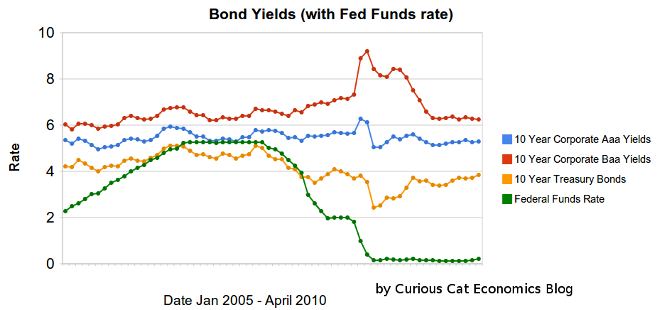

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 6 months. 10 year Aaa corporate bonds yields have increase 10 basis points to 5.29%. 10 year Baa yields have decreased 7 basis points to 6.25%. 10 year USA treasury bonds have increased 45 basis points (largely the effective of money scared into the safety of US treasuries leaving as the credit crisis eased. The federal funds rate remains under .25%.

The United States economy appears to be gaining strength and if job growth can continue the Fed will likely reduce the amount giveaways to the banks by increasing the fed funds rate (though when this will happen is still very hard to judge). The Fed will also likely sell mortgages back to the market which will increase long term rates. The Fed will likely start by changing the wording that the economic conditions “are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” When this language changes rates may well go up 25 to 50 basis points quickly.

Related: Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percentage of GDP 1990-2008 in OECD: USA, Japan, Germany…

Bogle on Bankers, Buffett, Obama; an interview of John Bogle, from February 2010.

But what made the decade quite so bad is that we then had a major recession or light depression at the end of 2008 to 2009 which is still with us. That coming with the market so highly valued meant that earnings growth was much less than what we might have expected. So looking out from here, I think we can look for better earnings growth. And dividend yields are back in decent territory but not great. We started this decade with a 1% dividend yield, and that’s an important part of investment returns, and now the dividend yield is around 2.25%, so a higher dividend yield contributing to future growth. So I think it’s highly likely that stocks will outpace bonds in the decade that just began.

…

Are we on the right path now? Has America learned its lesson?

Bogle: No. Unequivocally not. The long overdue reforms being discussed in Washington do not go nearly far enough, in my opinion. We need protection for consumers. Canada has a financial structure similar to ours except it has a consumer-protection board, which would prevent banks from giving people mortgages if they have no ability to pay them back. To get that done has been very difficult. Also, Senators (John) McCain and (Maria) Cantwell have proposed a return of the Glass-Steagall Act, and that’s gotten nowhere but it is long overdue. We should have banks behave as banks and not as investment banks or hedge-fund managers.

…

But let’s suppose the stock market creates a 10% return. And the value of the stock market today is around $13 trillion so 10% is $1.3 trillion. By my numbers, Wall Street and the mutual fund industry take $600 billion a year out of that return. That’s half of the return. So the only way investors are going to get their fair share of the $1.3 trillion is to reduce the costs and get the casinos out.

As usually John Bogle provides excellent analysis and vision.

Related: Bogle on the Retirement Crisis – Is Trying to Beat the Market Foolish? – Lazy Portfolios Seven-year Winning Streak – Sneaky Fees

The stock market showed again yesterday how non-efficient it can be at times. Several stocks fell to pennies a share for awhile before returning to tens of a dollars a share. While the markets continue to react violently, the economy appears to be gaining more strength.

Nonfarm payroll employment rose by 290,000 in April, the unemployment rate increase to 9.9%, and the labor force increased sharply, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in manufacturing, professional and business services, health care, and leisure and hospitality. Federal government employment also rose, reflecting continued hiring of temporary workers for Census 2010. Since December, nonfarm payroll employment has expanded by 573,000, with 483,000 jobs added in the private sector. The vast majority of job growth occurred during the last 2 months.

Household Survey Data

In April, the number of unemployed persons was 15.3 million, and the unemployment rate edged up to 9.9%. The rate had been 9.7% for the first 3 months of this year.

The number of long-term unemployed (those jobless for 27 weeks and over) continued to trend up over the month, reaching 6.7 million. In April, 45.9% of unemployed persons had been jobless for 27 weeks or more.

In April, the civilian labor force participation rate increased by 0.3 percentage point to 65.2 percent, as the size of the labor force rose by 805,000. Since December, the participation rate has increased by 0.6 percentage point. The employment-population ratio rose to 58.8 percent over the month and has increased by 0.6 percentage point since December.

Manufacturing added 44,000 jobs in April. Since December, factory employment has risen by 101,000. Over the month, gains occurred in several durable goods industries, including fabricated metals (9,000) and machinery (7,000). Employment also grew in nondurable goods manufacturing (14,000).

Related: USA Added 162,000 Jobs in March – Unemployment Rate Reached 10.2% (Oct 2009) – USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983 (March 2009) – Over 500,000 Jobs Disappeared in November, 2008

Read more

As I have said before, Elizabeth Warren is one of the people I find most informative on the economy we have created. This lecture (from January 31, 2008) is very interesting: The Coming Collapse of the Middle Class: higher risks, lower rewards and a shrinking safety net. It is important for us to realize that the decisions we make have consequences. If we allow corruption to grow and grow in the USA we will suffer more and more. If we continue to elect people that give away society wealth to those the pay them to the detriment of society (investment banks, drug companies, “intellectual property” lawyers, retail banks, farmers, trial lawyers, hedge fund managers, trust fund babies, physicians…) that naturally means their is less wealth for the rest of society.

Interesting data. Looking at standard family (Mom, Dad and 2 kids from 1970 to 2005), in inflation adjusted dollars: earnings increased a great deal (due to women working much more) but disposable income decreased. This is because basic expenses increased: health care, housing, transportation… (and this is with assuming employer provided health care – which has really been decreasing in likelihood over time). Those families are also more deeply in debt and reliant on 2 incomes. And if either income producer losses their jobs the economics of the family fail. Which means the family is much more at risk.

It really is great that lectures like this are available to us now.

Related: Elizabeth Warren Webcast On Failure to Fix the System – In the USA 43% Have Less Than $10,000 in Retirement Savings – Failure to Regulate Financial Markets Leads to Predictable Consequences – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren