There was a $1 trillion gap at the end of fiscal year 2008 between the $2.35 trillion states had set aside to pay for employees’ retirement benefits and the $3.35 trillion price tag of those promises, according to a new report released by the Pew Center on the States. The shortfall, which will have to be paid over the next 30 years by state and local governments, amounts to more than $8,800 for every household in the United States.

The figures detailed in Pew’s report, The Trillion Dollar Gap, include pension, health care and other non-pension benefits promised to both current and future retirees in states’ and participating localities’ public sector retirement systems.

Pew’s numbers likely underestimate the bill coming due because the most recent available data do not account for the second half of 2008, when states’ pension fund investments were particularly affected by the financial crisis. Additionally, most states’ accounting methods spread the investment declines over a period of time–meaning states will be dealing with their losses for several years.

“While the economic crisis and drop in investments helped create it, the trillion dollar gap is primarily the result of states’ inability to save for the future and manage the costs of their public sector retirement benefits,” said Susan Urahn, managing director, Pew Center on the States. “The growing bill coming due to states could have significant consequences for taxpayers—higher taxes, less money for public services and lower state bond ratings. States need to start exploring reforms.”

In fiscal year 2008, states’ pension plans had $2.8 trillion in long-term liabilities, with more than $2.3 trillion reserved to cover those costs. Overall, states’ pension systems were 84 percent funded—above the 80 percent funding level recommended by experts. Still, the unfunded portion–$452 billion–is substantial, and states’ performance is down slightly from an 85 percent combined funding level in fiscal year 2006. Pension liabilities have grown by $323 billion since 2006, outpacing asset growth by almost $87 billion.

Retiree health care and other non-pension benefits, such as life insurance, create another huge bill coming due: a $587 billion total liability to pay for current and future benefits, with only $32 billion–or just over 5 percent of the cost–funded as of fiscal year 2008. Half of the states account for 95 percent of the liability. Because of a 2004 Governmental Accounting Standards Board rule, the full range of non-pension liabilities was officially reported in fiscal year 2008 for the first time across all 50 states.

Many state and local governments continue to provide very large pay to state and local government employees and often use very generous retirement packages as a way of disguising the true cost of the pay packages they provide.

Related: NY State Raises Pension Age to Save $48 Billion – True Level of USA Federal Deficit – Charge It to My Kids – USA Federal Debt Now $516,348 Per Household – Politicians Again Raising Taxes On Your Children – Consumer Debt Reduced below $2.5 Trillion

Read more

As I have said previously, capitalists support the estate and inheritance taxes. Not those that see themselves as nobility, and call wish to be called capitalists, that want to reward the children of the wealthy (because we all know they need more advantages than they already get). While the Democrats voted in favor of capitalism (letting those who earn wealth prosper) instead of supporting nobility, as has been the recent trend, they did so only for the richest few. So they decided Kings and Queens should not pass all their wealth to the kids (still they can pass more than 50% of it – oh don’t you feel sorry for those poor kids you might have to get just $3.85 million instead of the $7 million they “need”). So the Democrats decided all the children of Lords, Dukes, Earls… should not have to have their trust funds impinged in any way.

“We make the estate tax go away for 99.75 percent of the people in the country,” said North Dakota Democrat Earl Pomeroy, the main sponsor. Republicans who voted against the measure said they favored repealing the levy.

Congress in 2001 decided to drop the estate tax in 2010 before reinstating it in 2011 at the previous higher top rate of 55 percent for estates valued at more than $1 million.

Isn’t it amazing how little the children of wealthy are asked to share in the huge inheritances they get. But until the economic literacy of the country improves they are able to pretend noble blood lines passing down huge fortunes are not just those with the gold making the rules.

You might notice the government is in pretty desperate need of money. But some still think asking the kids of the super rich to part with some of their inheritance is too much to ask. I wish they would learn about economics. It is not capitalist to reward being born in the right house with more cash than than many will every earn working 40 plus years (a 50% inheritance tax on the super rich is less than it should be – and it shouldn’t be just the super rich that pay inheritance tax). Maybe exempt $1-2 million and index that. The next million at 50%. Then increase the rate 5% every million. I don’t really see any need to give some kid $100 million because they happen to have been born to a rich parent. Capitalism is about rewarding economic productivity not the birth lottery.

Related: Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Killing Capitalism in Favor of Special Interests – Ignorance of Capitalism – Charge It to My Kids – Buffett on Taxes

N.Y. Raises Pension Requirements to Save $48 Billion

…

For new workers, the bill raises the age for retirement without penalty to 62 from 55, imposes a 38 percent penalty on non-uniformed workers who retire before 62 and increases the minimum years of service to draw a pension to 10 from 5, according to Paterson’s office.

Overtime payments included in calculating pension benefits will be capped at $15,000 a year for civilian workers, and 15 percent of wages for police and firefighters.

Raising the retirement age from 55 to 62 (for new workers) is something that should have been done decades ago. 62 is too young for a full retirement age. If a country has the life expectancies we do they either need to have huge retirement savings (which for NY State would mean huge taxes to support that level of retirement savings) or live off the wealth saved in previous generations (or count on taxes of future generations).

Unfortunately for too long all of the USA we have chosen not to save for retirement when we work and then retire when we still have decades to live (on average). That is not sustainable. You can only add so much to the credit card (buy now let someone pay later strategy). Increasing from 55 to 62 is a good move. But it is too little and too late. More should be done.

Saving for retirement is not complicated. It is just that many people would rather speed money now and now save it. That is easy to understand but it is not helped if we make it sound like saving for retirement is hard. It takes some discipline. But certainly adults should be able to show some discipline. We have to stop acting like not saving for retirement is somehow acceptable. It is no more acceptable than those that had to store food for the winter a few hundred years ago deciding they would rather go swimming all summer and worry about the winter later.

And state governments should not provide out-sized retirement benefits which must be paid for by the taxpayers. 80 years ago maybe setting the retirement age at 55 made sense. It certainly did not for new workers in 1980 (or 1990 or 2000 at least now in 2009 they are making a move in the right direction).

Related: Working Longer and Delaying Retirement – Many Retirees Face Prospect of Outliving Savings – Pushing your financial problems into the future – Gen X Retirement

The Federal Weatherization Assistance Program has been around for decades and funding has been increased as part of the stimulus bills. This type of spending is better than much of what government does. It actually invests in something with positive externalities. It targets spending to those that need help (instead of say those that pay politicians to give their companies huge payoffs and then pay themselves tens of millions in bonuses).

The Depart of Energy provides funding, but the states run their own programs and set rules for issues such as eligibility. They also select service providers, which are usually nonprofit agencies that serve families in their communities, and review their performance for quality. In many states the stimulus funds have increased the maximum funds have increased to $6,500 per household, from $3,000.

The weatherization program targets low-income families: those who make $44,000 per year for a family of four (except for $55,140 for Alaska and $50,720 for Hawaii).

The program provides funds for those with low-income for the like of: insulation, air sealing and at times furnace repair and replacement. Taking advantage of this program can help you reduce your energy bills and reduce the amount of energy we use and pollution created. And it employs people to carry out these activities.

The Weatherization Assistance Program invests in making homes more energy efficient, reducing heating bills by an average of 32% and overall energy bills by hundreds of dollars per year.

Weatherization is also often a very good idea without any government support. If you are eligible for some help, definitely take a look at whether it makes sense for you. And even if you are not, it is a good idea to look into saving on your energy costs.

Related: Oil Consumption by Country in 2007 – Japan to Add Personal Solar Subsidies – personal finance tips – Kodak Debuts Printers With Inexpensive Cartridges – Personal Finance Basics: Dollar Cost Averaging

Read more

Is it cynical to think that politicians want to provide payments from the treasury to those that paid the politicians? More cynical to think the politicians that created huge Wall Street Welfare payments won’t actually do anything except talk about how they think it is bad that those they paid billions to are buying new mansions and yachts? More cynical to think they will continue to provide huge amounts of nearly free cash for those that paid them to speculate with? More cynical to think if any of those speculators lose money they will give them more welfare? More cynical to think those bought and paid for politicians won’t actually take any steps to tax or curtail speculation? I think maybe I am cynical about Washington doing anything other than talk about how they don’t want to provide huge amounts of cash to Wall Street all the while giving their Wall Street friends huge amounts of cash that will be paid back by our grandchildren.

Wouldn’t it be nice if the politicians actually took actions to fund a partial payback of the hundreds of billions (or maybe trillions) of bailout dollars by taxing financial speculation? I doubt it will happen. But maybe I am too cynical. Maybe politicians will not just do what they have been paid to do. But it seems the best predictor of what congress will do is based on what they are paid to do, based on their past and current behavior. Now what congress will say is very different. those paying Congressmen might not love it if the congressmen call them names but through a few billion more and they are happy to be called names while given the cash to buy new jets and sports teams and parties for their daughters.

Making Wall Street pay by Dean Baker

The logic of a financial transactions tax is simple. It would impose a modest fee on trades of stocks, futures, credit default swaps and other financial instruments. For example, the UK puts a 0.25% tax on the sale or purchase of shares of stock. This has very little impact on people who buy stock with the intent of holding it for a long period of time.

…

We can raise more than $140bn a year taxing financial transactions, an amount equal to 1% of GDP.

…

Since the financial sector is the source of the country’s current economic and budget problems it also makes sense to have this sector bear the brunt of any new taxes that may be needed. The economic collapse caused by Wall Street’s irrational exuberance has led to a huge increase in the country debt burden. It seems only fair that Wall Street bear the brunt of the clean-up costs. A financial transactions tax is the way to make sure that this happens.

One problem with investing in mutual funds is potential tax bills. If the fund has invested well and say bought Google at $150 and then Google was at $700 (a few years ago) there is the potential tax liability of the $550 gain per share. So if funds have been successful (which is one reason you may want to invest in them) they often have had a large potential tax liability.

With an open end mutual fund the price is calculated each day based on the net asset value, which is fair but really the true value if there is a large potential tax liability is less than if there was none. So in reality you had to believe the management would outperform enough to make up for the extra taxes that would be owed.

Well, the drastic stock market decline over the last few years has turned this upside down and many mutual funds actual have tax losses that they have realized (which can be used to offset future capital gains). Say the fund had realized capital losses of $30,000,000 last year. Then if they have capital gains of $20,000,000 next year they can use the losses from last year and will not report any taxable capital gains. And the next year the first $10,000,000 in capital gains would be not table either. Business Week, had an article on this recently – Big Losers Can Be Big Tax Shelters

…

Yet it is Miller’s newer charge, Legg Mason Opportunity, which holds stocks of all sizes and can take short positions, that will prove to be the real tax haven. Morningstar pegs its losses at 285% of its $1.2 billion in assets.

…

There are other funds with returns so ugly and losses so large that it may not matter what their trading style is for many years: Fidelity Select Electronics (FSELX), -539%; MFS Core Equity A, -369%; Janus Worldwide (JAWWX), -304%; Vanguard U.S. Growth (VWUSX), -227%.

How does a fund have over 100% tax losses? The way I can think of is if they have a great deal of redemptions. If the fund shrinks in size from a $3 billion fund to a $300 million fund they could have a 50% realized capital loss (down to $750 million) but then another $450 million in redemptions). Now the $300 million has a $750 million capital loss or 250%.

Related: Shorting Using Inverse Funds – Lazy Portfolio Results – Does a Declining Stock Market Worry You? – Asset Allocations Make A Big Difference

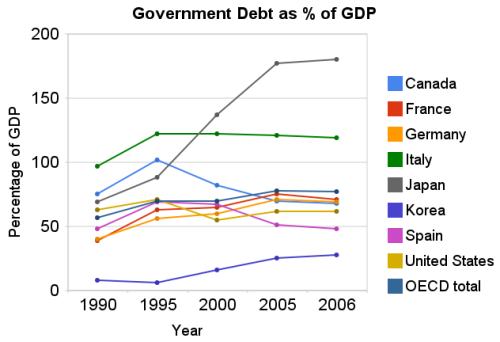

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Now on to the good news. As bad as the USA has been at spending tomorrows increases in taxes today, compared to the OECD countries we are actually better than average. The OECD is made up of countries in Europe, the USA, Japan, Korea, Australia, New Zealand and Canada. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2006 at 62% while the overall OECD total is 77%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2006 total of 180% (that is a big problem for them). Korea is in the best shape at just a 28% total in 2006 but that is an increase from just 8% in 1990.

Related: Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Who Will Buy All the USA’s Debt? – Top 12 Manufacturing Countries in 2007 – Oil Consumption by Country

Read more

Group of Rich Americans Sues UBS to Keep Names Secret in Tax Case

…

The lawsuit, which UBS described in an internal memo late Tuesday, stems from UBS’s agreement last week to turn over to federal authorities in Washington the names of 250 wealthy Americans suspected of using secret UBS offshore accounts and entities to evade taxes.

UBS reached a $780 million deferred-prosecution agreement to settle accusations that it used undisclosed offshore private banking services to help wealthy Americans evade taxes. But the bank is still under scrutiny by the Justice Department, which is seeking to force it to disclose the names of the 52,000 American clients it suspects may have evaded taxes.

So how many of these people will be serving time in jail do you think. Lets say for example, they ended up stealing $10,000 from the US government by evading taxes. Now UBS has to worry about the Swiss laws on disclosing information. But for the Americans all they are doing is trying to cover up a crime they committed. Do you think they will be punished for the crime in the first place? What about for trying to cover up the crime after the fact? The lack of moral fiber of so many rich in the USA is disheartening. I hope those that tried to steal from all the rest of us, and then tried to cover up their crimes, are thrown in jail at least as long as an average criminal that is young and poor that steals the amount they did and then tries to prevent witnesses from providing evidence to the Justice Department. And not in some country club jail either. But I doubt they will be. More rich people act ethically than those that don’t, but the number that are outrageously unethical is far too high.

Related: Super Spoiled Brats – Why Pay Taxes or be Honest – Estate Tax Repeal – CEOs Plundering Corporate Coffers

Feds Rethink Rules on Retirement Savings

Among the possible changes: allowing taxpayers to delay taking required withdrawals from their individual retirement accounts, 401(k) plans and other similar accounts this year — or at least reducing the amount that must be withdrawn. Also under consideration are various ways to provide tax relief for people who already have made their required withdrawals for this year.

This is silly. Everyone in the situation of having to make a withdrawal has know about the requirement for years. My guess is this has been the law for over 20 years. Yes, the stock market is down. Yes, being forced to sell now would be bad. And how does providing “tax relief” to those who already made required withdrawals make any sense? Why not just have the treasury send checks to every American, who had a loss on an investment this year, equal to the amount of their loss? (By the way this is sarcasm – they should not really do that). These people have lost any sense of what investing, planning, responsibly… are.

First, knowing you have required withdrawals from your IRA, you should not hold those assets in stock (I suppose you could have significant cash assets outside your IRA and chose to just use the next option). Second, you can buy the stock outside your IRA at the same minute you sell them in the IRA. What is the big deal: the cost should be about $20 in stock commission for each stock – you save that much each time you fill up your gas tank lately (compared to prices this summer). All that not having to withdraw funds does is let those wealthy enough not to need a small amount of their IRA or 401(k) savings by the time they are 70 1/2 to keep deferring taxes on their investment gains.

Therein lies one of the major problems. This year’s distributions are based on Dec. 31, 2007, levels — a time when market prices generally were far above today’s deeply depressed values. As a result, “millions of Americans are forced to withdraw larger-than-anticipated amounts from already-depleted retirement funds,” says David Certner, legislative policy director at AARP, an advocacy group that represents nearly 40 million older Americans.

What kind of 1984 newspeak is this? I mean this is absolutely ridicules. You have to withdraw the exact amount you knew on January 1st 2008. Nothing about that has changed in almost a year. How can the Wall Street Journal report this without pointing out the completely false claim.

Read more

The USA national debt decreased almost $1 billion yesterday. If it decreased by $1 billion dollars a day in just 10,526 days the USA government would be out of debt. That is just under 29 years, that doesn’t seem so bad. Unfortunately the decrease yesterday is not likely the start of a new trend (it is just daily variation).

In the last month the debt is up over $580 Billion. At that rate, well lets just say if that rate continued long we would be in even more serious trouble than we have been placed in by the amazingly irresponsible behavior of the politicians increasing taxes on our grandchildren (with massive spending they chose to fund by huge tax increases on our grandchildren) have been doing the last 5 years. In the last year they have spent $1.46 Trillion more than they paid for (which will have to be paid for by future taxes – although the recent decision to purchase $125 billion in bank stocks perhaps opens another option for the the government to start buying companies and use profits they make to pay off the debt they are taking on).

The current debt stands at $10,525,823,144,117. That is a bit over $10.5 Trillion.

Related: True Level of USA Federal Deficit – USA Federal Debt Now $516,348 Per Household – Washington Paying Out Money it Doesn’t Have