Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online.

- Long Term Care Insurance – Financially Wise but Current Options are Less Than Ideal by John Hunter – “The questions about long term care insurance are not about the sensibility of the coverage abstractly, it is very wise. But the complexities, today, in the real world make the question of buying more a guess about what coverage you will actually receive if you need it.”

- Figuring Out The Real Price Of College by Jacob Goldstein – “For the current school year, the average sticker price for tuition and fees at a private, nonprofit college is $28,500, according to a report from the College Board.

The average price students actually pay is less than half that — $12,970. That’s almost identical to the $12,650 that students paid, on average, in the 2001-2002 school year. (These are inflation-adjusted dollars.) Of course, this is just the average. What students actually pay varies wildly.”

- The Philippines Astounds the Skeptics by Bruce Einhorn – “Much of the credit for the good feeling should go to Aquino and his efforts to tackle corruption and improve the country’s infrastructure… As wages rise in China, the Philippines has a chance to attract investment from companies looking for low-wage alternatives, but the country’s notorious culture of bribery remains a major obstacle to growth”

- Periodic Table Of Dividend Champions by David Van Knapp – the post looks at the 105 stocks raising dividends 25 straight years and looking at current yield and dividend growth rate highlights 34 for further study by an investor “Similarly, some investors may be interested in stocks that have a low current yield coupled with a high rate of dividend growth.”

Marina Bay Sands Casino, Singapore. Singapore added their first two casinos in 2010 and have already the 2nd most gambling revenue of any area: after Macau and ahead of Las Vegas.

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. This carnival is different than other carnivals: I select posts from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- Hospital of Cards by Andrew Foy, MD – “For some perspective on the magnitude of the healthcare bubble consider that from 1990 to 2007 the cost of all items, as measured by the Bureau of Labor Statistics (BLS), rose by 159 percent while housing rose 163 percent and medical care rose a staggering 216 percent. A recent study by the Kaiser Family Foundation found that between 1999 and 2011, health-insurance premiums increased 168 percent while workers’ total earnings increased only 50 percent. Over that same time period, government spending on healthcare increased 240 percent while GDP increased 62 percent. The BLS reported that over the last 50 years, the percent of workers employed in private-sector healthcare has gone from 3 percent to over 11 percent and employment has continued to grow throughout the current recession.”

- Apple’s Earning are Again Great, Significantly Exceeding High Expectations by John Hunter – Apple posted quarterly quarterly net profit of $11.6 billion (an increase of 94% in net income)… Apple’s Gross margin was 47.4% (the best ever) compared to 41.4% in the year-ago quarter. International sales accounted for 64% of the quarter’s revenue…

- Demand for Rental Units Could Disrupt Fed by Kathleen Madigan – “The supply among rental housing is the tightest in more than a decade as only 8.8% of units were vacant in the first quarter. And given the steep fall in homeownership rates in the U.S., the demand for rental units is the highest in 15 years.”

- 5 Reasons Why Dividend Investing Rocks – “Dividend investors always look for high and sustainable dividend growth and any stock that decides to slow that down or even stop growing the dividend entirely raises red flags.”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month with links to new, related, interesting content online.

- For Capitalism to Survive, Crime Must Not Pay by Bruce Judson – “Justice must be blind so that both parties — whether weak or powerful — can assume that an agreement between them will be equally enforced by the courts.

There is a second, perhaps even more fundamental, reason that equal justice is essential for capitalism to work. When unequal justice prevails, the party that does not need to follow the law has a distinct competitive advantage. A corporation that knowingly breaks the law will find ways to profit through illegal means that are not available to competitors. As a consequence, the competitive playing field is biased toward the company that does not need to follow the rules.” (the crony capitalism that has grown in the last few decades in the USA is poisoning the country with a failure to justly prosecute those that break laws if they are rich and connected to the other powerful cronies. This is a serious problem. – John).

- Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually by John Hunter – “This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.”

- What America Pays In Taxes – In 2011 the USA government collected $1,100 billion in personal income taxes, $741 billion in payroll taxes (social security and medicare) [this should be a hint that look only at income taxes paid it might be very misleading – John], $200 billion in corporate taxes, $10 billion in estate and gifts taxes and $268 billion in other taxes (customs duties, excise taxes on products such as gasoline…).

- Value Investing is Not Necessarily Buy and Hold Investing by Shailesh Kumar – “Value investors choose to buy a stock when it is cheaper than the intrinsic value of the stock and sell it when it becomes more expensive.”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than other carnival: I select posts from the blogs I read (instead of just posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- Why the April Jobs Report Could Be a Disaster – “the one-two punch of a warmer winter and unusual seasonal adjustment factors stemming from the financial crisis could combine to create something of a disaster for those writing the labor market headlines in early-May when the April jobs data is reported.” [it also may not turn out to be an issue, but it is an interesting post and the type of thing you need to consider when looking at economic data – John]

- Evaluating Your Auto Insurance Policy – “many companies offer defensive driver discounts if you take a course or install a device in your car to monitor your habits. You can also get good student discounts for students on your policy, low mileage discounts for cars you don’t drive much, accident-free discounts when you haven’t been in an accident lately, and loyalty discounts for sticking with the company.”

- Buyting Foreclosed Homes as Rental Investments – “Since 2007, investors have been trolling the cratered suburbs stretching from California to Florida for cheap houses to flip. And firms such as PennyMac Mortgage Investment Trust have sought value in subprime-mortgage-backed securities. Waypoint, which owns 1,100 houses and is buying five more a day, is betting that converting foreclosures into rentals is a better way to make a profit.”

- How Long Can We Finance the Debt? by James Kwak – “Since the Federal Reserve is expected to reduce its balance sheet as the economy recovers, if foreign holdings of U.S. government debt simply remain at current levels (as a share of GDP), they expect that 10-year yields would climb to 7.9 percent by 2020—rather than 5.4 percent as forecast in the CBO’s baseline.”

- The Case for Raising Top Tax Rates – “In 1980, the top marginal rate was 70 percent for families making more than $215,400 — about $587,000 in current dollars. And these families pocketed a much smaller share of the nation’s income than they do now. Today, people earning over $200,000 a year capture more than a third of national income.”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. If you are interested in hosting the carnival, add a comment including a link to your blog.

- Savers, who did nothing to create the financial crisis, are being punished – “Our policy makers do need to think about what we are transferring to the banks,” Mr. Todd said. “Why is the public obligated to provide them with all those subsidies? Nobody will ask these questions.” [I agree, the large financial institutions are most responsible for the credit crisis and what they get is welfare paid for by others and they don’t even admit to their welfare status, pretending that the large financial institutions are not getting billions of dollars in direct and indirect aid from the rest of us]

- You’d Be A Fool To Hold Anything But Cash Now, interview with David Stockman – “Q: You sound as if we’re facing a financial crisis like the one that followed the collapse of Lehman Brothers in 2008.

A: Oh, far worse than Lehman. When the real margin call in the great beyond arrives, the carnage will be unimaginable.” - The end of cheap China – “Labour costs have surged by 20% a year for the past four years… Labour costs are often 30% lower in countries other than China, says John Rice, GE’s vice chairman, but this is typically more than offset by other problems, especially the lack of a reliable supply chain.”

- Killing the competition: How the new monopolies are destroying open markets by Barry Lynn – “the basic characteristics shared by all real markets. Most important is an equality between the seller and the buyer, achieved by ensuring that there are many buyers as well as many sellers.” [this is fundamental to how capitalism provides benefits to the society. As markets are made less free (think of any market with very few buyer or sellers – that is lots of them today) the risks increase that society will lose to those few players who can extract monopolistic rents from the broken markets. The concept that free markets result in benefit to society through competition require real markets and competition, just using the word capitalism doesn’t bring the benefits, the system must have capitalistic traits – John]

- What Portion Of Your Portfolio Should You Invest In Bonds? – “The universal rule is quite simple. If you own 100% of your portfolio in stocks and bonds you would invest so that: Bond proportion = your age %; Stock proportion = 100% – bond proportion” [I have a long comment on the post, I disagree with this specific advice today, the concept is sound, but bonds are not the right investment to balance the portfolio – John]

- Adam Smith versus Business by Sheldon Richman – “Smith knew the difference between being sympathetic to the competitive economy – which he called the ‘system of natural liberty’ — and being sympathetic to owners of capital (who might well have acquired it by less-than-kosher means, that is, through political privilege). He knew something about business lobbies.”

- USA Consumer and Real Estate Loan Delinquency Rates from 2001 to 2011 by John Hunter – “Residential real estate delinquency rates fell just 25 basis points (to a still extremely large 9.86%). Commercial real estate delinquency rates fell an impressive 186 basis points (to a still high 6.12%). Credit card delinquency rates fell 86 basis points to a 17 year low, 3.27%.”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

|

Empire State Building, New York City by John Hunter |

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month.

- India’s panel price crash could spark solar revolution – “In India, electricity from solar supplied to the grid has fallen to just 8.78 rupees per kilowatt-hour compared with 17 rupees for diesel.”

- Buffett Says Bonds Among Most Dangerous Assets on Inflation – “Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as these holders continued to receive timely payments of interest and principal… Current rates… do not come close to offsetting the purchasing-power risk that investors assume.”

- How much should you save with each paycheck to reach retirement goals? – “For many, saving 10-15% will indeed be enough. If you find that you’re not currently on track for the retirement you envisioned, you can take steps now to change that.” [10-15% of income for retirement probably can be about right if you plan on working a standard 40-50 years and start adding close to 10% before you reach 30, and investment results are decent, and … and … and … Obviously if you don’t add at those levels starting earlier you will need to save more later. – John

- Why Spain’s Unemployed Are Heading For Germany – “Spain’s near-23 percent unemployment rate is driving highly educated people like Fuente and Sandino abroad by the tens of thousands. This year more people left Spain than moved there for the first time in more than a generation. And Germany’s a principal destination.”

- We Prefer Being Forced To Save – “Employers can do a number of things in addition to automatically enrolling employees and increasing their contributions amounts. They can make the websites easy to understand and be proactive about forcing the providers of the plans to make things less complicated. Even something so simple as having the retirement account website automatically bookmarked on work computers could go a long way.”

- Why Has the Baltic Dry Index Collapsed? by Steven Hansen – “just a small increase in the supply of ships can make a major difference in a very competitive marketplace. It makes the BDI an inoperative economic indicator, and one less tool which can be used as an economic metric.”

- Looking for higher dividend yields–and dividend growth? Here are three picks by Jim Jubak – “Pipeline master limited partnership Kinder Morgan Energy Partners (KMP). The partnership paid $4.32 a unit in 2010 and $4.58 in 2011 and thanks to new pipelines serving the U.S. energy boom and the likely drop down of assets from general partner Kinder Morgan’s (KMI) acquisition of El Paso (EP), I think the partnership will see growing cash flows that it can pass through to unit holders.”

- 5 Big Car Buying Mistakes by David Weliver – “We ignore financing terms. This makes no sense: Fighting tooth and nail with a car salesman for three hours to get an extra $500 off the price, and then financing the car with no money down at 6.0% for four years at a cost of over $2,000.”

For the second time in 2 weeks WordPress just completely failed to save a post I wrote 🙁 this is my second creation of this post.

The Curious Cat Investing, Economics and Personal Finance Carnival is published twice each month. We find useful recent personal finance, investing and economics blog posts and articles to share with you.

- 2 Billionaire Brothers’ Insider Buying At Colfax by Zack Miller – “[In] the Danaher Business System… management believes its found a demonstrable, repeatable recipe for success, and it drives both culture and process at the company and its acquisitions. DBS is a form of Japanese kaizen, comprising 4 components: 1) People 2) Plans 3) Processes 4) Performance” [I own Danaher and have it in my 12 stocks for 10 year portfolio – John, my management blog focuses on such management systems]

- Apple’s Impossibly Good Quarter by John Hunter – “You can’t grow quarterly sales from $26.7 billion to $46.3 billion. $26 million to $46 million, fine that is possible, billions however – not possible. Except Apple did. You can’t grow a $6 billion quarterly profit to $13 billion in 1 year. Except Apple did. You can’t generate a cash flow of $17.5 billion in a quarter. Except Apple did. You can’t have a stockpile of $100 billion in cash. Except Apple does. These figures would not have been seen as unlikely just 3 years ago. They were impossible. But Apple achieved them.”

- How to Save the Euro by George Soros – “the cuts in government expenditures that Germany wants to impose on other countries will push Europe into a deflationary debt trap. Reducing budget deficits will put both wages and profits under downward pressure, the economies will contract, and tax revenues will fall. So the debt burden, which is a ratio of the accumulated debt to the GDP, will actually rise, requiring further budget cuts, setting in motion a vicious circle.”

- Japan’s Trade Figures: Some Perspective by Eamonn Fingleton – “In a typical maneuver, goods might be shipped to China via Hong Kong. The goods are exported from Japan at heavily discounted prices and a Hong Kong subsidiary takes a huge profit in selling to China. Such profits constitute hidden export revenues that are not caught in the visible trade numbers. The maneuver makes sense because Japan’s corporate tax rate is one of the world’s highest.” [This is one, of many things, that make economic data difficult to rely on – you have to pay close attention to the details – John]

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

- Recovering Adam Smith’s ethical economics – “He justified commercial society for its tremendous contribution to the prosperity, justice, and freedom of its members, and most particularly for the poor and powerless in society.” [This post covers a topic I think is very important and have written about several times – John]

- A Man. A Van. A Surprising Business Plan. by Zoe Chace – “Adam had tricked out the van to be a mobile solution to Chinese bureaucracy. There are a couple of Mac laptops and a printer, plus an old couch, Christmas lights and bamboo mats. It’s as cozy as a dorm room. And confused visa applicants line up outside.” [wonderful – John]

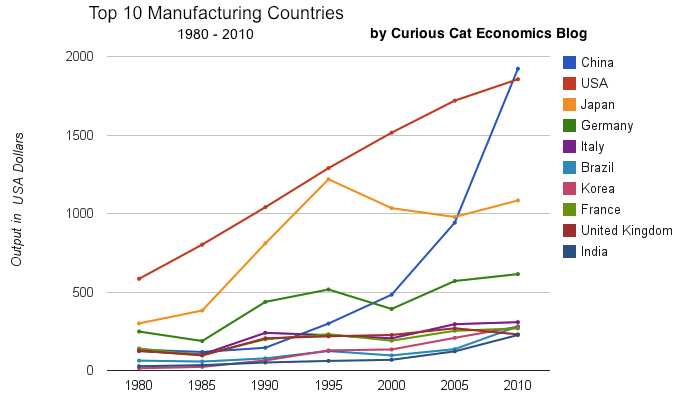

- Chart of Manufacturing Output from 2000 to 2010 by Country by John Hunter – “Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).”

- Ultimate Sustainable Dividend Portfolio – “I would expect the Ultimate Sustainable to do better in difficult times and worse in great times. Why? The USDP is a more stable portfolio that will fluctuate less over time…”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month.

The new year starts with markets still highly uncertain due to the after affects of the too-big to fail credit crisis and the Euro-zone crisis. Job markets leave many people’s personal finances is trouble and those that are in good shape have a much greater challenge determining what are optimal personal financial strategies.

And markets embody the uncertainty. Investing strategies are also made more difficult by the current uncertainties. Continuing with long held strategies seems wise, but less comforting in these troubled times.

- 32 Best Dividend Stocks for 2012 by Shailesh Kumar – “The following table lists the best dividend stocks for 2012 based on dividend yields, dividend growth rate and dividend sustainability. All the stocks in this list have a P/E ratio of 15 or below.”

- How I Switched to Long Term Thinking – “I started spending some time each day thinking about the decisions I made that day, particularly ones I would often see myself repeating. Outside of the moment, I’d look at the short term benefits of my options as well as the long term benefits and I’d decide independently what the best long-term choice was.”

- A Country In Denial About Its Fiscal Future by Robert Samuelson – “Political leaders assume that financial markets won’t ever choke on U.S. debt and force higher interest rates, stiff spending cuts and tax increases. At best, this is wishful thinking. At worst, it’s playing Russian roulette with the country’s future.”

Top 10 Countries for Manufacturing Production in 2010: China, USA, Japan, Germany… by John Hunter. China took over first place from the USA in manufacturing output in 2010. From 1980 to 2010 China increased output 1345%. The total top 10 group of countries increased output 302%. From 1995 to 2010 China increased output 543%. The group increased 64%.

Flip-flops for sale in Singapore by John Hunter

Flip-flops for sale in Singapore by John Hunter