Apple posted quarterly revenue of $39.2 billion and quarterly net profit of $11.6 billion, or $12.30 per share (an increase of 94% in net income). These results compare to revenue of $24.7 billion and net profit of $6.0 billion, or $6.40 per diluted share, for the same quarter in 2011. Apple’s Gross margin was 47.4% (the best ever) compared to 41.4% in the year-ago quarter. International sales accounted for 64% of the quarter’s revenue.

Apple sold 35.1 million iPhones in the quarter, 88% unit growth over the year-ago quarter. Apple sold 11.8 million iPads during the quarter, a 151% unit increase over the year-ago quarter. And they sold 4 million Macs during the quarter, a 7% unit increase over the year-ago quarter. Apple sold 7.7 million iPods, a 15% unit decline from the year-ago quarter.

“Our record March quarter results drove $14 billion in cash flow from operations,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the third fiscal quarter, we expect revenue of about $34 billion and diluted earnings per share of about $8.68.” Don’t be surprised to see Apple significantly beat these numbers, they usually provide “estimates” that are far bellow what results turn out to be.

Apple built their cash stockpile to over $110 billion. Even paying the dividend that they have announced, they are going to be building their cash stockpile going forward without some amazingly large purchases. The announced dividend will cost Apple about $10 billion annually. I wish Apple would increase the dividend. They have also announced a plan to repurchase about $10 billion in stock starting in about 6 months. That would be a huge commitment for most companies, for Apple it seems to be about 2 months of cash the business will generate. I worry they will make foolish purchases just because having that much sitting in the bank makes it so easy.

The results are again fantastic. Apple’s stock price, relative to earnings, continues to be very reasonable (even cheap). Increases in the stock price have been more than outpaced by profit growth. It does seems profit growth has to slow, and likely dramatically (of course it seemed incredibly unreasonable to expect increases of even 33% of what Apple has done in the last 3 years). The stock price is not expensive, even if earnings growth collapsed, which it isn’t expected to do in the next year. On fundamental factors the stock remains very attractive.

The biggest risk is that when so much has gone so right for Apple for so long aren’t they poised to suffer some major setbacks? I can accept the case for a dramatic slowing in earning for the iPhone, which is their primary driver of earnings. It is hardly certain but there is this potential. I don’t foresee significant actual declines (earning less in 2013 than 2012, for example). But even assuming no growth in iPhone profits from 2013 to 2016 at this price Apple seems to be a good investment (and few expect no growth for iPhone earning for that period). iPhone sales now account for 58% of Apple’s revenue; three years ago, they totaled 27% of revenue.

Other areas should be strong in 2012, 2013 and beyond: iPads, Macs, iTunes and App sales. And everyone is expecting some huge new product or products. The leading candidate is a new Apple TV that actually makes a big move into the market. The stock price doesn’t even need some big new product but if it comes that is just more reason to be positive on Apple as an investment.

I don’t see any signs of troubles brewing. The only reason to be nervous is that it seems crazy that such extraordinary success on such a huge scale can continue. That can explain being nervous but it doesn’t justify missing out on this attractive investment.

Related: Apple’s Impossibly Good Quarter – The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects (Sept 2011) – Leadership quotes from Steve Jobs – Intel Reports Their Best Quarter Ever (March 2010) – 12 stocks for 10 years portfolio

The basics of retirement planning are not tricky. Save 10-15% of your income for about 40 years working career (likely over 15%, if you don’t have some pension or social security – with some pension around 10+% may be enough depending on lots of factors). That should get you in the ballpark of what you need to retire.

Of course the details are much much more complicated. But without understanding any of the details you can do what is the minimum you need to do – save 10% for retirement of all your income. See my retirement investing related posts for more details. Only if you actually understand all the details and have a good explanation for exactly why your financial situation allows less than 10% of income to be saved for retirement every year after age 25 should feel comfortable doing so.

There is value in the simple rules, when you know they are vast oversimplifications. I am amazed how many professionals don’t understand how oversimplified the rules of thumb are.

Here is one thing I see ignored nearly universally. I am sure some professions don’t but most do. If you have retirement assest such as a pension or social security (something that functions as an annuity, or an actually annuity) that is often a hugely important part of your retirement portfolio. Yet many don’t consider this when setting asset allocations in retirement. That is a mistake, in my opinion.

A reliable annuity is most like a bond (for asset allocation purposes). Lets look at an example for if you have $1,500 a month from a pension or social security and $500,000 in other financial assets. $1,500 * 12 gives $18,000 in annual income.

To get $18,000 in income from an bond/CD… yielding 3% you need $600,000. That means, at 3%, $600,000 yields $18,000 a year.

Ignoring this financial asset worth the equivalent of $600,000 when considering how to invest you $500,000 is a big mistake. Granted, I believe the advice is often too biased toward bonds in the first place (so reducing that allocation sounds good to me). To me it doesn’t make sense to invest that $500,000 the same way as someone else that didn’t have that $18,000 annuity is a mistake.

I also don’t think it makes sense to just say well I have $1,100,000 and I want to be %50 in bonds and 50% in stocks so I have “$600,000 in bonds now” (not really after all…) so the $500,000 should all be in stocks. Ignoring the annuity value is a mistake but I don’t think it is as simple as just treating it as though it were the equivalent amount actually invested.

Related: Immediate Annuities – Managing Retirement Investment Risks – How to Protect Your Financial Health – Many Retirees Face Prospect of Outliving Savings

Tesco is in my 12 stocks for 10 years portfolio. One of the big reasons I bought is management’s commitment to using good management practices, in particular lean thinking (based on Toyota’s management principles). These principles include: investing in the long term, customer focus, respect for employees.

With those practices in place and the good international expansion potential (including the USA) the opportunities are good (thus I liked the investment). Short term hiccups don’t really bother me. I would rather avoid them but I can accept them. The think that worries me about Tesco is I am becoming less and less convinced they are committed to lean management principles. Instead they seem to just be practicing the same lame management that so many companies employ. They can still be successful that way but the lost value to shareholders is great and makes me very close to deciding to eliminate my investment. I already sold half of the position, last year.

I now live in Malaysia and the Tesco’s here are horrible. There is no evidence of customer focus. They have lousy “fresh” (often not) vegetables. It is very easy to be sloppy as you expand. They obviously are not concerned enough to practice lean thinking in Malaysia. That is a concern. But large organizations often struggle to manage themselves competently and one small area ignoring lean thinking principles isn’t enough to say Tesco is ignoring them completely. More and more evidence is pointing to Tesco being sloppy and ignore lean thnking, however.

The main current financial problems are in the home market issues not directly related to lean thinking. Those I could easily chose to wether, if I believe the company is committed to smart lean management principle, but I am not any longer (sadly). For me, I need to see more evidence of commitment to lean principles or I will likely sell out my investment.

Another problem I have is Amazon was my other retail investment and I have significant valuation concerns – I am closer to selling more than buying more (I have sold some). I have long been looking at Costco – I would have been much better off buying it over Tesco 🙁 I am still considering it (I would love to buy Costco, it is just a valuation concern that holds me back, the company and the future prospects look great).

I lost no faith in Toyota (another stock in my sleep well portfolio) during the recent struggles. There were some slip-ups. Toyota’s responses were great – just as I would expect. Mainly the stories were greatly overblown.

Related: Tesco: Consistent Earnings Growth at Attractive Price – Apple’s Impossibly Good Quarter – Taking a Look at Some Dividend Aristocrats

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online.

- For Capitalism to Survive, Crime Must Not Pay by Bruce Judson – “Justice must be blind so that both parties — whether weak or powerful — can assume that an agreement between them will be equally enforced by the courts.

There is a second, perhaps even more fundamental, reason that equal justice is essential for capitalism to work. When unequal justice prevails, the party that does not need to follow the law has a distinct competitive advantage. A corporation that knowingly breaks the law will find ways to profit through illegal means that are not available to competitors. As a consequence, the competitive playing field is biased toward the company that does not need to follow the rules.” (the crony capitalism that has grown in the last few decades in the USA is poisoning the country with a failure to justly prosecute those that break laws if they are rich and connected to the other powerful cronies. This is a serious problem. – John).

- Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually by John Hunter – “This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.”

- What America Pays In Taxes – In 2011 the USA government collected $1,100 billion in personal income taxes, $741 billion in payroll taxes (social security and medicare) [this should be a hint that look only at income taxes paid it might be very misleading – John], $200 billion in corporate taxes, $10 billion in estate and gifts taxes and $268 billion in other taxes (customs duties, excise taxes on products such as gasoline…).

- Value Investing is Not Necessarily Buy and Hold Investing by Shailesh Kumar – “Value investors choose to buy a stock when it is cheaper than the intrinsic value of the stock and sell it when it becomes more expensive.”

I have donated more to Tricke Up than any other charity for about 20 years now. There is a great deal of hardship in the world. It can seem like what you do doesn’t make a big dent in the hardship. But effective help makes a huge difference to those involved.

My personality is to think systemically. To help put a band aid on the current visible issue just doesn’t excite me. Lots of people are most excited to help whoever happens to be in their view right now. I care much more about creating systems that will produce benefits over and over into the future. This view is very helpful for an investor.

Trickle Up invests in helping people create better lives for themselves. It provides some assistance and “teaches people to fish” rather than just giving them some fish to help them today.

The stories in this video show examples of the largest potential for entrepreneurship. While creating a few huge visible successes (like Google, Apple…) is exciting the benefits of hundreds of millions of people having small financial success (compared to others) but hugely personally transforming success is more important. Capitalism is visible in these successes. What people often think of as capitalism (Wall Street) has much more resonance with royalty based economic systems than free market (free of market dominating anti-competitive and anti-market behavior) capitalism.

Related: Kiva Loans Give Entrepreneurs a Chance to Succeed – Micro-credit Research – Using Capitalism in Mali to Create Better Lives

Pitfalls in Retirement (pdf) is quite a good white paper from Meril Lynch, I strongly recommend it.

could safely spend 10% or more of their savings each year.

But, as explained below, the respondents most on target were the one in 10 who estimated sustainable spending rates to be 5% or less. This is significantly impacted by life expectancy; if you have a much lower life expectancy due to retiring later or significant health issues perhaps you can spend more. But counting on this is very risky.

This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.

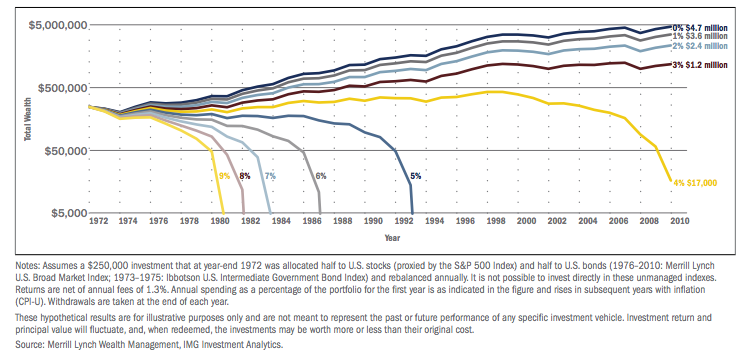

Chart showing retirement assets over time based on various spending levels, from the Merill Lynch paper.

The chart is actually quite good, the paper also includes another good example (which is helpful in showing how much things can be affected by somewhat small changes*). One piece of good news is they assume much larger expense rates than you need to experience if you choose well. They assume 1.3% in fees. You can reduce that by 100 basis points using Vanguard. They also have the portfolio split 50% in stocks (S&P 500) and 50% in bonds.

Several interesting points can be drawn from this data. One the real investment returns matter a great deal. A 4% withdrawal rate worked until the global credit crisis killed investment returns at which time the sustainability of that rate disappeared. A 5% withdrawal rate lasted nearly 30 years (but you can’t count on that at all, it depends on what happens with you investment returns).

Related: What Investing Return Projections to Use In Planning for Retirement – How Much Will I Need to Save for Retirement? – Saving for Retirement

Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate dropped to 8.2%, the United States Bureau of Labor Statistics reported today. Employment rose in manufacturing, food services, and health care, but was down in retail trade. The change in total nonfarm payroll employment for January was revised from +284,000 to +275,000, and the change for February was revised from +227,000 to +240,000 (together this adds just 4,000 more jobs brining the total added jobs with this report to 124,000.

Adding 120,000 jobs in a month is mediocre in general for the USA economy. The biggest reason for disappointment is during recoveries jobs are normally added at a higher rate, and given how many jobs were lost in the during the credit crisis outsized job gains are needed. The other reason adding 120,000 jobs was disappointing is the consensus estimate was for over 200,000 jobs to be added.

The number of long-term unemployed (those jobless for 27 weeks and over) was essentially unchanged at 5.3 million in March and remains one of the biggest employment problems for the economy. These individuals accounted for 42.5% of the unemployed. Since April 2010, the number of long-term unemployed has fallen by 1.4 million.

In the prior 3 months, payroll employment had risen by an average of 246,000 per month. Private-sector employment grew by 121,000 in March, including gains in manufacturing, food services, and health care.

Manufacturing employment rose by 37,000 in March, with gains in motor vehicles and parts (+12,000), machinery (+7,000), fabricated metals (+5,000), and paper manufacturing (+3,000). Factory employment has risen by 470,000 since a recent low point in January 2010. Manufacturing continues providing some of the best employment news.

Related: Latest USA Jobs Report Adds 286,000 Jobs; Another Very Strong Month (Mar 2012) – USA Adds 216,00 Jobs in March 2011; the Unemployment Rate Stands at 8.8% – USA Added 162,000 Jobs in March 2010 – Another 663,000 Jobs Lost in March 2009 in the USA

Warren Buffett continues to write his excellent annual shareholder letter. It is a pleasure to read them every year. I have selected a few passages to include:

Charlie and I don’t expect to win many of you over to our way of thinking – we’ve observed enough human behavior to know the futility of that – but we do want you to be aware of our personal calculus. And here a confession is in order: In my early days I, too, rejoiced when the market rose. Then I read Chapter Eight of Ben Graham’s The Intelligent Investor, the chapter dealing with how investors should view fluctuations in stock prices. Immediately the scales fell from my eyes, and low prices became my friend. Picking up that book was one of the luckiest moments in my life.

Investors face challenges within their own psychology. This is one, but not the only one.

Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back on business that their competitors are eagerly writing. That old line, “The other guy is doing it so we must as well,” spells trouble in any business, but in none more so than insurance. Indeed, a good underwriter needs an independent mindset akin to that of the senior citizen who received a call from his wife while driving home. “Albert, be careful,” she warned, “I just heard on the radio that there’s a car going the wrong way down the Interstate.” “Mabel, they don’t know the half of it,” replied Albert, “It’s not just one car, there are hundreds of them.”

Tad has observed all four of the insurance commandments, and it shows in his results. General Re’s huge float has been better than cost-free under his leadership, and we expect that, on average, it will continue to be. In the first few years after we acquired it, General Re was a major headache. Now it’s a treasure.

The insurance business is explained well in this, and his other shareholder letter.

Related: Warren Buffett’s 2010 Letter to Shareholders – Warren Buffett’s Q&A With Shareholders 2009 – Warren Buffett’s 2007 Letter to Shareholders

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than other carnival: I select posts from the blogs I read (instead of just posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- Why the April Jobs Report Could Be a Disaster – “the one-two punch of a warmer winter and unusual seasonal adjustment factors stemming from the financial crisis could combine to create something of a disaster for those writing the labor market headlines in early-May when the April jobs data is reported.” [it also may not turn out to be an issue, but it is an interesting post and the type of thing you need to consider when looking at economic data – John]

- Evaluating Your Auto Insurance Policy – “many companies offer defensive driver discounts if you take a course or install a device in your car to monitor your habits. You can also get good student discounts for students on your policy, low mileage discounts for cars you don’t drive much, accident-free discounts when you haven’t been in an accident lately, and loyalty discounts for sticking with the company.”

- Buyting Foreclosed Homes as Rental Investments – “Since 2007, investors have been trolling the cratered suburbs stretching from California to Florida for cheap houses to flip. And firms such as PennyMac Mortgage Investment Trust have sought value in subprime-mortgage-backed securities. Waypoint, which owns 1,100 houses and is buying five more a day, is betting that converting foreclosures into rentals is a better way to make a profit.”

- How Long Can We Finance the Debt? by James Kwak – “Since the Federal Reserve is expected to reduce its balance sheet as the economy recovers, if foreign holdings of U.S. government debt simply remain at current levels (as a share of GDP), they expect that 10-year yields would climb to 7.9 percent by 2020—rather than 5.4 percent as forecast in the CBO’s baseline.”

- The Case for Raising Top Tax Rates – “In 1980, the top marginal rate was 70 percent for families making more than $215,400 — about $587,000 in current dollars. And these families pocketed a much smaller share of the nation’s income than they do now. Today, people earning over $200,000 a year capture more than a third of national income.”

Flip-flops for sale in Singapore by John Hunter

Flip-flops for sale in Singapore by John Hunter