Delinquencies in closed-end loans fell slightly in the second quarter, driven by a drop in home equity loan delinquencies, according to results from the American Bankers Association’s Consumer Credit Delinquency Bulletin.

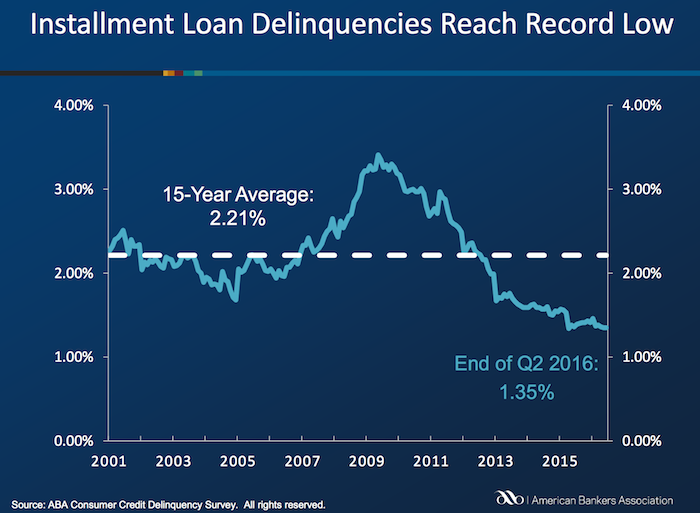

The composite ratio, which tracks delinquencies in eight closed-end installment loan categories, fell 3 basis points to 1.35% of all accounts – a record low. This also marked the third year that delinquency rates were below the 15-year average of 2.21%. The ABA report defines a delinquency as a late payment that is 30 days or more overdue. This is good news but the personal financial health of consumers in the USA is still in need of significantly improvements to their balance sheets. Debt levels are still too high. Savings levels are still far to low.

Home equity loan delinquencies fell 4 basis points to 2.70% of all accounts, which helped drive the composite ratio down. Other home related delinquencies increased slightly, with home equity line delinquencies rising 6 basis points to 1.21% of all accounts and property improvement loan delinquencies rising 2 basis points to 0.91% of all accounts. Home equity loan delinquencies dipped further below their 15-year average of 2.85%, while home equity line delinquencies remained just above their 15-year average of 1.15 percent.

Bank card delinquencies edged up 1 basis point to 2.48% of all accounts in the second quarter. They remain significantly below their 15-year average of 3.70 percent.

The second quarter 2016 composite ratio is made up of the following eight closed-end loans. All figures are seasonally adjusted based upon the number of accounts.

Closed-end loans

Home equity loan delinquencies fell from 2.74% to 2.70%.

Mobile home delinquencies fell from 3.41% to 3.17%.

Personal loan delinquencies fell from 1.44% to 1.43%.

Direct auto loan delinquencies rose from 0.81% to 0.82%.

Indirect auto loan delinquencies rose from 1.45% to 1.56%.

Marine loan delinquencies rose from 1.03% to 1.23%.

Property improvement loan delinquencies rose from 0.89% to 0.91%.

RV loan delinquencies rose from 0.92% to 0.96%.

Open-end loans

Bank card delinquencies rose from 2.47% to 2.48%.

Home equity lines of credit delinquencies rose from 1.15% to 1.21%.

Non-card revolving loan delinquencies rose from 1.57% to 1.65%.

Related: Debt Collection Increasing Given Large Personal Debt Levels (2014) – Consumer and Real Estate Loan Delinquency Rates from 2001 to 2011 in the USA – Good News: Credit Card Delinquencies at 17 Year Low (2011) – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – The USA Economy Needs to Reduce Personal and Government Debt (2009)

Peer to peer lending has grown dramatically the last few years in the USA. The largest platforms are Lending Club (you get a $25 bonus if you sign up with this link – I don’t think I get anything?) and Prosper. I finally tried out Lending Club starting about 6 months ago. The idea is very simple, you buy fractional portions of personal loans. The loans are largely to consolidate debts and also for things such as a home improvement, major purchase, health care, etc.).

With each loan you may lend as little as $25. Lending Club (and Prosper) deal with all the underwriting, collecting payments etc.. Lending Club takes 1% of payments as a fee charged to the lenders (they also take fees from the borrowers).

Borrowers can make prepayments without penalty. Lending Club waives the 1% fee on prepayments made in the first year. This may seem a minor point, and it is really, but a bit less minor than I would have guessed. I have had 2% of loans prepaid with only an average of 3 months holding time so far – much higher than I would have guessed.

On each loan you receive the payments (less a 1% fee to Lending Club) as they are made each month. Those payments include principle and interest.

This chart shows the historical performance by grade for all issued loans that were issued 18 months or more before the last day of the most recently completed quarter. Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses. From LendingClub web site Nov 2015, see their site for updated data.

Lending Club provides you a calculated interest rate based on your actual portfolio. This is nice but it is a bit overstated in that they calculate the rate based only on invested funds. So funds that are not allocated to a loan (while they earn no interest) are not factored in to your return (though they actually reduce your return). And even once funds are allocated the actual loan can take quite some time to be issued. Some are issued within a day but also I have had many take weeks to issue (and some will fail to issue after weeks of sitting idle). I wouldn’t be surprised if Lending Club doesn’t start considering funds invested until the loan is issued (which again would inflate your reported return compared to a real return), but I am not sure how Lending Club factors it in.

Business should not be allowed to store credit card numbers that can be stolen and used. The credit card providers should generate a unique credit card number for the business to store that will only work for the purchaser at that business.

Also credit card providers should let me generate credit card numbers as I wish for use online (that are unique and can be stopped at any time I wish). If I get some customer hostile business that makes canceling a huge pain I should just be able to turn off that credit card “number.”

Laws should be adjusted to allow this consumer controlled spending and require that any subscription service must take the turning off of the payments as cancellation.

For some plan where the consumer agrees up front to say 12 months of payments then special timed numbers should be created where the potentially convoluted process used now remain for the first 12 months.

Also users should be able to interact with there credit reports and do things like turn on extra barriers to granting credit (things like they have to be delayed for 14 days after a text, email [to as many addresses and the consumer wants to enter] and postal notification are sent to the user. Variations on how these work is fine (for example, setting criteria for acceptance of the new credit early at the consumers option if certain conditions are met (signing into the web site and confirming information…).

Better security on the cards themselves are also needed in the USA. The costs of improvement are not just the expenses credit card and retailers face but the huge burden to consumers from abuse of the insecure system in place for more than a decade. It is well past time the USA caught up with the rest of the world for on-card security.

The providers have done a lousy job of reducing the enormous burden of fraud on consumers. As well as failing to deal adequately with customer hostile business practices (such as making canceling very cumbersome and continuing to debit the consumer’s credit card account).

Related: Protect Yourself from Credit Card Fraud – Personal Finance Tips on the Proper use of Credit Cards – Continued Credit Card Company Customer Dis-Service – Banks Hoping they Paid Politicians Enough to Protect Billions in Excessive Fees

As I have said, the behavior (driven by the poor ethical standards of the “leaders” of our financial institution) of our financial institutions means, as a a customer, you have to be on guard for their tactics to trick you out of your money. Essentially you have to expect them to behave like a pickpockets and be on guard against them at all times. This is an extremely sad state of affairs: that the ethical failings of such critically important players in our economy are so widespread, long-lasting and accepted. However, as we have seen, they profit from this behavior and their long track record of such behavior provides evidence they will continue acting in this way.

Discover to refund $200 million to credit card customers

The Consumer Financial Protection Bureau and Federal Deposit Insurance Corp. found that Discover Financial Services telemarketers often talked faster when explaining fees and terms as they pitched the services, leading customers to think there was no additional fee, the regulators said Monday.

It is very good to see the Consumer Financial Protection Bureau taking action to protect the consumers from the financial institutions continued efforts to evade the law and take a little bit from millions of consumers. This type of behavior has been tolerated previously, and should never have been. The financial institutions strategy to take small amounts from millions of people was a wise way of dealing with the tendency of law enforcement to ignore such “small infractions” – they didn’t seem to bother seeing that taking small amounts from millions of people results in hundreds of millions of dollars in ill gotten gains.

Far too much of the bad practices are continuing. And when they are caught the consequences are far too small (which is why they keep behaving unethically). Discover is only being charged $14 million in civil penalties for their lapses (and has to return $200 million it took unfairly).

It is good to have police to try and catch literal pickpockets. And it is good to have the Consumer Financial Protection Bureau to catch financial institutions that take far more than pickpockets can dream of away from the wallets of consumers.

Related: Capital One Bank Agrees to Refund $150 Million to 2 Million Customers and Pay $60 Million in Fines – Very Bad Customer Service from Discover Card – Credit Card Regulation Has Reduced Abuse By Banks – Continued Credit Card Company Customer Dis-Service – I Strongly Support the Consumer Financial Protection Bureau

Sadly, Congress refused to allow the person that should have headed to the Consumer Financial Protection Bureau (CFPB) to do so: Elizabeth Warren. If we are lucky she will be joining congress as the new senator from Massachusetts to reduce the amount of big donnor favoritism that prevails there now. That attitude will still prevail, she will just be one voice standing against the many bought and paid for politicians we keep sending back to Washington (there are a couple now, but they are vastly outnumbered).

Even with congressional attempts to stop the CFPB from being able to enforce laws against their big donnors, the CFPB has announced their first public enforcement action: an order requiring Capital One Bank to refund approximately $140 million to two million customers and pay an additional $25 million penalty. This is a good, small step that is helping creating a rule of law instead of a rule of those capturing regulators and giving lots of cash to politicians. But it is a very small step. The system is still mainly about captured regulators and giving lots of cash to politicians.

This action results from a CFPB examination that identified deceptive marketing tactics used by Capital One’s vendors to pressure or mislead consumers into paying for add-on products such as payment protection and credit monitoring when they activated their credit cards.

“Today’s action puts $140 million back in the pockets of two million Capital One customers who were pressured or misled into buying credit card products they didn’t understand, didn’t want, or in some cases, couldn’t even use,” said CFPB Director Richard Cordray. “We are putting companies on notice that these deceptive practices are against the law and will not be tolerated.”

Consumers with low credit scores or low credit limits were offered these products by Capital One’s call-center vendors when they called to have their new credit cards activated. As part of the high-pressure tactics Capital One representatives used to sell these add-on products, consumers were:

- Misled about the benefits of the products: Consumers were sometimes led to believe that the product would improve their credit scores and help them increase the credit limit on their Capital One credit card.

- Deceived about the nature of the products: Consumers were not always told that buying the products was optional. In other cases, consumers were wrongly told they were required to purchase the product in order to receive full information about it, but that they could cancel the product if they were not satisfied. Many of these consumers later had difficulty canceling when they called to do so.

- Misinformed about cost of the products: Consumers were sometimes led to believe that they would be enrolling in a free product rather than making a purchase.

- Enrolled without their consent: Some call center vendors processed the add-on product purchases without the consumer’s consent. Consumers were then automatically billed for the product and often had trouble cancelling the product when they called to do so.

One of the less obvious costs of a poor credit rating these days is large companies see you as someone to take advantage of. They often target those with poor credit for extremely lousy deals that they wouldn’t try to sell to those with good credit. The presumption, I would imagine, is someone able to maintain a good credit rating is much less likely fall for our lousy deals.

Related: Protect Yourself from Credit Card Fraud (facilitated by financial institutions) – Anti-Market Policies from Our Talking Head and Political Class – Banks Hope they Paid Politicians Enough to Protect Billions in Excessive Fees

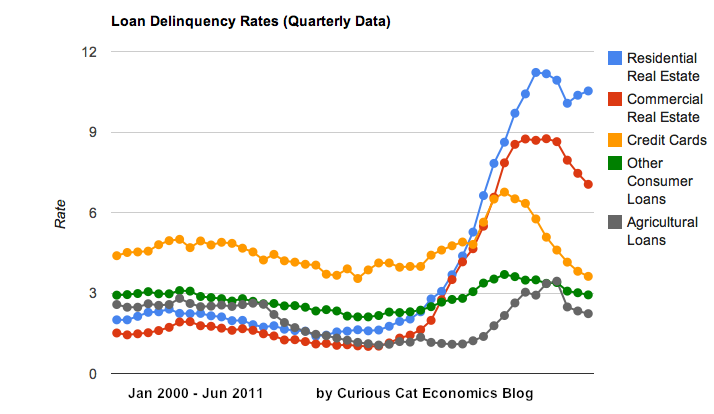

Chart showing loan delinquency rates from 2000-2011, shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

Residential real estate delinquency rates increased in the first half of 2011 in the USA. Other debt delinquency rates decreased. Credit card delinquency rates have actually reached a 17 year low.

While the job market remains poor and the serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk for world economic stability the USA economy does exhibit positive signs. The economy continues to grow – slowly but still growing. And the reduction in delinquency rates is a good sign. Though the residential and business real estate rates are far far too high.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

In the first place debit cards are a bad idea. They don’t have the same protection as credit cards. Banks pushed them in the USA because of the huge fees they charged (hidden from users). Now those banks are not allowed to charge the hugely excessive fees (compared to any other country) they had been charging retailers. And the banks are now trying to push huge fees onto those using the cards. Just dump any debit card you have.

Secondly, you should have long ago severed any ties with the large banks (that not surprisingly are the ones announcing the huge fees, so far). They provide lousy service and extract exorbitant fees whenever they can sneak them by you. Choosing to do business with companies that you must remain hyper vigilante to abuse from is just not sensible. Small banks unfortunately get bought out by the large banks to prevent competition. So while using small banks is ok, you keep having to go to a new one as the large ones buy out your bank to prevent the competition.

So it is more sensible to just pick a credit union. Credit unions are decent overall. Some can still be bad choices but it is almost impossible to do worse than any of the large banks. If you use ATMs a good deal make sure you minimize ATM fees when selecting a credit union (their policies in that area – waived fees, network ATM access… are significantly different between your options).

The free checking we have grown accustom to may well be on the way out. That seems fine to me. Essentially the government’s subsidy to the large banks and financial institutions in repressing short term interest rates (at the expense of course of savers and retirees) has greatly reduced the value of checking and savings balances at banks. I am sure the large banks will be the most customer unfriendly as fees are added to accounts, based on their track record.

Obviously you should not carry credit card balances, with high interest rates.

There really is almost no excuse for dealing with the large banks (other than a mortgage that was sold to them without your permission where you have no option but to put up with their behavior as their customer). Many of the other extremely bad customer service industries (cable TV, internet access providers, airlines) have monopolistic powers than often make it extremely difficult to avoid dealing with them. Of course the large banks make huge anti-competitive moves that shouldn’t allowed in any capitalistic system. But then our system is more about what you can buy with your cash payments to congress than capitalism. And you can’t accept the proponents claims of capitalism as a reason to do what they ask; more often then not those playing the capitalism over government argument are asking for anti-capitalist measures (allowing anti-competitive practices etc.) in support of special interest at the expense of society (markets require regulation to have the benefits of competition provide a dividend to society).

Related: Credit Card Regulation Has Reduced Abuse By Banks – Credit Card Issuers Still Seeking to Take Your Money – More Outrageous Credit Card Fees

I have written about the importance of protecting yourself against the companies that provide you financial services. There are few (if any) industries that as systemically try to trick and deceive customers out of large amounts of money as the financial services sector does. In addition to watching them, you it also makes sense to watch your credit card charges. For some reason attorneys general let large scale financial fraud go with much less policing than petty theft by juveniles (if some kids come in and take your TV they will be in trouble, if some large bank does the same thing to all of the household goods of many people that never even were their customers criminal charges are ignored for everyone involved – one of many such examples of bad decisions by attorneys general).

Because financial fraudsters are allowed to continue without much fear of prosecution: thousands, or tens or thousands, or hundreds of thousands and then maybe something will be done, of course that is a lot of people to suffer before action is taken. For that reason we are subject to long standing schemes to take money fraudulently go on for a long time. I wouldn’t even be surprised if most companies found to have taken money that isn’t theirs are left off when they refund money to those people that caught them and that is seen as ok.

Given this state of affairs, many have discovered just sending bills to people and companies and billing your credit card for things you didn’t order is a good way to steal money. Since law enforcement is extremely lax about stopping this. It is in your interest to protect yourself.

Bill Guard is one new service to watch your credit card charges and alert you to potentially fraudulent charges. It seems like a pretty good idea. Like Google flagging spam email for you. I really would think credit card companies should do this (they do but I guess not nearly well enough – no surprise there). I don’t so much love the idea of sharing credit card info with these people. And I don’t charge much so I can review my bill easily, myself. I can imagine lots of others though have difficulty remember every charge. If so, this may well be wise.

Read more

The national credit card delinquency rate (the rate of borrowers 90 or more days past due) decreased for the sixth consecutive quarter, dropping to 0.6% at the end of the second quarter in 2011. This is the lowest mark observed in 17 years. Credit card debt per borrower increased $20 in the quarter to $4,699, though it remains near record-low levels (and yet still at a level that is far too high).

Although credit card delinquencies were expected to drop, the data released today shows credit card delinquency rates improving by more than at any other time since the recovery began in 2009, both on a quarter-over-quarter basis (-18.9%) and on a year-over-year basis (-34.8%).

“National credit card delinquency rates have fallen to levels not seen since 1994 as consumers continue to tighten their spending,” said Ezra Becker, vice president of research and consulting in TransUnion’s financial services business unit. “TransUnion believes that the recovering economy is only indirectly impacting delinquency rates. More important and impactful to the decline in bank card delinquency are that consumers are using credit cards more responsibly; a large number of delinquent accounts have moved to charge-off status; and lenders remain conservative in their underwriting.”

The record low-level of credit card debt that has continued post recession is supported by a separate TransUnion credit card deleveraging analysis released in July. The analysis found that consumers made an estimated $72 billion more in payments on their credit cards than purchases between the first quarters of 2009 and 2010.

This is good news. We still need to reduce pay off much more of the excessive debt we took on living beyond our means the last few decades, but at least this is a small positive step. Overall consumer debt increased in the 2nd quarter, according to the Federal Reserve, and stands at over $2.45 Trillion. Revolving debt (credit cards) decreased slightly but non-revolving debt increased more. Consumer debt peaked near $2.55 Trillion in 2009 and recently bottomed just below around $2.4 in 2010. Consumer debt totals still need a great deal of improvement.

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2010 – Consumer Debt Down, but Still Over $2.4 Tillion in the USA –

I strongly support Elizabeth Warren and strongly support her for to head the Consumer Financial Protection Bureau. She would do a great deal to improve the economy of the USA. And she would do a great deal to improve the life of tens or hundreds of millions of people. We have allowed a few people to bribe our elected officials to distort markets to damage hundreds of millions and provide huge gains for a few. We need to support capitalism not crooked elites breaking capitalism to favor their allies at the expense of the economy and those who want to benefit from free markets. It is very difficult to impede the greed fueled distortions that politicians put in place to break free markets and provide huge benefits to those who pay them. Elizabeth Warren is one of the few that is knowledgeable and skillful enough to reduce the damage those people cause the economy and everyone else.

Why I Support Elizabeth Warren and the CFPB

Nobody is entirely innocent; money’s promise is for most of us a siren’s call. And, as a nation, we’ve willfully scanted education in civic and financial literacy in schools at all levels. So guilt is not worth focusing on. We need instead a future practice of clear rules and tough oversight. And we need to remind ourselves that Adam Smith’s concept of an invisible hand did not contemplate that hand’s picking the pockets of the people whose individual decisions and actions, if the market works perfectly, let supply match demand.

There are few political appointments I care much about. They normally are so co-opted even if they have good ideas they can’t get anything done. Don Berwick is a great person to have lead health care reform. The system is so messed up I am skeptical he can actually get much done, but I also strongly support him.

Elizabeth Warren is excellent and wise enough to actually accomplish things even with those who will attempt to thwart and improvements in the financial system that move forward capitalism at the expense of a few nobles that are protected by political allies. I have no doubt those in power will still thwart most efforts to stop politically sanctioned distortion of markets to enrich a few people that then pay a portion of their gains to the politicians that let them ruin free markets for their own huge personal gains.

Very few political appointees make much difference. If Elizabeth Warren gets this position she will have a good chance and making a huge difference o the quality of life for hundreds of millions of people and the economy overall. That is true even though she will have to continually fight those politicians seeking to protect the anti-competitive benefits they have lavished upon those that pay them to enact policies that benefit them at the expense of everyone else.

Related: If you Can’t Explain it, You Can’t Sell It – Middle Class Families from 1970-2005 (webcast of Elizabeth Warren) – What the Financial Sector Did to Us – Politicians Again Raising Taxes On Your Children