One of the things that annoy me as an investor is how happy the executives are to grant themselves huge amount of pay in general and stock in particular. The love to giveaway huge amounts of stock to themselves and their buddies and then pretend that isn’t a cost.

Thankfully the GAAP rules changed a few years ago to require making the costs of stock giveaways show up on official earnings statements. Now, the companies love to trumpet non-GAAP earnings that exclude stock based compensation to employees.

The stock based costs are huge.

SG Securities estimates that corporates bought back $480 billion in stock last year, and then reissued about $180 billion.

The theme of the article is that stock buybacks have declined drastically very recently. There has been a huge bubble recently fueled by the too-big-too-fail bailout (quantitative easing). But don’t expect the executives giving themselves tons of stock to decline.

Accounting isn’t as straight forward as people who have never looked at it would like to think. While giving away stock is definately a cost, it isn’t a cash cost. The cash flow statement is best for looking at cash anyway. And the better your company does the more the free spirited giveaway of stock costs (both in your reduced share of the well performing company and the higher cost to buy back the shares they gave away).

They have excuses that they hire people who are not motivated enough to do their job for their pay so they need to offer stock options as a extra payment. But the main reason they like it is they can pretend that the pay to employees isn’t costing as much as it is because we gave them stock options not cash. As if paying $1 billion in cash is somehow more costly than giving away options and then spending $1 billion on buybacks of the stock they gave away.

Options make a lot of sense for small private companies. In a very limited way they can make sense as companies grow. But the practices of executives in huge bureaucracies giving away large amounts of your equity, on top of huge paychecks, is very harmful.

Related: Apple’s Outstanding Shares Increased from 848 to 939 million shares from 2006 to 2013 (while I think Apple’s large buyback is good, the huge share giveaways continue and are bad policy) – Google is Diluting Shareholder Equity by 1% a year (2009-2013) – Executives Again Treating Corporate Treasuries as Their Money

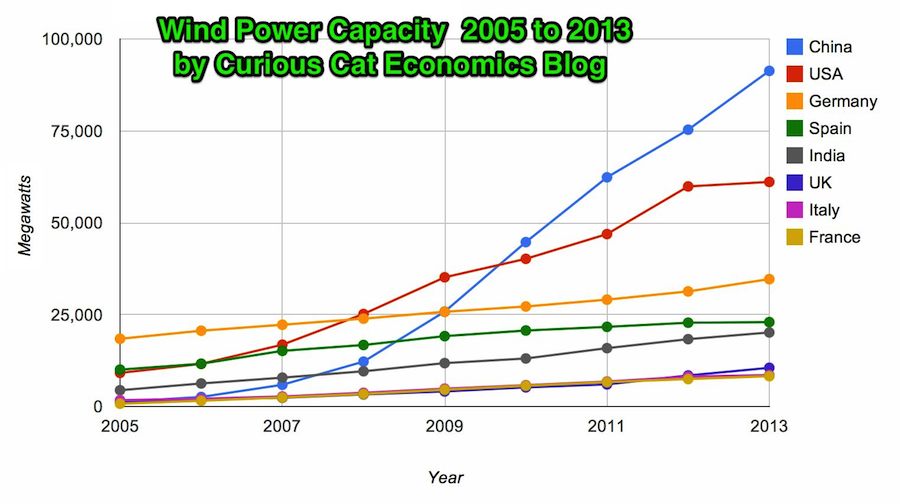

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. Chart may be used with attribution as specified here.

In 2013 the addition to wind power capacity slowed a great deal in most countries. Globally capacity was increased just 13% (the increases in order since 2006: 26%, 27%, 29%, 32%, 25%, 19% and again 19% in 2012). China alone was responsible for adding 16,000 megawatts of the 25,838 total added globally in 2013.

At the end of 2013 China had 29% of global capacity (after being responsible for adding 62% of all the capacity added in 2013). In 2005 China had 2% of global wind energy capacity.

The 8 countries shown on the chart account for 81% of total wind energy capacity globally. From 2005 to 2013 those 8 countries have accounted for between 79 and 82% of total capacity – which is amazingly consistent.

Wind power now accounts for approximately 4% of total electricity used.

Related: Chart of Global Wind Energy Capacity by Country 2005 to 2012 – In 2010 Global Wind Energy Capacity Exceeded 2.5% of Global Electricity Needs – Global Trends in Renewable Energy Investment – Nuclear Power Generation by Country from 1985-2010

Hedge funds seek to pay the managers extremely well and claim to justify enormous paydays with claims of superior returns. Markets provide lots of volatility from which lots of different performances will result. Claiming the random variation that resulted in the superior performance of there portfolio as evidence the deserve to take huge payments for themselves from the current returns is not sensible. But plenty of rich people fall for it.

As I have written before: Avoiding Hedge Fund Investments is One of the Benefits of Being in the 99%.

This is pretty well understood by most knowledgeable investors, financial planners and investing experts. But funds that charge huge fees continue to get away with it. If you are smart you will avoid them. A few simple investing rules get you well into the top 10% of investors

- seek low fees

- diversify – pay attention to risk of portfolio overall

- limit trading (low turnover)

- use tax advantage accounts wisely (in the USA 401(k)s and IRAs)

From a personal finance perspective, saving money is a key. Most people fail at being decent investors before they even get a chance to invest by spending more than they can afford and failing to save, and even worse going into debt (other than to some extent for college education and house). Consistently putting aside 10-20% of your income and investing wisely will put you in good shape over the long term.

Options can be used as an aggressive strategy to make money with investments. By following news events for quite a few different companies you can put yourself in the position to act when stories break, or events occur which can cause mini trends in their stock price.

Volatile stocks with frequent news provide the opportunity to make money on large changes in price. Amazon is a company an Amazon that often makes headlines. Recently, they have been in the news quite a bit, and savvy binary options traders have been cleaning up.

Binary options are a type of option in which the payoff can take only two possible outcomes. The cash-or-nothing binary option pays some fixed amount of cash if the option expires in-the-money while the asset-or-nothing pays the value of the underlying security.

For example, a purchase is made of a binary cash-or-nothing call option on Amazon at $320 with a binary payoff of $1000. Then, if at the future maturity date, the stock is trading at or above $320, $1000 is received. If its stock is trading below $100, nothing is received. An investor could also sell a put where they would make a payoff if the conditions are met and have to payoff nothing if the conditions are not met.

Examples of big news in the recent past

Amazon Fire Cell Phone – Earlier this year, we watched as Jeff Bezos unveiled the new Amazon Fire 3-D cell phone. As happens in most cases when a company unveils a great new product, we saw this cell phone cause Amazon’s stock price to go through the roof. So, as a trader, seeing the unveiling happen first hand would indicate that the value of Amazon was going to rise, and give the trader unique opportunity to make trades on realistic expectations with this asset.