Abuse of the credit system by 3rd party collection agencies (and credit reporting agencies) in the USA has been a long term problem.

An attempt to partially address some of the abuses was a change in the required reporting practices that impacted collections accounts specifically, known as the National Consumer Assistance Plan (NCAP), which rolled into effect during the second half of 2017. The plan has many components, including: (1) a requirement for more frequent, detailed, and accurate reporting of collections accounts, including reflecting when those accounts have been paid; (2) a prohibition against reporting debts that did not arise from an agreement to pay, or from, medical collections less than 180 days old; (3) the removal of collections accounts that did not arise from a contract or agreement to pay; and (4) permission to report any account only when there is sufficient information to link the account with an individual’s credit files (requiring a name, address, and some other personally identifying information such as a Social Security number or date of birth).

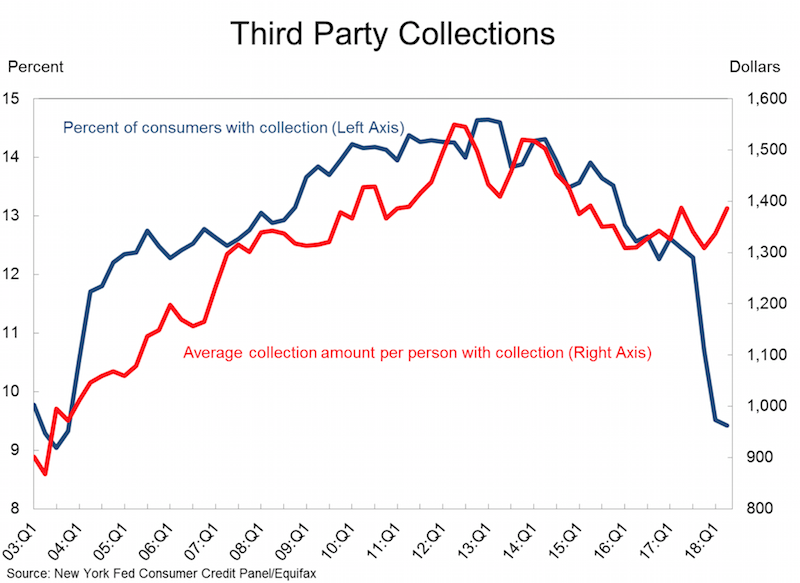

All in all, the changes in credit reporting prompted by the National Consumer Assistance Plan have resulted in an $11 billion reduction in the collections accounts balances being reported on credit reports. A total of 8 million people had collections accounts completely removed from their credit report. However, collections accounts do indeed align with other negative events and the cleanup of collections accounts had the largest impact on the borrowers with the lowest scores.

These borrowers will certainly benefit in the long run from the cleanup of their credit reports, since higher scores are associated with better access to credit, to the job market, and even to the rental housing market. But the immediate impact of the removal of collections will be muted for most of those affected (other items are also impacting their current credit score).

In the longer-term there may be a rebound in collections account reporting because creditors will likely begin collecting the newly required personally identifying information as they adjust to this reporting change.

This was a small good step in protecting consumers from the bad behavior of credit reporting companies and their customers. But much more must be done to protect us from having our financial lives negatively impacted by bad practices of the credit reporting companies.

Related: Cleaning Up Collections – Avoiding the Vicious Cycle of Credit Problems – Truly Free Credit Report – USA Household Debt Jumps to Record $13.15 Trillion

The latest massive breach of USA citizen’s private information by poorly run companies once again shows how we are voting for the wrong type of people. We need to start electing people that fix problems instead of watching things burn.

It is not impossible to improve if you elect people that care about making things better. If you elect people that are driven mainly by doing favors for those giving them cash you get the system we have now.

I believe in designing systems that use markets to create the best solutions to desired outcomes (this is the basic idea of real capitalism – instead of the crony capitalism we have been infected with). Europe has much more respect for citizen’s privacy that the USA does. Europe has much more effect laws on protecting citizen’s privacy. For decades the 2 political parties in the USA have taken large cash donations (and more, future cushy jobs…) to allow the current system to punish citizen’s as their private information is abused and they are expected to spend their time and resources to fix the problems created by the identity theft the lack of decent systems in the USA to stop identity theft. And the design by the 2 parties to put the cost of dealing with it on voters and the benefits (of selling private consumer information and using poor security practices to create problems that voters have to clean up) to those giving the parties cash.

We need to stop voting for such corrupt parties and such poor representatives of our interests (though they are very good representatives of those paying them cash).

So what is a simple starting point for taking the burden of dealing with the easy identity theft our political parties and companies that don’t care about the costs of their sloppy practices on society are?

- Force those approving false credit to pay. Anytime you have to fix credit given falsely in your name they must pay you. Say, $1,000 minimum.

- Force those providing false information about you to pay. If credit bureaus report false information about you that you must correct it is $50 if it is fixed within 7 days of a simple internet form being completed. If it takes 30 days the cost is $150. If they require you to provide additional information, additional costs accrue. They must provide your the original documentation on the loans.

- Give consumer automatic and free control over the use of their private information.

Obviously, credit freezes, and managing that status must be free. - Any organization that collects private financial information must have liability insurance. That insurance will automatically pay per security breach. For name + SSN ($150) + Date of birth ($20) + cell phone number ($20) + current address ($100) + credit card number ($50) + email address ($10) + mother’s maiden name ($25), etc. If you do not collect SSN, credit card number, cell phone number or current address this will not apply. I haven’t given it any thought, but there should be some level of private information that pushes you into the category of the organization that must have liability coverage (what that is can be worked out).

- The funds for those security breaches are paid to the Consumer Financial Protection Bureau and used to

- create better security practices for private information

- fund enforcement of those better security practices

- fund law enforcement investigations and criminal prosecution of those abusing private financial information

This idea needs to be expanded beyond my 1 hour of thinking about it, but it is sad that in 1 hour I can think of much more effective ideas than our political parties have put in place in 20 years.

The reliance on SSN as a identifier for people is something that shouldn’t have been allowed. It is one of many things that should be fixed and it should be fixed quickly.

The organization created here needs to focus on privacy of data. They need to encourage the use of encryption. They need to be given a seat at the table to counter those seeking to promote hacking (both leaving insecure software in place and creating insecurity in the software ecosystem to exploit and be exploited by criminals and other states) to benefit state sponsored spying. That debate will result in tradeoffs. Sometimes they will decide to allow our private information to be put at risk for other benefits. But they need to accept the responsibility of doing so. It would likely be sensible to charge the departments leaving open security holes and creating security holes anytime it becomes obvious that they are responsible for the harm to us. Otherwise they pretend there are not costs to the very bad security practices that our government has been encouraging (even as crazy as it sounds building backdoors into software – which is a security disaster obviously).

Other than the extremely sad state of affairs in health care in the USA (with the Republicans focusing on making it much worse) the biggest threat to our personal finances is likely the lack of security in our financial system (though to be fair there are other plausible candidates – very high debt level…).

Related: Protecting Your Privacy and Security (2015) – Making Credit Cards More Secure and Useful (2014) – Governments Shouldn’t Prevent Citizens from Having Secure Software Solutions USA Congress Further Aids Those Giving Them Cash Risks Economic Calamity Again – Security, Verification of Change – 8 Million New Potential Victims of Identity Theft (2008)

Even though there are plenty of ways to improve the economic conditions for most people today is very good compared to similar people 50 years ago. There are a few, small population segments that there are arguments for being worse off, but these are a tiny percentage of the global population.

However, we humans often compare ourselves to whoever is better off than us and feel jealous. So instead of appreciating good roads, food, shelter, health care, etc. we see where things could be better (either our parents had it a bit better or these people I see on TV or in this other country, etc.). It is good to see how we could improve if we then take action to improve. To just be frustrated that others have it better doesn’t do any good, it doesn’t seem to me.

There are significant ways governments can help or hinder the economic well being of their citizens. I am a big believer in the power of capitalism to provide wealth to society. That isn’t the same as supporting the huge push to “crony capitalism” that many of the political parties throughout the world are promoting. The “capitalism” in that phrase exists for alliteration, the real meaning is the word crony.

street scene in Seoul, South Korea (photo by John Hunter)

These Are the World’s Most Innovative Economies

These type of rankings are far from accurate, what does most innovative really mean? But they do provide some insight and I think those at the top of the list do have practices worth examining. And I do believe those near the top of this list are doing a better job of providing for the economic future of their citizens than other countries. But the reality is much messier than a ranking illustrates.

With that in mind the ranking shows

- Korea

- Sweden

- Germany

- Switzerland

- Finland

- Singapore

- Japan

- Denmark

- USA

One thing that is obvious is the ranking is very biased toward already rich countries. When you look at the measures they use to rank it is easy to see this is a strong bias with their method.

China is 21st. Malaysia is 23rd and an interesting country doing very well compared to median income (I am just guessing without actually plotting data). Hong Kong is 35th, which is lower than I imagine most people would have predicted. Thailand is 44th. Brazil is 46th and even with their problems seems low. Brazil has a great deal of potential if they can take care of serious problems that their economy faces.

In a previous post I examined the GDP Growth Per Capita for Selected Countries from 1970 to 2010, Korea is the country that grew the most (not China, Japan, Singapore…).

Related: Leading Countries for Economic Freedom: Hong Kong, Singapore, New Zealand, Switzerland – Economic Consequences Flow from Failing to Follow Real Capitalist Model and Living Beyond Our Means – Easiest Countries in Which to Operate a Businesses (2011)

The International Federation of Health Plans has published the 2015 Comparative Price Report, Variation in Medical and Hospital Prices by Country. Once again this illustrates the excessive cost of health care in the USA. See related posts for some of our previous posts on this topic.

The damage to the USA economy due to inflated health care costs is huge. A significant portion of the excessive costs are due to policies the government enacts (which only make sense if you believe the cash given to politicians by those seeking to retain the excessive costs structure in the USA the last few decades buy the votes of the political parties and the individual politicians).

In 2015, Humira (a drug from Abbvie to treat rheumatoid arthritis that is either the highest grossing drug in the world, or close to it) costs $2,669 on average in the USA; $822 in Switzerland; $1,362 in the United Kingdom. This is the cost of a 28 day supply.

All the prices shown here are for the prices reported are the average allowed costs, which include both member cost sharing and health plan payment. So it only includes costs for those covered by health plans (it doesn’t include even much larger price tags given those without insurance in the USA).

Harvoni (a drug from Gilead to treat hepatitis C is also near the top of drugs with the largest revenue worldwide). This is also a drug that has been used as a lightning rod for the whole area of overpriced drugs. One interesting thing is this is actually one that is not nearly as inflated in the USA over other countries nearly as much as most are. Again, for a 28 day supply the costs are $16,861 in Switzerland; $22,554 in the United Kingdom and $32,114 in the USA. Obviously quite a lot but “only” double the cost in the USA instead of over triple for Humira (from Switzerland to the USA).

Tecfidera is prescribed to treat relapsing multiple sclerosis. The cost for a 30 day supply vary from $663 in the United Kingdom to $5,089 in the USA ($1,855 Switzerland).

There are actually some drugs that are more expensive outside the USA (though it is rare). OxyContin is prescribed to treat severe ongoing pain and is also abused a great deal. The prices vary from $95 in Switzerland to $590 in the United Kingdom ($265 in United States).

The report also includes the cost of medical procedures. For both the drugs and the procedures they include not only average but measures to show how variable the pricing is. As you would expect (if you pay attention to the massive pricing variation in the USA system) the variation in the cost of medical procedures is wide. For an appendectomy in the USA the 25th percentile of cost was $9,322 and for the 95th was $33,250; the average USA cost was $15,930. The average cost in Switzerland was $6,040 and in the United Kingdom was $8,009.

As has been obvious for decades the USA needs to stop allowing those benefiting from the massively large excessive health care costs in the USA from buying the Democrats and Republicans support to keep prices so high. But there has been very little good movement on this front in decades.

Related: USA Heath Care System Needs Reform – USA Health Care Spending 2013: $2.9 trillion $9,255 per person and 17.4% of GDP – Decades Later The USA Health Care System is Still a Deadly Disease for Our Economy – USA Spends $7,960 per person Compared to Around $3,800 for Other Rich Countries on Health Care with No Better Health Results (2009) – Drug Prices in the USA (2005)

When I lived in Malaysia I learned that the residential electricity rates were very low for the low levels of use and climbed fairly rapidly as you used a lot of electricity (say running your air conditioner a lot). I think this is a very good idea (especially for the not yet rich countries). In rich countries even most of the “poor” have high use of electricity and it isn’t a huge economic hardship to pay the costs.

Effectively the rich end up subsidizing the low rates for the poor, which is a very sensible setup it seems to me. The market functions fairly well even though it is distorted a bit to let the poor (or anyone that uses very little electricity) to pay low rates.

In a country like Malaysia as people become rich they may well decide to use a great deal of electricity for air conditioning (it is in the tropics). But their ancestors didn’t have that luxury and having that be costly seems sensible to me. Allowing the poor to have access to cheap electricity is a very good thing with many positive externalities. And subsidizing the rate seems to be a good idea to me.

Often you get bad distortions in how markets work when you try to use things like subsidies (this post is expanded from a comment I made on Reddit discussing massive bad investments created by free electricity from the power company to city governments – including free electricity to their profit making enterprises, such as ice rinks in Puerto Rico).

View of downtown Johor Bahru from my condo (a small view of Singapore visible is in the background)

With the model of low residential rates for low usage you encourage people to use less electricity but you allow everyone to have access at a low cost (which is important in poor or medium income countries). And as people use more they have to pay higher rates (per kwh) and those rates allow the power company to make a profit and fund expansion. Often in developing countries the power company will be semi-private so the government is involved in providing capital and sharing in profits (as well as stockholders).

The USA mainly uses central air conditioning everywhere. In Malaysia, and most of the world actually, normally they just have AC units in some of the rooms. In poor houses they may well have none. In middle class houses they may have a one or a couple rooms with AC units.

Even in luxury condos (and houses) they will have some rooms without AC at all. I never saw a condo or house with AC for the kitchen or bathrooms. The design was definitely setup to use AC in fairly minimal ways. The hallways, stairways etc. for the “interior” of the high rise condos were also not air conditioned (they were open to the outside to get good air flow). Of course as more people become rich there is more and more use of AC.

Related: Traveling for Health Care – Expectations – Looking at the Malaysian Economy (2013) – Pursuing a Growing Economy While Avoiding the Pitfalls That Befall to Many Middle Income Countries – Singapore and Iskandar Malaysia – Looking at GDP Growth Per Capita for Selected Countries from 1970 to 2010 – Malaysian Economy Continues to Expand, Budget Deficits Remain High (2012) – Iskandar Malaysia Housing Real Estate Investment Considerations (2011)

Peer to peer lending has grown dramatically the last few years in the USA. The largest platforms are Lending Club (you get a $25 bonus if you sign up with this link – I don’t think I get anything?) and Prosper. I finally tried out Lending Club starting about 6 months ago. The idea is very simple, you buy fractional portions of personal loans. The loans are largely to consolidate debts and also for things such as a home improvement, major purchase, health care, etc.).

With each loan you may lend as little as $25. Lending Club (and Prosper) deal with all the underwriting, collecting payments etc.. Lending Club takes 1% of payments as a fee charged to the lenders (they also take fees from the borrowers).

Borrowers can make prepayments without penalty. Lending Club waives the 1% fee on prepayments made in the first year. This may seem a minor point, and it is really, but a bit less minor than I would have guessed. I have had 2% of loans prepaid with only an average of 3 months holding time so far – much higher than I would have guessed.

On each loan you receive the payments (less a 1% fee to Lending Club) as they are made each month. Those payments include principle and interest.

This chart shows the historical performance by grade for all issued loans that were issued 18 months or more before the last day of the most recently completed quarter. Adjusted Net Annualized Return (“Adjusted NAR”) is a cumulative, annualized measure of the return on all of the money invested in loans over the life of those loans, with an adjustment for estimated future losses. From LendingClub web site Nov 2015, see their site for updated data.

Lending Club provides you a calculated interest rate based on your actual portfolio. This is nice but it is a bit overstated in that they calculate the rate based only on invested funds. So funds that are not allocated to a loan (while they earn no interest) are not factored in to your return (though they actually reduce your return). And even once funds are allocated the actual loan can take quite some time to be issued. Some are issued within a day but also I have had many take weeks to issue (and some will fail to issue after weeks of sitting idle). I wouldn’t be surprised if Lending Club doesn’t start considering funds invested until the loan is issued (which again would inflate your reported return compared to a real return), but I am not sure how Lending Club factors it in.

There have been quite a few complaints about companies hiring foreign nationals to work in the USA to save money (and costing citizens jobs or reducing their pay). The way the laws are now, companies are only suppose to hire people to work in the USA that can’t be met with USA workers. The whole process is filled with unclear borders however – it is a grey world, not black and white.

I think one of the things I would do is to make it cost more to hire foreigners. Just slap on a tax of something like $10,000 per year for a visa. If what I decided was actually going to adopted I would need to do a lot more study, but I think something like that would help (maybe weight it by median pay – multiple that by 2, or something, for software developers…).

It is a complex issue. In general I think reducing barriers to economic competition is good. But I do agree some make sense in the context we have. Given the way things are it may well make sense to take measures that maybe could be avoided with a completely overhauled economic and political system.

I believe there are many good things to having highly skilled workers in your country. So if the problem was in recruiting them (which isn’t a problem in the USA right now) then a tax on the each visa wouldn’t be wise, but I think it might make sense now for the USA.

I think overall the USA benefits tremendously from all the workers attracted from elsewhere. We are much better off leaving things as they are than overreacting the other way (and being too restrictive) – but I do believe it could be tweaked in ways that could help.

Outsourcing Made by India Seen Hit by Immigration Law

…

Indians received more than half the 106,445 first-time H-1Bs issued in the year ending September 2011, according to a U.S. Department of Homeland Security report. The second-biggest recipient was China with 9.5 percent.

…

While the legislation raises the annual H-1B cap to as much as 180,000 from 65,000, it increases visa costs five-fold for some companies to $10,000. It also bans larger employers with 15 percent or more of their U.S. workforce on such permits from sending H-1B staff to client’s sites.

The aim is to balance the U.S. economy’s need to fill genuine skills gaps with protection for U.S. citizens from businesses that may use the guest-worker program to bring in cheaper labor

Related: Relocating to Another Country – Working as a Software Developer – Science PhD Job Market in 2012 – Career Prospect for Engineers Continues to Look Positive

As I have said, the behavior (driven by the poor ethical standards of the “leaders” of our financial institution) of our financial institutions means, as a a customer, you have to be on guard for their tactics to trick you out of your money. Essentially you have to expect them to behave like a pickpockets and be on guard against them at all times. This is an extremely sad state of affairs: that the ethical failings of such critically important players in our economy are so widespread, long-lasting and accepted. However, as we have seen, they profit from this behavior and their long track record of such behavior provides evidence they will continue acting in this way.

Discover to refund $200 million to credit card customers

The Consumer Financial Protection Bureau and Federal Deposit Insurance Corp. found that Discover Financial Services telemarketers often talked faster when explaining fees and terms as they pitched the services, leading customers to think there was no additional fee, the regulators said Monday.

It is very good to see the Consumer Financial Protection Bureau taking action to protect the consumers from the financial institutions continued efforts to evade the law and take a little bit from millions of consumers. This type of behavior has been tolerated previously, and should never have been. The financial institutions strategy to take small amounts from millions of people was a wise way of dealing with the tendency of law enforcement to ignore such “small infractions” – they didn’t seem to bother seeing that taking small amounts from millions of people results in hundreds of millions of dollars in ill gotten gains.

Far too much of the bad practices are continuing. And when they are caught the consequences are far too small (which is why they keep behaving unethically). Discover is only being charged $14 million in civil penalties for their lapses (and has to return $200 million it took unfairly).

It is good to have police to try and catch literal pickpockets. And it is good to have the Consumer Financial Protection Bureau to catch financial institutions that take far more than pickpockets can dream of away from the wallets of consumers.

Related: Capital One Bank Agrees to Refund $150 Million to 2 Million Customers and Pay $60 Million in Fines – Very Bad Customer Service from Discover Card – Credit Card Regulation Has Reduced Abuse By Banks – Continued Credit Card Company Customer Dis-Service – I Strongly Support the Consumer Financial Protection Bureau

Sadly, Congress refused to allow the person that should have headed to the Consumer Financial Protection Bureau (CFPB) to do so: Elizabeth Warren. If we are lucky she will be joining congress as the new senator from Massachusetts to reduce the amount of big donnor favoritism that prevails there now. That attitude will still prevail, she will just be one voice standing against the many bought and paid for politicians we keep sending back to Washington (there are a couple now, but they are vastly outnumbered).

Even with congressional attempts to stop the CFPB from being able to enforce laws against their big donnors, the CFPB has announced their first public enforcement action: an order requiring Capital One Bank to refund approximately $140 million to two million customers and pay an additional $25 million penalty. This is a good, small step that is helping creating a rule of law instead of a rule of those capturing regulators and giving lots of cash to politicians. But it is a very small step. The system is still mainly about captured regulators and giving lots of cash to politicians.

This action results from a CFPB examination that identified deceptive marketing tactics used by Capital One’s vendors to pressure or mislead consumers into paying for add-on products such as payment protection and credit monitoring when they activated their credit cards.

“Today’s action puts $140 million back in the pockets of two million Capital One customers who were pressured or misled into buying credit card products they didn’t understand, didn’t want, or in some cases, couldn’t even use,” said CFPB Director Richard Cordray. “We are putting companies on notice that these deceptive practices are against the law and will not be tolerated.”

Consumers with low credit scores or low credit limits were offered these products by Capital One’s call-center vendors when they called to have their new credit cards activated. As part of the high-pressure tactics Capital One representatives used to sell these add-on products, consumers were:

- Misled about the benefits of the products: Consumers were sometimes led to believe that the product would improve their credit scores and help them increase the credit limit on their Capital One credit card.

- Deceived about the nature of the products: Consumers were not always told that buying the products was optional. In other cases, consumers were wrongly told they were required to purchase the product in order to receive full information about it, but that they could cancel the product if they were not satisfied. Many of these consumers later had difficulty canceling when they called to do so.

- Misinformed about cost of the products: Consumers were sometimes led to believe that they would be enrolling in a free product rather than making a purchase.

- Enrolled without their consent: Some call center vendors processed the add-on product purchases without the consumer’s consent. Consumers were then automatically billed for the product and often had trouble cancelling the product when they called to do so.

One of the less obvious costs of a poor credit rating these days is large companies see you as someone to take advantage of. They often target those with poor credit for extremely lousy deals that they wouldn’t try to sell to those with good credit. The presumption, I would imagine, is someone able to maintain a good credit rating is much less likely fall for our lousy deals.

Related: Protect Yourself from Credit Card Fraud (facilitated by financial institutions) – Anti-Market Policies from Our Talking Head and Political Class – Banks Hope they Paid Politicians Enough to Protect Billions in Excessive Fees

High frequency trading is rightly criticized. It isn’t bad because rich people are getting richer. It is bad because of the manipulation of markets. Those being

- Front running – having orders executed milliseconds in advance to gain an edge (there is no market benefit to millisecond variation). In the grossest for it is clearly criminal: putting in orders prior to known orders from a customer to make money at the expense of your customer and others in the market. My understanding is the criminal type is not what they are normally accused of, of course, who knows but… Instead they front run largely by getting information very quickly and putting in orders to front run based on silly price difference (under 1/10 of a cent).

- Putting in false orders to fake out the market – you are not allowed to put in false orders. It is clear from the amount of orders placed and immediately withdrawn they are constantly doing this. Very simply any firm doing this should be banned from trading. It wouldn’t take long to stop. Of course the SEC should prosecute people doing this, but don’t hold your breath.

Several things should be done.

- Institute a small new financial transaction tax – adding a bit of friction to the system will reduce the ludicrous stuff going on now. Use this tax to fund investigation and prosecution of bad behavior.

- Redo the way matching of orders is done to promote real market activity not minute market arbitrage and manipulation – I don’t know exactly what to do but something like putting in a timing factor along with price. An order that is within 1/10 of cent for less than 1,000 shares are executed in order of length of time they have been active (or something like that).

- Institute rules that if you cancel more than 20% of your order (over 10 in a day) in less than 15 minutes you can’t enter an order for 24 hours. Repeated failures to leave orders in place create longer bans.

- Don’t let those using these strategies get their money back when they do idiotic things like sell bull chip companies down to 20% of their price at the beginning of the day. You don’t get to say, oh I didn’t really mean to buy this stock that lost me 50% the day I bought it, give me money back. There is no reason high frequency traders should be allowed to take their profits and then renege on trades they don’t like later.

Speculation is fine, within set rules for a fair market. Traders making money by manipulating the system instead of through beneficial activities such as making a market shouldn’t be supported.

To the extent high frequency trading creates fundamental buying opportunities take advantage of the market opportunity. Just realize the high frequency traders may be able to reverse you gains (and if you lose you are not going to be granted the same favors).

Related: Naked Short Selling – Misuse of Statistics, Mania in Financial Markets – Failure to Regulate Financial Markets Leads to Predictable Consequences – Fed Continues Wall Street Welfare

The truth is the billions of dollars high frequency traders steal from others market returns matters much less to true investors. For long terms holdings the less than a cent they steal from other market participants is small. It is still bad. Just people really get more excited about it than they need to. I would love to just get 1/1000 of cent on every trade made in the markets, I could retire. But they are mainly stealing very small amounts from tons of different people. Now the fake orders and trades that go against them that they then get reversed are a different story.