Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. This carnival is different than other carnivals: I select posts from what I read (instead of posting those that submit to the carnival as many carnivals do). If you would like to host the carnival add a comment below.

- Hospital of Cards by Andrew Foy, MD – “For some perspective on the magnitude of the healthcare bubble consider that from 1990 to 2007 the cost of all items, as measured by the Bureau of Labor Statistics (BLS), rose by 159 percent while housing rose 163 percent and medical care rose a staggering 216 percent. A recent study by the Kaiser Family Foundation found that between 1999 and 2011, health-insurance premiums increased 168 percent while workers’ total earnings increased only 50 percent. Over that same time period, government spending on healthcare increased 240 percent while GDP increased 62 percent. The BLS reported that over the last 50 years, the percent of workers employed in private-sector healthcare has gone from 3 percent to over 11 percent and employment has continued to grow throughout the current recession.”

- Apple’s Earning are Again Great, Significantly Exceeding High Expectations by John Hunter – Apple posted quarterly quarterly net profit of $11.6 billion (an increase of 94% in net income)… Apple’s Gross margin was 47.4% (the best ever) compared to 41.4% in the year-ago quarter. International sales accounted for 64% of the quarter’s revenue…

- Demand for Rental Units Could Disrupt Fed by Kathleen Madigan – “The supply among rental housing is the tightest in more than a decade as only 8.8% of units were vacant in the first quarter. And given the steep fall in homeownership rates in the U.S., the demand for rental units is the highest in 15 years.”

- 5 Reasons Why Dividend Investing Rocks – “Dividend investors always look for high and sustainable dividend growth and any stock that decides to slow that down or even stop growing the dividend entirely raises red flags.”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

|

Empire State Building, New York City by John Hunter |

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month. This carnival is different than others in two significant ways. First, I select posts from the blogs I read (instead of just posting those that submit to the carnival). I think this provides readers a better selection of valuable material (many of the best blogs don’t take time to submit to carnivals). And second, I include articles when I think they are interesting. I figure the primary purpose is to provide links to good recent content, so just because something isn’t a blog post doesn’t exclude it from inclusion.

- Recovering Adam Smith’s ethical economics – “He justified commercial society for its tremendous contribution to the prosperity, justice, and freedom of its members, and most particularly for the poor and powerless in society.” [This post covers a topic I think is very important and have written about several times – John]

- A Man. A Van. A Surprising Business Plan. by Zoe Chace – “Adam had tricked out the van to be a mobile solution to Chinese bureaucracy. There are a couple of Mac laptops and a printer, plus an old couch, Christmas lights and bamboo mats. It’s as cozy as a dorm room. And confused visa applicants line up outside.” [wonderful – John]

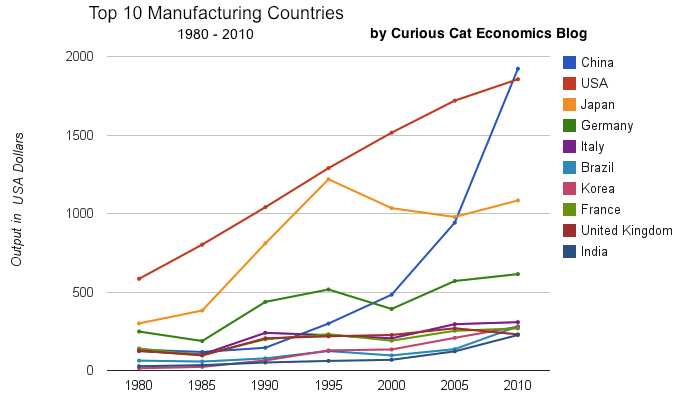

- Chart of Manufacturing Output from 2000 to 2010 by Country by John Hunter – “Europe has 4 countries in this list (if you exclude Russia) and they do not appear likely to do particularly well in the next decade, in my opinion. I would certainly expect Brazil, India, Korea and Indonesia to out produce Italy, France, UK and Spain in 2020. In 2010 the total was $976 billion by the European 4 to $961 billion by the non-European 4. In 2000 it was $718 billion for the European 4 to $343 billion (remember all the data is in 2010 USD).”

- Ultimate Sustainable Dividend Portfolio – “I would expect the Ultimate Sustainable to do better in difficult times and worse in great times. Why? The USDP is a more stable portfolio that will fluctuate less over time…”

Welcome to the Curious Cat Investing, Economics and Personal Finance Carnival: find useful recent personal finance, investing and economics blog posts and articles. The carnival is published twice each month.

The new year starts with markets still highly uncertain due to the after affects of the too-big to fail credit crisis and the Euro-zone crisis. Job markets leave many people’s personal finances is trouble and those that are in good shape have a much greater challenge determining what are optimal personal financial strategies.

And markets embody the uncertainty. Investing strategies are also made more difficult by the current uncertainties. Continuing with long held strategies seems wise, but less comforting in these troubled times.

- 32 Best Dividend Stocks for 2012 by Shailesh Kumar – “The following table lists the best dividend stocks for 2012 based on dividend yields, dividend growth rate and dividend sustainability. All the stocks in this list have a P/E ratio of 15 or below.”

- How I Switched to Long Term Thinking – “I started spending some time each day thinking about the decisions I made that day, particularly ones I would often see myself repeating. Outside of the moment, I’d look at the short term benefits of my options as well as the long term benefits and I’d decide independently what the best long-term choice was.”

- A Country In Denial About Its Fiscal Future by Robert Samuelson – “Political leaders assume that financial markets won’t ever choke on U.S. debt and force higher interest rates, stiff spending cuts and tax increases. At best, this is wishful thinking. At worst, it’s playing Russian roulette with the country’s future.”

Top 10 Countries for Manufacturing Production in 2010: China, USA, Japan, Germany… by John Hunter. China took over first place from the USA in manufacturing output in 2010. From 1980 to 2010 China increased output 1345%. The total top 10 group of countries increased output 302%. From 1995 to 2010 China increased output 543%. The group increased 64%.

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts and articles. If you want to have an post considered for the next carnival please submit it to quixperito: money.

- A Retailer’s Perspective on Amazon’s Amazingly Awesome Quarter by Scot Wingo – “This quarter provided more mounting evidence that Amazon is essentially running away with market share in e-commerce. Consequently, we believe retailers urgently need to think of an Amazon Strategy – partner, compete, co-opetition? Amazon is becoming so big and growing so fast, you almost can’t afford not get on this train.”

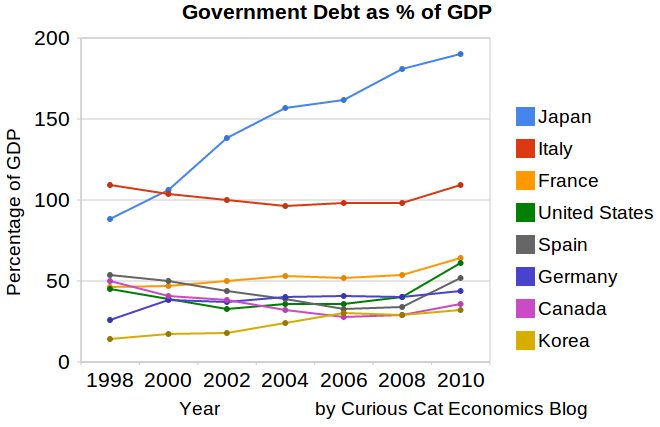

- Government Debt as Percent of GDP 1998-2010 for OECD countries by John Hunter – There has been a dramatic increase from 2008-2010. The USA is up from 41% of GDP to 61%. Spain is up from 34% to 52% (but given all the concern with Spain this doesn’t seem to indicate the real debt problems they have. Economic data contains quite of bit of noise, unfortunately.

- Cause of Decline in U.S. Financial Position by Barry Ritholtz – “The Pew Center reported in April 2011 the cause of a $12.7 trillion shift in the debt situation, from a 2001 CBO forecast of $2.3 trillion cumulative surplus by 2011 versus the estimated $10.4 trillion public debt in 2011. The major drivers were:

Revenue declines due to two recessions, separate from the Bush tax cuts of 2001 and 2003: 28%

Defense spending increases: 15%

Bush tax cuts of 2001 and 2003: 13%

Increases in net interest: 11%

Other non-defense spending: 10% - How This Blog Earns Full-Time Income from Part-Time Work by David Weliver – “for the most part, I’ve tried to focus on simply writing on topics that are unique, helpful, that answer specific questions. (It’s easy enough to be helpful, I think, but with billions of web pages out there, being unique is a never-ending challenge).”

- How to live off investment income – 1. Set up a cash buffer account between your regular monthly spending, and your income-spewing engines. 2. Work out how much of your annual investment income you will/can spend. The rest of the money you will reinvest…

- A Risky Investment Isn’t a Bad Investment by Kevin McKee – “If you want all the potential for Apple-esque gains, you need to be prepared to accept Enron-esque results. That’s the magic of risk; it goes both ways. Would I hold 100% of my portfolio in company stock? No.”

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- 5 Unconventional Ideas That Really Shouldn’t Be – “Before going to college or graduate school, know if this large investment of time and money is the best investment for you. For some people, college or grad school is the best investment. For some, self-education is.”

- 12 Stocks for 10 Years: Oct 2010 Update by John Hunter – Google is the top holding and top performer up 184% since the inception of the fund, PetroChina is up 102% and Templeton Dragon Fund is up 100%.

- 7 Ways To Retire Rich and On Time by Laura Adams – “1) Start an investing routine as early as possible. It might surprise you to know that the most important factor for investing success isn’t the investments you choose—it’s time… Compounding interest is a powerful force that can make even the most inexperienced investor rich… 4) Increase your savings rate each year. “

- 10 stocks for the next 10 years by James Jubak – “Johnson Controls (JCI). The stock did amazingly well in 2010—up 42.3%–considering that two of the company’s three businesses were in sectors of the economy that had been crushed. 2011 will be a better year for the company’s auto interior and auto battery business and for its building-wide energy efficiency unit… Yingli Green Energy Holding (YGE) is my choice for a horse to ride in China’s solar industry.”

- Six investing books that never left my bookshelf – “The Intelligent Investor: This has been referred to as the “value investor’s Bible” and the title is deserved. In it, Benjamin Graham, a former Columbia professor and the mentor of Warren Buffett, outlines his value-investing philosophy.”

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent personal finance, investing and economics blog posts I found interesting.

- “New Normal” math: How your investing plans must change – “I don’t think the implications of changing stocks’ rate of return from 10% to 5% have sunk in. We acknowledge that stock returns will be poor, and yet all of our retirement advice – save 10% of your income… withdraw 4% in retirement – stays the same.”

- Manufacturing Output as a Percent of GDP by Country by John Hunter – “For the 14 biggest manufacturing countries in 2008, the overall manufacturing GDP percentage was 23.7% of GDP in 1980 and dropped to 17% in 2008… USA economy dropped from 21% in 1980 to 18% in 1990, 16% in 2000 and 13% in 2008.”

- Masters of Earning More – “Ben actually loves his full-time job, but still freelances on the side. Earning more isn’t just for people who hate their job or are in severe credit-card debt. He freelances because he enjoys it.”

- Five plays on the China Middle Class Explosion by Cody Willard – “The middle class in China now stands at nearly 25% of the population (which is 50 million new members a year!).”

- Who Educates The Investors? by Bill Waddell – “Who would want to listen to the insights of someone concerning a manufacturing investment who knows so little about the current state of manufacturing that he thinks Toyota introduced lean to reduce working capital over a five year period?”

- Refinance Now, If You Can by David Weliver – “If you currently owe $200,000 on your mortgage at 5.75%, refinancing could save you more than $100 a month on your payment and reduce the interest you pay over the life of the loan.” (rates are down a bit more since this example was posted – John)

- A Cheap Internet Stock With High Dividend Yield – “stock offers an impressive 6.8% dividend yield and yet the stock only trades at 5x consensus 2011 earnings estimates.”

- Personal Finance Basics: Avoid Debt by John Hunter – “Debt is often toxic to personal financial success. The simple step you can take to avoid the problems many face is to just not buy things until you save up for them. If you want some new shoes or new Droid Incredible or to go see a football game (American or World Cup style) that is fine. Just save up the money and then spend it.”

Related: Curious Cat investing articles – Curious Cat Investing and Economics Custom Search Engine – Curious Cat Investing and Economics Carnival #5

The Curious Cat Investing and Economics Carnival highlight recent interesting personal finance, investing and economics blog posts.

- The money made by Microsoft, Apple and Google, 1985 until today – “In terms of profit Apple was ahead of Microsoft in the 1980s, but was then passed and left behind. This chart actually reveals that Apple’s upswing the last few years is the first time the company’s profits have really taken off in a big way. Another interesting observation is how closely the profits of Apple and Google match, even though Apple’s revenues are significantly higher.”

- Real Estate and Consumer Loan Delinquency Rates 1998-2009 by John Hunter – “That last half of 2009 saw residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies increase 98 basis points to 8.81%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.”

- The Principle That Can Make You Rich or Keep You Broke by David Weliver – “Unfortunately, inertia can also keep us at rest; the same principle that helps us achieve positive goals can make it increasingly difficult to escape bad habits.” (John: Very true, see my post on habits).

- Why do we work so much? – “The countries that consistently rank as having the world’s “happiest people” also tend to work fewer hours than people in the U.S… Most corporate ladders are designed to reward employees with money instead of time. Assuming we only want money to use as a tool for happiness, this makes no sense.”

- How Does Apple Become a $300 Billion Company? by Eric Bleeker – “The more Apple can look like the Microsoft of the mobile world, the more it will be worth. Commanding a market with even half the dominance Microsoft did with operating systems is a once-in-a-generation opportunity, but I’m not so sure the mobile world is built in a way that’ll allow that.”

- Top Fed Official Wants To Break Up Megabanks, Stop The Fed From Guaranteeing Wall Street’s Profits by Shahien Nasiripour – “I don’t think we have any business guaranteeing Wall Street spreads,” Hoenig said. “We need to recognize that and address it by removing these guaranteed extremely low rates. I think it’s extremely important that we do that, and not create the conditions for speculative activity and a new crisis down the road.”

- Evaluating Microfinance by Michael Frank – “I decided to use a variation on the “waiting list-control group” method regularly used in medical studies. My evaluation design requires a call for loan applicants in the most similar nearby community that does not have a similar microfinance program already present.”

Welcome to the Curious Cat Investing and Economics Carnival: we highlight interesting recent personal finance, investing and economics blog posts.

- The 4% rule and other fallacies of retirement planning – “I might try a 5% withdrawal rate, which according to the Trinity study, would give me an 80% chance of not outliving my money. As time goes on, I’ll adjust up or down depending on what life and the market throws at me.”

- The lesson of the Greek crisis: Every government cheats and no one wants to know by James Jubak – “The IMF projects that U.S. net debt as a percentage of GDP will be 66.8% in 2010, more than twice that for Canada, and gross debt will be 93.6% of GDP, still almost 14 percentage points above Canada’s.”

- Renting 101: What You Should Know Before You Sign by Austin Morgan – “Renter’s insurance helps protect the items in your apartment in case of theft or damage. The renter’s insurance will also cover you in case a visitor in your apartment gets injured or their items get damaged.”

- In the USA 43% Have Less Than $10,000 in Retirement Savings by John Hunter – “if you plan ahead you have a long time for compounding to work in your favor. Unfortunately most people continue to fail to make even the most minimal efforts to save for retirement”

- The US Has A Spending Problem, China Has A Savings Problem – “Back in 2005 the savings rate in the US dropped to below 1%. That’s sad considering up until the mid 80s we were always above 5% and crested 10% a few times… Our savings rate is currently just under 5%… The savings rate in China is something like 30%; and this number has grown in recent years, “

- When will the Fed raise interest rates? by Olivier Coibion and Yuriy Gorodnichenko – “given current information and barring political or populist pressures, one can reasonably expect the Federal Reserve to start raising interest rates toward the end of this year in its attempt to balance the risks of higher inflation against prolonging the current economic downturn.”

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent personal finance, investing and economics blog posts we found interesting.

- 5 Financial Milestones to Aim for By Age 30 – 1. Contribute to a Roth and a Traditional IRA… 2. Build Six Months Worth of Expenses in your Emergency Fund… 3. Make the Credit Card Companies Hate You…

- USA again the leading manufacturing country, data of the Largest Manufacturing Countries in 2008 by John Hunter – The USA’s share of the manufacturing output, of the countries that manufactured over $185 billion in 2008, 28% in 1990, 28% in 1995, 32% in 2000, 28% in 2005… 24% in 2008. China’s share has grown from 4% in 1990… 10% in 2000… to 18% in 2008.

- Afraid to stay in but scared to get out? Join the club by James Jubak – “If you have to keep $60,000 in cash so that you can sleep at night knowing that you’ve got your financial bases cover, then the loss of a potential gain on that money is, in my book, worth it. I’ve sold into this rally to sock away my kids’ tuition for 2010 and my 2010 tax payment.”

- Invented, Completely New Meaning of the “Invisible Hand” by Gavin Kennedy – “In fact, Stigler explicitly criticises ‘legends’ of the ‘naïve doctrine’ that Smith should be associated with notions that ‘whenever a person seeks to serve his own ends, he invariably serves the ends of society’.”

- The Quiet Danger of Non-Inflation-Adjusted Stock Returns by Stephen Dubner – “the ‘real-real’ value of stocks does make you appreciate how so many people got so jazzed about the spike in housing prices over the last decade: it’’ exciting to see inflation working in your favor day after day…”

- Think You Don’t Need Health Insurance? Think Again – “Very bad medical problems can and do happen to many of us – maybe even you. Those very bad medical problems can be very expensive and potentially ruin one’s financial future if they do not have adequate health insurance.”

- Don’t Be Suckered By Stock Market Rally In 2010 – “For those who do not want to invest, it is best to save up your money and wait for better opportunities since valuations are high right now… I suggest fixed deposits as the best option to preserve your principal.”

- Resolving U.S. Indebtedness: Various Scenarios by Arnold Kling – “Some major technologies, probably either wet or dry nanotech, produce so much economic growth that the ratio of debt to GDP stays under control. I give this a 20 percent chance… Inflate away the debt with moderate inflation… I gives this a 15 percent chance….”

Related: Curious Cat Investing and Economics Custom Search Engine – Curious Cat Investing and Economics Carnival #2