The stories you most frequently hear about China in Africa are

- resource extraction (oil, metals, etc.)

- infrastructure loans from China (with Chinese labor and Chinese companies doing the work, often to aid resource extraction)

- farming exports to China

While those are happening an excellent report from McKinsey (Dance of the Lions and Dragons) provides an in depth look at a much more entrepreneurial state of affairs. While there are big government backed efforts (including those with Chinese state owned company participation) there are many small companies making entrepreneurial investments led by Chinese entrepreneurs seeing a opening to build successful companies.

Chinese firms’ decisiveness is indicative of the relationship between the comparative advantages of Chinese entrepreneurs and the opportunities in African markets. To some, the high returns earned by Chinese firms are symptomatic of a market failure: too little competition in African markets. But in sectors such as manufacturing, there are too few African firms with the capital, technology, and skills to invest successfully and too few Western firms with the risk appetite to do so in Africa. Thus the opportunities are reaped by Chinese entrepreneurs who have the skills, capital, and willingness to live in and put their money in unpredictable developing-country settings.

What makes the decisiveness of Chinese investors all the more impressive is that they are mostly using their own money. Two-thirds of the private firms we surveyed, and over half of all firms in our sample, reported that their investments were self-financed through retained earnings or savings, or funded through personal loans. Only 13 percent of investment funds came from financing schemes linked to the Chinese government, and less than 20 percent came from Chinese or African commercial bank loans

I believe investments in Africa will provide great investment returns in the next 20 years. There are many challenges but the opportunity is much greater than most people realize. The potential returns are quite high due to the lack of capital and interest being shown in African opportunities.

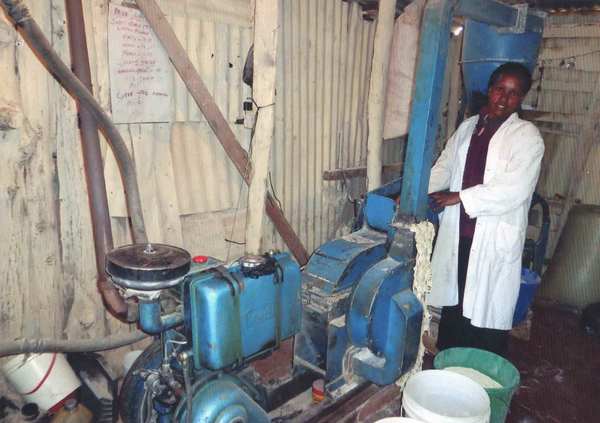

Factory in Nigeria (I think) that my family toured.

Likely huge companies, such as Google, Tencent, Facebook, Toyota and Alibaba will do very well. But there are many opportunities. That Africa is made up of 54 different countries creates challenges for investors and companies seeking to grow (but also creates variation and opportunities). It will be interesting to see how big the role Chinese entrepreneurs play in the next 20 years in Africa.

The report is an excellent detailed look at Chinese investment in Africa. It is a long and worthwhile read.

Related: Kiva Loans Give Entrepreneurs a Chance to Succeed – Drone Deliveries to Hospitals in Rwanda – Using Capitalism in Mali to Create Better Lives – Promoting Innovation in Sierra Leone

Once upon a time in a land not so far away, if you wanted to start a business, you had to choose a city in which to settle–not just for the business but for yourself. A lot of thought went into figuring out where to set up your new company’s home base. Delaware and Nevada, for example, have been popular choices because of its business friendly regulations and corporate tax laws. Once you got your central location up and running you could think about expanding to multiple locations or turning your company into a franchise.

Those days are over. Sure, there are some who prefer to build businesses traditionally, but today thanks to advancements in technology and the rise of the internet and the ability to receive and send money online, even internationally, people can start a company anywhere and operate it from anywhere else (provided local incorporation laws do not require a specific length of time spent on site).

Migrants have long moved to a new country for work, and then transferred funds home. This has been nearly completely those migrating from poor countries (or poor areas in the countries) to rich countries. Now individuals from rich countries are taking advantage of low cost countries to lower their living expenses while running most of your day to day from…just about anywhere.

Businesses Can’t Really Be Nomadic, Can They?

It’s true: not every business is suited to a nomadic lifestyle. Independent retail shops, for example: though it is possible to oversee basic operations from wherever you are, until you have a full support staff you are going to be needed onsite. Local service businesses that specialize in trades like contracting, plumbing, electrics, etc. Those are difficult to operate via telecommute. Most other companies, however, can be adapted to a global marketplace and base of operations fairly easily.

I traveled for 4 years in SE Asia while operating my business. During that time my brother took a year to travel around the world with his family while running his business. He visited clients during his travels which took him through Brazil, Turkey, South Africa, India, Singapore, Australia and more. We met up for a week in Bali. There are challenges but there are great rewards also for businesses that allow you to travel while you work.

Which Businesses Are Best Suited to the Nomadic Lifestyle?

As previously stated, if you work hard enough at building your company and support team, you can run just about any sort of business from anywhere. That said, there are some companies and business types that lend themselves more easily to the nomadic lifestyle.

Chris Guillebeau covers a few of these businesses and the entrepreneurs who started them in his book, The $100 Startup. One entrepreneur, for example, runs a linguistics and translation business internationally. He loves languages and loves teaching so he moves from country to country, learning the local languages and then teaching them to tourists and expatriates who choose to move there. Guillebeau himself has turned his book into a tour, a conference (The World Domination Summit) and a series of Unconventional Guides. He travels all over the world and writes from wherever he happens to be at the time.

My comments on a post by Kiva about their decision to end the Kiva Zip (direct to people loans – no intermediary financial institution) program in Kenya.

I do think it is very important to retain an infrastructure for those people you got to try the new effort with, as I believe Kiva will. This has to be part of any innovation efforts – a budget to include unwinding the effort in a way that is in keeping with Kiva’s mission to help people. I strongly believe in efforts to avoid abandoning those who worked with you in general, but for those taking loans from Kiva it is much more important than normal.

Keep up the good work. And keep challenging Kiva to get better and not get complacent when things are not going as well as they should. I am happy to continue to lend to Kiva but I also am concerned that the focus on making a difference and making people’s lives better can be lost in the desire to grow.

I made a loan via Kiva zip for Hilda to buy a posho mill machine. The loan was repaid in full.

The Curious Cats group on Kiva has made over $27,000 in loans to entrepreneurs around the world (the way Kiva works the groups, they don’t include Kiva Zip loans). You can join us. I believe in the model of micro-finance (Investing in the Poorest of the Poor [this one is grants instead of loans]), though I also believe we need more data on real experience of borrowers. Kiva Zip gives loans directly to people with a 0% interest rate. Normal Kiva loans have financial institutions (some of which are charities but they still have expenses) make the loans and Kiva lenders provide capital (at 0%) but the borrowers have to pay interest (the idea is they pay lower interest since the financial institution has a 0% cost of capital).

Related: Kiva Loans to Entrepreneurs in Columbia, India and Kenya – Kiva Loans Give Entrepreneurs a Chance to Succeed (2011) – Using Capitalism to Create Better Lives in Mali (2009)

I have been giving loans through Kiva for many years now. I enjoy the opportunity to help out entrepreneurs around the world. And the web site is well done to give you a psychological boost – photos of the entrepreneurs, stories on what they will do, etc..

I often have difficulty finding real entrepreneurs (many of the loans are for things like education, fixing up their house, buying motorcycle/car, etc. that may well be very important but are not really related to entrepreneurship in most cases). That is fine, in this session I had 3 loans to entrepreneurs and 2 loans for solar energy solutions for people’s homes. Improved energy, cooking or water access are some things I am happy to lend to that are not entrepreneur related. Though usually the water loans are – to an entrepreneur that will sell clean water to a neighborhood and sometimes the solar energy ones are, though not in this case.

Kelly in Medellin, Columbia is starting a shoe business.

Kelly in Medellin, Columbia is starting a shoe business.

The write-ups on Kiva are often fairly well done; targeting those interested in making loans. Kelly’s:

She works as a saleswoman in different shoe stores in the municipality of Medellin.

She wants to start her own business making and selling shoes of all styles. She wants to start this activity because she has the desire to generate the resources she needs to support herself and her education, in addition to helping with expenses at home.

She is a young, very disciplined entrepreneur. She is requesting a loan to buy a wide range of materials such as leather, soles, adhesives, and fabrics. With these elements, she can start this business and improve her quality of life.

I often screen the data on delinquencies and defaults for the partner bank in making loan decisions. It isn’t because I am worried about losing my loan (I just re-lend what I get paid back). But if I lend to organizations that are having more failures I increase their supply of money to make loans which don’t seem to be working out for borrowers as well as another lender). I want my money going to help people, not get people into a mess.

I like charity that provides leveraged impact. I like charity that is aimed at building long term improvement. I like entrepreneurship. I like people having work they enjoy and can be proud of. And I like people having enough money for necessities and some treats and luxuries.

I think sites like oDesk provide a potentially great way for people to lead productive and rewarding lives. They allow people far from rich countries to tap into the market demand in rich counties. They also allow people to have flexible work arrangements (if someone wants a part time job or to work from home that is fine).

These benefits are also true in the USA and other rich countries (even geography – there are many parts of the USA without great job markets, especially many rural areas). The biggest problem with rich country residents succeeding on something like oDesk is they need quite a bit more money than people from other countries to get by (especially in the USA with health care being so messed up). There are a great deal of very successful technology people on oDesk (and even just freelancing in other ways), but it is still a small group that is capable and lucky enough to pull in large paychecks (it isn’t only technology but that is the majority of high paying jobs I think on oDesk).

But in poor countries with still easily 2 billion and probably much more there is a huge supply of good workers. There is a demand for work to be done. oDesk does a decent job of matching these two but that process could use a great deal of improvement.

I think if I became mega rich one of the projects I would have would be to create an organization to help facilitate those interested in internet based jobs in poor countries to make a living. It takes hard work. Very good communication is one big key to success (I have repeatedly had problems with capable people just not really able to do what was expected in communications). I think a support structure to help with that and with project management would be very good. Also to help with building skills.

If I were in a different place financially (and I were good at marketing which I am not) I would think about creating a company to do this profitably. The hard part for someone in a rich country to do this is that either they have to take very little (basically do it as charity) or they have to take so much cash off the top that I think it makes it hard to build the business.

But building successful organizations that can grow and provide good jobs to those without many opportunities but who are willing to work is something I value. I did since I was a kid living in Nigeria (for a year). I didn’t see this solution then but the idea of economic well being and good jobs and a strong economy being the key driver to better lives has always been my vision.

This contrast to many that see giving cash and good to those in need as good charity. I realize sometimes that is what is needed – especially in emergencies. But the real powerful change comes from strong economy providing people the opportunity to have a great job.

I share Dr. Deming’s personal aim was to advance commerce, prosperity and peace.

Related: Commerce Takes More People Out of Poverty Than Aid – Investing in the Poorest of the Poor – I am a big fan of helping improve the economic lives of those in the world by harnessing appropriate technology and capitalism – A nonprofit in Queens taught people to write iPhone apps — and their incomes jumped from $15k to $72k

I find it disheartening that it is necessary to take out a loan to pay for vocational school after graduating from middle school (this is in Indonesia but the same thing happens all over in those countries that are not the most wealthy). Indonesia has been doing extremely well economically (which many people do not realize).

Kafita already graduated from junior high school and wants to go to vocational school.

So essentially she is paying for high school. I sure hope it is financially beneficial. This is the kind of investment in the economic development of a country that I wish governments could make. If not, I sure wish the super rich would give money to fund this kind of education instead of giving trust fund babies millions for conspicuous consumption.

It is disgusting how spoiled brats are such vapid people that they do what they do, while so many hundred of millions of kids lives could be changed with the most wasteful spending these trust fund babies that our politicians keep giving massive tax breaks to. Our politicians should be ashamed of themselves. And so should the spoiled brats.

I have donated more to Tricke Up than any other charity for about 20 years now. There is a great deal of hardship in the world. It can seem like what you do doesn’t make a big dent in the hardship. But effective help makes a huge difference to those involved.

My personality is to think systemically. To help put a band aid on the current visible issue just doesn’t excite me. Lots of people are most excited to help whoever happens to be in their view right now. I care much more about creating systems that will produce benefits over and over into the future. This view is very helpful for an investor.

Trickle Up invests in helping people create better lives for themselves. It provides some assistance and “teaches people to fish” rather than just giving them some fish to help them today.

The stories in this video show examples of the largest potential for entrepreneurship. While creating a few huge visible successes (like Google, Apple…) is exciting the benefits of hundreds of millions of people having small financial success (compared to others) but hugely personally transforming success is more important. Capitalism is visible in these successes. What people often think of as capitalism (Wall Street) has much more resonance with royalty based economic systems than free market (free of market dominating anti-competitive and anti-market behavior) capitalism.

Related: Kiva Loans Give Entrepreneurs a Chance to Succeed – Micro-credit Research – Using Capitalism in Mali to Create Better Lives

400 million people in India and 1.2 billion people worldwide do not have electric power at home. Mera Gao Power provides a wonderful market solution. Mera Gao Power can install solar power systems at a low cost that can be paid back in just 2 years by charging only 50 cents a month to users (for 7 hours of electricity a day). So they provide funding (through investors and grants) and recoup the investment quickly by providing a valuable service at a price users can afford.

Four solar panels are sufficient to power an entire village of 100 households with quality light and mobile charging. These panels are installed on the roofs of existing households, thus eliminating the need for land. Since power is generated during the day and used at night they use batteries to store the power.

By utilizing LED lights, MGP’s micro grid design is ultra energy efficient. This is the key to reducing power generation and storage equipment. Each household is provided with two or four LED lights.

Mera Gao Power received funding from USAID Development Innovation Ventures. The video presents their innovation for a village-level solar micro grid to electrify rural Uttar Pradesh for a White House meeting.

Related: Appropriate Technology: Solar Water Heaters in Poor Cairo Neighborhoods – Top Countries For Renewable Energy Capacity – Water Pump Merry-go-Round – Letting Children Learn, Hole in the Wall Computers – Homemade Windmills for Electricity – Water and Electricity for All

Manuel De Jesus, miller and farmer in El Salvador, will use his loan to buy parts for this milling euipment.

There is a great deal focus recently on the “99%” (via occupy wall street and the like). The truth is these are mainly about the 5% or 10% (those rich, but not quite as rich as the richest 1% – and much further from the richest than they were a few decades ago). As I have written before, most of those in the USA (also Europe, Japan…) are rich (though this is changing, a greater percentage of the USA is not rich, looking globally, than maybe any point since the 1930s).

We get confused because many near us are even richer and think that means the rest of us are very poor. But those in the USA are often in the 5% or 10% – not the 30% or 60% or 90% they seem to think they are. $50,000 in annual income puts you in the top 1% globally. $25,000 puts you in the top 10%.

I agree with the desire to reduce the political and market corruption, as I have written for years.

For the 99% (or the 90% anyway), I really think the best things are government policies that reduce corruption and increase market forces. Letting actually capitalism work instead of political and corporate cronyism failing to let markets work as they should. Also giving education and the chance to build a better life for yourself are important. Thankfully many countries have been doing very well on this front: Singapore, Korea, Brazil, Ghana, China… That doesn’t mean there are not huge issues to still address for most of the 90%, there are.

Microfinance in general, and Kiva in particular, are one great way to help. Again it isn’t perfect. And those getting the loans are not given an easy life. They are given a chance to try and build there business to improve there economic condition. This isn’t a certain success. And I do worry that taking on too high an interest rate, or loan amount, can leave people worse off than before. But when looking at the system of microfinance I really like the opportunity it gives people, who haven’t been given many.

Those getting loans have to make smart personal finance and business decisions. If they do well they can greatly improve their financial situation. I made several more loans today, using money repaid by previous borrowers. I try to find loans where I am able to help fund a investment that will improve capacity (but that isn’t always possible) – a new machine that makes them more efficient for example. I also try to avoid loans where the interest rate is over 30% (which might seem very high, but rates below 20% are very rare given the economics of these loans – they are very costly to service). What Kiva does is provide the funds people like me lend as interest free loans to the partner banks. The idea is that this allows partner banks to provide more capital for loans (obviously) and at a lower rate because the bank isn’t having to pay interest on the funds.

My loans today went to: Mali, Honduras, Senegal, Ecuador, Togo, Philippines and in the photo above El Salvador. The Curious Cat Kivans group has now lent $12,925 in 320 loans. We now have 11 members, join up and help give people an opportunity to improve their economic condition.

Related: More Kiva Entrepreneur Loans: Kenya, Honduras, Armenia… – Using Capitalism in Mali to Create Better Lives – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania

I made several more Kiva loans to entrepreneur in Kenya, Lebanon, Nicaragua, Kenya, Honduras and Armenia (brining my total loans to 251). It really is great to see real people using capitalism to improve their lives. And being able to help by lending some money is wonderful. When looking for loans I give preference to loans that improve productivity and increasing capacity of the entrepreneur. If they use the proceeds of the loan to increase their capacity to produce they can pay off the loan and find themselves much better off.

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).A nice example of this is the loan to Douglas Osusu (pictured). He has requested this loan of 80,000 KES to purchase a dairy cow and a posho mill. This loan also has a portfolio yield (Kiva’s equivalent of an annual percentage rate) of 19%. 19% is very loan for loans on Kiva (remember there are significant costs to servicing micro-loans) – I like the rate to be under 30% but sometimes accept rates up to 40% (or even higher occasionally). I also give great preference to low rates, as the lower the rate the better for the entrepreneur. The 3rd factor I consider is the history of the field partner bank (default rate, delinquency rate and currency exchange loss rate). In this case the field partner is new and carries risk because of that. Still in this case I really like the loan and I like that this lender is charging low rates so I want to take the risk and see how they can do. The amount I lend is based on the combination of these factors – I lend more when I have several reasons to really like the loan.

Join other readers by making loans and joining the Curious Cats Lending Team: 8 members, 213 loans totaling $8,775. Comment with the link to your Kiva page and I will add a link on Curious Cat Kivans.

My current default rate is 1.39% and the delinquency rate is 8.49% (see chart of USA general delinquency rates). The delinquency rate is exaggerated due to technical details (some difficulties in reporting in various countries and such things). Agricultural loans often become delinquent on Kiva but still are paid in full (in my experience). While the defaulted loan rate is 1.39% if you look at the percent of dollars lost I have a rate of 1.2% (this is nearly all due to a bank that failed over a year ago to which I had 2 loans where I lost $87.50 of $100 – there are also 2 other losses for under $5). I add to my total loan amount a couple times a year but also I get to keep relending as money is paid back.

Some of my favorite ways to help reduce extreme poverty are Trickle Up, Kiva and using Global Giving to find small organizations.

Related: 100th Entrepreneur Loan – More Kiva Entrepreneur Loans: Kenya, El Salvador (June 2010) – Kiva Opens to USA Entrepreneur Loans – MicroFinance Currency Risk – Kiva Fellows Blog: Nepalese Entrepreneur Success