Hedge funds sell themselves as investments for elites and justify their extraordinary expenses mainly by appealing to elites egos. Well, hedge funds by and large do poorly. This is largely due to huge expenses. Add to that the incentives managers have to take huge risks: the managers often get 20% of extraordinary gains and if they lose, well you lose your money. These incentives to take huge risks do mean a few hedge funds do spectacularly well each year (of course more usually do spectacularly poorly over time).

Warren Buffett knew this and wagered a long term investment in a low cost Vanguard S&P 500 Index fund would beat a hedge fund over the long term.

Buffett Seizes Lead in Bet on Stocks Beating Hedge Funds

…

Buffett’s argument, like the large pension funds, is that funds of hedge funds cost too much, according to a statement he posted on longbets.org, a website backed by the nonprofit Long Now Foundation that fosters “long-term thinking.” In addition to the 2 percent management fee and 20 percent performance fee that hedge funds typically charge, the funds of funds add another layer of fees, on average 1.25 percent of assets and 7.5 percent of any gains, according to data compiled by Bloomberg.

There may be many nice things about being in the 1% of the USA (being in 1% of the World is something more people in the USA should realize they are – more than 50% of the USA is in the 1% of everyone) but investing in hedge funds is mainly fools helping make a few more of the 1% by paying huge fees for lousy investments. Yes a few hedge funds will manage to do well. As would a few monkey’s throwing darts at a page of investments each quarter. The odds of picking a hedge fund for a long period of time that does so well the huge fees are justified are not great. Missing out on this investment option is not one you should feel sad about.

Related: Is the Stock Market Efficient? – Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – 12 Stocks for 10 Years: January 2012 Update

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. If you are interested in hosting the carnival, add a comment including a link to your blog.

- Savers, who did nothing to create the financial crisis, are being punished – “Our policy makers do need to think about what we are transferring to the banks,” Mr. Todd said. “Why is the public obligated to provide them with all those subsidies? Nobody will ask these questions.” [I agree, the large financial institutions are most responsible for the credit crisis and what they get is welfare paid for by others and they don’t even admit to their welfare status, pretending that the large financial institutions are not getting billions of dollars in direct and indirect aid from the rest of us]

- You’d Be A Fool To Hold Anything But Cash Now, interview with David Stockman – “Q: You sound as if we’re facing a financial crisis like the one that followed the collapse of Lehman Brothers in 2008.

A: Oh, far worse than Lehman. When the real margin call in the great beyond arrives, the carnage will be unimaginable.” - The end of cheap China – “Labour costs have surged by 20% a year for the past four years… Labour costs are often 30% lower in countries other than China, says John Rice, GE’s vice chairman, but this is typically more than offset by other problems, especially the lack of a reliable supply chain.”

- Killing the competition: How the new monopolies are destroying open markets by Barry Lynn – “the basic characteristics shared by all real markets. Most important is an equality between the seller and the buyer, achieved by ensuring that there are many buyers as well as many sellers.” [this is fundamental to how capitalism provides benefits to the society. As markets are made less free (think of any market with very few buyer or sellers – that is lots of them today) the risks increase that society will lose to those few players who can extract monopolistic rents from the broken markets. The concept that free markets result in benefit to society through competition require real markets and competition, just using the word capitalism doesn’t bring the benefits, the system must have capitalistic traits – John]

- What Portion Of Your Portfolio Should You Invest In Bonds? – “The universal rule is quite simple. If you own 100% of your portfolio in stocks and bonds you would invest so that: Bond proportion = your age %; Stock proportion = 100% – bond proportion” [I have a long comment on the post, I disagree with this specific advice today, the concept is sound, but bonds are not the right investment to balance the portfolio – John]

- Adam Smith versus Business by Sheldon Richman – “Smith knew the difference between being sympathetic to the competitive economy – which he called the ‘system of natural liberty’ — and being sympathetic to owners of capital (who might well have acquired it by less-than-kosher means, that is, through political privilege). He knew something about business lobbies.”

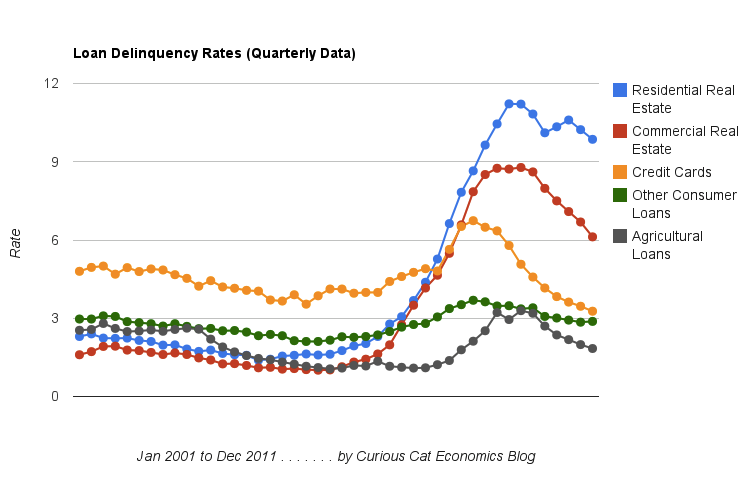

- USA Consumer and Real Estate Loan Delinquency Rates from 2001 to 2011 by John Hunter – “Residential real estate delinquency rates fell just 25 basis points (to a still extremely large 9.86%). Commercial real estate delinquency rates fell an impressive 186 basis points (to a still high 6.12%). Credit card delinquency rates fell 86 basis points to a 17 year low, 3.27%.”

2012 Retirement Confidence Survey

The data would be better if some value were placed on defined benefit plans; currently it is a bit confusing how much they may help. But the $25,000 threshold is so low that no matter what being under that value is extremely bad news for anyone over 40. And failing to have saved over just $25,000 toward retirement is bad news for anyone over 30 without a defined benefit plan.

Thirty-four percent of workers report they had to dip into savings to pay for basic expenses in the past 12 months.

…

Thirty-five percent of all workers think they need to accumulate at least $500,000 by the time they retire to live comfortably in retirement. Eighteen percent feel they need between $250,000 and $499,999, while 34 percent think they need to save less than $250,000 for a comfortable retirement.

Workers who have performed a retirement needs calculation are more than twice as likely as those who have not (23 percent vs. 10 percent) to expect they will need to accumulate at least $1 million before retiring.

66% of workers say their family has retirement savings and 58% say they are currently saving for retirement. These results are fairly consistent over the last few decades (the current values are in the lower ranges of results).

Nearly everyone wishes they had more money. One way to act as though you have more than you do is to borrow and spend (which is normally unwise – it can make sense for a house and in limited amounts when you are first going out on your own). Another is to ignore long term needs and just live it up today. That is a very bad personal finance strategy but one many people follow. Saving for retirement is a personal finance requirement. If you can’t save for retirement given your current income and lifestyle you need to reduce your current spending to save or increase your income and then save for retirement.

A year or two of failing to do so is acceptable. Longer stretches add more and more risk to your personal financial situation. It may not be fun to accept the responsibilities of adulthood and plan for the long term. But failing to do so is a big mistake. Determining the perfect amount to save for retirement is complicated. A reasonable retirement saving plan is not.

Saving 10% of your gross income from the time you are 25 until 65 gives you a decent ballpark estimate. Then you can adjust even 5 or 10 years as you can look at your situation. It will likely take over 10% to put you in a lifestyle similar to the one you enjoy while working. But many factors are at play. To be safer saving at 12% could be wise. If you know you want to work less than 40 years saving more could be wise. If you have a defined benefit plan (rare now, but, for example police or fire personnel often still do you can save less but you must work until you gain those benefits or you will be in extremely bad shape.

IRAs, 401(k) and 403(b) plans are a great way to save for retirement (giving you tax deferral and Roth versions of those plans are even better – assuming tax rates rise).

Related: In the USA 43% Have Less Than $10,000 in Retirement Savings – Saving for Retirement

Nonfarm payroll employment rose by 227,000 in February, and the unemployment rate was unchanged at 8.3%, the U.S. Bureau of Labor Statistics reported today. The change in total nonfarm payroll employment for December was revised from +203,000 to +223,000, and the change for January was revised from +243,000 to +284,000. Which brings the total new jobs for this report to 286,000 (227+20+39). This is very good news. There are other serious economic concerns (failure, after years, to take any meaningful action to prevent systemic too big to fail risk, policies harming savers to benefit too big to fail institutions, extremely large and dangerous budget deficits…) and the employment situation still has a long way to go to recover from the credit crisis crash but the recent job news is strongly positive.

The number of unemployed persons, at 12.8 million, was essentially unchanged in February. The unemployment rate held at 8.3%, 80 basis points below the August 2011 rate of 9.1%.

The number of long-term unemployed (those jobless for 27 weeks and over) remains at very damaging levels; it was little changed at 5.4 million in February. These individuals accounted for 42.6% of the unemployed.

Both the labor force and employment rose in February. The civilian labor force participation rate, at 63.9 percent, and the employment-population ratio, at 58.6 percent, edged up over the month.

Private-sector employment grew by 233,000, with job gains in professional and business services, health care and

social assistance, leisure and hospitality, manufacturing, and mining. Government jobs declined by 6,000. In 2011,

government lost an average of 22,000 jobs per month.

Professional and business services added 82,000 jobs in February. Just over half of the increase occurred in temporary help services (+45,000). Job gains also occurred in computer systems design (+10,000) and in management and technical consulting services (+7,000). Employment in professional and business services has grown by 1.4 million since a recent low point in September 2009.

Health care and social assistance employment rose by 61,000 over the month. Within health care, ambulatory care services added 28,000 jobs, and hospital employment increased by 15,000. Over the past 12 months, health care employment has risen by 360,000.

In February, employment in leisure and hospitality increased by 44,000, with nearly all of the increase in food services and drinking places (+41,000). Since a recent low in February 2010, food services has added 531,000 jobs.

Manufacturing employment rose by 31,000 in February. All of the increase occurred in durable goods manufacturing, with job gains in fabricated metal products (+11,000), transportation equipment (+8,000), machinery (+5,000), and furniture and related products (+3,000). Durable goods manufacturing has added 444,000 jobs since a recent trough in January 2010. Of all the good news the continued manufacturing gains may well be the best news.

Related: Nov 2010 USA Unemployment Rate Rises to 9.8% – USA Unemployment Rate Remains at 9.7% (Feb 2010) – Another 663,000 Jobs Lost in March 2009, in the USA

Chart showing loan delinquency rates from 2001-2011. It shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

2011 saw delinquency rates for loans fall across the board in the USA. Residential real estate delinquency rates fell just 25 basis points (to a still extremely large 9.86%). Commercial real estate delinquency rates fell an impressive 186 basis points (to a still high 6.12%). Credit card delinquency rates fell 86 basis points to a 17 year low, 3.27%.

The job market continues to struggle, though it is doing fairly well the last few months. The serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk to the economy are not easy to solve: and we made no progress in doing so in 2011. The reduction in delinquency rates is a good sign for the economy. The residential real estate delinquency rates are still far too high as is government debt. And the failure to address the too big to fail (big donors to the politicians) is continuing to cause great damage to the economy.

We need to reduce consumer and government debt. Many corporations are actually flush with cash, so at least we don’t have a huge corporate debt problem. Reducing debt load will decrease risks to the economy and provide wealth for consumers to tap as they move into retirement. The too-big-to-fail big political donors like to keep policies in place that encourage too much debt and favor complex financial instruments that they take huge fees from and then let the government deal with the aftermath. The politicians continued favors to too-big-to-fail institutions is very damaging to out economic well being.

Across the board, the wealthy economies are facing a rapidly aging population (the USA is actually acing this at a much slower rate than most other rich countries – which is helpful).

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2011 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

400 million people in India and 1.2 billion people worldwide do not have electric power at home. Mera Gao Power provides a wonderful market solution. Mera Gao Power can install solar power systems at a low cost that can be paid back in just 2 years by charging only 50 cents a month to users (for 7 hours of electricity a day). So they provide funding (through investors and grants) and recoup the investment quickly by providing a valuable service at a price users can afford.

Four solar panels are sufficient to power an entire village of 100 households with quality light and mobile charging. These panels are installed on the roofs of existing households, thus eliminating the need for land. Since power is generated during the day and used at night they use batteries to store the power.

By utilizing LED lights, MGP’s micro grid design is ultra energy efficient. This is the key to reducing power generation and storage equipment. Each household is provided with two or four LED lights.

Mera Gao Power received funding from USAID Development Innovation Ventures. The video presents their innovation for a village-level solar micro grid to electrify rural Uttar Pradesh for a White House meeting.

Related: Appropriate Technology: Solar Water Heaters in Poor Cairo Neighborhoods – Top Countries For Renewable Energy Capacity – Water Pump Merry-go-Round – Letting Children Learn, Hole in the Wall Computers – Homemade Windmills for Electricity – Water and Electricity for All

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

|

Empire State Building, New York City by John Hunter |