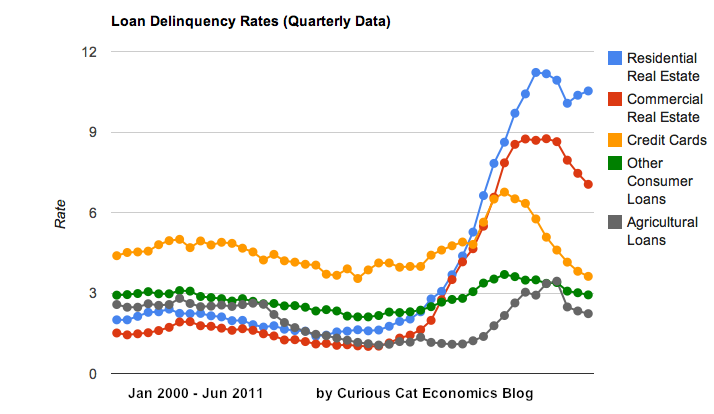

Chart showing loan delinquency rates from 2000-2011, shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

Residential real estate delinquency rates increased in the first half of 2011 in the USA. Other debt delinquency rates decreased. Credit card delinquency rates have actually reached a 17 year low.

While the job market remains poor and the serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk for world economic stability the USA economy does exhibit positive signs. The economy continues to grow – slowly but still growing. And the reduction in delinquency rates is a good sign. Though the residential and business real estate rates are far far too high.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

The national credit card delinquency rate (the rate of borrowers 90 or more days past due) decreased for the sixth consecutive quarter, dropping to 0.6% at the end of the second quarter in 2011. This is the lowest mark observed in 17 years. Credit card debt per borrower increased $20 in the quarter to $4,699, though it remains near record-low levels (and yet still at a level that is far too high).

Although credit card delinquencies were expected to drop, the data released today shows credit card delinquency rates improving by more than at any other time since the recovery began in 2009, both on a quarter-over-quarter basis (-18.9%) and on a year-over-year basis (-34.8%).

“National credit card delinquency rates have fallen to levels not seen since 1994 as consumers continue to tighten their spending,” said Ezra Becker, vice president of research and consulting in TransUnion’s financial services business unit. “TransUnion believes that the recovering economy is only indirectly impacting delinquency rates. More important and impactful to the decline in bank card delinquency are that consumers are using credit cards more responsibly; a large number of delinquent accounts have moved to charge-off status; and lenders remain conservative in their underwriting.”

The record low-level of credit card debt that has continued post recession is supported by a separate TransUnion credit card deleveraging analysis released in July. The analysis found that consumers made an estimated $72 billion more in payments on their credit cards than purchases between the first quarters of 2009 and 2010.

This is good news. We still need to reduce pay off much more of the excessive debt we took on living beyond our means the last few decades, but at least this is a small positive step. Overall consumer debt increased in the 2nd quarter, according to the Federal Reserve, and stands at over $2.45 Trillion. Revolving debt (credit cards) decreased slightly but non-revolving debt increased more. Consumer debt peaked near $2.55 Trillion in 2009 and recently bottomed just below around $2.4 in 2010. Consumer debt totals still need a great deal of improvement.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Consumer Debt Down, but Still Over $2.4 Tillion in the USA –

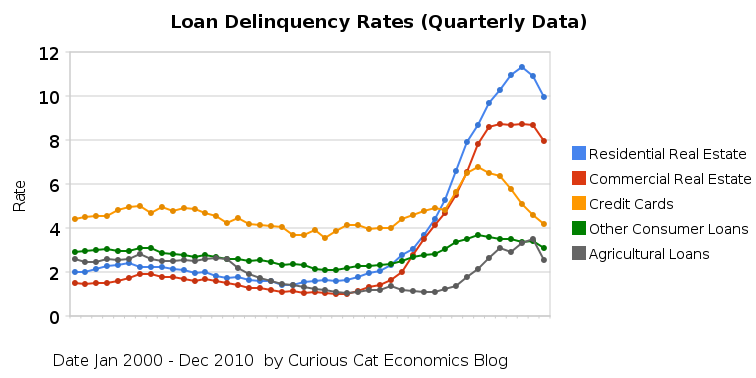

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The second half of 2010 saw real estate, agricultural, credit card and other loan delinquencies decrease. The rates are still quite high but at least are moving in the right direction. Residential real estate delinquencies decreased 138 basis points in the second half of 2010, to 9.94%, which brought them to just below the rate at the end of 2009. In the second half of 2010, commercial real estate delinquencies decreased 77 basis points to 7.97% (which was also exactly 77 basis points less than at the end of 2009. Agricultural loan delinquencies decreased 76 basis points, to 2.55% (down 53 basis points from the end of 2009). Consumer loan delinquencies decreased, with credit card delinquencies down 90 basis points to 4.17% and other consumer loan delinquencies down 27 basis points to 3.1%. The credit card delinquency rate decreased a very impressive 219 basis points in 210.

Related: Real Estate and Consumer Loan Delinquency Rates 2000 through June 2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – posts with charts showing economic data

Read more

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

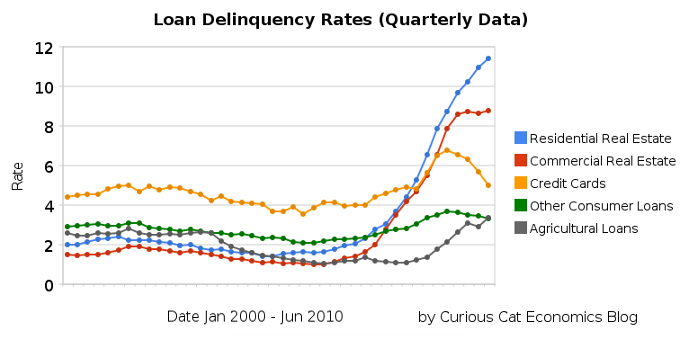

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The first half of 2010 saw residential real estate delinquencies continue to increase and other consumer loan delinquencies decreasing (both trends continue those of the last half of 2009). Residential real estate delinquencies increased 118 basis points to 11.4%. Commercial real estate delinquencies increased just 7 basis points to 8.79%. Agricultural loan delinquencies also increased (25 basis points) though to just 3.35%. Consumer loan delinquencies decreased, with credit card delinquencies down 131 basis points to 5.01% and other consumer loan delinquencies down 15 basis points to 3.34%.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… –posts with charts showing economic data

Read more

Consumer debt decreased at an annual rate of 3.25% in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 9.5%, and nonrevolving credit (car loans…) was about unchanged.

Revolving consumer debt now stands at $827 billion down $39 billion this year. That is on top of a $92 decline in 2009. Hopefully we can continue this success.

Through June of 2010 total outstanding consumer debt was $2,419 billion, a decline of $30 billion ($21 billion of the decline was in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion so far: from $2,561 billion to $2,449 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

Thankfully over the last year at least consumer debt has been declining, but it needs to decline more. I disagree with those that want to see short term improvement in the economy powered by consumer debt. It would be nice to see improvement to the current economy. But we can’t afford to achieve that with more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt

Number of the Week: Default Repercussions

As of April, 25% of Americans had fallen into the least-creditworthy category, garnering a rating of less than 600 from FICO, the main arbiter of consumer credit in the U.S. That compares to only 15% before the recession

…

Some may be able to get mortgage loans through Federal Housing Administration programs, which allow for credit scores as low as 580. But none will qualify for loans guaranteed by Fannie Mae or Freddie Mac, which account for the lion’s share of the market and typically require credit scores of at least 650. Getting auto loans or credit cards will also be tough.

Related: Avoiding the Vicious Cycle of Credit Problems – Personal Finance Basics: Avoid Debt – USA Consumer Debt Stands at $2.44 Trillion

Many aspects of personal finance can get a bit confusing or require some study to understand. But really much of it isn’t very complicated. Debt is often toxic to personal financial success. The simple step you can take to avoid the problems many face is to just not buy things until you save up for them. If you want some new shoes or new Droid Incredible or to go see a football game (American or World Cup style) that is fine. Just save up the money and then spend it.

If you limit your borrowing you will get ahead financially. I think borrowing for a home is fine (I suggest saving up a 20% down-payment – or at least 10%, and many banks are again requiring this sensible step). And don’t overextend yourself – borrow what you can comfortably afford – even if you run into financial difficulty. It might be likely you earn more 5 years from now, but it is certainly possible you will earn less. Remember that.

Borrowing for school is fine but be careful. Huge education debts are a large burden. Don’t ignore this factor when selecting a school. And don’t fall prey to the for-profit education scams that have become very prevalent. I would be very very skeptical of any for profit educational institution and would much prefer long term public or private institutions with long term success (colleges, universities and community colleges). Technical training can be very good but you have to be very careful to not be taken advantage of.

Borrowing for a car is ok, but I would avoid it if possible. And other than that I would avoid debt, if at all possible. If you want a big expensive wedding, fine, save up the money. If you want a vacation to East Africa, great, save up the money. If you want the latest, new tech gadget, great save up the money first.

And saving up for your emergency fund (if it isn’t fully funded already) and for retirement should be right after food, shelter, health and disability insurance and any debt you already have to be paying back. After you have committed money to your emergency fund and retirement then choose what to do with your remaining discretionary income. It is critical to have built up an emergency fund so if you have any emergency you can tap that without going into debt and digging yourself a personal financial hole you have to dig out of.

Personal financial success is not some get rich quick scheme or magic. Success is Achieved by doing some really simple things well. It is not complicated but that isn’t the same thing as easy. Showing restraint is not what we are urged to do by the marketers. So while not buying what you can’t afford is not exactly an amazing insight, hundreds of millions of people (in the USA and Europe I know, and probably everywhere that consumer debt is easy to get) fail financially just because they refuse to follow this advice.

Related: Avoid credit card debt – How to Protect Your Financial Health – Curious Cat personal finance basics – Can I Afford That?

Default, Not Thrift, Pares U.S. Debt

…

That sounds like a lot, but it’s better than it was before: At its peak in the first quarter of 2008, the debt-to-income ratio stood at 131%. Economists tend to see 100% as a reasonable level, so we’re almost a third of the way there.

…

Since household debt hit its peak in early 2008, banks have charged off a total of about $210 billion in mortgage and consumer loans, including credit cards. If one assumes that investors suffered at least that much in losses on similar loans that banks packaged and sold as securities (a very conservative assumption), then the total – that is, the amount of debt consumers shed through defaults – comes to much more than $400 billion.

Problem is, that’s more than the concurrent decrease in household debts, which amounts to only $372 billion, according to the Federal Reserve. That means consumers, on average, aren’t paying down their debts at all. Rather, the defaulters account for the whole decline, while the rest have actually been building up more debt straight through the worst financial crisis and recession in decades.

Interesting data, and not good news. We need to reduce consumer debt levels by reducing the borrowing we are doing. This is not a new need. We have been living beyond our means for far too long. That is not a solid base for an economy. It does boost current GDP but only by consuming future productive capacity (when you borrow from external sources – other countries – as we have been doing).

Related: USA Consumer Debt Stands at $2.44 Trillion – How a Family Shed $106,000 in Debt

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 it has fallen over $112 billion so far: from $2,561 billion to $2,449 billion. Through April of 2010 total outstanding consumer debt $9 billion (so essentially it has been at a standstill). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

The solution to this problem is to stop spending beyond your means by even increasing levels of personal and government debt. Thankfully over the last year at least consumer debt has been declining. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt