Mosaic offers a new investment option to easily invest in solar energy projects. Mosaic connects investors seeking steady, reliable returns to high quality solar projects. To date, over $2.1 million has been invested through Mosaic and investors have received 100% on-time repayments.

The site provides full prospectives on each project. The yields have been between 4.5% and 5% for 8 to 10 year projects. The funds pay for solar installation and then the locations that take the loans pay them back with the saving on their electricity bill (sometimes selling power to the utility based on the organizations electricity needs and amount generated at any specific time).

The bonds have risks, of course. And I am pretty sure they are very illiquid. But for those looking for some decent yield alternatives they may offer a good choice. They also provide the benefit of supporting green energy

The current bond being offered, 657 kW on Pinnacle Charter School in Federal Heights, Colorado offers a yield of 5.4%. The public offerings have only been available for a few months and they have sold out quickly so far.

Mosaic has done a good job creating a simple process to invest online. You create your account and if you chose to invest and are allocated a portion of an offering it is funded from your bank account. You can invest as little as $25.

Related: Looking for Yields in Stocks and Real Estate – Taking a Look at Some Dividend Aristocrats – Pay as You Go Solar in India – posts on solar energy on Curious Cat Science and Engineering blog

Us treasury yield hit a incredibly low level years ago and they have continued to fall further. Granted this is mainly due to the bailout of the economy necessitated by the politicians favors to the too-big-too-fail financial institutions that have given those politicians so much cash over the years. Other factors are at play but the extent of the excessive punishment of savers is mainly due to political bailouts of bankers and bailouts of the economy caused by the bankers actions.

This extremely low rate environment is crippling to many retirees. The small percentage that actually did what they were told to have been blindsided by years of artificially low rates (and it is likely to continue for years). This has pushed some that would have been comfortable in retirement into an uncomfortable one an has pushed some from a challenging balancing act to essentially having to eliminate every possible expense (and even that may not be enough).

I can’t believe long term bonds are a sensible investment now. Of course I haven’t thought they were for 10 years, but they are even worse now. Bonds of “strong” governments (USA, Germany, Japan) are paying less than inflation (sometimes even less than 0 nominally – I think this has just been for short term issues so far).

I cannot see putting more than token amounts into long term bonds at these rates. Corporate bonds are not much better. The economic damaged caused by out of control too-big-too-fail institution is huge and continuing. And the politicians that have been paid lots of cash by those too-big-too-fail institutions continue to treat the too-big-too-fail players are favored friends. The yields are corporate bonds are not good for companies that are strong.

The alternatives are not great. But real assets, strong dividend stocks, strong company stocks, and short term bonds seem like better options to me in many cases. And hope we elect people that will put the economic interest of the country ahead of a few well paid friends at too-big-too-fail institution. They also need to eliminate the captured “regulators” that have facilitated the continued wrecking of the global economy. I don’t hold out much hope for this though. We keep re-electing those given lots of cash by the too-big-too-fail crowd and they continue giving them favors. We are getting what we deserve given this poor performance on our part but it is pretty annoying having to watch us vote ourselves into economic calamity.

Related: Buffett Cautions Against Buying Long Term USD Bonds – Is Adding More Banker and Politician Bailouts the Answer? – Bill Gross Warns Bond Investors – Congress Eases Bank Laws (1999)

The basics of retirement planning are not tricky. Save 10-15% of your income for about 40 years working career (likely over 15%, if you don’t have some pension or social security – with some pension around 10+% may be enough depending on lots of factors). That should get you in the ballpark of what you need to retire.

Of course the details are much much more complicated. But without understanding any of the details you can do what is the minimum you need to do – save 10% for retirement of all your income. See my retirement investing related posts for more details. Only if you actually understand all the details and have a good explanation for exactly why your financial situation allows less than 10% of income to be saved for retirement every year after age 25 should feel comfortable doing so.

There is value in the simple rules, when you know they are vast oversimplifications. I am amazed how many professionals don’t understand how oversimplified the rules of thumb are.

Here is one thing I see ignored nearly universally. I am sure some professions don’t but most do. If you have retirement assest such as a pension or social security (something that functions as an annuity, or an actually annuity) that is often a hugely important part of your retirement portfolio. Yet many don’t consider this when setting asset allocations in retirement. That is a mistake, in my opinion.

A reliable annuity is most like a bond (for asset allocation purposes). Lets look at an example for if you have $1,500 a month from a pension or social security and $500,000 in other financial assets. $1,500 * 12 gives $18,000 in annual income.

To get $18,000 in income from an bond/CD… yielding 3% you need $600,000. That means, at 3%, $600,000 yields $18,000 a year.

Ignoring this financial asset worth the equivalent of $600,000 when considering how to invest you $500,000 is a big mistake. Granted, I believe the advice is often too biased toward bonds in the first place (so reducing that allocation sounds good to me). To me it doesn’t make sense to invest that $500,000 the same way as someone else that didn’t have that $18,000 annuity is a mistake.

I also don’t think it makes sense to just say well I have $1,100,000 and I want to be %50 in bonds and 50% in stocks so I have “$600,000 in bonds now” (not really after all…) so the $500,000 should all be in stocks. Ignoring the annuity value is a mistake but I don’t think it is as simple as just treating it as though it were the equivalent amount actually invested.

Related: Immediate Annuities – Managing Retirement Investment Risks – How to Protect Your Financial Health – Many Retirees Face Prospect of Outliving Savings

Pitfalls in Retirement (pdf) is quite a good white paper from Meril Lynch, I strongly recommend it.

could safely spend 10% or more of their savings each year.

But, as explained below, the respondents most on target were the one in 10 who estimated sustainable spending rates to be 5% or less. This is significantly impacted by life expectancy; if you have a much lower life expectancy due to retiring later or significant health issues perhaps you can spend more. But counting on this is very risky.

This is likely one of the top 5 most important things to know about saving for retirement (and just 10% of the population got the answer right). You need to know that you can safely spend 5%, or likely less, of your investment assets safely in retirement (without dramatically eating into your principle.

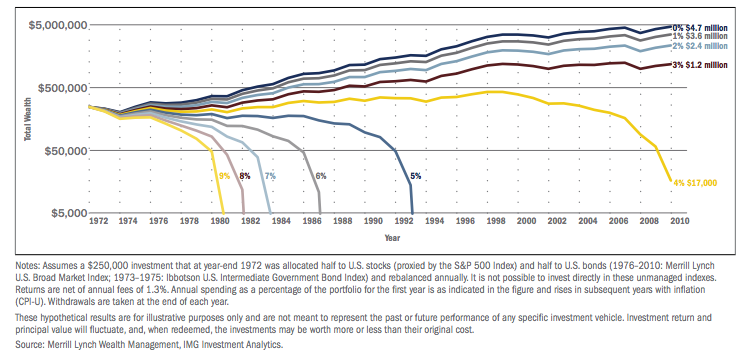

Chart showing retirement assets over time based on various spending levels, from the Merill Lynch paper.

The chart is actually quite good, the paper also includes another good example (which is helpful in showing how much things can be affected by somewhat small changes*). One piece of good news is they assume much larger expense rates than you need to experience if you choose well. They assume 1.3% in fees. You can reduce that by 100 basis points using Vanguard. They also have the portfolio split 50% in stocks (S&P 500) and 50% in bonds.

Several interesting points can be drawn from this data. One the real investment returns matter a great deal. A 4% withdrawal rate worked until the global credit crisis killed investment returns at which time the sustainability of that rate disappeared. A 5% withdrawal rate lasted nearly 30 years (but you can’t count on that at all, it depends on what happens with you investment returns).

Related: What Investing Return Projections to Use In Planning for Retirement – How Much Will I Need to Save for Retirement? – Saving for Retirement

My preference is for a lower use of bonds than the normal portfolio balancing strategies use. I just find the risks greater than the benefits. This preference increases as yields decline. Given the historically low interest rates we have been experiencing the last few years (and low yields even for close to a decade) I really believe bonds are not a good investment. Now for someone approaching or in retirement I do think some bonds are probably wise to balance the portfolio (or CDs). But I would limit maturities/duration to 2 or 3 years. And really I would pursue high yielding stocks much more than normal.

In general I like high yielding stocks for retirement portfolios. Many are very good long term investments overall and I prefer to put a portion of the portfolio others would place in bonds in high yielding stocks. Unfortunately 401(k) [and 403(b)] retirement accounts often don’t offer an option to do this. Luckily IRAs give you the options to invest as you chose and by placing your IRA in a brokerage account you can use this strategy. In a limited investing option retirement account [such as a 401(k)] look for short term bond funds, inflation protected bonds and real estate funds – but you have to evaluate if those funds are good – high expenses will destroy the reasons to invest in bond funds.

There are actually quite a few attractive high yield stocks now. I would strive for a very large amount of diversity in high yield stocks that are meant to take a portion of the bonds place in a balanced portfolio. In the portion of the portfolio aimed at capital appreciation I think too much emphasis is placed on “risk” (more concentration is fine in my opinion – if you believe you have a good risk reward potential). But truthfully most people are better off being more diversified but those that really spend the time (it takes a lot of time and experience to invest well) can take on more risk.

A huge advantage of dividends stocks is they often increase the dividend over time. And this is one of the keys to evaluate when selected these stock investments. So you can buy a stock that pays a 4% yield today and 5 years down the road you might be getting 5.5% yield (based on increased dividend payouts and your original purchase price). Look for a track record of increasing dividends historically. And the likelihood of continuing to do so (this is obviously the tricky part). One good value to look at is the dividend payout rate (dividend/earnings). A relatively low payout (for the industry – using an industry benchmark is helpful given the different requirement for investing in the business by industry) gives you protection against downturns (as does the past history of increasing payouts). It also provides the potential for outsized increases in the future.

There are a number of stocks that look good in this category to me now. ONEOK Partners LP pays a dividend of 5.5% an extremely high rate. They historically have increased the dividend. They are a limited partnership which are a strange beast not quite a corporation and you really need to read up and understand the risks with such investments. ONEOK is involved in the transportation and storage of natural gas. I would limit the exposure of the portfolio to limited partnerships (master limited partnerships). They announced today that the are forecasting a 20% increase in 2012 earnings so the stock will likely go up (and the yield go down – it is up 3.4% in after hours trading).

Another stock I like in this are is Abbott, a very diversified company in the health care field. This stock yields 3.8% and has good potential to grow. That along with a 3.8% yield (much higher than bond yields, is very attractive).

My 12 stocks for 10 year portfolio holds a couple investments in this category: Intel, Pfizer and PetroChina. Intel yields 3.9% and has good growth prospects though it also has the risk of deteriorating margins. There margins have remains extremely high for a long time. Maybe it can continue but maybe not. Pfizer yeilds 4.6% today which is a very nice yield. At this time, I think I prefer Abbott but given the desire for more diversification in this portion of the portfolio both would be good holdings. Petro China yields 4% today.

When invested in a retirement portfolio prior to retirement I would probably just set up automatic reinvesting of the dividends. Once in retirement as income is needed then you can start talking the dividends as cash, to provide income to pay living expenses. I would certainly suggest more than 10 stocks for this portion of a portfolio and an investor needs to to educate themselves evaluate the risks and value of their investments or hire someone who they trust to do so.

Related: Retirement Savings Allocation for 2010 – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors

The fundamental truth right now is that the overall economy in Europe, the USA and Japan is weak and has some serious long term problems. But the connection between that and company weakness is not incredibly strong. Many companies have huge cash hoards, built up through the large profits they continue to make. Yes, the economy entering a serious downturn will hurt many companies. A railroad is going to lose some sales if retail sales decline (and so they don’t have to be shipped). Airlines (historically problematic companies to begin will) will struggle. Banks that pay exorbitant amounts to senior staff have trouble making money without handouts of taking huge risks that then result in more handouts once the risks fail (as usually a bad economy will expose the risks they have taken). Companies that can only do well based on large top line growth will suffer. But that isn’t all companies.

When you look at companies like Google, Apple, Tesco, Danaher, Amazon even Toyota I really don’t see many problems looking forward. They seem perfectly capable of staying profitable, even growing profits, even in the face of economic decline in Europe, the USA and Japan (if that happens: it is possible, but not certain – very low growth is possible). Companies that have very good prospects at staying profitable, even getting more profitable going forward are hardly the type of investment I want to sell. Especially not to put it in the bank and get 0%, or a money market fund and pay someone for the privilege of having my money.

The options for investing today don’t look so great. But I really don’t see any reason to be concerned about owning stocks that have good prospects to do well even if the quite a few large economies do poorly in the next decade. In fact I am happy to own them. Frankly the biggest worry I have is that the senior executives will loot the owners profits with exorbitant pay (this is not a worry at Toyota and less of one at Amazon). I would worry more about owning index funds in such an environment. But even as bad as things look now, I am not sure they will really turn out as bad as we fear – especially for many companies, for some yes, but many are well prepared for change).

And the prospects in emerging markets look incredibly good to me. Yes they will slow their growth a bit if the large economies stall, but I think it is foolish to avoid investments in China, Singapore, Brazil, Korea, India, Ghana, Malaysia, Indonesia. In fact that is where companies like Google, Tesco, Apple, Toyota and Amazon are going to be making lots of money. Emerging markets are volatile and the companies in them are too. This will continue.

Read more

His point on dollar cost averaging is sensible. Markets go up, more than down, overall [the statistically best approach] if you have a lump sum to invest the best strategy would be to invest it all now. There is added risk with this however, which he would accept. Also it doesn’t change the main reason people end up dollar cost averaging (by default, with retirement savings from each paycheck).

He discusses these ideas, and many more in his book: Debunkery: Learn It, Do It, and Profit from It-Seeing Through Wall Street’s Money-Killing Myths.

Related: Curious Cat investment books – Investment Risk Should be Evaluated as Part of a Portfolio, Rather than Risk of Each Individual Investment – Save Some of Each Raise

This is another article supporting my belief that long term bonds are not investments I want to take on now. The risks of inflation and low yields seem like a very bad combination.

Buffett Says Avoid Long-Term Bonds Tied to Eroding Dollar, quoting Warren Buffett:

…

“I would much rather own businesses,” he said. “It’s very easy to take away the value of fixed-dollar investments.”

By “take away” he mean the government can undertake policies to “inflate” their way out of a budget mess. By undertaking policies that create inflation (drastically increasing the money supply, borrowing huge amounts of money, running huge trade deficits…) the country can devalue the currency, the US dollar in this case, and thus reduce the effective cost of the payments they have to make on long term bonds (because they pay back the loans with devalued, inflated, dollars). I believe he is right and long term USD bonds are a very risky (inflation risk) investing option today. Of course I have felt the same way for the last 5 years. I own very little in the way of bonds – I do own a bit of TIPS (Treasury Inflation-Protected Securities), in my 401(k) – but stopped allocating money to that class in the last year.

Related: Bill Gross Warns Bond Investors (March 2010) – Bond Yields Stay Very Low, Treasury Yields Drop Even More – Who Will Buy All the USA’s Debt?

The biggest investing failing is not saving any money – so failing to invest. But once people actually save the next biggest issue I see is people confusing the investment risk of one investment in isolation from the investment risk of that investment within their portfolio.

It is not less risky to have your entire retirement in treasury bills than to have a portfolio of stocks, bonds, international stocks, treasury bills, REITs… This is because their are not just risk of an investment declining in value. There are inflation risks, taxation risks… In addition, right now markets are extremely distorted due to the years of bailouts to large banks by the central banks (where they are artificially keeping short term rates extremely low passing benefits to investment bankers and penalizing individual investors in treasury bills and other short term debt instruments). There is also safety (for long term investments – 10, 20, 30… years) in achieving higher returns to gain additional assets – increased savings provide additional safety.

Yes, developing markets are volatile and will go up and down a lot. No, it is not risky to put 5% of your retirement account in such investments if you have 0% now. I think it is much riskier to not have any real developing market exposure (granted even just having an S&P 500 index fund you have some – because lots of those companies are going to make a great deal in developing markets over the next 20 years).

I believe treating very long term investments (20, 30, 40… years) as though the month to month or even year to year volatility were of much interest leads people to invest far too conservatively and exacerbates the problem of not saving enough.

Now as the investment horizon shrinks it is increasing import to look at moving some of the portfolio into assets that are very stable (treasury bills, bank savings account…). Having 5 years of spending in such assets makes great sense to me. And the whole portfolio should be shifted to have a higher emphasis on preservation of capital and income (I like dividends stocks that have historically increased dividends yearly and are likely to continue). And the same time, even when you are retired, if you saved properly, a big part of your portfolio should still include assets that will be volatile and have good prospects for long term appreciation.

Related: books on investing – Where to Invest for Yield Today – Lazy Portfolios Seven-year Winning Streak (2009) – Fed Continues Wall Street Welfare (2008), now bankers pay themselves huge bonuses because the Fed transferred investment returns to too-big-to-fail-banks from retirees, and others, investing in t-bills.

Municipal bonds seem safe. But the incredible long period of irresponsible spending and taking on long term liabilities (pensions, health care costs, infrastructure to maintain) and low taxes and selling off future income streams (to consume today) leaves those bonds with questionable financial backing in many locations. Municipal bond investments should be examined more closely today in light of the problems in the market.

Video shows the State Budgets: The Day of Reckoning by 60 minutes.

Wave of Muni Defaults to Spur Layoffs, Social Unrest: Whitney

Muni experts, including an analyst from Standard & Poor’s, dismissed her predictions, saying the numbers don’t add up.

…

“States clearly have been funding municipal governments—for now up to 40 percent of their total expenditures,” she explained. “As the states become more compromised from a fiscal standpoint, that funding is going to end.”

…

Whitney added that it’s way too soon to see muni bonds as a buying opportunity. But she said that can change quickly.

“When you start to see the first major defaults in this area [the states and cities], when you see more defaults and indiscriminate selling—if you do your research now and figure out who’s protected where and which revenues are protected, there will be great buying opportunities,” Whitney said.

“People are complacent about these defaults. The news about all this isn’t out there yet,” Whitney went on to say. “And only when it is out there, then there will be a buying opportunity [for munis].”

Related: USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations – NY State Raises Pension Age to Save $48 Billion – What the Bailout and Stimulus Are and Are Not – posts on bonds