market. As jobs return they will come back into the market.

The economy has lost 8.2 million jobs since the recession started in December 2007. Now that was the bubble induced peak still, by the time the economy adds 8 million jobs many more jobs will be needed (since 125,000 additional jobs are needed each month). Still if we added 200,000 a month it would take 40 months to get back to the previous peak total. And by that time the economy would have accumulated another 9 million jobs needed (it would be about Dec 2013 = 6 * 12 months *125,000/month). While the bubble induced peak may well be a unrealistic target, the job market needs to add over 200,000 jobs a month to regain ground lost over the last several years.

In March, the number of unemployed persons was little changed at 15.0 million, and the unemployment rate remained at 9.7%. The number of long-term unemployed (those jobless for 27 weeks and over) increased by 414,000 over the month to 6.5 million. In March, 44.1% of unemployed persons were jobless for 27 weeks or more. Both are all time highs.

The civilian labor force participation rate (64.9%) and the employment-population ratio (58.6%) continued to edge up in March. The average length of unemployment rose to 31 weeks – the highest average ever (since 1948).

Related: USA Unemployment Rate Remains at 9.7% – 663,000 Jobs Lost in March, 2009 in the USA – Another 450,000 Jobs Lost in June, 2009 – Manufacturing Employment Data – 1979 to 2007

Read more

3. The payment ploy: A dealer might say, “We can get you into this car for only $389 a month.” Probably true, but how? In some cases, the dealer may have factored in a large down payment or stretched the term of the loan to 60 or 72 months. Focus on the price of the car rather than the monthly payment. Never answer the question, “How much can you pay each month?” Stick to saying, “I can afford to pay X dollars for the car.”

Some good advice. I bought my last car at CarMax which gave a good price and none of these tricks (I didn’t have a trade in – I donated it) and I paid cash. They offered a great deal on a Toyota Rav4 when I was looking. I believe, those that are interested in getting the very best deal and are skilled and able to defend themselves from the dealer can do better than CarMax. But I would bet most people would be much better off using CarMax.

Related: Manufacturing Cars in the USA – Avoiding Phone Fees – Actually Free Credit Report – How to Use Your Credit Card Properly