USA consumers pay huge fees on debit cards not found in most other rich countries. Other countries provide debit cards with much cheaper fees than USA banks mandate now given their anti-competitive oligopolistic pricing power. I haven’t seen anyone (that isn’t in the pay of banks) arguing for keeping excessive fees in place. But there are lots of people being paid by the banks (including most likely, “your” representative).

Banks want a favor — at your expense

David Frum, special assistant to President George Bush, is exactly right.

…

[banks] are lobbying hard to repeal the cap on debit card fees in advance of the July date when Dodd-Frank goes into effect… Congress is not swayed by arguments. It is swayed by clout — and on this issue, it is the banks who have the clout.

…

Based on that experiment, economist Robert Shapiro of Sonecon estimates that about 56% of the value of reduced swipe fees will reach the final consumer. That’s the basis for his calculation of savings of $230 per household. That’s also the basis for his further calculation that reduced swipe fees will translate into a one-time gain of 250,000 new jobs.

The new Republican House majority appropriately mistrusts government regulation. But if the financial crisis taught us anything, it should have taught that financial regulation is different from other forms of regulation. Invisible charges imposed by a financial cartel is not my idea of a free market.

The caps were part of the huge bailout taxpayers gave banks and were meant to be a partial watering down of a few of the smaller favors their bought and paid for politicians had given them over the years (as “punishment” for their misdeeds).

Read more

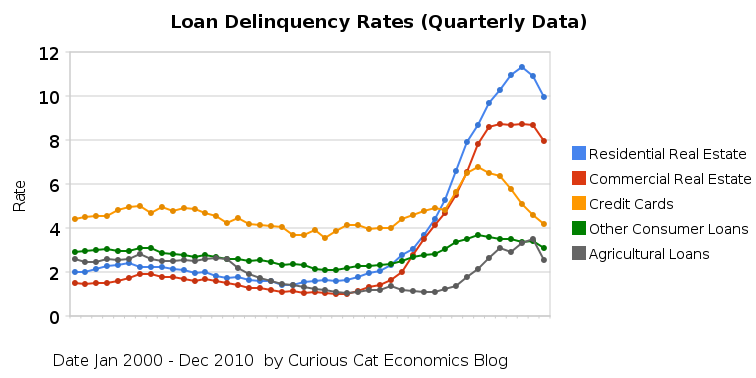

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The second half of 2010 saw real estate, agricultural, credit card and other loan delinquencies decrease. The rates are still quite high but at least are moving in the right direction. Residential real estate delinquencies decreased 138 basis points in the second half of 2010, to 9.94%, which brought them to just below the rate at the end of 2009. In the second half of 2010, commercial real estate delinquencies decreased 77 basis points to 7.97% (which was also exactly 77 basis points less than at the end of 2009. Agricultural loan delinquencies decreased 76 basis points, to 2.55% (down 53 basis points from the end of 2009). Consumer loan delinquencies decreased, with credit card delinquencies down 90 basis points to 4.17% and other consumer loan delinquencies down 27 basis points to 3.1%. The credit card delinquency rate decreased a very impressive 219 basis points in 210.

Related: Real Estate and Consumer Loan Delinquency Rates 2000 through June 2010 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – posts with charts showing economic data

Read more

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

Some companies (Banks, Verizon, Comcast, credit card insurers, United, car dealers…) continually find new ways to be hostile to customers. It really is amazing people put up with their horrible practices. The latest from the fees to check bags, fees to for paying company expenses, waste your time on voice mail hell if you want to talk to us crowd is fees to pay bills using automated systems.

The customer hostility of these companies is part of their DNA. We should recognize the new attempts to fleece customers but there is no reason to be surprised by the new, ever more hostile customer behavior of these companies. There are alternatives for consumers, just find them, and support them. Some industries are dominated by customer hostile companies (which can make avoiding them hard): banks (both consumer and investment banks), credit cards, airlines, cable companies, cell phone service. Even in those industries you can find ethical companies: Southwest Airlines, many credit unions, CarMax…

…

And yet these guys are charging $15. I asked Chase, “How can you charge that much for an automated transaction?” They said, “Well, that’s how much we charge.” And you look at some of the other charges out there. For instance, this week Verizon Communications is introducing a new $3.50 charge if you pay your bill online, automated phone system, or to a service rep without using their recurring, automatic bill paying system.

Time Warner Cable charges $4.99 to pay by phone with a human being, but it too charges nothing to use the automated system.

“People pay for a product or service,” said Doug Heller, executive director of Consumer Watchdog, a Santa Monica advocacy group. “They shouldn’t have to pay again just for the right to pay them.”

Related: Protect Yourself from 11 Car Dealer Tricks – Poor Customer Service: Discover Card – Best Buy Asks Man to Change His Name – Is Poor Service the Industry Standard?

Consumer debt decreased at an annual rate of 3.25% in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 9.5%, and nonrevolving credit (car loans…) was about unchanged.

Revolving consumer debt now stands at $827 billion down $39 billion this year. That is on top of a $92 decline in 2009. Hopefully we can continue this success.

Through June of 2010 total outstanding consumer debt was $2,419 billion, a decline of $30 billion ($21 billion of the decline was in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion so far: from $2,561 billion to $2,449 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

Thankfully over the last year at least consumer debt has been declining, but it needs to decline more. I disagree with those that want to see short term improvement in the economy powered by consumer debt. It would be nice to see improvement to the current economy. But we can’t afford to achieve that with more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt

Most of the practices deemed unfair or deceptive by the Federal Reserve have disappeared from new credit card offers since federal passage of the Credit CARD Act last year, according to a new report by the Pew Charitable Trusts, Two Steps Forward: After the Credit CARD Act, Cards Are Safer and More Transparent – But Challenges Remain.

The report finds that issuers have eliminated practices such as “hair trigger” penalty rate increases (disproportionate charges for minor account violations), unfair payment allocation, and raising interest rates on existing balances. However, Pew’s research also highlights a sharp rise in cash advance fees, continued widespread use of other penalty interest rates and an emerging trend of credit card companies failing to disclose penalty interest rates in their online terms and conditions.

One interesting tidbit from the report which studied the 12 largest banks and 12 largest credit unions: together these institutions control more than 90 percent of the nation’s outstanding credit card debt.

Less than 25 percent of all cards examined had an overlimit fee, which is down from more than 80 percent of cards in July 2009. Additionally, mandatory arbitration clauses, which can limit a consumer’s right to settle disputes in court, are now found in 10 percent of cards compared to 68 percent in July 2009.

At least 94% of bank cards and 46% of credit union cards (once again showing credit unions are likely to be a better option – though not always)came with interest rates that could go up as a penalty for late payments or other violations. But nearly half these warnings failed to inform the consumer of the actual penalty interest rate or how high it could climb.

Bank cash advance and balance transfer fees increased on average by one-third during this period, from 3% of each transaction to 4%. Credit union cash advance fees went up by one quarter, from 2% to 2.5%. Both increases (which again show how poorly banks fair in comparison) are unconscionable given the incredible low costs of money today. You should not pay these ludicrously high fees.

Related: Credit Card Issuers Still Seeking to Take Your Money – Continued Credit Card Company Customer Dis-Service – Legislation May Finally Pass to Address the Worst Credit Card Fee Abuse (Dec 2007)

Failing to pay for the deferred costs of current expenditures gets all those practicing credit card budget thinking in trouble. That includes lots of individuals. But it also includes many governments. They pay huge rewards to special interests and act like they think the cost doesn’t exist. Only an extremely financially illiterate society could elect so many of these people. We have not learned that in the modern financial economies financial illiteracy is a huge societal problem (along with scientific illiteracy).

Padded Pensions Add to New York Fiscal Woes

Such poor financial management by public sector organization (California is horrible also) are causing huge damage to those living in such poorly managed states.

The use of public money for outsize retirement pay really stings when budgets don’t balance, teachers are being laid off, furloughs are being planned

…

Roughly one of every 250 retired public workers in New York is collecting a six-figure pension, and that group is expected to grow rapidly in coming years, based on the number of highly paid people in the pipeline.

…

Thirteen New York City police officers recently retired at age 40 with pensions above $100,000 a year; nine did so in their 30s.

…

Before Yonkers adopted a richer pension formula for police in 2000, for instance, it was told the maximum cost would be $1.3 million a year. But instead, the yearly cost is now $3.75 million and rising. David Simpson, a spokesman for the mayor of Yonkers, said pension cost projections were “often lowballs,” so the city could get stuck. “Once you give something, you can’t take it away,” he said.

It isn’t complicated. So long as you elect people that are financial illiterate and only care about granting favors to special interests, not the consequences of doing so, you are setting yourself up for a great deal of pain once your credit card bill comes due.

Related: NY State Raises Pension Age to Save $48 Billion – Charge It to My Kids – Bogle on the Retirement Crisis – Politicians Again Raising Taxes On Your Children

Many people get into financial trouble in part due to their misuse of credit cards. By following a few simple rules you can avoid the missteps and use credit cards to improve you personal finances instead of falling into the credit card traps.

Most importantly, don’t use your credit card for loans. Pay off your balance each month. Pretty obvious advice but far too many people don’t follow it. If you use your credit card for a loans most of time that is a mistake and big risk to your personal financial future. Don’t do it. There is a reason pretty much all the advice from financial advisers on credit cards starts with this – it is the most important advice.

Second, if you don’t follow the advise above pay off your loan as soon as possible. Payment the minimum payment is huge mistake. You should not be making any discretionary purchases if you are not paying down your credit card debt substantially each month.

Continue reading tips on using your credit card in a smart way.

Related: Majoring in Credit Card Debt – Outrageous Credit Card Fees – Credit Card Debt and Delinquencies Decline

Credit problems create a vicious cycle. Credit card interest rates are increased, fees are onerous and even applying for jobs is negatively affected (many employers look at credit reports as one factor in the hiring process), insurance companies look at them too and can offer higher rates. Employers and insurers have the belief that bad credit is an indication of other risks they don’t want to take on. Once into the cycle there are challenges to deal with. I must admit I think it is silly to look at credit for most jobs. But a significant number of organizations do so that is an issue someone that gets themselves in this trouble has to deal with.

I think the best way to deal with this problem is to build a virtuous cycle of savings instead. We tend to focus on how to cope with a bad situation instead of how to take sensible actions to avoid getting in the bad situation. In general we spend far too much money and take on too much debt – we live beyond our means and fail to save. Then we have a perfectly predictable temporary hit to our financial situation and a vicious cycle begins.

If we just acted more responsibly when times were good we would have plenty of room to absorb a temporary financial hit without the negative cycle starting. The time to best manage this cycle is before you find yourself in it. Avoiding it is far better than trying to get out of it.

Build up an emergency fund. Don’t borrow using credit cards – or any form of consumer debt (borrowing for education, a car or a house, I think, are ok). Save up your money until you can afford what you want to purchase. Don’t buy stuff just to buy stuff.

Re: The Vicious Circle of Poor Credit

Related: Real Free Credit Report – In the USA 43% Have Less Than $10,000 in Retirement Savings – Financial Planning Made Easy

The government has stopped some of the worst abuses by credit card issuers however, those financial institutions are not without ways of continuing to take advantage of customers, Credit-Card Fees: the New Traps

…

Banks already are reaping more fees on overseas transactions. Not only are they raising foreign-exchange transaction fees—the cost customers pay for purchases made in foreign currencies—but they are expanding the definition of what qualifies as a foreign transaction.

In the past, people who made online purchases from foreign merchants, or who traveled to a country where the purchases are often in U.S. dollars such as the Bahamas, were generally immune from paying such fees. But Citi and Bank of America recently imposed their 3% foreign-transaction fees on all foreign transactions—even if that purchase is charged in U.S. dollars. Discover Financial Services also began charging a new 2% for foreign purchases last year.

…

And there are ways to avoid annual fees. Citigroup is alerting some customers that it is assessing a $60 annual fee on their cards. The cure for that is simple. If you spend $2,400 on the card in a 12-month period, the bank will refund the fee.

I’ll tell you a better way to avoid the abusive fees. Don’t deal with the large banks that the government bailed out. My credit union offers a credit card with no annual fee without any minimum spending requirements, and many others do as well.

Related: How to avoid getting ripped off by credit card companies – More Outrageous Credit Card Fees – Sneaky Credit Card Fees – USA Consumers Paying Down Debt –