Banks continue to pay our politicians well to make sure they continue doling out special favors to the large banks. It is up to you, and your neighbors whether you hold politicians accountable for the actions they took to create the climate for the credit crisis and the huge favors granted (with your money) by politicians to those investment bankers. The bankers count on their money buying the politicians. I would have to say they are smart to believe that, though there is a small chance the invulnerability they feel is possible to pierce with enough foolish moves by the bankers and their friends (but in order for that to happen people would have to actually vote to elect ethical, intelligent and patriotic politicians instead of those who play the public for fools). I would put my money on the public again using their votes to elect those that will enrich special interests that pay the politicians at the expense of the country.

Banks Say No. Too Bad Taxpayers Can’t

To protect themselves from getting piles of garbage loans shoveled their way when they buy mortgages, Fannie and Freddie require lenders or loan servicers to sign contracts requiring those firms to repurchase loans that don’t meet certain standards relating to borrower incomes, job status or assets. Loans that were extended fraudulently, or deemed to have been predatory, are also candidates for buybacks.

Surprise, surprise: banks don’t want to repurchase these loans. So when Fannie or Freddie identify problem mortgages and request repayment, a battle royal begins. Banks may argue, for example, that the repayment requests have flaws of their own.

But for us as taxpayers, watching this battle from the sidelines, one growing concern is how aggressively Fannie and Freddie will pursue their requests. If banks refuse to buy back flawed loans, taxpayers will have to cover more of the losses.

…

According to March 31 figures from Freddie, for instance, the amount of problem loans that it has asked other firms to buy back stood at $4.8 billion — up 26 percent from $3.8 billion just three months earlier.

…

Banks have been unwilling to mark all of the bad loans they have and mortgage securities they hold to their true values because that would require a loss,” said Kurt Eggert, a professor at the Chapman University School of Law. “But this is about banks trying to avoid losses and having the taxpayers absorb them.”

…

Michael Cosgrove, a Freddie spokesman, said that the company is aggressive about enforcing its right to recover on questionable loans because it has a duty to be a good steward of taxpayer dollars. “These reviews are more important than ever; there is no reason why taxpayers should pay for decisions that led to the sale of bad loans to Freddie Mac,” he said.

$4.8 billion? That seems amazingly low for all the fraudulent activity these banks are suppose to have engaged in. But so long as they can foist the problem loans into the taxpayers hands they can claim to deserve billions in bonuses for themselves. The staggering magnitude of the special favors bought by the bankers is amazing. The politicians have shown they are supporting their banking friends while saying a few tough words. And most likely the politicians and bankers will be celebrating another successful election this fall. If we want to change the outcome we can. But we don’t seem interested in doing so.

Related: Paying Back Direct Cash from Taxpayers Does not Excuse Bank Misdeeds – The Best Way to Rob a Bank is as An Executive at One – Sabotaging Regulated Financial Markets Leads to Predictable Consequences – Congress Eases Bank Laws – 1999

The fallout of the credit crisis continues. The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 10.1% percent of all loans outstanding as of the end of the first quarter of 2010, an increase of 59 basis points from the fourth quarter of 2009, and up 94 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased 106 basis points from 10.4% in the fourth quarter of 2009 to 9.40% this quarter.

The percentage of loans on which foreclosure actions were started during the first quarter was 1.23%, up 3 basis points from last quarter but down 14 basis points from one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.63%, an increase of five basis points from the fourth quarter of 2009 and 78 basis points from one year ago. This represents another record high. The combined percentage of loans in foreclosure or at least one payment past due was 14.0% on a non-seasonally adjusted basis, a decline from 15.0%.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 9.54%, a decrease of 13 basis points from last quarter, but an increase of 230 basis points from the first quarter of last year.

“The issue this quarter is that the seasonally adjusted delinquency rates went up while the unadjusted rates went down. Delinquency rates traditionally peak in the fourth quarter and fall in the first quarter and we saw that first quarter drop in the data. The question is whether the drop represents anything more than a normal seasonal decline or a more fundamental improvement. Most importantly, the normal seasonal drop is coming right at the point where we believe delinquencies could potentially be declining and the problem for the statistical models is determining which is which,” said Jay Brinkmann, MBA’s chief economist.

“The seasonal models say it is not a fundamental improvement and that the seasonal drop should have been larger to represent a true improvement, hence the increase in the seasonally adjusted numbers. Yet there is reason to believe the seasonally adjusted numbers could be too high. Simply put, fundamental market factors may be having a greater influence on the delinquency rates than is normally the case, but mathematical models have difficulty discerning the difference over a short period of time.

“Since discerning what represents a fundamental improvement versus a simply seasonal improvement is probably more of an art than a mathematical science at this point, the seasonally adjusted numbers should be viewed with a degree of caution.

The seasonally adjusted delinquency rate increased for all loan types with the exception of FHA loans. On a seasonally adjusted basis, the delinquency rate stood at 6.2% for prime fixed loans, 13.5% for prime ARM loans, 25.7% for subprime fixed loans, 29.1% percent for subprime ARM loans, 13.2% for FHA loans, and 8.0% for VA loans. On a non-seasonally adjusted basis, the delinquency rate fell for all loan types.

The foreclosure starts rate increased for all loan types with the exception of subprime loans. The foreclosure starts rate increased six basis points for prime fixed loans to 0.7%, 17 basis points for prime ARM loans to 2.3%, 18 basis points for FHA loans to 1.5%, and 8 basis points for VA loans to 0.9%. For subprime fixed loans, the rate decreased nine basis points to 2.6% and for subprime ARM loans the rate decreased 39 basis points to 4.3%.

Predicting is much harder than explaining past data. But I believe the odds for better reports on foreclosures and delinquencies over the next 12 months. Delinquencies may well rise. But it is certainly possibly things will get worse. And if the jobs added each month doesn’t average close to 200,000 things will likely not be very good. My guess is we will add over 2.0 million jobs in the USA in the next 12 months but that is far from certain.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Another Wave of Foreclosures Loom (July 2009) – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008)

Charlie Munger’s Thoughts on Just About Everything by Morgan Housel

Benjamin Graham used to say, “It’s not the bad investment ideas that fail; it’s the good ideas that get pushed into excess.” And that’s a lot of what happened here.

Some economic distortions come from the masses believing that other people are right. Others come from the need to make a living through behavior that may be less than socially desirable. I’ve always been skeptical of conventional wisdom. You have to be able to keep your head on when everyone else is losing theirs.

…

Take soccer as an example. It’s a tremendously competitive sport, and often times one team tries to work mayhem on the other team’s best player. The referee’s job is to limit this mayhem and rein in extreme forms of competition.

Regulation is similar. Most ambitious young men will be more aggressive than they should. That’s what happened with investment banking. I mean, look at Lehman Brothers. Everyone did what they damn well wanted until the whole place was pathological about its extremeness.

…

A lot of this [financial collapse] can be blamed on accountants. Accountants as a whole have been trained with too much math and not enough horse sense. If some of these insane accounting practices were never allowed, huge messes could have been avoided. Bankers have become quite good at manipulating accountants

…

Learning has never been work for me. It’s play. I was born innately curious. If that doesn’t work for you, figure out your own damn system.

More good thoughts from Warren Buffett’s partner at Berkshire Hathaway.

Related: Buffett and Munger’s 2009 Q&A With Shareholders – Berkshire Hathaway Annual Meeting 2008 – Misuse of Statistics, Mania in Financial Markets – Leverage, Complex Deals and Mania

According to a new report on Privately Held, Non-Resident Deposits in Secrecy Jurisdictions the United States is the country with the largest amount of private, non-resident, deposits. Cayman Islands takes second, upholding its commonly held reputation as a tax haven often used to avoid paying taxes own by wealthy people. Switzerland comes in 9th.

The countries with the most private, foreign deposits in billion of $US.

| Country | June 2008 | June 2009 | |

|---|---|---|---|

| 1 | United States | $2,899 | $2,183 |

| 2 | Cayman Islands | $1,515 | $1,550 |

| 3 | United Kingdom | $1,796 | $1,534 |

| 4 | Luxembourg | 588 | 435 |

| 5 | Germany | 494 | 426 |

| 6 | Jersey | 544 | 393 |

| 7 | Netherlands | 413 | 316 |

| 8 | Ireland | 273 | 276 |

| 9 | Switzerland | 289 | 274 |

| 10 | Hong Kong | 325 | 268 |

Since 2001 deposits in the Cayman Islands have more than tripled, while those in the UK have close to tripled and in the USA they have a bit more than doubled.

- Total Current total deposits by non-residents in offshore centers and secrecy jurisdictions are just under US$10 trillion;

- The United States, the United Kingdom, and the Cayman Islands top the list of jurisdictions, with the United States out in front with more than US$2 trillion in non-resident, privately held deposits in the most recent quarter for which data are available (June 2009);

- Contrary to expectations of perceived favorability for deposits, Asia accounts for only 6 percent of worldwide offshore deposits, although Hong Kong is the tenth most popular secrecy jurisdiction by deposits in this report;

- The rate of growth of offshore deposits in secrecy jurisdictions has expanded at an average of 9 percent per annum since the early 1990s, significantly outpacing the rise of world wealth in the last decade. The gap between these two growth rates may be attributed to increases in illicit financial flows from developing countries and tax evasion by residents of developed countries.

The report is an interesting read and provides some background on the banking practices often used in concert with wealthy people avoiding paying taxes. As you may we recall we noted that rich USA tax evaders tried to sue to hide their illegal activities from the Department of Justice. As far as I know those rich thieves have not been put in jail. I guess stealing tens and hundreds of thousands of dollars from the United States of America, by rich people, is not seen as important (either that or brides work to make sure the way rich people steal isn’t punished) say compared to some teenager stealing from a store.

Related: Government Debt Globally as Percentage of GDP 1990-2008 – USA, China and Japan Lead Manufacturing Output in 2008 – Oil Consumption by Country in 2007

The credit crisis has shown the lack of political (or regulatory) skill, ethics and character that the USA has now. The solutions are not simple. Some are obvious, like limiting leverage, not providing huge favors to those that pay politicians huge amounts of cash… While Canadian banking regulators actually did their jobs well it is hard to believe most any American regulators will do well given the last 20 years of failures. Raghuram Rajan provides some interesting thoughts on potential improvement in: Making Debt Holders into Watchdogs

Some banks – such as Citibank, Lehman Brothers, and Royal Bank of Scotland – loaded up on both risks, holding enormous quantities of mortgage-backed securities on the asset side and paying for them with short maturity debt on the liability side. Why did they do it? The simple answer: It was very profitable, provided the tail events did not materialize. Think of insurers that write a lot of earthquake policies (another tail risk). If you didn’t know they were writing earthquake insurance and not setting aside reserves, you would think they were enormously profitable until there’s a quake. For banks, there was always the threat of a day of reckoning when liquidity dried up and defaults skyrocketed. But they set aside few reserves against that happening.

…

Particularly worrisome, as my colleague Douglas Diamond and I have argued, is that once banks are leveraged enough that they will be severely distressed if economywide liquidity dries up, they double down on risky bets.

…

Here’s the drill: To make it harder for tail-risk-taking banks to grow, all banks should be required to issue a minimum level of debt (say, 10% of assets) that is automatically impaired – either converted to equity or written down – if the bank suffers sufficient losses. This will quickly change debt holders’ views on risky expansion. Moreover, no financial institution should be allowed to hold this debt.

Related: Why Congress Won’t Investigate Wall Street – Scientists Say Biotechnology Seed Companies Prevent Research – Drug Prices in the USA

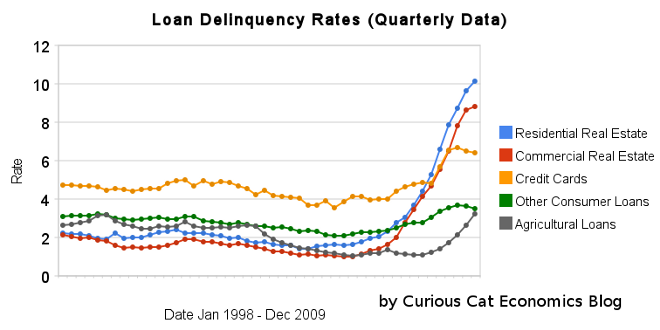

The chart shows the total percent of delinquent loans by commercial banks in the USA.

That last half of 2009 saw real estate delinquencies continue to increase. Residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies in 98 basis points to 8.81%. Agricultural loan delinquencies also increased (112 basis points) though to just 3.24%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.

Related: Loan Delinquency Rates Increased Dramatically in the 2nd Quarter – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… – posts with charts showing economic data

Read more

Half of Commercial Mortgages to Be Underwater

…

We now have 2,988 banks – mostly midsized, that have these dangerous concentrations in commercial real estate lending.” As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

…

Warren said it’s time for the government to “pull the plug” on mortgage lenders Fannie Mae and Freddie Mac. “I’m one of those people who never liked public-private partnership to begin with. I think what they did was use public when public was useful and private when private was useful,” she said. “And I think we’ve got to rethink that whole thing.”

“There is no implicit guarantee anymore,” she added. “I don’t care how big you are, if you make serious enough mistakes, then your business can be entirely wiped out.”

Financially literate people should know that the current commercial real estate market is in serious trouble. I still figure it will rebound well. I just want to wait and see how far prices fall and then try to buy when people are so frustrated they will sell at very low prices.

Related: Commercial Real Estate Market Prospects Remain Dim – Mortgage Delinquencies and Foreclosures Data Indicates 2010 Could Show Improvement – Jumbo Loan Defaults Rise at Fast Pace (Feb 2009)

Many people are ignoring huge costs (to the economy) and benefits (to those financial companies that ruined so many people’s lives and severely damaged the economy. Paying back money the government paid you is not that same as being innocent. While several of the too big to fail banks have paid back the direct cash they were given that is not an indication they are now off the hook for their disastrous behavior.

First we know that much of the money “sent to AIG” just went directly to Goldman Sachs and others. Those big banks had taken risks and the only way those risks paid off was with billions from taxpayers. Without that they would have been bankrupt. And then when they paid the money they received directly they still haven’t paid back the billions they got from taxpayers (via AIG). And this money was paid back at 100 cents on the dollar though those instruments were trading for much less in the market (the government certainly would have found a less costly solution but for ignorance or a desire to reward their former company and friends at Goldman Sachs.

Second, rates have been kept artificially low, to among other things, allow the big banks to make tens of billions (and costing savers tens of billions). Those savers have not been reimbursed for the losses caused by the big banks.

And third if I gamble with money from my company and win my bet on the Super Bowl and then put the money back, I am still not innocent. Just because many of the big banks have paid back the money they were given directly by taxpayers does not mean they didn’t get huge benefits from the government. Pretending they are not bad guys because after ruining the economy, costing millions of people their jobs and savings, getting many benefits from the government, they then pay back the direct cash payments is not accurate.

Response to: The New Bank Tax

Related: Elizabeth Warren Webcast On Failure to Fix the System – The Best Way to Rob a Bank is as An Executive at One – Failure to Regulate Financial Markets Leads to Predictable Consequences – Jim Rogers on the Financial Market Mess – Congress Eases Bank Laws (1999)

Nobel Prize winning economist Joseph Stiglitz explores the current financial system and the damage done to the economy due to that system. As he states in the video the credit crisis is not something that happened to the financial institutions. The credit crisis caused recession is something the financial sector did to us.

He covers the topics he discusses in the video in his new book: Freefall

Related: There is No Invisible Hand – Failure to Regulate Financial Markets Leads to Predictable Consequences – Market Inefficiencies and Efficient Market Theory – Congress Eases Bank Laws (1999) – Volcker on the Great Recession and Need for Reform

Yields are staying amazingly low today. Due to the credit crisis the federal reserve is shifting hundreds of billions of dollars from savers to bankers to allow banks to make up for losses they experienced (both in losses on bad loans and huge cash payments made to hundreds of executives over more than a decade). For that reason (and others) yields are extremely low now which is a great burden on those that saved and counted on reasonable investment yield.

Don’t be fooled by apologist for those causing the credit crisis that try and excuse their behavior and act as those paying back the bailout payments means they paid back the favors they were given. They have received much more from the policies of the federal reserve that has taken hundreds of billions of dollars from savers and given it to bankers. It has the same effect as a direct tax on savers being paid to bankers.

What is an investor/saver to do? James Jubak provides some excellent advice.

How to maximize what your cash pays even when nothing is paying much of anything now

You could lock your money up for decades and get 4.56% in a 30-year Treasury bond but 30 years is forever. And besides interest rates have to go up from today’s lows and that means bond prices will be coming down, probably fast enough to eat up all the interest that bond pays and more.

…

Not if you remember that interest rates are going up in most of the world (except maybe Europe and Japan) quite dramatically over the next 12 months. A year from now, perhaps sooner, you’ll be able to get yields swell north of anything you can find now.

That pretty much means that you’re guaranteed to lose money two ways by locking it up for the long term now.

…

For the short term you need to put your cash into something that’s as safe as possible but that offers you as much income as possible—and that doesn’t lock up your money for very long.

My choice dividend paying stocks—if they pay a high dividend, are extremely liquid, and are battle tested.

Whether you agree with his suggestions in the article is up to you. But even if you don’t he provides a very good overview of the options and risks that you have to navigate now as an investor seeking investments that provide a decent yield. I agree with him that interest rates seem likely to rise, making bonds an investment I largely avoid now myself.

Related: posts on financial literacy – Jubak Picks 10 Stocks for Income Investors – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – Bond Yields Show Dramatic Increase in Investor Confidence