The stock market capitalization by country gives some insight into how countries, and stocks, are doing. Looking at the total market capitalization by country doesn’t equate to the stock holdings by individuals in a country or the value of companies doing work in a specific country.

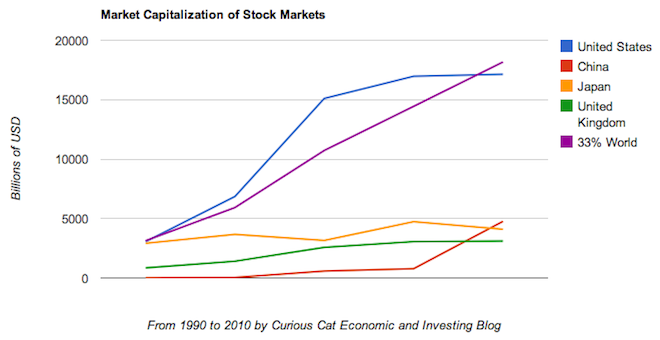

Chart of largest stock market capitalizations by country from 1990 to 2010

In the chart, I divided the world total by 3: just to make the chart look better. The USA was 32.5% of the total in 1990. The USA grew to 46.9% as the tech, finance and housing bubbles were all underway (also Japan was stagnating and the Chinese stock market hadn’t started booming to a significant extent). In 2010 the USA was back down to 31.4%. This will likely continue to decrease (at a much slower pace – I wouldn’t be surprised to see the USA at 25% in 2020) as the rest of the world’s markets continue to grow more quickly.

As with so much recent economic data China’s performance here is remarkable and Japan’s is distressing. China grew from nothing in 1990 to the 2nd largest country in 2010. Hong Kong add another $1 trillion to China’s $4.5 trillion. Canada is the only country above $2 trillion not included on this chart. China grew by $4 trillion from 2005 to 2010.

Related: Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Top 10 Countries for Manufacturing Production from 1980 to 2010 –

Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Government Debt as Percent of GDP 1998-2010

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online. Greece just voted for the party that wants to attempt to keep Greece in the Eurozone. We will see how that works. I don’t think the odds are great unless Greece is willing to substantially change their recent (last few decades) running of their economy.

- Big Investors Don’t Know Where to Put Their Cash by Sven Böll and Martin Hesse – “‘In the past, we searched for risk-free returns.’ He pauses for effect. ‘Today we know that what we mainly have are investments with return-free risk.’… Corporate bonds and the sovereign debt of emerging economies, once something for the intrepid, are suddenly seen as safe havens.”

- Are More Bailouts to Banker and Politicians the Answer to the Credit Crisis Aftermath? by John Hunter – “It feels to me similar to a situation where I have maxed out 8 credit cards and have a little bit left on my 9th. You can say that failing to approve my 10th credit card will lead to immediate pain. Not just to me, but all those I owe money to. That is true. But wasn’t the time to intervene likely when I maxed out my 2nd credit card and get me to change my behavior of living beyond my means then?”

- The Great Recession is changing our behavior–in ways that point to slower growth for a longer period of time by Jim Jubak – “The third, most powerful in its effects and the least obvious, is the way that the Great Recession has undermined existing belief in financial security. That decline in real and perceived security is likely to change where people put their money, what kinds of returns they think they can count on, and, therefore, how much money they think they can spend and how much they have to put away.”

- A Global Perfect Storm by Nouriel Roubini – “To prevent a disorderly outcome in the eurozone, today’s fiscal austerity should be much more gradual, a growth compact should complement the EU’s new fiscal compact, and a fiscal union with debt mutualization (Eurobonds) should be implemented. In addition, a full banking union, starting with eurozone-wide deposit insurance, should be initiated, and moves toward greater political integration must be considered, even as Greece leaves the eurozone.

CommentsUnfortunately, Germany resists all of these key policy measures…”

My parents in front of the Acropolis in Athens, Greece. Photo by John Hunter, see more of my photos.

Global Trends in Renewable Energy Investment 2012

…

renewable power (excluding large hydro) accounted for 44% of new generation

capacity added worldwide in 2011, up from 34% in 2010 [and 10% in 2004]. The $237 billion invested in building these green power plants compares with $223 billion of net new expenditure annually on building additional fossil-fuelled power plants globally last year.

…

Current predictions are that total installed capacity in non-hydro renewable power will rise ninefold to 2.5Tw by 2030, with investment in assets rising from $225 billion in 2011 to $395 billion-a-year by 2020 and $460 billion-a-year by 2030

Total investment in solar in 2011 increased 52% to $147 billion, driven by a drop of 50% in photovoltaic module prices. Investment in wind dropped 12% to $84 billion, while onshore wind turbine prices fell between 5 and 10%. Biomass and waste to energy was the 3rd largest renewable sector at $11 billion in investments (down 12% from 2010).

USA investment surged 51% to $51 billion just behind China at $52 billion (China increased investment in renewable energy by 17% from 2010). German investment dropped 12% to $31 billion.

In 2011 renewable energy power capacity (excluding large hydropower), as a percentage of total system capacity, reached 9%, up from 4% in 2004. Total renewable energy generation (excluding large hydro) reached 6%, up from 4% in 2004.

Related: Top Countries For Renewable Energy Capacity – Wind Energy Capacity Exceeds 2.5% of Global Electricity Needs – Leasing or Purchasing a Solar Energy System For Your Home

When critics say that Europe is running out of time to deal with the financial crisis I wonder if they are not years too late. Both in Europe responding and those saying it is too late.

It feels to me similar to a situation where I have maxed out 8 credit cards and have a little bit left on my 9th. You can say that failing to approve my 10th credit card will lead to immediate pain. Not just to me, but all those I owe money to. That is true.

But wasn’t the time to intervene likely when I maxed out my 2nd credit card and get me to change my behavior of living beyond my means then? If you only look at how to avoid the crisis this month or year, yeah another credit card to buy more time is a decent “solution.”

But I am not at all sure that bailing out more bankers and politicians for bad financial decisions is a great long term strategy. It has been the primary strategy in the USA and Europe since the large financial institution caused great recession started. And, actually, for long before that the let-the-grandkids-pay-for-our-high-living-today has been the predominate economic “strategy” of the last 30 years in the USA and Europe.

That has not been the strategy in Japan, Korea, China, Singapore, Brazil, Malaysia… The Japanese government has adopted that strategy (with more borrowing than even the USA and European government) but for the economy overall in Japan has not been so focused on living beyond what the economy produces (there has been huge personal savings in Japan). Today the risks of excessive government borrowing in Japan and borrowing in China are potentially very serious problems.

I can understand the very serious economic problems people are worried about if bankers and governments are not bailed out. I am very unclear on how those wanting more bailout now see the long term problem being fixed. Unless you have some system in place to change the long term situation I don’t see the huge benefit in delaying the huge problems by getting a few more credit cards to maintain the fiction that this is sustainable.

We have seen what bankers and politicians have done with the trillions of dollars they have been given (by governments and central banks). It hardly makes me think giving them more is a wonderful strategy. I would certainly consider it, if tied to some sensible long term strategy. But if not, just slapping on a few more credit cards to let the bankers and politicians continue their actions hardly seems a great idea.

Related: Is the Euro Going to Survive in the Long Run? (2010) – Which Currency is the Least Bad? – Let the Good Times Roll (using Credit) – The USA Economy Needs to Reduce Personal and Government Debt (2009 – in the last year this has actually been improved, quite surprisingly, given how huge the federal deficit is) – What Should You Do With Your Government “Stimulus” Check? – Americans are Drowning in Debt – Failure to Regulate Financial Markets Leads to Predictable Consequences

The extremely low interest rate environment created by the too big to fail financial institution bailouts has severely harmed savers. Most severely harmed those in retirement that didn’t count on irresponsibly regulators and bankers creating a situation where to avoid a depression they had to punish savers to favor large banks (and others).

For some savings that might normally go into bonds (if the bond market were not so manipulated by the central banks to punish savers) dividend stocks are a good option. The stocks have risks but frankly with extremely strong companies with huge amounts of positive cash flow the future looks brighter than it does for those debt ridden governments.

Apple (AAPL) announced they will start paying a $2.65 quarterly dividend which works out to $10.60 annually. At the current stock price, this is a yield of nearly 1.9%. That is hardly going to make you rich but it is extremely attractive when you can get a much higher yield than savings account, treasury bills… and have the potential gains in stock price. Yes you do also have risk of a declining stock price, but as I have said I think Apple’s stock is an extremely good investment now.

Other good options include: Intel (INTL) which offers a 3.3% yield and Abbott (ABT) which offers a 3.4% yield. I own those 3 and also ONEOK Partners (OKS) which sports a 4.8% yield (but is a bit tricker situation that is suitable for a lower investment I think).

Even a stock like Toyota (TM), which I like as an investment, while it offers only a 1.8% yield that is much higher than you get for savings or treasury bills. So even stocks that are not about yield in the normal market conditions offer an attractive yield today.

I am a bit nervous about health care dividend investments but Pfizer (PFE) is worth considering at 4.1% (as are JNJ and MRK). I really like ABT (they have raised dividends for over 40 straight years, I think), sadly they are splitting into 2 companies. Even so I am planning on staying invested but it is avery big change and would make me worried about having too much committed to ABT.

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. This carnival is different than other carnivals: I select posts, and articles, from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- How Much Should You Contribute To Your 401k? by David Weliver – “If your employer matches 401k funds, contribute enough to get the full match. Do this first. Even if you’re in debt. Even if you don’t put in a penny more. Next, if you can contribute to a Roth IRA, work on contributing the full $5,000 a year to that account before you contribute elsewhere.”

- USA’s creaking infrastructure holds back economy by Paul Davidson – “The U.S. is spending about half of the $2.2 trillion that it should over a five-year period to repair and expand overburdened infrastructure, says Andrew Herrmann, president of the American Society of Civil Engineers.

Inland waterways, for example, carry coal to power plants, iron ore to steel mills and grain to export terminals. But inadequate investment led to nearly 80,000 hours of lock outages in fiscal 2010, four times more than in fiscal 2000. Most of the nation’s 200 or so locks are past their 50-year design life.” - Earth to Dimon: Banks Don’t Have a Right to Profit by Yves Smith – “banks that exist only by virtue of state-granted charters — and more recently, huge transfers from the public — have persuaded public officials and regulators that they have a God-granted right not just to high levels of profit but also high levels of employee and executive compensation.”

- Road Map for Saving Health Care with Fareed Zakaria – “our [USA] out-of-control health care costs continue to climb. No other nation spends more than 12 percent of its economy on health care. America spends 17 percent. What’s more, we don’t really benefit from the huge price tag. Our healthy life expectancy, the standard measurement, ranks only 29th in the world, behind Slovenia… All of them, including free market havens like Taiwan, have found that they need to use an insurance or government sponsored model. And all of them provide universal health care at much, much lower costs than we do.”

Sunrise at Angkor Wat, Siem Reap, Cambodia by John Hunter