BenefitsCheckUp is a free service of the National Council on Aging. Many adults over 55 need help paying for prescription drugs, health care, utilities, and other basic needs. There are over 2,000 federal, state and private benefits programs available to help those living in the USA. But many people don’t know these programs exist or how they can apply.

BenefitsCheckUp asks a series of questions to help identify benefits that could save you money and cover the costs of everyday expenses in areas such as:

- Medications

- Food

- Utilities

- Legal

- Health care

- Housing

- Taxes

- Transportation

- Employment Training

While the National Council on Aging is focused on benefits for older people the service actually finds many sources that are not dependent on age.

If you complete the overall questionnaire it is fairly long (about 30 questions) but still can be completed in 10 minutes. Also you can target your request (say to health care) and have a shorter questionnaire. They will provide links and contact information to various programs you may qualify for based on your answers.

Related: Disability Insurance is Very Important – Personal Finance, Minimal Budgeting – Truly Free Credit Report – Manage Your Borrowing and Avoid Debt Negotiators

Credit scores are far from a great measure of whether a person is a great credit risk for a specific loan, in my opinion. However, they are very widely used and therefor, very important. They also are somewhat useful. And lenders don’t base judgement solely on credit scores, they consider many other factors, if they have any sense at all.

Credit scores range from 300 to 850. They are calculated by various credit reporting organizations, including FICO. They factor in payment history, percent of outstanding credit available that is used, credit report checks, length of outstanding credit accounts, etc..

Metlife report on consumers and credit scores provides some interesting data.

| Credit score range | Default rate* |

|---|---|

| 740-850 | .4% |

| 680-739 | 2.8% |

| 620-679 | 7.5% |

| 550-619 | 17% |

| 300-459 | 33.8% |

* Default rate in this case means, 90 days past due. MetLife got this data from the Consumer Financial Health Study dataset**.

Peer to peer lending platform, Lending Club, limits loans to those with a minimum credit score of 660 (remember there are multiple organizations that provide credit scores, this minimum is based on Lending Club’s score). In general I see scores above 700 in A and B loans, scores from 650-700 in C and D loans. Remember the credit score is not the only factor setting the rate (you will see scores above 700 in the C loans sometimes, etc.). Credit scores provide some insight but are just 1 factor in approving loans or setting rates (an important one but not a completely dominant one).

About 38% of people have credit scores from 750-850. Another 37% from 600-749 and about 25% from 350-599.

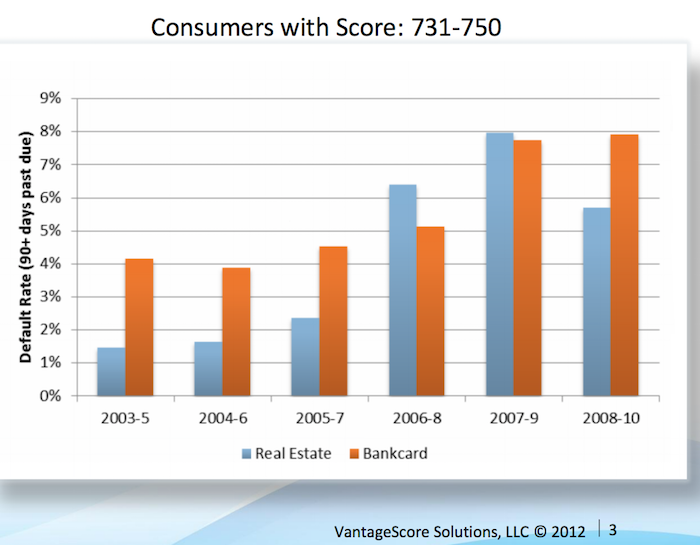

Vantage Score decided to make their score range go up to 1000, not the standard 850. Maybe a 750 score for them is comparable to 680? They say super-prime is 900+ (750-850 on more common scale), prime is 701-900 (680-739), near-prime 641-700 (620-679), subprime 501-640 (550-619). Anyway that chart shows the changing default rates from 2003 to 2010 by type of loan.

This Federal Reserve report on meeting between Federal Reserve Board staff and Fair Isaac Corporation (FICO) 20 June 2013 has some interesting material.

For guidance, the following table generally matches a borrower’s odds-of-default with the corresponding FICO 8 score (calculated on performance from Oct 2008 – Oct 2010). Of course, the range of scores and odds-of-default [the data is related to mortgages] will vary with each model as creditors develop and validate their own credit scoring models.

Odds-of Default FICO 8 Score percent of population** 5:1 610 9% 10:1 645 9% 20:1 685 6% 30:1 705 6% 40:1 720 6% 50:1 735 9% 100:1 770 30%

As you can see at a 610 level, 20 loans out of 100 defaulted. At 685 just 5 in 100 defaulted and at 770 just 1 in 100 did.

** I had to adjust this, because the report didn’t report it in this form, so it a very approximate measure (I made estimates for something like scores from 735 to 769 etc.). Again this is data from the Oct 2008 – Oct 2010 period. The rest of the population (about 25%) would have scores below 610.

Related: The Impact of Credit Scores and Jumbo Size on Mortgage Rates (2009) – Your FICO credit score explained – $2,540,000,000,000 in USA Consumer Debt

This page references a Fed report (that I can’t find) that found the following default rates on new loans for the two years after origination, 2000-2002:

| Credit score range | Default rate* |

|---|---|

| under 520 | 41% |

| 520-559 | 28% |

| 560-599 | 23% |

| 600-639 | 16% |

| 640-679 | 9% |

| 680-719 | 4.4% |

| over 720 | <1% |

The Consumer Financial Health Study respondents were asked to self-assess their credit quality and for permission to pull their actual credit scores.8 Forty-five percent of survey participants granted permission, yielding an “opt-in” sample size of 3,215. We appended two objective measures of creditworthiness to the dataset: Experian provided VantageScore 3.0 credit scores, and LexisNexis Risk Solutions provided RiskView scores. VantageScore is a generic credit scoring model that was created by the three major credit bureaus (Equifax, Experian and TransUnion) and, in addition to tradeline data, includes rent, utility and cell phone payment data when it is available in consumer credit files.

Health insurance options are confusing for those of us in the USA (those outside the USA are free of the frustrations of USA health care system). One of the features of a health insurance plan in the USA is the out-of-pocket “maximum.”

Now if you think you understand english you might think this is the maximum you have to pay out of your pocket. If you understand how horrible the USA health care system is and how nothing is easy, you probably suspect it isn’t a maximum at all. I find myself thinking that I don’t really understand what this seemingly simple value actually means, so I decided to research it and write this blog post.

First of all you have to pay the monthly premiums (assuming your employer doesn’t pay them for you), probably a few hundred or more dollars every month. Then the coverage likely has a deductible maximum for the year.

For this example, for 1 person the insurance costs $300/month with a yearly deductible maximum of $5,000. And the insurance plan says there is an out-of-pocket “maximum” of $6,500. Well 12 *$300 + $5,000 = $8,600. So, as you can probably guess, out-of-pocket “maximum” doesn’t actually mean the maximum out of your pocket. In fact the $8,600 is excluded from the out-of-pocket maximum calculation altogether.

So, you then might think ok, my actual out-of-pocket maximum (the most I will have to pay all year for health care) is $8,600 + $6,500 = $15,100. But that isn’t right either.

First, this is only for covered medical expenses, uncovered medical expenses are not included. This makes some sense, certainly, but in your planning, you can’t think your health care costs are capped at $15,100. Especially since in the USA lots of health care will be uncovered (dental care is often excluded, mental health care may well be limited, certain types of treatment may not be covered, prescription glasses, non-prescription drugs, addiction treatment…).

Remember, USA health care coverage isn’t even just limited by the type of care. For example, even if fixing your injured leg is covered, if you don’t do it using exactly the right places (where your health plan covers the cost), it may be considered to be uncovered care. In general, emergency care is more flexible for what is covered, but the horror stories of dealing with health insurers refusal to pay for provided health care adds risk to any health care someone gets in the USA.

Here is a good explanation of out-of-pocket cost questions (in this quote looking at out of network costs): “Out of Pocket Maximum” and health insurance plan terminology and calculation?

Peer to peer lending has grown dramatically the last few years in the USA. The largest platforms are Lending Club (you get a $25 bonus if you sign up with this link – I don’t think I get anything?) and Prosper. I finally tried out Lending Club starting about 6 months ago. The idea is very simple, you buy fractional portions of personal loans. The loans are largely to consolidate debts and also for things such as a home improvement, major purchase, health care, etc.).

With each loan you may lend as little as $25. Lending Club (and Prosper) deal with all the underwriting, collecting payments etc.. Lending Club takes 1% of payments as a fee charged to the lenders (they also take fees from the borrowers).

Borrowers can make prepayments without penalty. Lending Club waives the 1% fee on prepayments made in the first year. This may seem a minor point, and it is really, but a bit less minor than I would have guessed. I have had 2% of loans prepaid with only an average of 3 months holding time so far – much higher than I would have guessed.

On each loan you receive the payments (less a 1% fee to Lending Club) as they are made each month. Those payments include principle and interest.

This chart shows the historical performance by grade for all issued loans that were issued 18 months or more before the last day of the most recently completed quarter. Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses. From LendingClub web site Nov 2015, see their site for updated data.

Lending Club provides you a calculated interest rate based on your actual portfolio. This is nice but it is a bit overstated in that they calculate the rate based only on invested funds. So funds that are not allocated to a loan (while they earn no interest) are not factored in to your return (though they actually reduce your return). And even once funds are allocated the actual loan can take quite some time to be issued. Some are issued within a day but also I have had many take weeks to issue (and some will fail to issue after weeks of sitting idle). I wouldn’t be surprised if Lending Club doesn’t start considering funds invested until the loan is issued (which again would inflate your reported return compared to a real return), but I am not sure how Lending Club factors it in.

This chart shows that the percentage of millionaire families by highest education level is dramatically different by education level. The data is looking at USA family income for household headed by a person over 40. For high school dropouts, fewer than 1% are millionaires; all families it is about 5%; high school graduates about 6%; 4 year college degree about 22% and graduate or professional degree about 38%.

Interesting chart based on Federal Reserve data (via the Wall Street Journal)

While the costs of higher education in the USA have become crazy the evidence still suggests education is highly correlated to income. Numerous studies still show that the investment in education pays a high return. Of course, simple correlation isn’t sufficient to make that judgement but in other studies they have attempted to use more accurate measures of the value of education to life long earnings.

Related: The Time to Payback the Investment in a College Education in the USA Today is Nearly as Low as Ever, Surprisingly – Looking at the Value of Different College Degrees – Engineering Graduates Earned a Return on Their Investment In Education of 21%

The blog post with the chart, Why Wealth Inequality Is Way More Complicated Than Just Rich and Poor has other very interesting data. Go read the full post.

Average isn’t a very good measure for economic wealth data, is is skewed horribly by the extremely wealthy, median isn’t a perfect measure but it is much better. The post includes a chart of average wealth by age which is interesting though I think the $ amounts are largely worthless (due to average being so pointless). The interesting point is there is a pretty straight line climb to a maximum at 62 and then a decline that is about as rapid as the climb in wealth.

That decline is slow for a bit, dropping, but slowly until about 70 when it drops fairly quickly. It isn’t an amazing result but still interesting. It would be nice to see this with median levels and then averaged over a 20 year period. The chart they show tells the results for some point in time (it isn’t indicated) but doesn’t give you an idea if this is a consistent result over time or something special about the measurement at the time.

They also do have a chart showing absolute wealth data as median and average to show how distorted an average is. For example, median wealth for whites 55-64 and above 65 is about $280,000 and the average for both is about $1,000,000.

Related: Highest Paying Fields at Mid Career in USA: Engineering, Science and Math – Wealthiest 1% Continue Dramatic Gains Compared to Everyone Else – Correlation is Not Causation: “Fat is Catching” Theory Exposed

The number of USA households spending more than 50% of their income on rent is expected to rise at least 11% to 13.1 million by 2025, according to new research by Harvard University’s Joint Center for Housing Studies and Enterprise Community Partners.

The findings suggest that even if trends in incomes and rents turn more favorable, a variety of demographic forces—including the rapid growth of minority and senior populations—will exert continued upward pressure on the number of severely cost-burdened renters.

Under the report’s base case scenario for 2015-2025, the number of severely burdened households aged 65-74 and those aged 75 and older rise by 42% (830,000 to 1.2 million) and 39% (890,000 to 1.2 million); the number of Hispanic households with severe renter burdens increases 27% (2.6 million to 3.4 million); and the number of severely burdened single-person households jumps by 12% (5.1 million to 5.7 million).

Graph from the report. The blip of an improvement from 2010 to 2013 is due to the decline in home ownership which changed the makeup of the “rental population.” Moderate (severe)

burdens are defined as housing costs of 30–50% (more than 50%) of household income. Households with zero or negative income are assumed 30 to be severely burdened, while renters not paying cash rent are assumed to be unburdened.

Enterprise Community Partners argues for more government action on affordable housing. I am worried about such efforts being done in a sensible way but I do agree with the concept of supporting affordable housing. I would use zoning to require affordable housing construction along with market rate housing.

Doing such things well requires a government that is not corrupt and fairly competent which isn’t so easy looking across the USA (unfortunately). An example of somewhere that does this fairly well is Arlington Country, Virginia (which also has a good non-profit focused on affordable housing). Good non-profits can play a vital part in affordable housing over the long term.

The Leading Causes of Bankruptcy

The most important thing you can do to avoid bankruptcy is understand why a million people a year end up filing bankruptcy. 4 out of the top five reasons starts with medical expenses. This is followed by:

- Job loss

- Divorce

- Unexpected disaster

In some ways, all four items can be categorized as unexpected disaster. If we expanded the list just a bit more, it would include failure to have a proper financial plan. By now, the unexpected is so common, we ought to be expecting it. When the vicissitudes of life catch us completely off guard, bankruptcy is often the result.

This is why a proper emergency fund is so important for any personal financial plan.

Learn to Properly Use Credit

I separated poor or excessive use of credit from the rest as it is the only one of the top five that is self-inflicted. By now, it should be clear that using credit appropriately is important for a successful financial life.

Many people advise those struggling with debt to cut up the credit cards. Other financial advisors say just the opposite. Store credit cards such as those from Walmart can actually prove beneficial in the right hands. Today we have many personal financial tools at our disposal, if we use them wisely they can be very helpful, if you use them foolishly we will pay.

Live Below Your Means

One of the biggest mistakes people make is to live up to their means. They commit to all kinds of services they can afford at the time. But because Job instability is such a real and present reality, the loss of even a little bit of income suddenly leaves us living above our means. We need to adjust our lifestyle expectations to something lower than what we think we can afford.

Even applying this advice to the best of your ability, you still might have to file for bankruptcy. It is important to know that bankruptcy is not the end of the line. There are those who can help you recover. Bankruptcy is not a punishment, but a solution. It is the ultimate second chance.Â

If you fall into bankruptcy the important thing is to change your habits and practices to take advantage of your second financial chance.

When you sell your primary residence in the USA you are able to exclude $250,000 in capital gains (or $500,000 if you file jointly). The primary test of whether it is your primary residence is if you lived there 2 of the last 5 years (see more details from the IRS). You can’t repeat this exemption for 2 years (I believe).

It doesn’t matter if you buy another house or not, that exclusion of up to $250,000 is all that can be excluded (you must pay tax on anything above that amount – taxed at capital gains rates for long term gains).

For investment property you can do 1031 exchanges which defers capital gains taxes. Otherwise capital gains will be taxed as you would expect (as capital gains).

When you inherit a house the tax basis will be “stepped up” to the current market rate. So if you then sell your basis isn’t what the owner paid for it, but what it was worth when it was given to you.

Related: Looking for Yields in Stocks and Real Estate – Your Home as an Investment – Home Values and Rental Rates

Credit is the ability to buy now and pay later. It takes credit to get an auto loan, a mortgage and other types of financing. Your credit score says a lot about your credit habits. This is a three-digit number ranging from 300 to 850, and it tells creditors how likely you are to pay your bills. The higher your credit score, the better your chances of getting approved for financing and the lower your interest rate will be.

Credit has many benefits. Most people can’t pay cash for homes, college education or new cars. Without loans, buying a house or car would be impossible for many. And since it takes credit to build credit, many people apply for their first credit card in college to establish a credit history. A credit card also provides emergency funds when we’re short on cash.

Although we use credit regularly as consumers, there are dangers associated with credit. We can avoid some of these problems with responsible use. But unfortunately, credit management education isn’t taught in high school, and many adults don’t learn about credit management until after they’ve made mistakes.

Potential Dangers of Credit

Credit puts a lot of things within our financial reach, so it’s easy to get in over our heads. We might not have enough in savings to purchase an electronic device or take a vacation, but with one quick application, we can get approved for financing and take advantage of life’s pleasures. There’s nothing wrong with getting a loan. But some people can’t stop using credit and they get into serious debt.

Too much debt has a significant negative impact on your personal finances. Paying off that debt will reduce your available disposable income to build an emergency fund (if you haven’t done so already) or save for retirement a house or other large purchases.

Of course, debt isn’t the only thing to be concerned with. Getting credit also means you’re vulnerable to identity theft. This is one of the fastest growing crimes in the U.S. And while some people think it can’t happen to them, no one is invincible.

Keeping Your Credit Report Accurate

Identity theft involves someone stealing your personal information and purchasing items in your name or opening new accounts in your name. It can drive down your credit score and take several months or years to fix. Identity theft often goes unnoticed because some people never monitor their personal credit reports or file credit disputes

You might wonder, what is a credit dispute? As a consumer, you have the right to check your credit history and receive one free credit report from each of the bureaus annually. You are entitled to ask questions about anything included within your credit reports.Â

A new study, Secure Retirement, New Expectations, New Rewards: Work in Retirement for Middle Income Boomers, explores how Boomers are blurring the lines between working for pay and retirement (as I have discussed in posts previously, phased retirement).

From their report:

The define middle income as income between $25,000 and $100,000 with less than $1 million in investable assets and boomers as those born between 1946 and 1964.

Nearly 70% of retirees retired earlier than they planned to. Many did so due to health issues. Only 3% retired so they could travel more.

48% of middle income boomer retirees wish they could work. For those wishing to, but unable to work: 73% cannot due to health, 17% can’t find a job and 10% must care for a loved one.

Nearly all (94%) nonretirees who plan to work in retirement would like some kind of special work arrangement, such as flex-time or telecommuting, but only about one third (37%) of currently employed retirees have such an arrangement.

It seems to me, both employees and employers need to be more willing to adapt. Workers seem to be more willing, even though they claim they are not: this is mainly a revealed versus stated preference, they claim they won’t accept lower pay but as all those that do show, they really are willing to do so, they just prefer not to. This report is based on survey data which always has issue; nevertheless there are interesting results to consider.

61% of middle income boomers who ware working say they do so because they want to work, not because they have to work.

Only 12% of working middle income boomer retirees work full time all year. 60% work part-time. 7% are seasonal while 16% are freelance and 4% are other. Of those identifying as non-retired 75% work full time while 17% are part-time.

49% plan to work into their 70’s or until their health fails.

51% are more satisfied with their post-retirement work than their pre-retirement work. 27% are equally satisfied with their jobs.

As I have stated in previous posts I think a phased approach to retirement is the most sensible thing for society and for us as individuals. Employers need to provide workable options with part time work. The continued health care mess in the USA makes this more of a challenge than it should be. With USA health care being closely tied to employment and it costing twice as much as other rich countries (for no better results) it complicates finding workable solutions to employment. The tiny steps taken in the Affordable Care Act are not even 10% of magnitude of changes needed for the USA health care system.

Related: Providing ways for those in their 60’s and 70’s (part time schedules etc.) – Companies Keeping Older Workers as Economy Slows (2009) – Keeping Older Workers Employed (2007) – Retirement, Working Longer to Make Ends Meet