My preference is for a lower use of bonds than the normal portfolio balancing strategies use. I just find the risks greater than the benefits. This preference increases as yields decline. Given the historically low interest rates we have been experiencing the last few years (and low yields even for close to a decade) I really believe bonds are not a good investment. Now for someone approaching or in retirement I do think some bonds are probably wise to balance the portfolio (or CDs). But I would limit maturities/duration to 2 or 3 years. And really I would pursue high yielding stocks much more than normal.

In general I like high yielding stocks for retirement portfolios. Many are very good long term investments overall and I prefer to put a portion of the portfolio others would place in bonds in high yielding stocks. Unfortunately 401(k) [and 403(b)] retirement accounts often don’t offer an option to do this. Luckily IRAs give you the options to invest as you chose and by placing your IRA in a brokerage account you can use this strategy. In a limited investing option retirement account [such as a 401(k)] look for short term bond funds, inflation protected bonds and real estate funds – but you have to evaluate if those funds are good – high expenses will destroy the reasons to invest in bond funds.

There are actually quite a few attractive high yield stocks now. I would strive for a very large amount of diversity in high yield stocks that are meant to take a portion of the bonds place in a balanced portfolio. In the portion of the portfolio aimed at capital appreciation I think too much emphasis is placed on “risk” (more concentration is fine in my opinion – if you believe you have a good risk reward potential). But truthfully most people are better off being more diversified but those that really spend the time (it takes a lot of time and experience to invest well) can take on more risk.

A huge advantage of dividends stocks is they often increase the dividend over time. And this is one of the keys to evaluate when selected these stock investments. So you can buy a stock that pays a 4% yield today and 5 years down the road you might be getting 5.5% yield (based on increased dividend payouts and your original purchase price). Look for a track record of increasing dividends historically. And the likelihood of continuing to do so (this is obviously the tricky part). One good value to look at is the dividend payout rate (dividend/earnings). A relatively low payout (for the industry – using an industry benchmark is helpful given the different requirement for investing in the business by industry) gives you protection against downturns (as does the past history of increasing payouts). It also provides the potential for outsized increases in the future.

There are a number of stocks that look good in this category to me now. ONEOK Partners LP pays a dividend of 5.5% an extremely high rate. They historically have increased the dividend. They are a limited partnership which are a strange beast not quite a corporation and you really need to read up and understand the risks with such investments. ONEOK is involved in the transportation and storage of natural gas. I would limit the exposure of the portfolio to limited partnerships (master limited partnerships). They announced today that the are forecasting a 20% increase in 2012 earnings so the stock will likely go up (and the yield go down – it is up 3.4% in after hours trading).

Another stock I like in this are is Abbott, a very diversified company in the health care field. This stock yields 3.8% and has good potential to grow. That along with a 3.8% yield (much higher than bond yields, is very attractive).

My 12 stocks for 10 year portfolio holds a couple investments in this category: Intel, Pfizer and PetroChina. Intel yields 3.9% and has good growth prospects though it also has the risk of deteriorating margins. There margins have remains extremely high for a long time. Maybe it can continue but maybe not. Pfizer yeilds 4.6% today which is a very nice yield. At this time, I think I prefer Abbott but given the desire for more diversification in this portion of the portfolio both would be good holdings. Petro China yields 4% today.

When invested in a retirement portfolio prior to retirement I would probably just set up automatic reinvesting of the dividends. Once in retirement as income is needed then you can start talking the dividends as cash, to provide income to pay living expenses. I would certainly suggest more than 10 stocks for this portion of a portfolio and an investor needs to to educate themselves evaluate the risks and value of their investments or hire someone who they trust to do so.

Related: Retirement Savings Allocation for 2010 – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- A 401k With Employer Matching is More Liquid Than You Think by Kevin McKee – “If your employer offers 401k matching, it’s simple: max it out. The one thing you’ll want to check is when the money is vested. All 401k money is immediately vested at my company, so once the match is in the account, it’s yours.”

- Potential Euro Collapse & Rapid Redistribution Of Personal Wealth – “When we look at these two situations, what we can plainly see is that there is a massive redistribution of wealth that goes on when we have monetary crises. Millions of innocent people who’ve been playing by the rules and responsibly saving and investing are financially devastated. Other millions of people are enjoying lucrative profits and tax-advantaged surges in their personal net worth.”

- 3 Dividend Growth Stocks selected by Gordon Model by Norman Tweed – “What this tells you is that constant future dividend growth is additional yield. Gordon speaks about earnings growth also in the paper. However, this is a highly conservative usage, leaving out pure growth stocks and concentrating on yield only. It is most applicable for utilities and slow growth rate stocks.”

- 6 Online Retirement Planning Tools You Need to Know by Ryan Guina – “if your situation is more complicated, then it may be worth looking into a tool such as Maximize My Social Security, which costs $40 annually. This tool can help you determine the best strategy for maximizing your social security benefit. This tool can be especially helpful when you may need to decide when to collect retiree, spousal, survivor, divorcee, parent, or child benefits.”

I have written about the importance of protecting yourself against the companies that provide you financial services. There are few (if any) industries that as systemically try to trick and deceive customers out of large amounts of money as the financial services sector does. In addition to watching them, you it also makes sense to watch your credit card charges. For some reason attorneys general let large scale financial fraud go with much less policing than petty theft by juveniles (if some kids come in and take your TV they will be in trouble, if some large bank does the same thing to all of the household goods of many people that never even were their customers criminal charges are ignored for everyone involved – one of many such examples of bad decisions by attorneys general).

Because financial fraudsters are allowed to continue without much fear of prosecution: thousands, or tens or thousands, or hundreds of thousands and then maybe something will be done, of course that is a lot of people to suffer before action is taken. For that reason we are subject to long standing schemes to take money fraudulently go on for a long time. I wouldn’t even be surprised if most companies found to have taken money that isn’t theirs are left off when they refund money to those people that caught them and that is seen as ok.

Given this state of affairs, many have discovered just sending bills to people and companies and billing your credit card for things you didn’t order is a good way to steal money. Since law enforcement is extremely lax about stopping this. It is in your interest to protect yourself.

Bill Guard is one new service to watch your credit card charges and alert you to potentially fraudulent charges. It seems like a pretty good idea. Like Google flagging spam email for you. I really would think credit card companies should do this (they do but I guess not nearly well enough – no surprise there). I don’t so much love the idea of sharing credit card info with these people. And I don’t charge much so I can review my bill easily, myself. I can imagine lots of others though have difficulty remember every charge. If so, this may well be wise.

Read more

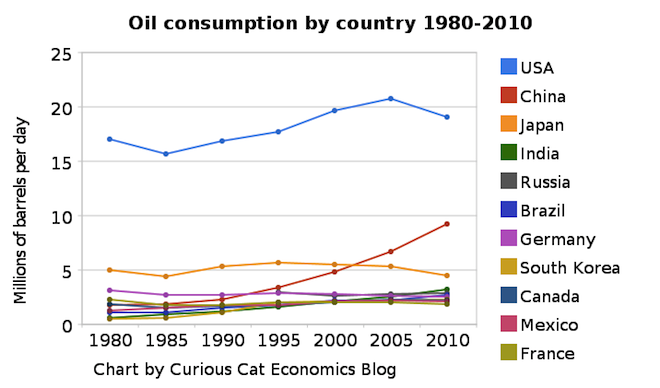

Chart of petroleum consumption by country 1980-2010 by the Curious Cat Investing and Economics Blog. The chart may be used with attribution.

The USA remains, by a huge margin, the largest consumer of petroleum products (motor gasoline, jet fuel, liquefied petroleum gases, residential fuel oil…) using 22% of the total (with about 4.5% of the population). From 1980 to 2010 the global consumption increased 38% to 87 million barrels a day.

From 1980 to 2010 USA consumption increased 12% (so less than global consumption). Meanwhile, Germany, Japan and France decreased petroleum use by 19%, 17% and 10% respectively. Many countries have very low use in 1980 and have grown their economies dramatically over this period and increased petroleum use dramatically also: India up 433%, China up 411%, South Korea up 360%.

Africa, in total, used 3.3 million barrels a day in 2010, up 120% from 1980. Africa used 73% of what Japan used in 2010 and 17% of what the USA used and 50% more than Canada. The data shows no sign of declining petroleum consumption on a global basis. The USA uses as much as China, India, Brazil and Africa combined. I believe, in 2015 those countries (by which I mean all the countries in Africa too, not that Africa is a country, which of course it is not) will use more than the USA (and likely show significant growth from 2010 levels).

Data is from the US Energy Information Agency.

Related: Oil Production by Country 1999-2009 – Top Countries For Renewable Energy Capacity – Chart of Nuclear Power Production by Country from 1985-2009 – Increasing USA Foreign Oil Dependence In The Last 40 years

This was a bad month for jobs in the USA. Not only did the U.S. Bureau of Labor Statistics report that the number of jobs remained at the same level as last month (125,000 additional jobs are needed for population growth, on average and we have huge losses from the credit crisis recession that have to be gained back) the last 2 months were revised down. The change in total nonfarm payroll employment for June was revised from

a gain of 46,000 to a gain of 20,000, and the July was revised down from gaining 117,000 job to gaining

85,000. That results in a total loss for this report of 58,000.

Still much better than the huge losses of several years ago but, along with the last few months, not a good sign for short term job growth. And the failure to address decades of favors given by politicians to too big to fail banks may actually create serious problems much sooner than most people feared. Pretty much everyone knew that the failure to address the main cause of the credit crisis was setting us up for again having the economy suffer huge blows due to the behavior of too big to fail institutions but I, and I think most people, thought it would be at least 5 years away and maybe even 10 before we had to seriously pay for the failures of our politicians to address this problem they (and their predecessors created).

It really seems like politicians don’t understand that their predecessors (decades ago) could afford to payoff large political donors and avoid dealing with problems and the enormous amount of wealth the economy was generating would let us prosper (even with lousy leadership), but that is no longer the case. The USA has used up huge economic advantages and that easy time is not coming back. Sadly the main hope for the USA is that other countries leaders create enough waste that the USA can remain competitive with all the waste our create (extremely lousy health care system, for example). It seems the American public doesn’t understand either, if anything we are electing even less intelligent and capable leaders today (over the last 10 years).

The USA has 14 million unemployed. Among the major worker groups, the unemployment rates for adult men was 8.9%, adult women 8.0% and teenagers 25.4%, whites. Of those 14 million the number of long-term unemployed (those jobless for 27 weeks and over) was about unchanged at 6 million in August.

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose from 8.4 million to 8.8 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour over the month to 34.2 hours. The manufacturing workweek was 40.3 hours for the third consecutive month; factory overtime increased by 0.1 hour over the month to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged down to 33.5 hours in August, after holding at 33.6 hours for the prior 6 months.

As bad as this news is, it could be much worse. The economy is actually growing (very slowly), probably. Many companies are actually still very profitable (I am not counting companies that have fake profits with congress approved ability to report fake values for their assets – Congress granted their too big too fail donors, this, and many other favors while most others are left out in the cold). The wealth in the USA, even after we have been consuming our capital to live beyond what we earn each year (for decades) is still extremely high. This allows us to live well and invest even with many bad practices in place. We continue to have many excellent companies doing great work and providing great jobs. Even with all the problems in the USA there are few countries that are in as enviable an economic position. The biggest problem I see is we have been squandering those advantages far too easily and quickly for far too long. That leaves us much more economically venerable than we need to be.

Related: Paying Back Direct Cash Bailouts from Taxpayers Does not Excuse Bank Misdeeds – USA Unemployment Rate at 9.6% (after losing 54,000 job in Aug 2010)