I believe it is wise from an environmental and economic viewpoint to invest in renewable energy projects. I believe the costs of fossil fuel based energy will continue to increase. Renewable energy is continuing to improve and when considering the negative externalities caused by oil, gas and coal and the continuing improvement in wind, solar and geothermal generation investment in renewable energy are going to payoff well for countries.

| Top countries for installed renewable energy capacity | ||

|---|---|---|

| Rank | Country | Capacity (GigaWatts) |

| 1 | China | 103.4 |

| 2 | USA | 58.0 |

| 3 | Germany | 48.9 |

| 4 | Spain | 27.8 |

| 5 | Japan | 26.0 |

| 6 | India | 18.7 |

| 7 | Italy | 16.7 |

| 8 | Brazil | 13.8 |

| 9 | France | 9.6 |

The largest increases in renewable energy capacity by country from 2005 to 2010 are: China (up 106%), South Korea (up 88%), Turkey (up 85%), Germany (up 67%), Italy and Japan (up 45%). All the data is from the Pew Clean Engery Program report: Who’s Winning the Clean Energy Race? (pdf).

…

India is poised to take a leadership role in the solar sector, with a target of deploying 20 GW by 2020. In 2010, the country set about getting its National Solar Mission in place by permitting 0.5 GW worth of large solar thermal capacity and a modest 150 MW worth of photovoltaic (PV) solar.

My guess is that the stimulus packages in several countries contributed greatly to the increases (notably Germany and Italy targeted green investments – as did China to some extent, in Wind Energy). Spain took a hit as debt levels caused the government to cut spending. I would imagine this is likely to happen in Italy (and was expected to happen in Germany – the extent of decreases is less certain after the earthquake in Japan).

Related: Chart of oil consumption by country from 1990-2009 – Wind Power Capacity Up 170% Worldwide from 2005-2009 – Japan to Add Personal Solar Subsidies (2008) – Chart of Top Nuclear Power Generating Countries from 1985 to 2009 – Wind Power has the Potential to Produce 20% of Electricity Supply by 2030

Earning more is an important and simple idea that is ignored far to often. Simple, doesn’t mean, easy, just easy to understand. This is something people should definitely consider in their personal financial planning.

There is a important caveat to remember, people earning a lot of money often have large financial problems and go bankrupt. Earning more if you borrow more than you earn and rely on ever increasing earnings can make you even more venerable than those earning less. A significant factor is how likely you are to replace your current earning if you need to find a new job.

There is also another concern to watch for – don’t become a slave to your desire to earn more. The reason to earn more is to improve your life long situation. If you sacrifice what you enjoy too much it becomes a bad trade off. Short term sacrifices may well be wise. But many people find themselves in decades long sacrifices to try and get ahead. This isn’t a good plan.

Making money online can be enjoyable and rewarding. However, it isn’t easy. I am putting more effort into this area and will be doing a great deal more in the next year. We will see how successful I am.

Related: Earn more money. It matters more than everything else combined. – 10 Jobs That Provide a Great Return on Investment – Earn More Money to buy luxuries (don’t go into debt) – High Expectations

Read more

This is another article supporting my belief that long term bonds are not investments I want to take on now. The risks of inflation and low yields seem like a very bad combination.

Buffett Says Avoid Long-Term Bonds Tied to Eroding Dollar, quoting Warren Buffett:

…

“I would much rather own businesses,” he said. “It’s very easy to take away the value of fixed-dollar investments.”

By “take away” he mean the government can undertake policies to “inflate” their way out of a budget mess. By undertaking policies that create inflation (drastically increasing the money supply, borrowing huge amounts of money, running huge trade deficits…) the country can devalue the currency, the US dollar in this case, and thus reduce the effective cost of the payments they have to make on long term bonds (because they pay back the loans with devalued, inflated, dollars). I believe he is right and long term USD bonds are a very risky (inflation risk) investing option today. Of course I have felt the same way for the last 5 years. I own very little in the way of bonds – I do own a bit of TIPS (Treasury Inflation-Protected Securities), in my 401(k) – but stopped allocating money to that class in the last year.

Related: Bill Gross Warns Bond Investors (March 2010) – Bond Yields Stay Very Low, Treasury Yields Drop Even More – Who Will Buy All the USA’s Debt?

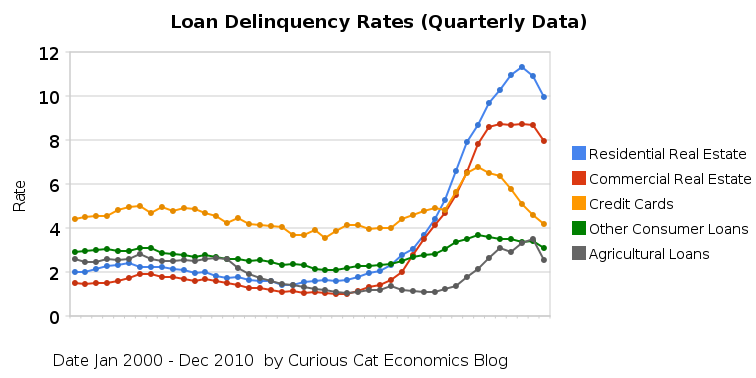

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The second half of 2010 saw real estate, agricultural, credit card and other loan delinquencies decrease. The rates are still quite high but at least are moving in the right direction. Residential real estate delinquencies decreased 138 basis points in the second half of 2010, to 9.94%, which brought them to just below the rate at the end of 2009. In the second half of 2010, commercial real estate delinquencies decreased 77 basis points to 7.97% (which was also exactly 77 basis points less than at the end of 2009. Agricultural loan delinquencies decreased 76 basis points, to 2.55% (down 53 basis points from the end of 2009). Consumer loan delinquencies decreased, with credit card delinquencies down 90 basis points to 4.17% and other consumer loan delinquencies down 27 basis points to 3.1%. The credit card delinquency rate decreased a very impressive 219 basis points in 210.

Related: Real Estate and Consumer Loan Delinquency Rates 2000 through June 2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – posts with charts showing economic data

Read more

For 2010 and 2011, the most that an individual can contribute to a traditional IRA or Roth IRA generally is the smaller of: $5,000 ($6,000 if the individual is age 50 or older), or the individual’s taxable compensation for the year. You have until your taxes are due (April 15th, 2011) to add to your IRA for 2010.

This is the most that can be contributed regardless of whether the contributions are to one or more traditional or Roth IRAs or whether all or part of the contributions are nondeductible. However, other factors may limit or eliminate the ability to contribute to an IRA as follows:

- An individual who is age 70½ or older cannot make regular contributions to a traditional IRA (just to make things complicated you can add to a Roth IRA) for the year.

Contributions to a Roth IRA are limited based on income. The limits are based on modified adjusted gross income (which is before deductions are taken). The Roth IRA earnings limits for 2010 are:

- Single filers: Up to $105,000; from $105,000 – $120,000 (a partial contribution is allowed)

- Joint filers: Up to $167,000; from $167,000 – $177,000 (a partial contribution)

For 2011 the earning limits increase to

- Single filers: Up to $105,000; from $107,000 – $122,000 (a partial contribution is allowed)

- Joint filers: Up to $167,000; from $169,000 – $179,000 (a partial contribution)

More details from the IRS website and earning limits details.

The income limits do not cap what you can add using a 401(k). So if you were planning on adding to a Roth IRA but cannot due to the income limits you may want to look into increasing your 401(k) contributions.

Related: Add to Your Roth IRA – Add to Your 401(k) and IRA – 401(k)s are a Great Way to Save for Retirement

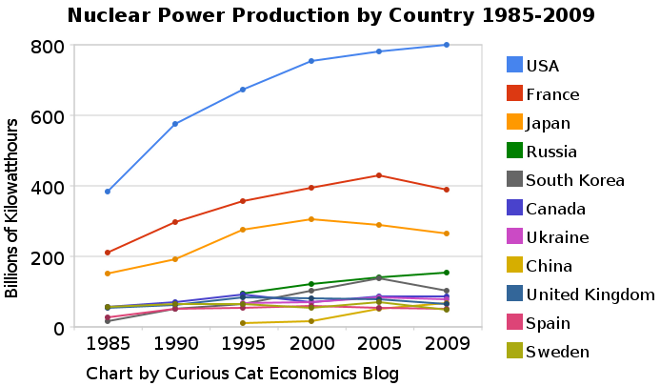

The chart shows the leading nuclear power producing countries from 1985-2009. The chart created by Curious Cat Investing and Economics Blog may be used with attribution. Data from US Department of Energy.

The chart shows the leading nuclear power producing countries from 1985-2009. The chart created by Curious Cat Investing and Economics Blog may be used with attribution. Data from US Department of Energy.___________________

Nuclear power provided 14% of the world’s electricity in 2009. Wind power capacity increased 170% Worldwide from 2005-2009, to a total of 2% of electricity used (38,025 Megawatts of capacity). The USA produced nearly twice as much electricity using nuclear power than any other country, which surprised me.

Another view of data on nuclear power shows which of the leading nuclear producing countries have the largest percentages of their electrical generating capacity provided by nuclear power plants (as of 2009). France has 75% of all electricity generated from nuclear power. Ukraine had the second largest percentage at 49%, then Sweden at 37% and South Korea at 35%. Japan is at 28% compared to 20% for the USA (I am surprised these are so close _ would have thought France and Japan would be much closer). Russia is at 18% and China was at just 2%. As of January 2011, 29 countries worldwide are operating 442 nuclear reactors for electricity generation and 65 new nuclear plants are under construction in 15 countries. Source, Nuclear Energy Institute.

From 1985 to 2009, USA production increased 108%, France 84% and Japan up 77%. South Korea is up 550% (from a very low starting point). Globally nuclear power production increased 80% from 1985 to 2009. From 2000-2009 production increased 5% in the USA and decreased by 1% in France and 13% in Japan. China was up 318% (from a very low level) from 2000-2009 (they did not have nuclear power capacity prior to 1995.

The global capacity of nuclear power was scheduled to increase more rapidly in the future before the earthquake in Japan and the crisis at the Kashiwazaki-Kariwa Nuclear Power Plant. China was going to add a great deal of capacity and is likely to over the next few years (nuclear power plants take many year to bring online so those coming online in the next few years have already had hundreds of millions invested in building them). Several European countries have already announced temporary closing of some plants (especially some plants nearing the end of their originally scheduled lives – which those countries had been in the process of extending).

As a comparison global oil production increased by 10.5% from 1999-2009, while nuclear global production increased by 5% from 2000-2009. From 1999-2009 USA oil production decreased 7%. Russia increased production 62% in the decade, moving it into first place ahead of Saudi Arabia that increased production 10%.

Related: Oil Production by Country 1999-2009 – Oil Consumption by Country 1990-2009 – Japan to Add Personal Solar Subsidies – Solar Thermal in Desert, to Beat Coal by 2020

Bill Gates is really doing some great stuff the last few years. He takes a look at the enormous problem with state government’s failure do deal with the very long term health care failure in the USA (this has been going on for the last few decades) and the financial games them play. His Twitter quote is: Enron would blush at the financial untruth State governments engage in.

I have written about these problems before, including in: USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations. One small (compared to the problem for the whole country) He notes is that California has a $62.5 billion health care liability and $3 billion set aside for it.

We have been doing a very bad job of electing people to honest manage budgets. We, or our children and grandchildren are going to pay for those failures. The longer we fail to elect people that will deal with the real decisions that need to be made for government spending and taxing the greater those bills for our mistakes will be.

Related: Are Municipal Bonds Safe? – USA Heath Care System Needs Reform – USA Spends Record $2.5 Trillion, $8,086 per person 17.6% of GDP on Health Care in 2009 – The USA Pays Double for Worse Health Results – The Long-Term USA Federal Budget Outlook

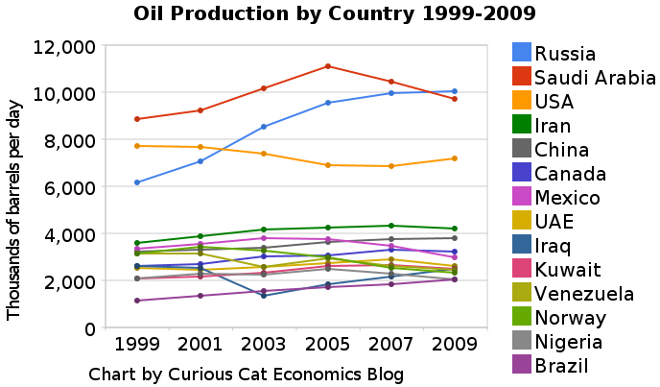

The chart shows the oil production over the last decade by the top oil producing countries. Production totals include crude oil, shale oil, oil sands and NGLs (the liquid content of natural gas where this is recovered separately). Excludes liquid fuels from other sources such as biomass and coal derivatives.

The chart shows the leading oil producing countries from 1999-2009. The chart created by Curious Cat Investing and Economics Blog may be used with attribution.

The chart shows the leading oil producing countries from 1999-2009. The chart created by Curious Cat Investing and Economics Blog may be used with attribution.___________________

The chart show 3 clear leaders in production Russia, Saudi Arabia and the USA (with the USA firmly in 3rd place). Those 3 were responsible for approximately a third of the total oil production in 2009. Russia greatly increased production. During the last decade world production increased from 72 million barrels a day to 80 million barrels a day. Russia accounted for 51% of the increase, close to 4 million barrels a day.

The next 11 countries are pretty closely grouped, with slightly increasing production over the period as a group. Brazil, the last country with over 2 million barrels of production a day in 2009, has the largest percentage increase in the period, producing 79% more in 2009 than they did in 1999. Russia increase production 62% over the period. The other countries ranged from a 23% increase (Canada) to a 25% decrease (Norway). The USA increased production 7% and China increased production 18%. World production increased 11%.

Last year I posted a chart showing oil consumption by the top oil consuming countries over the last 2 decades; showing all countries using over 2 million barrels of oil a day. The USA consumed 18.7 million barrels a day in 2009. Only China was also over 5 million barrels, using 8.2 million in 2009. Japan was next at 4.4 million.

Read more

Nonfarm payroll employment increased by 192,000 in February, and the unemployment rate decreased to 8.9%, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in manufacturing, construction, professional and business services, health care and transportation. Revisions also added 58,000 jobs added in the previous two months. The change in total nonfarm payroll employment for December was revised from +121,000 to +152,000, and the change for January was revised from +36,000 to +63,000.

The job gains are good news, but job growth has to sustain gains over 175,000 a month for at least 6 months (and gains over 250,000 would be much better) to begin to make a serious dent in the millions of jobs lost in the recession (weather likely restrained January job growth that showed up in the February figures if you take the average for the 2 months you get a gain of 127,500 jobs a month). Since a recent low in February 2010, total payroll employment has grown by 1.3 million, or an average of 106,000 per month. Approximately 125,000 jobs have to be added just to keep up with growth in the population. Until we are consistently adding 230,000+ jobs a months the employment picture is not improving strongly enough given the large number of recent job losses. Adding over 150,000 jobs a month is good, but more is needed to provide jobs for the large number of unemployed.

The number of long-term unemployed (those jobless for 27 weeks or more) was 6.0 million and accounted for 43.9% of the unemployed. Decreasing the number of long term unemployed is a key measure, as significant gains are made it is a sign pointing to better economic conditions.

Manufacturing employment rose by 33,000 in February. Almost all of the gain occurred in durable goods industries, including machinery (+9,000) and fabricated metal products (+7,000). Manufacturing has added 195,000 jobs since its most recent trough in December 2009; durable goods manufacturing added 233,000 jobs during this period.

Construction employment grew by 33,000 in February, following a decline of 22,000 in January that may have reflected severe winter weather. Within construction, specialty trade contractors accounted for the bulk of the February job gain (+28,000).

Related: USA Economy Adds 151,000 Jobs in October 2010, and Revisions Add 110,000 More – USA Unemployment Rate Remains at 9.7% (Feb 2010) – USA Unemployment Rate Rises to 8.1% (Feb 2009), Highest Level Since 1983

Read more

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- The Myth of Japan’s ‘Lost Decades’ by Eamonn Fingleton – “Japan’s surplus is up more than five-fold since 1990. And, yes, far from falling against the dollar, the Japanese yen has actually boasted the strongest rise of any major currency in the last two decades. How can such facts be reconciled with the ‘two lost decades’ story? I don’t think they can.”

- Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation by John Hunter – “It is not less risky to have your entire retirement in treasury bills than to have a portfolio of stocks, bonds, international stocks, treasury bills, REITs… This is because their are not just risk of an investment declining in value. There are inflation risks, taxation risks…” (including structural imbalances introduced by the Feb depressing short term yields to provide billions to large banks from the pockets of savers).

- Cheating Investors As Official Government Policy by Daniel R. Amerman – “When you put your savings into a money market fund, and the policy of the US government is to force interest rates to unnaturally low levels – you are being cheated out of the yield you should be receiving. When you buy a corporate bond or corporate bond fund – you are being cheated by overt government market interventions that have the explicitly stated purpose of lowering corporate borrowing costs.”

- Force Yourself to Save by – “Save 50% of any bonus or raise… Theoretically you could save 100% of your raise and maintain the same lifestyle, but that’s no fun. What’s the point of a raise if it doesn’t include a new PS3?” (I have long favored putting a portion of each raise toward a saving plan – John)

- Who holds the most U.S. Treasuries in the world? (Hint: It’s not China.) by James Jubak – “For a while China was the biggest holder of U.S. government debt. But now with $896 billion China has slipped to No. 2. As of last week, the leader of the pack is—the envelope, please–the New York Fed, which holds the Federal Reserve’s Treasury bills, notes, bonds, and TIPs. (TIPS are Treasury Inflation Protected Securities.) As of last week the Fed’s System Open Market Account held $1,108 billion in U.S. government debt. “

- 15 Things You Need to Do, Before Reading Another Financial Blog – “Set up a system to monitor your next goal – Now that you have a goal, set up a system to monitor your progress. I have Mint email monthly progress reports on my financial goals. Another way is track your goal is by doing a monthly review.”

- How Much House Can You Afford? by Ryan Guina – “if your mortgage payment is expected to jump $500 a month, set that money aside for a few months as part of your normal budgeting. Do this for other spending categories that may increase, such as utilities, home owner’s insurance, taxes, etc.”

- MERS: Stop Foreclosing in Our Name by Barry Ritholtz – “Allow me to spell this out for you more specifically: MERS is an abomination, a legal blasphemy that should be destroyed before it unleashes the four horsemen of the apocalypse.”

Related: investing books – articles on investing – Curious Cat Investing and Economics Search