This post is an exploration of a specific stock Tucows (TCX). Tucows, based in Canada, has built from their domain registration business into a company with 3 businesses poised for predictable cash flow generation.

In 2012 Tucows added Ting Mobile, a business that resells access to cell phone networks (Sprint, for CDMA, and T-mobile for GSM phones). This is not a flashy business but is a reliable cash flow generator.

In 2015 they added Ting Fiber, which builds fiber networks for small communities that have long been mistreated by incumbent Internet Service Providers (ISPs – such as Comcast and AT&T). This business requires a large up front investment but once it is operating provides a large and reliable cash flow.

Tucows has leveraged the cash flow from the domain registration business to build Ting business and now is leveraging the cash from both of those businesses to build the Ting Fiber business. I believe the Ting Fiber business is going to be a long term very profitable business.

Tucows’ commitment to customer service is a way they differentiate themselves from their competitors. They provide great customer service for the Ting service (I have been a customer for years specifically due to the good customer service).

Domain Services Business

OpenSRS and Enom are Tucows’ wholesale domain name providers.

This is a fairly boring business where the key is providing reliable service at a good price. It is not a high margin business, but one that consistently generates cash for Tucows.

If you look at the domain services business you will note that sales have decreased in 2018, this is due to Tucows a large customer (that had a very low margin deal with Tucows) that transferred away a 2.7 million domains. This seems to be a good business move but it does cause investors that don’t look closely to worry. They see a decline in revenue for their domain services businesses and worry about the long term prospects.

But investors that understand that this reflects a 1 time decrease in revenue may have the potential to pick up a bargain. The remainder of the business is expected to remain, and while it isn’t expected to grow much it should continue to provide cash to be invested elsewhere by Tucows.

Ting Mobile

Ting Mobile provides cell phone plans for as little at $10 a month. The charges are based off usage and are calculated based on the actual usage each month. For those that do not frequently use the data plans on their phones or have very high minutes of usage they are much cheaper than traditional plans. The average Ting Mobile subscriber bill is $23 (from Nov 2018 Tucows Investor presentation).

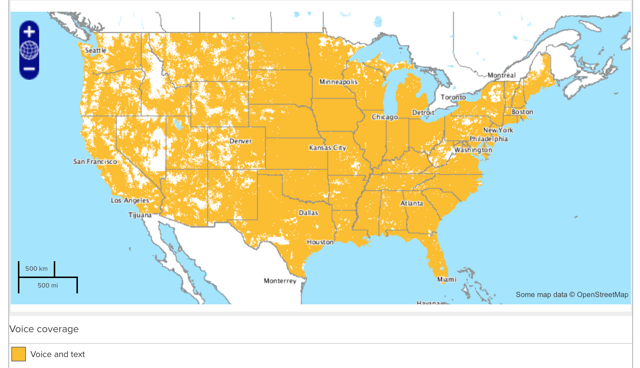

Ting coverage map

I don’t think they are competitive in prices for those that are heavy users of their smart phones. The image shows the phone call and text coverage map for CDMA devices on the Ting Mobile network.

So many companies market as though they care about customers yet they almost all treat customers very poorly. Ting is one the very few exceptions I have seen to that rule (Trader Joe’s is another).

This part of Tucows’ business has been generating profit consistently and continues to grow. It is not a very exciting business but it is profitable and their great customer service helps maintain customers for the long term.

The graphic (from Tucows investor presentation, Nov 2018) shows a slowly growing business with great customer satisfaction compared to their competitors.

Ting Internet

Ting Internet has already launched Gigabit speed internet service (via fiber) in Charlottesville, Virginia; Westminster, Maryland and Holly Springs, North Carolina. They have announced that Centennial, Colorado is the next location they will start building out in 2019.

Tucows provides very clear data on the costs of building out their fiber network and the expected returns. The costs are $2,500 – $3,000 per home. This value is based on amortizing the costs of building out the town’s infrastructure and assumes a 50% of the houses eligible to subscribe do subscribe to Ting Internet (within 2 to 5 years).

The Ting Fiber business is yet to bring in much revenue and is currently requiring cash to build up their infrastructure at each location. But 2019 should start to see significant additions of customers that are added as new neighborhoods go live and can start collecting income from customers. The initial site should be cash flow positive in 2019.

From their Nov 2018 conference call

In Q3, we added about 2,000 addresses and 900 customers to get to totals of 22,500 serviceable addresses and 6,200 active customers. With 3 towns, Sandpoint, Centennial and Fuquay-Varina, still in the foundational stages of construction, you will see outsized serviceable addresses added next quarter and thus we still expect to reach right around 30,000 serviceable addresses by the end of this year. And we continue to be pleased with how these serviceable addresses are translating predictably into subscribers and recurring margin.

…

we continue to feel confident about the core business as model, adoption of 20% after 1 year and 50% after 5 years, customers are indeed delivering $1,000 a year in margin and our build costs are coming in between 1,000 to 1,500 per serviceable address or $2,500 to $3,000 per customer at that projected 50% adoption.

I see Ting Internet as the most exciting long term cash flow generator. That business has a strong “moat” (it is difficult for competitors to get into the market). Their other businesses rely on good management to squeeze value from a challenging business environment. They continue to do that well, but they have little room for mistakes in the other 2 businesses, their competitors could take away their customers if they stumble or try to raise costs to consumers.

That Ting fiber business continues to grow. Currently it is requiring quite a bit of capital to invest in that infrastructure but the initial investments are starting to generate cash and that trend will continue.

Tucows stock cratered over 20% after the most recent earnings without justification in my opinion. The Ting mobile business has what appear to be some short term challenges but I think people greatly overreacted to that issue.

The stock had been going up quite a bit (and maybe got a bit ahead of itself so some pullback may have been warranted) but the decline was overdone. I had been watching it for several years and for the right portfolio and investment objectives this price decline offers an attractive entry point (it is just under $65 as I publish this post). It is the kind of company I want to hold for many years.

Related: Amazon Using a Costco Strategy? – Is it Time to Sell Apple? from 2013 (“No, it is not time to sell Apple”) – Apple’s Impossibly Good Quarter (2012)