The latest data from the commonwealth fund report confirms the status quo. The USA spends twice as much on their health care system for no better results. It is easier to argue the USA is below average in performance that leading. And for double the cost that is inexcusable.

Globally the rich countries citizens are not tremendously happy with health care systems overall. It seems likely not only does the USA cost twice and much as it should and perform poorly compared to countries doing an excellent job but the USA performs that poorly compared to countries that themselves have quite a bit of improvement to make. Which makes the state of the USA system even worse.

Data from the Commonwealth fund report published in 2011 with data for 2009, International Profiles of Health Care Systems, 2011:

Table showing, percent of GDP spent and total spending per capita in USD on health care by country.

| Country | 2007 | Spending |

|

2009 | Spending |

| Australia | 9.5% | $3,128 | 8.7% | $3,445 | |

| Canada | 9.8% | $3,326 | 11.4% | $4,363 | |

| Germany | 10.7% | $3,287 | 11.6% | $4,218 | |

| Japan | 8.5% | $2,878 | |||

| New Zealand | 9.0% | $2,343 | 10.3% | $2,983 | |

| UK | 8.3% | $2,724 | 9.8% | $3,487 | |

| USA | 16.0% | $6,697 | 17.4% | $7,960 |

| Survey of population, showing % that chose each statement (no data available for Japan) | |||||||

| Australia | Canada | Germany | New Zealand | UK | USA | ||

| 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | ||

| Overall health system views | |||||||

| Only minor changes needed, system works well | 24 – 24 | 26 – 38 | 20 – 38 | 26 – 37 | 26 – 62 | 16 – 29 | |

| Fundamental changes needed | 55 – 55 | 60 – 51 | 51 – 48 | 56 – 51 | 57 – 34 | 48 – 41 | |

| Rebuild completely | 18 – 20 | 12 – 10 | 28 – 14 | 17 – 11 | 15 – 3 | 34 – 27 | |

| Percent uninsured | 0 – 0 | 0 – 0 | <1 – 0 | 0 – 0 | 0 – 0 | 16 – 16 | |

Under currently law in the USA by 2020 the uninsured rate should decline to under 5% by 2020 (still far more than any rich country – nearly all of which are at 0%).

On many performance measures in the report the USA is the worst performing system (in addition to costing twice as much). Such as Avoidable Deaths, 2006–07, the USA had 96 per 100,000, the next highest was the UK at 83, Australia was the lowest at 57. And Diabetes Lower Extremity Amputation Rates per 100,000 population, the USA had 36 the next highest was New Zealand at 12, the lowest was the UK at 9. For experiencing a medical, medication or lab test rrror in past 2 years, the USA was at 18%, next worst was Canada at 17%, best was UK at 8%. The USA was top performer in breast cancer five-year survival rate, 2002–2007. And sometimes the USA was in the middle, able to get same/next day appointment when sick: the USA was at 57%, New Zealand achieved 78% while Canada only reached 45%.

It is possible to argue the USA provides mediocre results, which is consistent with most global health care performance measures. Unless you directly benefit from the current USA system it is hard to see how you can argue it is not the worst system of any rich country. Costing twice as much and achieving middling performance. All that doesn’t even factor in the cost in anguish and bankruptcies and restricting individual freedom (when you have to stay tied to a job you would rather leave, just because of health insurance) caused by the difficulty getting coverage and fighting with the insurance companies for payment and coverage for treatment expenses.

Related: Measuring the Health of Nations – USA Paying More for Health Care – Traveling for Health Care – resources for improvement health system performance

Apple has been performing amazingly well for years. They keep producing blockbuster hits over and over. Not only are these hits enormously popular they are enormously profitable.

The only real objections to Apple’s stock I can see are: the overall market value is so huge it just has to collapse (over $400 billion – the largest in the world) or it has to be time for a huge reversal of fortunes.

The problem with the view that it will fall is that the stock is very cheap by any rational measure. You are not paying much for all the earnings. Even if Apple does not continue the trend of the last 5 years, if it just stopped growing altogether, it is still cheap (if it does continue that trend it will break $1 trillion by 2014 – but I don’t think it will). The biggest risk is the profit margin shrinks drastically. That is possible. It is even somewhat likely to shrink a fair amount. But there isn’t much reason to think revenues will not grow. And to me, the current price makes sense only if revenues fall and profit margins fall. It takes the worst case scenario to make this stock seem overpriced.

The data on the last quarter (and for 2011 overall) are impossible (except they actually happened).

- record quarterly revenue of $46.33 billion ($26.74 billion in 2010)

- record quarterly net profit of $13.06 billion ($6 billion in 2010)

- Gross margin was 44.7 percent compared to 38.5 percent in the year-ago quarter

- $17.5 billion in cash flow from operations during the quarter (and $38 billion in the last year)

- $100 billion in cash now ($97.6 billion to be exact but since the data was gathered they probably passed $100 billion anyway). That is more than the market cap of all but 52 companies in the world.

You can’t grow quarterly sales from $26.7 billion to $46.3 billion. $26 million to $46 million, fine that is possible, billions however – not possible. Except Apple did. You can’t grow a $6 billion quarterly profit to $13 billion in 1 year. Except Apple did. You can’t generate a cash flow of $17.5 billion in a quarter. Except Apple did. You can’t have a stockpile of $100 billion in cash. Except Apple does. These figures would not have been seen as unlikely just 3 years ago. They were impossible. But Apple achieved them.

These figures are not short term blips. They are the latest in a long stream of amazingly results.

Related: How Apple Can Grow from $200 Billion to $300 Billion In Market Cap – Apple Tops Google (August 2008)

Apple has numerous, incredibly strong businesses. Each could be the linchpin of an extremely valuable company.

- iPhone initial sales and reoccurring income (over 50% of Apple’s revenue)

- app sales (for iPhones, iPads and Macs)

- iPads

- iTunes

- Macs

- Their retail store business – selling all their products

Total health expenditures in the USA in 2010 reached $2.6 trillion, $8,402 per person or 17.9% percent of GDP. All these are all time highs. Every year, for decades, health care costs have taken a larger and larger portion of the economic value created in the USA. The costs have risen much more rapidly than the costs in the rest of world. This creates a burden that slows the USA economy – it acts as a friction dragging everything else down. We not only need to slow down how fast we are getting worse (which we have done the last 2 years) but actually start making up for all the ground lost in the last few decades. We haven’t even started on that. The amount of work to do in getting our health system back to mediocre and reasonably priced is enormous (currently we have mediocre performance and extremely highly priced – twice as costly as other rich countries).

In 2009 the USA Spent Record $2.5 Trillion, $8,086 per person 17.6% of GDP on Medical Care.

USA health care spending grew 3.9% in 2010 following an increase of 3.8% in 2009. While those are the two slowest rates of growth in the 51 year history of the National Health Expenditure Accounts, they still outpaced both inflation and GDP growth. So yet again the health system expenses are taking a bigger portion of overall spending.

As a result of failing to address this issue for decades the problem is huge and will likely take decades to bring back just to a level where the burden on those in the USA, due to their broken health care system, is equal to the burden of other rich countries. Over 2 decades ago the failure in the health care system reached epidemic proportions but little has been done to deal with the systemic failures. Dr. Deming pointed to excessive health care cost, back then, as one of 7 deadly diseases facing American business. The fact that every year costs have increased more than GDP growth and outcome measures are no better than other rich countries shows the performance has been very poor. The disease is doing even more harm today.

Related: USA Heath Care System Needs Reform – USA Spends Record $2.3 trillion ($7,681 Per Person) on Health Care in 2008 – Systemic Health Care Failure: Small Business Coverage – Measuring the Health of Nations – How to improve the health care system performance – Management Improvement in Healthcare – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

I decided to take a look at some historical economic data to see if some of my beliefs were accurate (largely about how well Singapore has done) and learn a bit more while I was at it.

| country |

|

1970** |

|

2010*** |

|

% increase |

| Korea | 1,320 | 20,200 | 1,430 | |||

| China | 325 | 4,280 | 1,217 | |||

| Singapore | 4260 | 42,650 | 901 | |||

| Indonesia | 460 | 2,960 | 543 | |||

| Brazil | 1900 | 10,500 | 453 | |||

| Thailand | 850 | 4,600 | 441 | |||

| Portugal | 3,970 | 21,000 | 429 | |||

| Japan | 9,000 | 42,300 | 370 | |||

| Malaysia | 1,900 | 7,755 | 308 | |||

| Germany | 11,550 | 40,500 | 251 | |||

| UK | 10,400 | 36,300 | 249 | |||

| France | 13,600 | 40,600 | 199 | |||

| Mexico | 4,160 | 9,200 | 121 | |||

| Panama | 3,480 | 7,700 | 121 | |||

| India | 555 | 1,180 | 113 | |||

| USA | 23,350 | 47,100 | 102 | |||

| South Africa | 3,930 | 7,100 | 81 | |||

| Venezuela | 8,280 | 9,770 | 18 |

I just picked countries that interested me and seemed worth looking at. I looked for some around the starting position of Singapore and close to Singapore geographically. And looked at Panama as the closest match to Singapore (for Singapore’s main 1970 asset, convenient for shipping lanes, and very close for GDP per capita).

Malaysia and Singapore were 1 country after independence (from 1963-1965).

I can’t imagine more than a couple countries could reasonably be argued to have had better economic performance from 1970 to 2010 than Singapore (Korea? China? Who else?). Singapore had very little going for it in 1970. They had a good location for shipping and that is about it macro-economically. No natural resources. No huge storage of wealth. No preeminence in science, technology or business.

It seems to me that Singapore actually did have 1 other thing. A government that was to preside over a fantastic economic growth success. You won’t find many textbooks talking about the way to economic success is a very well run government. And there is good reason for that, I believe. Relying on a very well run government will nearly always fail. In some ways Singapore was like Japan but with significantly more government influence on the way economic development played out.

I was surprised how poorly the USA has faired. It isn’t so surprising that we lagged. People forget how rich the USA was in 1970. The USA is still very rich but bunched together with lots of other rich countries instead of way out ahead as they were in 1970. And in 1970 the lead was already contracting, for what it had been earlier. But even knowing the relative performance of the USA had lagged, I was surprised by how much it under-performed.

I was also surprised with India. I knew they have done poorly but I didn’t realize it had been this poor. The failures to greatly improve infrastructure, education and the stifling effect of their bureaucracy have been causing them great harm. They have been doing some good things in the last 10 years especially but still have a long way to go. Their premier education is actually pretty decent. The problem is the other 90% of the education is often poor and many people (especially women) hardly have any education at all. It is very hard to get ahead when you fail to take advantage of the talents of so many of your people.

Related: Singapore and Iskandar Malaysia – Chart of Largest Petroleum Consuming Countries from 1980 to 2010 – Chart of Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

- Recovering Adam Smith’s ethical economics – “He justified commercial society for its tremendous contribution to the prosperity, justice, and freedom of its members, and most particularly for the poor and powerless in society.” [This post covers a topic I think is very important and have written about several times – John]

- A Man. A Van. A Surprising Business Plan. by Zoe Chace – “Adam had tricked out the van to be a mobile solution to Chinese bureaucracy. There are a couple of Mac laptops and a printer, plus an old couch, Christmas lights and bamboo mats. It’s as cozy as a dorm room. And confused visa applicants line up outside.” [wonderful – John]

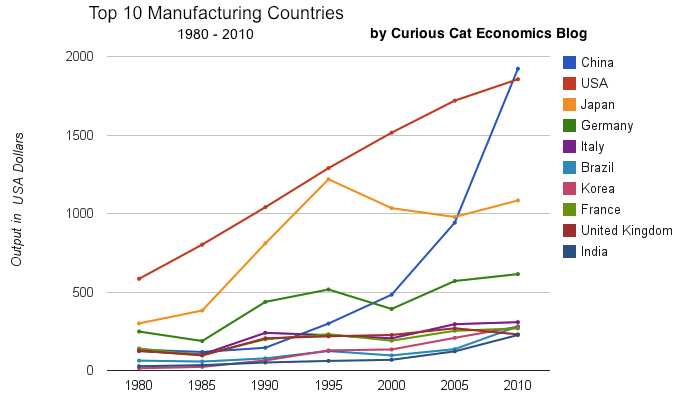

- Chart of Manufacturing Output from 2000 to 2010 by Country by John Hunter – “Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).”

- Ultimate Sustainable Dividend Portfolio – “I would expect the Ultimate Sustainable to do better in difficult times and worse in great times. Why? The USDP is a more stable portfolio that will fluctuate less over time…”

The 12 stock for 10 years portfolio consists of stocks I would be comfortable putting into an IRA for 10 years. The main criteria is for companies with a history of large positive cash flow, that seemed likely to continue that trend. I am considering adding Abbot to the portfolio, and maybe dropping Cisco.

Since April of 2005 the portfolio Marketocracy* calculated annualized rate or return (which excludes Tesco) is 5.7% (the S&P 500 annualized return for the period is 3.9%). Marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that (it is not like this portfolio takes much management), the return beats the S&P 500 annual return by about 380 basis points annually (it would be a bit less with Tesco, but still close above 3%, I would think – calculating rates of return with purchases and sales and dividends is a complete pain, which is one reason Marketocracy is so nice).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 350% | 9% | 7% | |

| Google – GOOG | 187% | 17% | 14% | |

| PetroChina – PTR | 115% | 8% | 6% | |

| Templeton Dragon Fund – TDF | 85% | 8% | 7% | |

| Templeton Emerging Market Fund – EMF | 44% | 5% | 7% | |

| Danaher – DHR | 43% | 10% | 10% | |

| Apple – AAPL | 42% | 9% | 9% | |

| Intel – INTC | 18% | 6% | 6% | |

| Cash (likely to be ABT soon) | – | 4% | 6% | |

| Cisco – CSCO | -2% | 5% | 4% | |

| Toyota – TM | -8% | 8% | 12% | |

| Pfizer – PFE | -9% | 6% | 7% | |

| Tesco – TSCDY | -13%** | 0%* | 5% |

The current marketocracy results can be seen on the Sleep Well marketocracy portfolio page.

Related: 12 Stocks for 10 Years: Feb 2011 Update – 12 Stocks for 10 Years, July 2011 Update – 12 Stocks for 10 Years, July 2009 Update – hand picked articles on investing

Read more

Nonfarm payroll employment rose by 200,000 in December, and the unemployment rate declined to 8.5% (the lowest rate in 3 years), continuing a downward trend. The change in total nonfarm payroll employment for October was revised from +100,000 to +112,000, and the change for November was revised from +120,000 to +100,000 (which results in total increase of 192,000 with this report: 200,000 – 8,000 lost in revisions).

The number of long-term unemployed (those jobless for 27 weeks or more) continues to be a big problem and was little changed at 5.6 million, accounted for 42.5% of the unemployed (quite a high percentage). While adding 192,000 is better than losing jobs or adding fewer, it is still not enough to make up for the credit crisis job losses. The economy needs to add 125,000 a month to keep up with population growth. Sustained gains over 230,000 month after month are needed to be what I would see as good, and really above 270,000 would be much better – but given the Eurozone problems, staying about 200,000 may really be good news.

The civilian labor force participation rate (64.0%) and the employment-population ratio (58.5%) were both unchanged over the month.

Over the past 12 months, nonfarm payroll employment has risen by 1.6 million. Employment in the private sector rose by 212,000 in December and by 1.9 million over the year. Government employment changed little over the month but fell by 280,000 over the year.

Employment in transportation and warehousing rose sharply in December (+50,000). Almost all of the gain occurred in the couriers and messengers industry (+42,000); seasonal hiring was particularly strong in December.

Retail trade continued to add jobs in December, with a gain of 28,000. Employment in the industry has increased by 240,000 over the past 12 months.

In December, manufacturing employment expanded by 23,000, following 4 months of little change. Employment increased in December in transportation equipment (+9,000), fabricated metals (+6,000), and machinery (+5,000).

Related: USA Unemployment Rate Rises to 9.8% (Nov 2010) – USA Unemployment Rate Remains at 9.7% (March 2010) – Over 500,000 Jobs Disappeared in November 2008

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month.

The new year starts with markets still highly uncertain due to the after affects of the too-big to fail credit crisis and the Euro-zone crisis. Job markets leave many people’s personal finances is trouble and those that are in good shape have a much greater challenge determining what are optimal personal financial strategies.

And markets embody the uncertainty. Investing strategies are also made more difficult by the current uncertainties. Continuing with long held strategies seems wise, but less comforting in these troubled times.

- 32 Best Dividend Stocks for 2012 by Shailesh Kumar – “The following table lists the best dividend stocks for 2012 based on dividend yields, dividend growth rate and dividend sustainability. All the stocks in this list have a P/E ratio of 15 or below.”

- How I Switched to Long Term Thinking – “I started spending some time each day thinking about the decisions I made that day, particularly ones I would often see myself repeating. Outside of the moment, I’d look at the short term benefits of my options as well as the long term benefits and I’d decide independently what the best long-term choice was.”

- A Country In Denial About Its Fiscal Future by Robert Samuelson – “Political leaders assume that financial markets won’t ever choke on U.S. debt and force higher interest rates, stiff spending cuts and tax increases. At best, this is wishful thinking. At worst, it’s playing Russian roulette with the country’s future.”

Top 10 Countries for Manufacturing Production in 2010: China, USA, Japan, Germany… by John Hunter. China took over first place from the USA in manufacturing output in 2010. From 1980 to 2010 China increased output 1345%. The total top 10 group of countries increased output 302%. From 1995 to 2010 China increased output 543%. The group increased 64%.