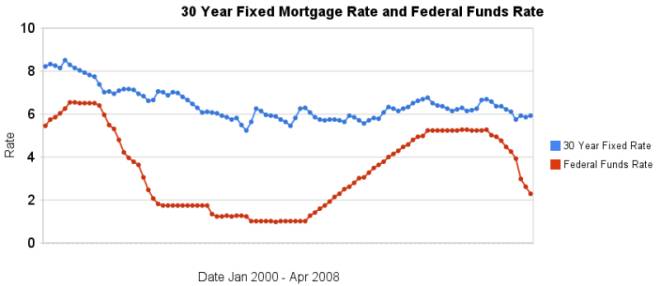

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

If you haven’t been reading about how mortgage rates might change because the federal funds rate might change and you look at this graph you might think why bother with this post. Well year after year financial web sites, magazines, television commentators mention that federal funds rates presage mortgage rate changes.

Since this post will likely be seen for years you may be reading this long after such myths have been dropped from the conventional wisdom. If so, great. But given how widespread this mis-conception is I don’t know how likely that is.

Want more data? See graphs of the federal funds rate versus mortgage rates for 1980-1999.

Comments

1 Comment so far

More dramatic evidence that changing in the federal funds rate do not lead to similar changes in 30 year fixed mortgage rates…