Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- Why Financial Literacy Fails (and What to Do About It) by JD Roth – “‘For years, I struggled with money,’ I told my interviewer today. ‘I knew the math, but I still couldn’t seem to defeat debt. It wasn’t until I started applying psychology to the situation that I was able to make changes.'”

- Get ready for the three big financial crises of 2012 by Jim Jubak – “So in 2012 Ireland—and Greece and Portugal—are going to face a huge choice. They can either try to grind out more austerity in the midst of a EuroZone recession or they can try to renegotiate some of that debt. If you remember, the battle over Greek bank debt almost scuttled the euro this year. Well, we’re going to see the same problem again in 2012…”

- How Long Would It Take To Build A $5000/Year Dividend Cash Flow? – John is able to investing $1000 per month in a portfolio now yielding 2.86% and dividends increasing 9% a year (under historical level for the stocks included)… a bit over 7 years…

-

Mark Cuban, invest in yourself. Keep your cash – wait to get a bargin based on the cash your have which allows you to take advantage of market opportunities.

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival. Investing markets continue to move in seemingly haphazard ways. The risks from excessive debt, failure to regulate financial institutions, political weakness (both of politicians and of populaces electing such incapable politicians), financial fraud and more make this a very difficult time to invest. We hope to help find useful recent personal finance, investing and economics blog posts and articles.

- The Unemployment Plan – “I just found out that I’m being “downsized” at the end of the year. While I have a small emergency fund, I do have a mortgage and a bit of credit card debt. I also have three kids at home. My wife will continue to work, but she has only a part-time job with minimal benefits. I am receiving a pretty good severance package, though.

Rather than panicking, I’m trying to be calm and rational about figuring out what’s next…” - Choosing Between An Annuity And A Dividend Portfolio – “Personally, I consider the choice between an annuity or a dividend portfolio to be a no-brainer. I think a systematic, sustainable and disciplined approach to dividend investing will outperform in almost all cases and while it will require a bigger time investment, that is a small price to get more flexibility, better returns and a much stronger growth potential.”

- From the webcast (see above) with Jim Rodgers. He sees a difficult period worldwide the next 2 years. He is short many shares everywhere (including emerging market). He also owns some shares. But overall he sees a difficult few years for stock markets.

He says China has a price bubble in real estate and many bankruptcies will take place. But it is not as bad as the USA problems where there was a credit bubble (you have to have a job to get real estate loans, while in the USA and UK you didn’t have too). Chinese banks are is less bad shape than the USA and Europe. - Manufacturing Employment Data: USA, Japan, Germany, UK… 1990-2009 by John Hunter – “Compensation in the countries currency is remarkably consistent across all countries from 1990-2009. Japan shows the only significant divergence in the period of 2002 – 2009 actually decreasing pay in real terms (a small amount – from 100 to 98) while the average increases to about 110.”

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- How the Plummeting Price of Cocaine Fueled the Nationwide Drop in Violent Crime – “But it’s not only a growing supply of product that led to the collapse of the cocaine market. Newfound competition in the form of locally-produced methamphetamines and prescription narcotics would continue to drive business away from cocaine… At a certain point the decision matrix for entering a life of drug-related crime collapses for all but those with no other alternate financial sources or for those with a personal interest in the craft.”

- Eight Reasons to be Bullish on the US Dollar by Steen Jakobsen and Michael Shedlock – “58% of the US dollar index is the Euro, and the Euro is a basket case. European banks are in worse shape than their US counterparts, and a breakup of the Eurozone that I expect will certainly exacerbate the problem.”

Video: Bogle says Market are About Fairly Valued Today- Investing in an Engineering Degree Provides a Lifetime Advantage of $1,090,000 by John Hunter – “the lifetime advantage ranges from $1,090,000 for Engineering majors to $241,000 for Education majors”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. If you want to have an post considered for the next carnival please submit it to quixperito: money.

- How I live on $7,000 per year by Jacob Lund Fisker – “If I had to venture a guess, I’d say I’m more frugal (the way your grandparents were frugal—in fact what I do wouldn’t be considered very extreme by your grandparents or great grandparents—I’d probably be average from their perspective) and I adhere more to a do-it-your-self ethics.”

- Invest in Communities to Advance Capitalism by Howard Schultz (CEO of Starbucks) – “It is no longer enough to serve customers, employees, and shareholders. As corporate citizens of the world, it is our responsibility — our duty — to serve the communities where we do business by helping to improve, for example, the quality of citizens’ education, employment, health care, safety, and overall daily life, plus future prospects.” [similar to Dr. Deming ideas from decades ago on the purpose of organizations, which I share – John].

- My dad taught me cashflow with a soda machine by Rob Fitzpatrick – “The vending machine didn’t magically make me want to be an entrepreneur. I wanted to be a video game designer, then an engineer, then a video game designer again, and then an academic. I get the impression kids are a bit slippery in that regard.

But when I stumbled into the startup world two decades later, the dots began to connect. Cashflow wasn’t a new concept.” - Disability Insurance is Very Important by John Hunter – “When I would have had gaps in coverage from work, I have purchased disability insurance myself. I am all in favor of saving money. About the only 2 things I don’t believe in saving money being very important are health and disability insurance.”

- What Other Dividend Lists Exist Besides the Dividend Aristocrats? – “companies that have increased their annual regular dividends for at least the past 10 consecutive years and have met specific liquidity screening criteria… The members of the Dividend Champions List include, those stocks (not limited to the S&P 500) that have increased their dividend for the past 25 years.”

- Buying a New Home and Converting Your Current Home Into a Rental Property by Philip Taylor – “By refinancing our mortgage, we reduced our mortgage payment by enough to allow us to rent out the property by at least a hundred more per month than all of our expenses: mortgage, property taxes, insurance, home owners association dues, repairs, and property management fees.”

- The perils of near monopoly by Joshua Gans – “Had Qantas had market shares akin to airlines in more competitive markets, the shut down would not have had the external spillovers, publicity and also the ability to shield Qantas — both managers and workers — from personal long-term consequences of such brinkmanship.”

Forest Glen Preserve, Illinois, Illinois by John Hunter

We collect useful recent personal finance, investing and economics blog posts to help you find useful information.

- How to Create a Million-Dollar Business This Weekend (Examples: AppSumo, Mint, Chihuahuas) by Tim Ferriss – “Don’t get me wrong–I’m not opposed to you trying to build a world-changing product that requires months of fine-tuning. All I’m going to suggest is that you start with a much simpler essence of your product over the course of a weekend, rather than wasting time building something for weeks… only to discover no one wants it.”

- The True Cost of Commuting – “In other words, a logical person should be willing to pay about $15,900 more for a house that is one mile closer to work, and $477,000 more for a house that is 30 miles closer to work. For a double-commuting couple, these numbers are $31,800 and $954,000.”

- Looking for Dividend Stocks in the Current Extremely Low Interest Rate Environment by John Hunter – “A huge advantage of dividends stocks is they often increase the dividend over time. And this is one of the keys to evaluate when selected these stock investments. So you can buy a stock that pays a 4% yield today and 5 years down the road you might be getting 5.5% yield (based on increased dividend payouts and your original purchase price).”

- I Stand With the Protesters by Lee Adler – “Stop the fraud, return to the rule of law, prosecute the bankers, punish the guilty, figure out what our assets are really worth and pay us a fair return, and most importantly, return basic standards of fairness and ethical behavior, something that many in society must relearn.”

- The Depression: If Only Things Were That Good by David Leonhardt – “In the short term, finance, health care and housing provide jobs, as their lobbyists are quick to point out. But it is hard to see how the jobs of the future will spring from unnecessary back surgery and garden-variety arbitrage. They differ from the growth engines of the past, which delivered fundamental value — faster transportation or new knowledge — and let other industries then build off those advances.”

- Banks Have a Right to Make a Profit; Customers Have the Right of Choice by Ryan Guina – “I encourage you to explore your options and find the bank which meets your needs, and won’t nickel or dime you with fees. I use USAA, which is an incredible bank. And there are a variety of fee free online savings accounts, free checking accounts, and hundreds of credit unions which don’t charge as many fees as some of the larger banks.”

- Remember when rare earth stocks were hotter than magma? Well, they’re 50% cheaper now by Jim Jubak – “The growing demand for rare earths from new technologies plus China’s moves had two immediate effects. First, prices for rare earth minerals, especially the rarer heavy rare earth elements soared with prices for some rare earth elements climbing ten times from 2009 into 2011. Second, the scramble was on for alternative sources of supply. Suddenly there was plenty of capital available to restart mines that had closed because of low prices and stricter environmental regulation outside of China.”

- Fighting Civil Forfeiture Abuse – “The net effect of these three factors [profit motive, standard of proof, innocent owner burden] is to increase the use of forfeiture by law enforcement agencies by incentivizing forfeiture through making it profitable for the agencies that engage in it, by making it easier to keep seized property (by lowering the standard of proof) and by making it more expensive and difficult for owners to challenge the action (by shifting the burden of proof to the innocent owner).”

Penang, Malyasia by John Hunter

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- A 401k With Employer Matching is More Liquid Than You Think by Kevin McKee – “If your employer offers 401k matching, it’s simple: max it out. The one thing you’ll want to check is when the money is vested. All 401k money is immediately vested at my company, so once the match is in the account, it’s yours.”

- Potential Euro Collapse & Rapid Redistribution Of Personal Wealth – “When we look at these two situations, what we can plainly see is that there is a massive redistribution of wealth that goes on when we have monetary crises. Millions of innocent people who’ve been playing by the rules and responsibly saving and investing are financially devastated. Other millions of people are enjoying lucrative profits and tax-advantaged surges in their personal net worth.”

- 3 Dividend Growth Stocks selected by Gordon Model by Norman Tweed – “What this tells you is that constant future dividend growth is additional yield. Gordon speaks about earnings growth also in the paper. However, this is a highly conservative usage, leaving out pure growth stocks and concentrating on yield only. It is most applicable for utilities and slow growth rate stocks.”

- 6 Online Retirement Planning Tools You Need to Know by Ryan Guina – “if your situation is more complicated, then it may be worth looking into a tool such as Maximize My Social Security, which costs $40 annually. This tool can help you determine the best strategy for maximizing your social security benefit. This tool can be especially helpful when you may need to decide when to collect retiree, spousal, survivor, divorcee, parent, or child benefits.”

The global economy continue to be fragile and chaotic. At the same time companies continue to make large, and often increasing, profit. Here are some good blog posts on investing, personal finance and the economy.

- The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects by John Hunter – “the prospects in emerging markets look incredibly good to me. Yes they will slow their growth a bit if the large economies stall, but I think it is foolish to avoid investments in China, Singapore, Brazil, Korea, India, Ghana, Malaysia, Indonesia. In fact that is where companies like Google, Tesco, Apple, Toyota and Amazon are going to be making lots of money. Emerging markets are volatile and the companies in them are too. This will continue.”

- Extreme Early Retirement in Practice: How Two People Did It by Robert Brokamp – “We recently spent three months in Guatemala nestled between three volcanoes, on the shores of beautiful Lake Atitlan, and our average spending was $40 per day for the two of us, which equates to $14,600 per year. Our hotel price included daily cleaning, wi-fi, room service, cable TV, and a view.”

- Are stocks cheap yet? Not if the economy is slowing, these numbers say by James Jubak – “A 20% drop in forecast earnings—the rough equivalent of an economic slowdown instead of a recession—would put the price-to-earnings ratio of the S&P 500 at 13. That’s below the average of 15 but not really very cheap given the degree of economic risk that an investor is taking on right now.”

- Private Pensions: Another Gradual Catastrophe by Evan Tarte – “Despite the arguably noble intent of defined benefit plans and the PBGC, these plans demand crippling contributions from employers and inevitably the taxpayer, and make little sense in today’s market environment. PBGC’s current deficit stands at $22 billion”

- Emergency Savings: is 6 Months Still Enough? by GE Miller – “with the average unemployment duration at 40.4 weeks, 6 months (or 26 weeks) is no longer enough, particularly when you take into account the possibility of medical emergency, pet operations, or other unforeseen circumstances. What is a good length these days? 1 year, at a minimum.”

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles. If you want to have an post considered for the next carnival please submit it to quixperito: money.

- A Retailer’s Perspective on Amazon’s Amazingly Awesome Quarter by Scot Wingo – “This quarter provided more mounting evidence that Amazon is essentially running away with market share in e-commerce. Consequently, we believe retailers urgently need to think of an Amazon Strategy – partner, compete, co-opetition? Amazon is becoming so big and growing so fast, you almost can’t afford not get on this train.”

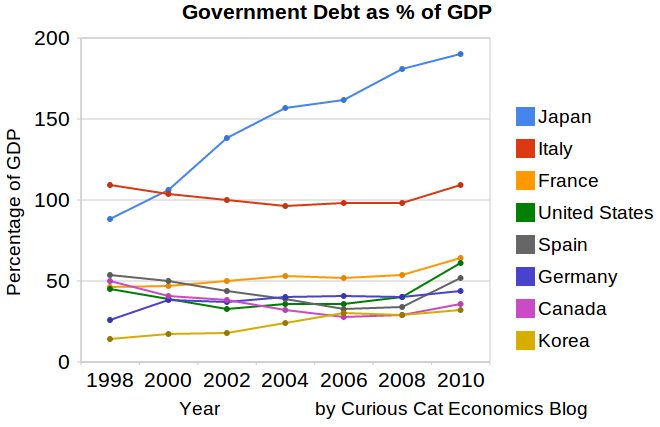

- Government Debt as Percent of GDP 1998-2010 for OECD countries by John Hunter – There has been a dramatic increase from 2008-2010. The USA is up from 41% of GDP to 61%. Spain is up from 34% to 52% (but given all the concern with Spain this doesn’t seem to indicate the real debt problems they have. Economic data contains quite of bit of noise, unfortunately.

- Cause of Decline in U.S. Financial Position by Barry Ritholtz – “The Pew Center reported in April 2011 the cause of a $12.7 trillion shift in the debt situation, from a 2001 CBO forecast of $2.3 trillion cumulative surplus by 2011 versus the estimated $10.4 trillion public debt in 2011. The major drivers were:

Revenue declines due to two recessions, separate from the Bush tax cuts of 2001 and 2003: 28%

Defense spending increases: 15%

Bush tax cuts of 2001 and 2003: 13%

Increases in net interest: 11%

Other non-defense spending: 10% - How This Blog Earns Full-Time Income from Part-Time Work by David Weliver – “for the most part, I’ve tried to focus on simply writing on topics that are unique, helpful, that answer specific questions. (It’s easy enough to be helpful, I think, but with billions of web pages out there, being unique is a never-ending challenge).”

- How to live off investment income – 1. Set up a cash buffer account between your regular monthly spending, and your income-spewing engines. 2. Work out how much of your annual investment income you will/can spend. The rest of the money you will reinvest…

- A Risky Investment Isn’t a Bad Investment by Kevin McKee – “If you want all the potential for Apple-esque gains, you need to be prepared to accept Enron-esque results. That’s the magic of risk; it goes both ways. Would I hold 100% of my portfolio in company stock? No.”

Photo of house in Norway, 1977 by Bill Hunter.

The Curious Cat Investing and Economics Carnival has been published infrequently over the last few years. My plan is to start publishing it much more frequently starting now.

- Personal Finance Basics: Long Term Disability Insurance by John Hunter – “people are much less aware of the importance of long term disability insurance. The census bureau estimates that you have a 20% chance you will be disabled in your lifetime.”

- Fed’s Low Interest Rates Crack Retirees’ Nest Eggs by Mark Whitehouse – “A long spell of low interest rates has created a windfall worth billions to banks, mortgage borrowers and others it was designed to benefit. But for many people who were counting on their nest eggs, those same low rates can spell trouble.”

- How to profit from the coming Greek default by Matthew Lynn – “Sell the U.S. banks but buy the dollar. If everyone knows Greece will have to default, what’s keeping them from pulling the plug? That’s easy. The Germans and the French won’t want to ‘re-profile’ all that Greek debt until they know their banks have largely sold both the debt and the credit-default swaps associated with it to someone else.”

- Buy Cheap Bonds with Safe Spread by Bill Gross – “Investors shouldn’t give their money away, and at the moment, the duration component of a bond portfolio comes close to doing just that – not because a bear market is just around the corner come July 1, but because it doesn’t yield enough relative to inflation.”

- How to retire with no savings – “Once you hit age 50, your chances of being jobless start to rise rapidly. You don’t get to choose when you retire. The job market or your ailing body will decide for you. Most retired Americans are getting by on incomes that you’d probably consider appropriate for the Third World. And even if they wanted to work until they died, they can’t.”

- Words of wisdom from Warren Buffett’s legendary sidekick – “You have to be a lifelong learner to appreciate this stuff. We think of it as a moral duty. Increasing rationality and improving as much as you can no matter your age or experience is a moral duty. Too many people graduate from Wharton today and think they know how to do everything. It’s a considerable mistake.

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles.

- The Myth of Japan’s ‘Lost Decades’ by Eamonn Fingleton – “Japan’s surplus is up more than five-fold since 1990. And, yes, far from falling against the dollar, the Japanese yen has actually boasted the strongest rise of any major currency in the last two decades. How can such facts be reconciled with the ‘two lost decades’ story? I don’t think they can.”

- Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation by John Hunter – “It is not less risky to have your entire retirement in treasury bills than to have a portfolio of stocks, bonds, international stocks, treasury bills, REITs… This is because their are not just risk of an investment declining in value. There are inflation risks, taxation risks…” (including structural imbalances introduced by the Feb depressing short term yields to provide billions to large banks from the pockets of savers).

- Cheating Investors As Official Government Policy by Daniel R. Amerman – “When you put your savings into a money market fund, and the policy of the US government is to force interest rates to unnaturally low levels – you are being cheated out of the yield you should be receiving. When you buy a corporate bond or corporate bond fund – you are being cheated by overt government market interventions that have the explicitly stated purpose of lowering corporate borrowing costs.”

- Force Yourself to Save by – “Save 50% of any bonus or raise… Theoretically you could save 100% of your raise and maintain the same lifestyle, but that’s no fun. What’s the point of a raise if it doesn’t include a new PS3?” (I have long favored putting a portion of each raise toward a saving plan – John)

- Who holds the most U.S. Treasuries in the world? (Hint: It’s not China.) by James Jubak – “For a while China was the biggest holder of U.S. government debt. But now with $896 billion China has slipped to No. 2. As of last week, the leader of the pack is—the envelope, please–the New York Fed, which holds the Federal Reserve’s Treasury bills, notes, bonds, and TIPs. (TIPS are Treasury Inflation Protected Securities.) As of last week the Fed’s System Open Market Account held $1,108 billion in U.S. government debt. “

- 15 Things You Need to Do, Before Reading Another Financial Blog – “Set up a system to monitor your next goal – Now that you have a goal, set up a system to monitor your progress. I have Mint email monthly progress reports on my financial goals. Another way is track your goal is by doing a monthly review.”

- How Much House Can You Afford? by Ryan Guina – “if your mortgage payment is expected to jump $500 a month, set that money aside for a few months as part of your normal budgeting. Do this for other spending categories that may increase, such as utilities, home owner’s insurance, taxes, etc.”

- MERS: Stop Foreclosing in Our Name by Barry Ritholtz – “Allow me to spell this out for you more specifically: MERS is an abomination, a legal blasphemy that should be destroyed before it unleashes the four horsemen of the apocalypse.”

Related: investing books – articles on investing – Curious Cat Investing and Economics Search