I think the current investing climate worldwide continues to be very uncertain. Historically I believe in the long term success of investing in successful businesses and real estate in economically vibrant areas. I think you can do fairly well investing in various sold long term businesses or mutual funds looking at things like dividend aristocrates or even the S&P 500. And investing in real estate in most areas, over the long term, is usually fine.

When markets hit extremes it is better to get out, but it is very hard to know in advance when that is. So just staying pretty much fully invested (which to me includes a safety margin of cash and very safe investments as part of a portfolio).

I really don’t know of a time more disconcerting than the last 5 years (other than during the great depression, World War II and right after World War II). Looking back it is easy to take the long term view and say post World War II was a great time for long term investors. I doubt it was so easy then (especially outside the USA).

Even at times like the oil crisis (1973-74…, stagflation…, 1986 stock market crash) I can see being confident just investing in good businesses and good real estate would work out in the long term. I am much less certain now.

I really don’t see a decent option to investing in good companies and real estate (I never really like bonds, though I understand they can have a role in a portfolio, and certainly don’t know). Normally I am perfectly comfortable with the long term soundness of such a plan and realizing there would be plenty of volatility along the way. The last few years I am much less comfortable and much more nervous (but I don’t see many decent options that don’t make me nervous).

One of the many huge worries today is the extreme financial instruments; complex securities; complex and highly leveraged financial institution (that are also too big to fail); high leverage by companies (though many many companies are one of the more sound parts of the economy – Apple, Google, Toyota, Intel…), high debt for governments, high debt for consumers, inability for regulators to understand the risks they allow too big to fail institutions to take, the disregard for risking economic calamity by those in too big to fail institutions, climate change (huge insurance risks and many other problems), decades of health care crisis in the USA…

A recent Bloomberg article examines differing analyst opinions on the Chinese banking system. It is just one of many things I find worrying. I am not certain the current state of Chinese banking is extremely dangerous to global economic investments but I am worried it may well be.

I was just taking a look at a couple of properties in Zillow and found it interesting how big the real estate tax bite can be. I have 2 rental properties and the real estate tax cost is 15% and 12% of the rental income. At least for my area Zillow underestimate rent rates (the vacancy rate is very low and properties in general rent within days or weeks – at rates 10%+ higher than Zillow estimates on average -based on my very limited sample of just what I happen to notice).

I thought I would look at the real estate tax to property value estimate and rent estimate by Zillow in Various locations.

Arlington, Virginia – real estate taxes were 1% of estimated property value and 17.5% of rental estimate.

Chapel Hill, North Carolina – 1.5% of value and 41% of rental estimate.

Madison, Wisconsin – 2.4% of value and 39% of rental estimate.

Flagstaff, Arizona – .7% of value and 9.5% of rental estimate.

Grand Junction, Colorado – .4% of value and 6% of rental estimate.

This is just an anecdotal look, I didn’t try to get a basket of homes in each market I just looked at about 1-5 homes so there is plenty of room for misleading information. But this is just a quick look and was interesting to me so I thought I would share it. While the taxes are deductible (from the profit of the rental property) they are a fixed expense, whether the house is rented or not that expense must be paid.

A high tax rate to rental rate is a cash flow risk – you have to make that payment no matter what.

In my opinion one of the most important aspects of rental property is keeping the units rented. The vacancy rate for similar properties is an extremely important piece of data. Arlington, Virginia has an extremely low vacancy rate. I am not sure about the other locations.

I wanted to use Park Slope, Brooklyn, NYC but the data was confusing/limited… so I skipped it; the taxes seemed super low.

Related: USA Housing Rents Increased 5.4% in the Last Year (Sep 2012) – USA Apartment Market in 2011 – Top Markets in the USA for Buying Rental Property (2011) –

Home Values and Rental Rates

The USA economy is still in very fragile ground. The continued problems created by policies focused on aiding too big too fail institutions and continued huge federal budge deficits are dangerous. And the continued problems in Europe and mounting problems in China are not helping. Still, rental prices continue to rise across the USA.

The graph above shows housing rents (as shown by the Zillow rent index) have increased 5.4% in the last year (through July) across the USA. In Boston the increase was 4.5%; Grand Junction, Colorado -4.9%; San Francisco up 8.8%; Washington DC up 7.3%; Raleigh, NC up 1.8% (though the last one couldn’t be added to the graph for some reason). I just picked some cities I found interesting – with some diversity.

Housing prices are up 1.2% in the same period, according to the Zillow price index.

When looking at data on rental prices and home prices you will notice different sources give different readings. Judging these changes across the nation is very difficult and requires making judgements. Even at the local level the measures are imprecise so the figures you see will vary. Taking a look at several different measures, from reputable sources, is often wise.

Related: USA Apartment Market in 2011 – Top USA Markets for Buying Rental Property – Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Apartment Rents Rise, Slightly, for First Time in 5 Quarters (April 2010)

The extremely low interest rate environment created by the too big to fail financial institution bailouts has severely harmed savers. Most severely harmed those in retirement that didn’t count on irresponsibly regulators and bankers creating a situation where to avoid a depression they had to punish savers to favor large banks (and others).

For some savings that might normally go into bonds (if the bond market were not so manipulated by the central banks to punish savers) dividend stocks are a good option. The stocks have risks but frankly with extremely strong companies with huge amounts of positive cash flow the future looks brighter than it does for those debt ridden governments.

Apple (AAPL) announced they will start paying a $2.65 quarterly dividend which works out to $10.60 annually. At the current stock price, this is a yield of nearly 1.9%. That is hardly going to make you rich but it is extremely attractive when you can get a much higher yield than savings account, treasury bills… and have the potential gains in stock price. Yes you do also have risk of a declining stock price, but as I have said I think Apple’s stock is an extremely good investment now.

Other good options include: Intel (INTL) which offers a 3.3% yield and Abbott (ABT) which offers a 3.4% yield. I own those 3 and also ONEOK Partners (OKS) which sports a 4.8% yield (but is a bit tricker situation that is suitable for a lower investment I think).

Even a stock like Toyota (TM), which I like as an investment, while it offers only a 1.8% yield that is much higher than you get for savings or treasury bills. So even stocks that are not about yield in the normal market conditions offer an attractive yield today.

I am a bit nervous about health care dividend investments but Pfizer (PFE) is worth considering at 4.1% (as are JNJ and MRK). I really like ABT (they have raised dividends for over 40 straight years, I think), sadly they are splitting into 2 companies. Even so I am planning on staying invested but it is avery big change and would make me worried about having too much committed to ABT.

The national occupancy climbed 110 basis points during the year, and effective rents jumped 4.7% according MPF Research.

Occupancy rates increased to 94.6% at the end of 2011, up from 93.5% a year ago and from 91.8% when the occupancy rates bottomed in late 2009.

MPF Research predicts occupancy rates to increase another 50 basis points, and rents to rise 4.5%.

Northern California’s apartment markets ranked as the nation’s rent growth leaders during calendar 2011, despite the fact that some weakness registered in the performances recorded in parts of the Pacific Northwest specifically during the fourth quarter. Year-over-year, effective rents for new leases jumped 14.6% in San Francisco, 12.3% in San Jose, and 9% in Oakland. With rents down 0.4%, Las Vegas was the nation’s only major apartment market that lost pricing power during calendar 2011.

Rent Growth Leaders in Calendar 2011

| Rank | Metro Area | Annual Rent Growth |

| 1 | San Francisco | 14.6% |

| 2 | San Jose | 12.3% |

| 3 | Oakland | 9.0% |

| 4 | Boston | 8.3% |

| 5 | New York | 7.3% |

| 6 | Austin | 7.2% |

Related: Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Top USA Markets for Buying Rental Property – Apartment Rents Rise, Slightly, for First Time in 5 Quarters – It’s Now a Renter’s Market

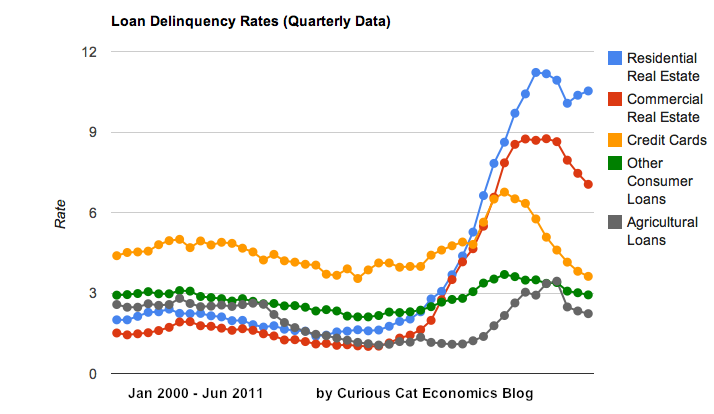

Chart showing loan delinquency rates from 2000-2011, shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

Residential real estate delinquency rates increased in the first half of 2011 in the USA. Other debt delinquency rates decreased. Credit card delinquency rates have actually reached a 17 year low.

While the job market remains poor and the serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk for world economic stability the USA economy does exhibit positive signs. The economy continues to grow – slowly but still growing. And the reduction in delinquency rates is a good sign. Though the residential and business real estate rates are far far too high.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

For the first time ever average 30 year fixed mortgage rates have fallen under 4%. My guess about interests rates have not been very good the last decade or so. I can’t believe people actually want to lend at these rates but obviously I have been wrong. The risks of lending at these rates over the long term just seem way too high to take a paltry 4%. But obviously I have been wrong.

So if you didn’t refinance when I suggested it (and refinance, myself), previously, you may want to look at doing so now. Or you may believe that listen to me about interest rates doesn’t seem very wise.

I have even read that banks are reducing fees in order to encourage refinancing. Seems crazy to me, but what do I know.

You do need to have a decent loan to value ratio (certainly no more than 90%, and probably 80% would be better). That can be difficult for those that have had large decreases in their homes value. Also you need a great credit rating and a stable job situation. But if you qualify refinancing at these rates should be a great financial move for many. I’m perfectly happen to have done so earlier, I didn’t quite pick the bottom but I still think over 30 years these rates (the current rates and earlier rates of 4 1/4% or 4 3/8%) will seem like a dream.

Related: Fixed Mortgage Rates Reach New Low (August 2010) – Lowest 30 Year Fixed Mortgage Rates in 37 Years (Dec 2008) – The Impact of Credit Scores and Jumbo Size on Mortgage Rates (Jan 2009)

Buying investments when prices are low is often a good investment strategy. Sometimes the prices just get lower, so it doesn’t always work. But, most likely the USA housing market will turn around, at some point. Buying real estate before prices start to rise may well be a very profitable investment. And rental property can be a very good investment, even without price appreciation, if the rental income provides a nice cash flow. This is especially true with interest rates so low (so a decent cash flow is very attractive compared to other investments). Of course, real estate investing also has challenges.

The HomeVestors-Local Market Monitor Best Markets to Invest in Rental Property ranking forecasts the expected performance of rental real estate properties, specifically single-family homes maintained as rental properties. The rankings show the extra return, or risk-return premium, that an investor must demand from rental property in a local market. The risk-return premium can be added to the regular capitalization rate to produce a risk-adjusted cap rate at full occupancy for a local market. The ranking is calculated based on three-year forecasts of home prices (reflecting underlying home-price appreciation potential) and gross rents (as a proxy for potential investor cash flow). Of course, this is based on the creators expectation (and therefore hardly to be relied upon – they have no track record to measure against yet) but it is interesting.

The Top 10 markets in the new ranking are:

- Las Vegas, Nevada

- Detroit, Michigan

- Warren, Michigan

- Orlando, Florida

- Bakersfield, California

- Tampa-St. Petersburg, Florida

- Phoenix, Arizona

- Ft. Lauderdale, Florida

- Rochester, New York

- Stockton, California

Obviously their expectations favor cities that have seen drastic price declines. And that makes sense, as long as those cities rental markets are steady and housing prices stabilize.

An interesting piece of data: HomeVestors and Local Market Monitor estimate that approximately 14% of single-family homes in the USA are maintained as rental properties.

I do believe rental property investments in many markets in the USA may well be quite wise. Investing in rental properties is much more difficult than say stocks and has some high costs (if you chose to higher a property manager, for example). Real estate also requires a long term (5+ year commitments) to have reasonable expectations of successful investing results.

Related: Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Home Values and Rental Rates – Landlords See Increase in Apartment Rentals (June 2010)

I am renting my house in Arlington, Virginia. If you are interested here is a great house with a large yard in a wonderful, quiet neighborhood near the Washington DC metro, great restaurants, parks, shopping and more. See more pictures of the house and floorplans.

Related: backyard wildlife – Apartment Vacancies Fall to Lowest in 3 Years in the USA – Apartment Rents Rise, Slightly, for First Time in 5 Quarters (April 2010)

Read more

Apartment Vacancies in U.S. Fall to Lowest in Almost Three Years

…

Effective rents, or what tenants actually pay, increased in 75 of the 82 markets Reis tracks, to an average $991 a month from $967 a year earlier and $986 in the fourth quarter. Landlords’ asking rents also climbed, to $1,047 from $1,027 a year earlier and $1,043 in the previous quarter, according to the report.

…

San Jose, California, had the most growth in effective rents during the past year, with 5.2 percent, followed by suburban Virginia and New York City, according to Reis. Effective rents declined 1.5 percent in Las Vegas during the year and grew the least in Orlando, Florida; and Colorado Springs, Colorado.

Rents have been slowly recovering the last year, after the economic shocks of the credit crisis. People, moved back into parents house and more people started sharing apartments and houses in the last few years as people where thrown out of jobs due to the after effects of the financial actions by large financial institutions. Slowly the economy has been recovering and jobs have been slowly growing and as a result the rental market has been strengthening .

Also the decline in construction the last few years has decreased the normal addition to supply. At the same time the population has continued growing. Some areas of the country seem to still have a large overcapacity in housing but areas that are adding jobs (such as Northern Virginia and New York City) are seeing increasing rents.

I have 2 properties for rent in Arlington, Virginia.

Related: Landlords See Increase in Apartment Rentals (July 2010) – USA Housing Inventory Puts Pressure on Prices (Sep 2010) – Apartment Rents Rise, Slightly, for First Time in 5 Quarters (Apr 2010) – It’s Now a Renter’s Market (Apr 2009) – Housing Rents Falling in the USA (Feb 2009)