Health Savings Accounts (HSA) allow you to save money in order to pay health expenses in a tax free account. They are similar to an IRA but are for health expenses.

Eligibility is limited to those with high deductible health care plans.

HSA funds can be saved over the years. Flexible spending accounts are somewhat similar but that money can not be rolled from one year to the next. The idea with HSA is you can save money in good years so you have money to pay health care expenses in years when you have them.

Health Savings Accounts are meant to cover deductibles, co-pays, uncovered health needs etc. that those stuck with the current USA health care system have to deal with. HSA are best used by people who are healthy, as the idea is to save up money during healthy years so there is a cushion of funds to pay health expenses later.

Health Savings Accounts are not a substitute for health care insurance. The health care system in the USA is so exorbitantly expensive only the very richest could save enough even for relatively minor health needs that are free to all citizens in most rich countries. HSA are legally available to you without health insurance but doing without health insurance in the USA is a disastrous personal financial action in the USA.

And the system is even worse in having ludicrously high charges that all insurance companies get huge discounts on. But if you try to use the USA health system without insurance the unconscionable charges that no insurance company pays will be billed to you. Even if your insurance company paid nothing, the reduction in fees just due to providers not charging the massive uninsured premium charges is critical.

Your HSA contribution is taken out of your paycheck on a pre-tax basis and grows tax deferred.

Withdrawals from an HSA for qualified medical expenses are free from federal income tax. At age 65, you can withdraw money from the HSA to use in retirement for expenses not related to health care. You will owe taxes at this time, but no penalty.

Related: 2015 Health Care Price Report, Costs in the USA and Elsewhere – Health Insurance Considerations for Digital Nomads – Personal Finance Basics: Health Insurance

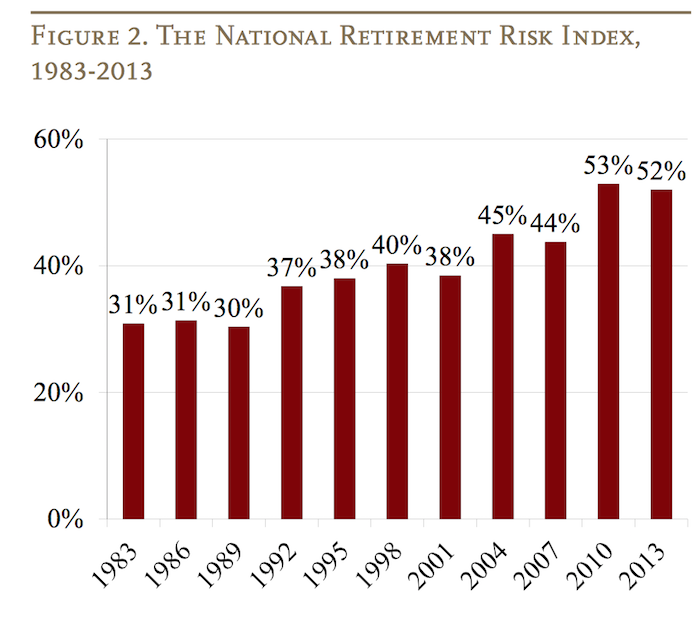

The Center for Retirement Research at Boston College is a tremendous resource for those planning for, or in, retirement. The center created the National Retirement Risk Index (NRRI) to capture a macroeconomic level measure of how those in the USA are progressing toward retirement.

Based on the Federal Reserve’s 2013 Survey of Consumer Finances the Center updated the NRRI results (the entire article is a very good read).

The lower the risk number in the chart the better, so things have not been going well since the 1990s for those in the USA saving for retirement.

As the report discusses their are significant issues with retirement planning that defy easy prediction; this makes things even more challenging for those saving for retirement. The report discusses the difficulty placed on retirees by the Fed’s extremely low interest rate policy (a policy that provides billions each year to too-big-too-fail banks – hardly the reward that should be provided for bringing the world to economic calamity but never-the-less that transfer of wealth from retirees to too-big-to-fail banks is the policy the Fed has chosen).

That exacerbates the problems of too little savings during the working career for those in the USA. The continued evidence is that those in the USA continue to spend too much today and save too little. Also you have to expect the Fed and politicians will continue to make policy that favors their friends at too-big-fail banks and hedge funds and the like. You can’t expect them to behave differently than they have been the last 50 years. That means the likely actions by the government to take from median income people to aid the richest 1% (such as bailing out the bankers with super low interest rate policies and continue to subsidize losses and privatize their winning bets) will continue. You need to have extra savings to support those policies. Of course we could change to do things differently but there is no realistic evidence of any move to do so. Retirement planning needs to be based on evidence, not hopes about how things should be.

Related: How Much of Current Income to Save for Retirement – Save What You Can, Increase Savings as You Can Do So – Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Retirement Planning: Looking at Assets (2012) – How Much Will I Need to Save for Retirement? (2009)

I have long thought the binary retirement system we have primarily used is less than ideal. It would be better to transition from full time work to part time work to retirement as people move into retirement. According to this study, from the University of Michigan Retirement Research Center, the phased retirement option is becoming more common.

Macroeconomic Determinants of Retirement Timing

The paper doesn’t really focus much on what I would find interesting about the details of how we are (or mainly, how we are not) adjusting to make partial retirement fit better in our organization (the paper is focused on a different topic). The paper does provide some interesting details about the changes with retirement currently.

Related: Career Flexibility – 67 Is The New 55 – Retirement Delayed, Working Longer

Building your saving is largely about not very sexy actions. The point where most people fail is just not saving. It isn’t really about learning some tricky secret.

You can find yourself with pile of money without saving; if you win the lottery or inherit a few million from your rich relative via some tax dodge scheme like generation skipping trusts or charitable remainder trusts.

But the rest of us just have to do a pretty simple thing: save money. Then, keep saving money and invest that money sensibly. The key is saving money. The next key is not taking foolish risks. Getting fantastic returns is exciting but is not likely and the focus should be on lowering risk until you have enough savings to take risks with a portion of the portfolio.

My favorite tips along these lines are:

- spend less than you make

- save some of every raise you get

- save 10-15% of income for retirement

- add to any retirement account with employer matching (where say they add $500 for every $1,000 you put into your 401(k)

Spending less than you make and building up your long term savings puts you in the strongest personal finance position. These things matter much more than making a huge salary or getting fantastic investing returns some year. Avoiding risky investments is wise, and sure making great returns helps a great deal, but really just saving and investing in a boring manner puts you in great shape in the long run. Many of those making huge salaries are in atrocious personal financial shape.

Another way you can boost savings is to do so when you pay off a monthly bill. So when I paid off my car loan I just kept saving the old payment. Then I was able to buy my new car with the cash I saved in advance when I was ready for a new car.

I have donated more to Tricke Up than any other charity for about 20 years now. There is a great deal of hardship in the world. It can seem like what you do doesn’t make a big dent in the hardship. But effective help makes a huge difference to those involved.

My personality is to think systemically. To help put a band aid on the current visible issue just doesn’t excite me. Lots of people are most excited to help whoever happens to be in their view right now. I care much more about creating systems that will produce benefits over and over into the future. This view is very helpful for an investor.

Trickle Up invests in helping people create better lives for themselves. It provides some assistance and “teaches people to fish” rather than just giving them some fish to help them today.

The stories in this video show examples of the largest potential for entrepreneurship. While creating a few huge visible successes (like Google, Apple…) is exciting the benefits of hundreds of millions of people having small financial success (compared to others) but hugely personally transforming success is more important. Capitalism is visible in these successes. What people often think of as capitalism (Wall Street) has much more resonance with royalty based economic systems than free market (free of market dominating anti-competitive and anti-market behavior) capitalism.

Related: Kiva Loans Give Entrepreneurs a Chance to Succeed – Micro-credit Research – Using Capitalism in Mali to Create Better Lives

For 2010 and 2011, the most that an individual can contribute to a traditional IRA or Roth IRA generally is the smaller of: $5,000 ($6,000 if the individual is age 50 or older), or the individual’s taxable compensation for the year. You have until your taxes are due (April 15th, 2011) to add to your IRA for 2010.

This is the most that can be contributed regardless of whether the contributions are to one or more traditional or Roth IRAs or whether all or part of the contributions are nondeductible. However, other factors may limit or eliminate the ability to contribute to an IRA as follows:

- An individual who is age 70½ or older cannot make regular contributions to a traditional IRA (just to make things complicated you can add to a Roth IRA) for the year.

Contributions to a Roth IRA are limited based on income. The limits are based on modified adjusted gross income (which is before deductions are taken). The Roth IRA earnings limits for 2010 are:

- Single filers: Up to $105,000; from $105,000 – $120,000 (a partial contribution is allowed)

- Joint filers: Up to $167,000; from $167,000 – $177,000 (a partial contribution)

For 2011 the earning limits increase to

- Single filers: Up to $105,000; from $107,000 – $122,000 (a partial contribution is allowed)

- Joint filers: Up to $167,000; from $169,000 – $179,000 (a partial contribution)

More details from the IRS website and earning limits details.

The income limits do not cap what you can add using a 401(k). So if you were planning on adding to a Roth IRA but cannot due to the income limits you may want to look into increasing your 401(k) contributions.

Related: Add to Your Roth IRA – Add to Your 401(k) and IRA – 401(k)s are a Great Way to Save for Retirement

I have posted about the need to save money while you are working numerous times. Here is a good article looking at the large number of people that have failed to do so and are now retiring.

Retiring Boomers Find 401(k) Plans Fall Short

…

Vanguard long advised people to put 9% to 12% of their salaries—including the employer contribution—in their 401(k) plans. The current median amount that people contribute is 9%, counting the employer contribution, Vanguard says.

Recently, Vanguard has begun urging people to contribute 12% to 15%, including the employer contribution, because of the stock market’s weak returns and uncertainty about the future of Social Security and Medicare.

…

Experts estimate Social Security will provide as much as 40% of pre-retirement income, or $35,080 a year for that median family. That leaves $39,465 needed from other sources. Most 401(k) accounts don’t come close to making up that gap.

The median 401(k) plan held $149,400, including plans from previous jobs, according to the Center for Retirement Research. To figure the annual income from that, analysts typically look at what the family would get from a fixed annuity. That $149,400 would generate just $9,073 a year for a couple, according to New York Life Insurance Co., the leading provider of such annuities— less than one-quarter of the $39,465 needed.

Just 8% of households approaching retirement have the $636,673 or more in their 401(k)s that would be needed to generate $39,465 a year.

Knowing exactly what is needed for retirement is difficult. But knowing what is a responsible amount is not. It is certainly no less than 8%, and is likely the 12-15% figure Vanguard recommends. If you start at 10% from the time you join the full time workforce (in your 20’s) then you have some flexibility you can see how thing look when you are 30, maybe 12% is sensible, maybe 15%, maybe 10%. If you fail to save for a decade however, you are likely to need to be at 15%, or higher.

Read more

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

In the USA we fail to save nearly enough for retirement by and large. And fail to save emergency funds or prepare for economically difficult times. We by and large chose to spend today and hope tomorrow will be good rather than first establishing a good financial safety net before expanding spending.

When people are debating withdrawing from their retirement account it is actually not the important decision it seems to be (normally). Normally the important decision was years before when they chose to take on consumer debt and not to build up an emergency fund. And when they failed to just build up saving beyond that which could be used for nice vacations, a new car, or to live on in economically challenging times.

If someone had been saving 15% of their salary in retirement since they started working if they took an amount that left them at 10% that is hardly a horrible result. While someone that was already behind by say adding just 3% to retirement savings and they took out all of it that would be much worse.

And we should remember even having a retirement account to withdraw from might put you ahead of nearly 50% of the population (and our state and federal governments, by the way). If you have to resort to withdrawing from your retirement account don’t think of that as the failure. The failure was most likely the lack of savings for years prior to that. And as soon as possible, re-fund your retirement account and build up a strong emergency fund, even if that means passing spending on things you want.

Related: Retirement Savings Allocation for 2010 – 401(k)s are a Great Way to Save for Retirement – Save Some of Each Raise

Countries that can still be travelled on the cheap

If you’re keen to surf or lie on the beach you’re all set to have an adventure for peanuts. As long as you steer clear of tourist-trap resorts, you’ll struggle to spend more than $23.50 a day. Nourish your inner cheapskate and buy souvenirs away from the tourist areas; head to the central market in Denpasar or Ubud’s Pasar Sukowati.

…

Eastern Europe used to be dirt cheap back in the good old days of the Cold War. Now that peace has broken out, costs are on the up. Poland, though, is still at the inexpensive end: a daily budget of $29 will easily get you around the country.

Poland is a nation that’s been run over so many times by invading forces that it’s become bulletproof. Now this EU member is on the rise, so get in quick before the prices go up for good. Rural towns are picturesque and cheap to visit; tiny towns like Krasnystaw in the Lubelskie region are a miser’s wonderland.

…

If you’re looking for a scuba-diving destination where you can put your entire budget into going under, Honduras is the place to be. With sleeping budgets as low as $12 a night and meals available for even less you can really stretch out the funds.

Sitting pretty next door to the Caribbean Sea, you’ll have plenty of time to count your pennies as you sun yourself on the golden beaches. The developers haven’t invaded quite yet, but you’d better get in quick, before the good old days slip into the past.

After snorkelling and kayaking around Roatan’s West Beach, splurge on a visit to the Unesco-listed Archaeological Park of Copan; entry is $18.

Related: Great Time for a Vacation – Travel guide books – Traveling To Avoid USA Health Care Costs – Travel Photo blog